Asian stocks advanced and benchmark Japanese bond yields inched toward an exit from negative territory as a risk-on mood permeated global financial markets.

Japanese shares led gains in early Asian trading Friday, while U.S. futures were little changed. The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, fell 0.49 percent to 12,000 as of 6:45 a.m.

Short on time? Well, then listen to this podcast for a quick summary of All You Need To Know before the opening bell.

Here's a quick look at all that could influence equities today.

- U.S. stocks sputtered late in the session Thursday but still managed to close at a record high as traders were whipsawed by conflicting headlines on the progress of trade talks with China.

- Oil is set for a weekly gain amid signs China and the U.S. are making progress in resolving the protracted trade dispute that's undermined demand in the world's two largest economies.

Get your daily fix of global markets here.

Earning Reactions To Watch

BPCL (Q2, QoQ)

- Revenue fell 15.7 percent to Rs 64,340.7 crore.

- Net profit rose 58.9 percent to Rs 1,708.5 crore.

- Ebitda rose 9 percent to Rs 2,374.9 crore versus Rs 2,179.8 crore.

- Margin stood at 3.7 percent versus 2.9 percent.

- Tax reversal of Rs 580.3 crore in the current quarter.

Power Grid Corporation (Q2, YoY)

- Revenue rose 4.8 percent to Rs 8,685 crore.

- Net profit rose 9.4 percent to Rs 2,527.4 crore.

- Ebitda rose 8.3 percent to Rs 7,556.9 crore.

- Margin stood at 87 percent versus 84.2 percent.

Indraprastha Gas (Q2, YoY)

- Revenue rose 19.4 percent to Rs 1692 crore.

- Net profit rose 2 times to Rs 381 crore.

- Ebitda rose 27.5 percent to Rs 393 crore.

- Margin stood at 23.2 percent versus 21.7 percent.

- Deferred Tax Gain of Rs 69.5 crore in current quarter.

DLF (Q2, YoY)

- Revenue fell 19.8 percent to Rs 1,715.5 crore.

- Net profit rose 19.1 percent to Rs 445.9 crore.

- Ebitda fell 46.9 percent to Rs 350.3 crore.

- Margin stood at 20.4 percent versus 30.8 percent.

- Exceptional gain of Rs 143.6 crore in current quarter.

- Other expenses rose 91 percent to Rs 394.2 crore.

Wockhardt (Q2, YoY)

- Revenue fell 28.7 percent to Rs 802.2 crore.

- Net loss to Rs 82.8 crore.

- Ebitda fell 16.9 percent to Rs 43.3 crore.

- Margin stood at 5.4 percent versus 4.7 percent.

GlaxoSmithKline Consumer Healthcare (Q2, YoY)

- Revenue rose 5.7 percent to Rs 1,345.1 crore.

- Net profit rose 25.3 percent to Rs 345.3 crore.

- Ebitda rose 11.9 percent to Rs 395.8 crore.

- Margin stood at 29.4 percent versus 27.8 percent.

United Breweries (Q2, YoY)

- Revenue rose 3.5 percent to Rs 1,579.6 crore.

- Net profit fell 29.6 percent to Rs 114.9 crore.

- Ebitda fell 39.3 percent to Rs 192.3 crore.

- Margin stood at 12.2 percent versus 20.8 percent.

- RM as percent of Sales at 47.7 percent.

- Other expenses rose 18 percent to Rs 508.9 crore.

Trent (Q2, YoY)

- Revenue rose 33.4 percent to Rs 854.9 crore.

- Net profit fell 12 percent to Rs 18.6 crore.

- Ebitda rose 2.2 times to Rs 129.4 crore.

- Margin stood at 15.1 percent versus 9 percent.

- Depreciation rose 6 times; Finance Cost rose 5.2 times.

Amber Enterprises (Q2, YoY)

- Revenue rose 89 percent to Rs 623.2 crore.

- Net profit at Rs 11.8 crore.

- Ebitda rose 2.7 times to Rs 36.6 crore.

- Margin stood at 5.9 percent versus 4.2 percent.

Thyrocare Technologies (Q2, YoY)

- Revenue rose 11.8 percent to Rs 116.2 crore.

- Net profit rose 38.7 percent to Rs 35.1 crore.

- Ebitda rose 20.9 percent to Rs 52.1 crore.

- Margin stood at 44.8 percent versus 41.5 percent.

- Samples processed rose 5 percent to 0.52 crore.

- Investigations performed rose 11 percent to 2.99 crore.

Nifty Earnings To Watch

- Eicher Motors

- GAIL

- Mahindra & Mahindra

- Nestle

Other Earnings To Watch

- Ashok Leyland

- Tata Power

- Teamlease Services

- Great Eastern Shipping

- State Trading Corporation of India

- Triveni Engineering & Industries

- TTK Prestige

- Sobha

- MRF

- Music Broadcast

- Narayana Hrudayalaya

- Equitas Holdings

- Dr. Lal Path Labs

- Dredging Corporation of India

- Bank of Baroda

- Akzo Nobel

- AVT Natural Products

- Bharat Forge

- Bharat Wire Ropes

- Birlasoft

- Camlin Fine Sciences

- Century Textiles & Industries

- Chalet Hotels

- Dhanuka Agritech

- Elgi Equipments

- Excel Industries

- FDC

- Federal-Mogul Goetze

- GNA Axles

- Goodricke Group

- Greenply Industries

- Gujarat State Petronet

- Gulf Oil Lubricants

- Himatsingka Seide

- IDFC

- Hindustan Fluorocarbon

- INEOS Styrolution

- Jaypee Infratech

- Khadim

- Magma Fincorp

- Matrimony.com

- Max India

- Max Ventures and Industries

- Nelcast

- NLC India

- Rane Holdings

- Rico Auto Industries

- RSWM

- Sical Logistics

- Sundaram Finance Holdings

- Tata Investment Corporation

- Zuari Global

- Allahabad Bank

- Allcargo Logistics

- BSL

- Capacit'e Infraprojects

- Capri Global Capital

- Century Plyboards

- Crisil

- Essel Propack

- H.G. Infra Engineering

- IDBI Bank

- Indiabulls Real Estate

- KEC International

- Steel Strips Wheels

- Sundaram Multi Pap

- Tata Communications

- TCNS Clothing

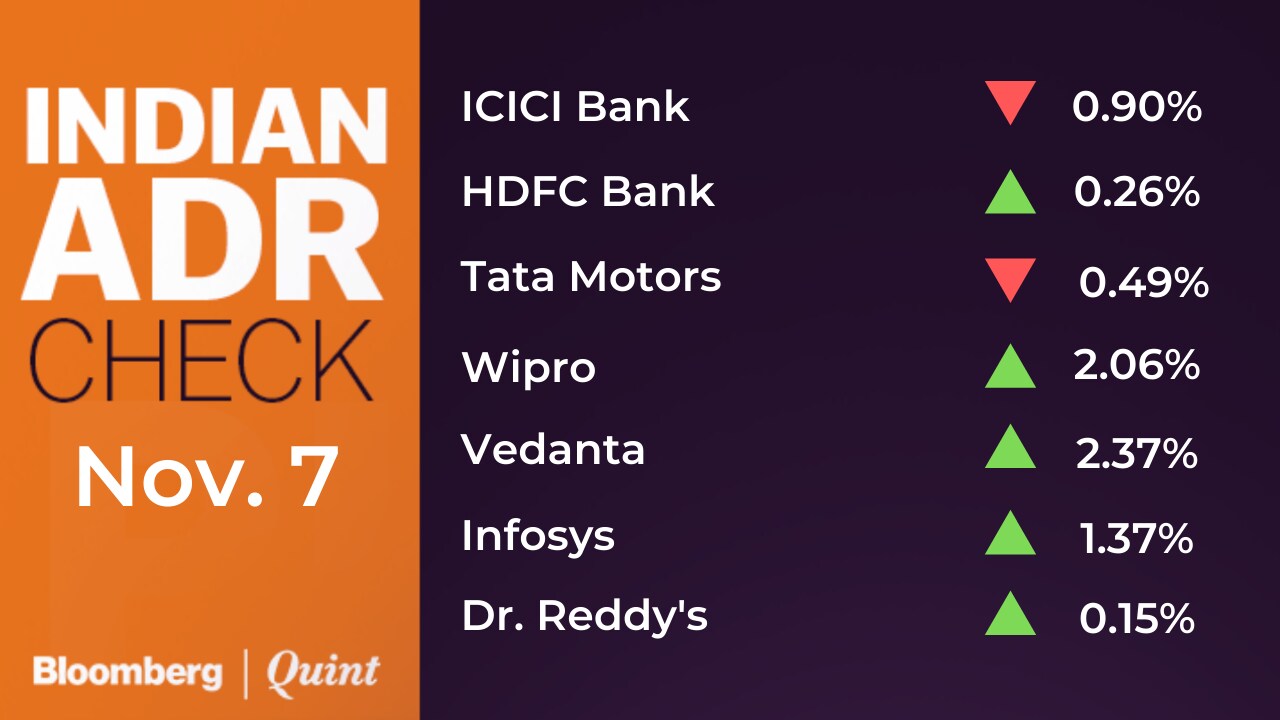

Indian ADRs

Stocks To Watch

- Raymond spun off its branded lifestyle business into a separate entity as part of a restructuring plan. The company's lifestyle business, which comprises branded textiles, branded apparel and garments, would be separately listed on the bourses after the demerger, the textile maker said in an exchange filing. These segments cumulatively contributed almost 81 percent in sales for the financial year 2018-19, the filing said. Besides, the company also plans to “fully reduce debt” by issuing equity to JK Investo Trade (India) Ltd., its associate firm. Raymond announced the allotment of equity shares and compulsorily convertible preference shares to JKIT at a price of Rs 674 per share aggregating to rupees Rs 350 crore. As a result of equity issuance of Rs 225 crore and compulsorily convertible preference share issue of Rs 125 crore, JKIT's stake would rise to 12.01 percent from the present 4.57 percent assuming full conversion into equity, the filing added.

- Bajaj Finance has set issue price at Rs 3,900 per share.

- Mindtree's Chief Financial Officer Pradip Kumar Menon has resigned, adding to the exodus of its top management since a hostile takeover by Larsen & Toubro Ltd. Menon would be pursuing career opportunities outside the company, the company said in an exchange filing, adding he would be relieved from services on Nov. 15.

- Future Retail stated that promoters hold 47.02 percent stake, out of which 72.65 percent stake in encumbered.

- Elantas Beck said that it is continuing with normal production operations and is also complying with temporary revocation order issued by Gujarat Pollution Control Board for company's plant in Bharuch.

- Sudarshan Chemical has incorporated an arm in Japan to sell colour pigments.

- Reliance Home Finance NHB has imposed a penalty of Rs 45,000 on the company for contravention of NHB Directions.

- DLF has appointed Vivek Anand as the CFO of the company.

MSCI November 2019 Semi-Annual Index Review saw 8 additions and 4 deletions for MSCI India Index.

Read more on stocks to watch out for in today's trade here: https://t.co/7DZXcmQOYz pic.twitter.com/Hjbf3dXKvGCorrects earlier version which misstated penalty imposed on Reliance Home Finance by NHB.

Brokerage Radar

Edelweiss on Power Grid

- Maintained ‘Buy' with a price target of Rs 233.

- Stable quarter; InvIT monetisation potential trigger.

- Change in MAT rate impacts revenue; capitalisation picks up pace.

- Inexpensive valuation and 4% dividend yield is comforting.

Edelweiss on Trent

- Maintained ‘Buy' with a price target of Rs 590.

- Strong revenue growth; gross margin contracts.

- Private labels aiding Westside; Star Market monitorable.

- SSSG of 13 percent YoY YTD was highest among our retail coverage.

Edelweiss on Engineers India

- Maintained ‘Reduce' with a price target of Rs 105.

- Stable operating performance; one-time DTA impacts net profit.

- Near-term pipeline weak; delays continue to persist.

- Government privatisation drive could impact ordering and decision making.

Macquarie on BPCL

- Maintained ‘Neutral' with a price target of Rs 500.

- EBITDA, ex-inventory and forex, missed estimates.

- Marketing performance was strong, supported by strong marketing margins.

- Refining performance was weak in the second quarter on lower core margins.

On IGL

Morgan Stanley

- Maintained ‘Overweight' with a price target of Rs 414.

- Earnings beat again as India's energy transition chugs along.

- Earnings beat and gas demand highlight the steady move away from oil.

- As gas gets cheaper and pollution challenges become more acute, car manufacturers push more CNG sales.

Edelweiss

- Maintained ‘Buy'; hiked price target to Rs 448 from Rs 424

- Strong September quarter numbers.

- Robust volume momentum; margins surge.

- Multiple growth drivers likely to pump up near-term volumes.

On HPCL

Jefferies

- Maintained ‘Hold'; cut price target to Rs 320 from Rs 335.

- Core EBITDA was weak on soft refining.

- Debt rose to five-year highs on higher capex and working capital.

- Earnings may recover on soft oil prices, benign auto fuel margins and IMO uplift.

Nomura

- Maintained ‘Buy' with a price target of Rs 340.

- September quarter missed estimates mainly due to weak refining.

- Surprisingly, HPCL reported refining inventory gain.

- Refining margins have been weaker so far in the third quarter.

On Sun Pharma

Emkay

- Maintained ‘Hold'; hiked price target to Rs 490 from Rs 465.

- September quarter's Ebitda was above estimates as R&D and advertising costs remained largely flat QoQ.

- India growth positively surprised but base U.S. sales, excluding Taro, was weak .

- Pick-up in specialty biz key in raising earnings trajectory.

PhillipCapital

- Maintained ‘Neutral' with a price target of Rs 450

- September quarter earning performance was in the lines

- See earnings challenges led by staggered penetration of specialty portfolio, continued higher specialty promotional spend, increasing R&D, and continued pricing issues in the U.S.

- No near-term benefit from its strategic initiatives

On UPL

JPMorgan

- Maintained ‘Overweight' with a price target of Rs 700.

- Ebitda below expectations due to adverse revenue mix.

- Revenue growth supported by volume as price declines.

- All eyes on second half for margin improvement and debt reduction.

Morgan Stanley

- Maintained ‘Overweight' with a price target of Rs 759.

- Ebitda as reported in the first half is largely in line with seasonality.

- About 15 percent volume growth and four days' reduction in working capital were positive.

- Negative was gross margin compression, due to strong growth in Latam, greater competitive intensity and adverse product mix.

Trading Tweaks

- Uniply Industries to move into ASM Framework

- Vishwaraj Sugar Industries, Indiabulls Real Estate, Alok Industries to move into short term ASM Framework

- R.P.P. Infra Projects to move out of short term ASM Framework

Who's Meeting Whom

- Cipla to meet WhiteOak Capital, CLSA and other investors from Nov. 8-Dec. 9

Insider Trading

- LG Balakrishnan promoter and director Rajvirdhan sold 41,000 shares on Nov. 5

- Cyient promoters acquired 20,000 shares on Nov. 7

- Ultratech Cement promoter Aditya Marketing & Manufacturing sold 2.7 lakh shares on Nov. 4

- Uniply Industries promoters sold 2.1 lakh shares from Aug.t 22-Sept. 27

Money Market Update

- The rupee closed at 70.97/$ on Thursday versus 70.98/$ on Wednesday

F&O Cues

Index Futures

- Nifty November futures closed at 12,047.9, premium of 35.9 points versus 42 points.

- Nifty November Futures open interest up 3 percent, adds 4.4 lakh shares in open interest.

- Nifty Bank November futures closed at 30,664.3, premium of 31.3 points versus 73 points.

- Nifty Bank November futures series open interest up 6 percent, adds 8,38,000 shares in open interest.

Options

- Nifty PCR at 1.46 versus 1.44 (across all series).

Nifty Weekly Expiry: Nov. 14

- Max open interest on call side at 12,000 (13.9 lakh shares).

- Max open interest on put side at 11,900 (14.6 lakh shares).

- open interest addition seen at 12,000P (+8.9 lakh shares), 11,900P (+8.7 lakh shares), 12,000C (+8.7 lakh shares).

Nifty Monthly Expiry: Nov. 28

- Max open interest on call side at 12,000 (17.9 lakh shares).

- Max open interest on put side at 11,600 (19.4 lakh shares).

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.