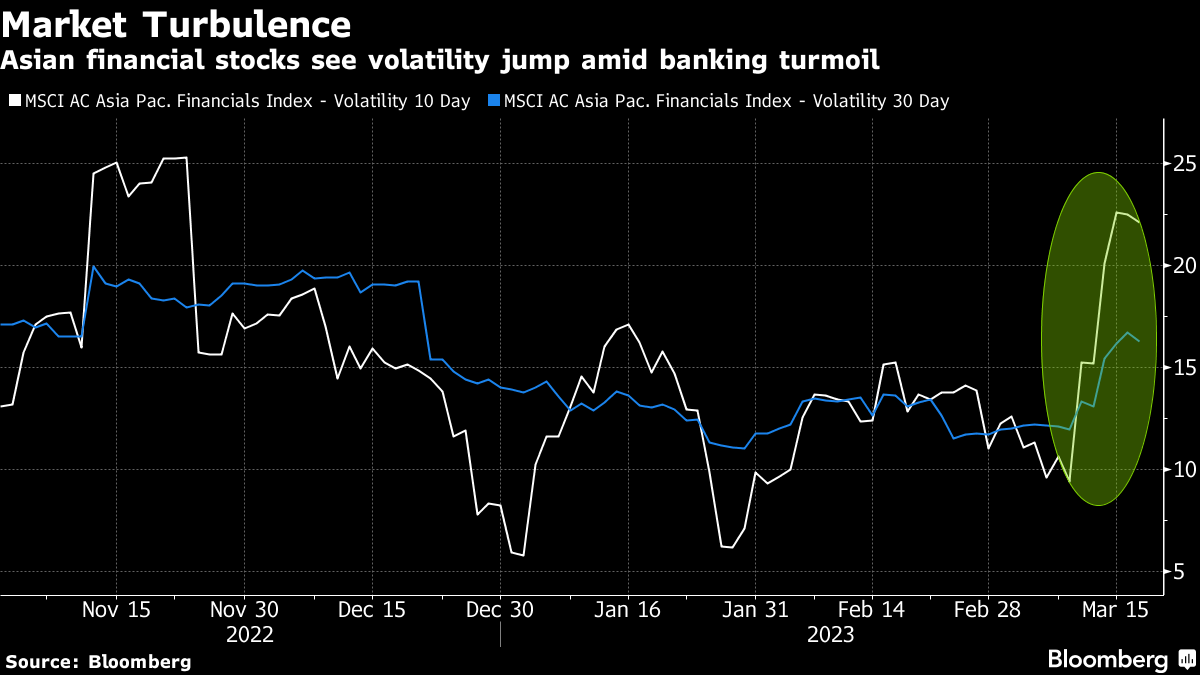

(Bloomberg) -- Asian bank stocks rose after a rescue package for First Republic Bank sparked a rebound in US shares despite ongoing concerns over the health of Credit Suisse Group AG and the collapse of Silicon Valley Bank.

The MSCI Asia Pacific Financials Index climbed as much as 1%, paring its weekly loss to 2.7%. Japanese megabanks were again among the gainers, with Mizuho Financial Group up as much as 2.3% after the biggest US banks pledged $30 billion of fresh cash for First Republic Bank. Mitsubishi UFJ Financial Group Inc. and Sumitomo Mitsui Financial Group Inc. each rose more than 1% before swinging to declines.

“Despite the headlines, we view the prospective returns in leading financial firms across the region to be appealing,” Vikas Pershad, an Asian equities portfolio manager at M&G Investments, wrote in a note. “This includes housing finance firms in India and mega-cap banks in Japan. The recent dislocations have been enough that we have added to existing positions.”

Broader Asian equities also got a boost from Wall Street's rally. The MSCI Asia Pacific Index added 1.2% as Japan's Topix climbed 0.7%, South Korea's Kospi advanced 0.9% while Australia's S&P/ASX 200 index added 0.2%.

Among other regional financial stocks, Hana Financial Group Inc. gained as much as 3.6% in Seoul while ANZ Group Holdings Ltd. advanced 1.5% in Sydney. Shares of China Merchants Bank Co., Hang Seng Bank Ltd. and Bank of East Asia Ltd. all gained more than 1% in Hong Kong.

Rina Oshimo, a senior strategist at Okasan Securities, pointed out that the recovery in Japanese banking shares is relatively slow given that value stocks had already risen earlier this year and domestic yields remain low. A Topix gauge of Japanese banking stocks is down more than 11% this week, set for the worst performance since April 2020.

The First Republic news came after a lifeline from Swiss regulators earlier this week stabilized Credit Suisse, easing worries that troubles at the European lender would lead to a cascading crisis in that region.

“Banking jitters are fading quickly for now and that has everyone scrambling back into risky assets,” Ed Moya, senior market analyst at Oanda, wrote in a note.

--With assistance from and .

(Updates with stock moves, additional commentary throughout)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.