Stocks in Asia had a muted start Thursday after global equities rallied on the final two days of what was still their worst month in more than six years.

Japanese stocks indexes dipped and equities in Australia and South Korea advanced. Futures signaled gains for equities in Hong Kong and China.

The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, gained 0.3 percent to 10,422 as of 7:20 a.m.

Short on time? well, then listen to this podcast for a quick summary of the article!

BQ Live

Here's a quick look at all that could influence equities today.

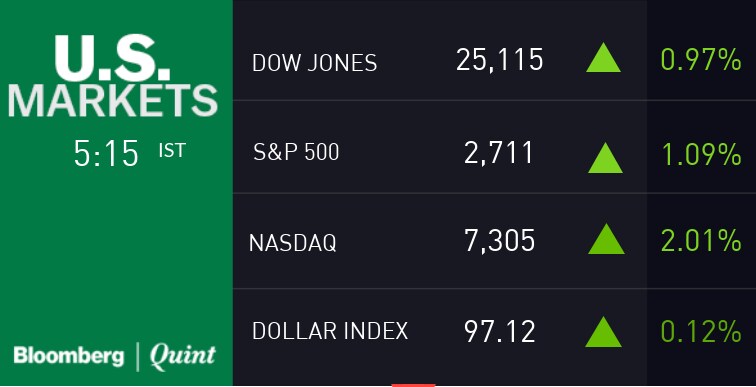

U.S. Market Check

U.S. stocks rallied for a second day to close out one of the worst months of the bull market on an upbeat note. The dollar added to a 16-month high and Treasury yields jumped.

- The S&P 500 Index capped its biggest two-day surge since February, paring its biggest monthly decline since 2011 to 7 percent.

- The Nasdaq 100 Index jumped 2.3 percent, but still fell the most in any month during the bull market.

Europe Market Check

European equities rallied, trimming their monthly drop as corporate profit-beats spurred optimism.

- Miners and energy companies led the way as almost every sector on the Stoxx Europe 600 climbed.

- Italian bonds bucked a decline as the risk-on mood sent core European debt lower.

- The euro drifted down as inflation accelerated in October and underlying price pressures increased, handing policy makers a headache after growth data disappointed.

- The pound rebounded after Tuesday's slump.

Asian Cues

- Japan's Topix index dropped 0.6 percent.

- FTSE China A50 Index futures added 0.2 percent.

- Australia's S&P/ASX 200 Index advanced 0.4 percent.

- South Korea's Kospi index added 0.4 percent.

- Futures on Hong Kong's Hang Seng rose 0.4 percent.

- S&P 500 futures rose 0.1 percent. The S&P 500 advanced 1.1 percent. The Nasdaq composite added 2 percent.

Commodity Cues

- West Texas Intermediate crude dropped 0.5 percent to $64.99 a barrel, on track for a fourth consecutive decline.

- Brent crude traded lower for the fourth day, down 1 percent at $74.71 a barrel.

- Gold futures added 0.1 percent to $1,215.84 an ounce.

Shanghai Exchange:

- Copper traded lower for the fourth day, down 0.7 percent.

- Zinc traded lower for the third day, down 0.9 percent.

- Steel snapped a three-day losing streak, up 0.1 percent.

- Aluminium traded lower for the sixth day and is set for its longest losing streak in nearly two months, down 0.8 percent.

- Rubber snapped its three-day losing streak, up 0.5 percent.

Here are some key events still to come this week:

- Earnings season includes: Macquarie, Apple, Alibaba, Credit Suisse, Exxon Mobil, and Shell.

- A monetary policy decision is due in the U.K. Thursday

- On Friday, the final U.S. jobs report before the November midterm elections may show hiring improved and that the unemployment rate held at a 48-year low.

Datawatch

- 10:30 a.m: Nikkei India Manufacturing PMI for October, prior 52.2.

Indian ADRs

Stocks To Watch

- Adani Enterprises to be in focus as it reconsiders the mine plan for its Carmichael coal project in Queensland to allow production with a much lower initial capital investment, according to Lucas Dow, CEO of the company's Australian unit, according to a Bloomberg report.

- Eicher Motors reported production loss of 25,000 units of motorcycle in September and October due to labour issues at its Chennai manufacturing facility.

- Coal India offer for sale received demand at an indicative price of Rs 266.03 per share with non-retail category receiving a 106 percent demand bid at 15.84 crore shares versus 14.9 crore shares offered. Company said that government will exercise over-subscription option up to 6 percent in addition to the base offer. (Bloomberg News)

- ONGC clarified that it has terminated oil rig contract with Mercator on Oct. 10 and had invoked performance bank guarantee submitted by the consortium which was led by Mercator, who in return had filed arbitration petitions on Sept. 26 and Oct. 16. Pursuant to the termination of contract ONGC is working on alternate ways for completion of the balance work of the project.

- Fortis Healthcare: The Competition Commission of India approved acquisition of the company and Fortis Malar Hospital by Northen TK Venture. (Bloomberg News)

- Religare filed an application in Delhi High Court for stay of redemption 15 lakh non-convertible preference share due on Oct. 31 in the matter of Daiichi Sankyo Company. The total redemption amount stands at Rs 42 crore.

- Bosch India said it was considering a share-buyback proposal for Nov. 5.

- Shriram EPC bagged order worth Rs 236 crore from Drinking Water and Sanitization Department of Jharkhand Government.

- Lemon Tree Hotels signs license agreement for 27 room city hotel in Bhutan. The hotel is expected to be operational by March next year.

- KEI Industries to set-up new facility with proposed capacity addition of 3 lakh Kms per annum by March 2019. Investment required would be Rs 55-60 crore which would be funded by internal accrual and debt. New facility to add Rs 300 crore of annual revenue. Post this, company will invest additional Rs. 30 crores in the next financial year, which will add another 3 lakh kms capacity and additional revenue of Rs 300 crore at full capacity.

- VA Tech Wabag secured Rs 1,000 crore order for engineering, design and build contract towards the expansion of sewage water treatment plant from the Middle East.

- Listing alert: Adani Gas will make its stock market debut on Monday (Nov. 5). The scrip will be in T2T segment for 10 trading days.

IndusInd Bank discloses details of exposure to IL&FS group. pic.twitter.com/ViCPRQ9Ktw

- IOCL raises jet fuel prices by 5.2% compared to last prices.

- IOCL raises ATF prices by on an average Rs 3,838/Kl.

- ATF price were cut by on average Rs 2,000/Kl due to excise duty cut.

Read: https://t.co/qCtvgFCE3i pic.twitter.com/AoxWZMgX9SNifty Earnings To Watch

- Hindustan Petroleum Corporation

- HDFC

Other Earnings To Watch

- Aarti Industries

- Arvind

- Berger Paints

- DLF

- GlaxoSmithKline Consumer Healthcare

- Godrej Properties

- ICRA

- IIFL Holdings

- Marico

- Mahindra Logistics

- Parag Milk

- SRF

- Tata Communications

- Trent

- Welspun Corp

- Zuari Agro Chemicals

Earnings Reaction To Watch

L&T (Q2, YoY)

- Revenue up 21 percent at Rs 32,081 crore.

- Net profit up 22 percent at Rs 2,230 crore.

- Ebitda up 27 percent at Rs 3,770 crore.

- Margin at 11.7 percent versus 11.2 percent.

- Exceptional gain of Rs 295 crore versus Rs 137 crore.

Tata Motors (Q2, Consolidated YoY)

- Revenue up 3.3 percent at Rs 72,112.1 crore.

- Ebitda down 16.4 percent At Rs 6,757.6 crore.

- Net loss at Rs 1,049 crore versus net profit at Rs 2,482.8 crore.

- Margin at 9.4 percent versus 11.5 percent.

JLR Earnings

- Net revenue down 11 percent to £5.6 billion.

- Ebitda margin at 9.1 percent versus 11.8 percent.

- Loss at £100 million versus £253 million.

Vedanta (Q2, Consolidated YoY)

- Revenue up 5.16 percent at Rs 22,705 crore.

- Net profit down 34.3 percent at Rs 1,343 crore.

- Ebitda down 8.15 percent at Rs 5,208 crore.

- Margin at 22.9 percent versus 26.3 percent.

- Interim dividend at Rs 17 per share.

Adani Power (Q2, Consolidated YoY)

- Revenue up 16.6 percent at Rs 7,181.5 crore.

- Net profit up 22.1 percent at Rs 3,86.9 crore.

- Ebitda up 9.7 percent at Rs 2,330.3 crore.

- Margin at 32.4 percent versus 34.5 percent.

- Other income at Rs 475.7 crore versus Rs 255.6 crore.

- Additional relief of claims worth Rs 1136.3 crore in current quarter.

Canara Bank (Q2, YoY)

- Net interest income up 17.9 percent at Rs 3281.3 crore.

- Net profit up 15.1 percent at Rs 299.5 crore.

- Provisions at Rs 2403.1 crore versus Rs 2,466.2 crore. (QoQ)

- GNPA at 10.56 percent versus 11.05 percent. (QoQ)

- NNP at 6.54 percent versus 6.91 percent. (QoQ)

Castrol India (Q3 Calendar Year 2018, YoY)

- Revenue up 7.6 percent at Rs 926.9 crore.

- Net profit down 15.6 percent at Rs 150.4 crore.

- Ebitda down 10.3 percent at Rs 227.4 crore.

- Margin at 24.5 percent versus 29.4 percent.

- Cost of raw materials at Rs 455.3 crore versus Rs 351.6 crore.

Sanofi India (Q3 Calendar Year 2018, YoY)

- Revenue up 11.4 percent at Rs 743.8 crore.

- Net profit up 2.5 percent at Rs 119.2 crore.

- Ebitda up 2 percent at Rs 187.3 crore.

- Margin at 25.2 percent versus 27.5 percent.

HEG (Q2, YoY)

- Revenue up 4.4 times at Rs 1,793.8 crore.

- Net profit up 7.8 times at Rs 8,88.9 crore.

- Ebitda up 7.2 times at Rs 1368.8 crore.

- Margin at 76.3 percent versus 46.3 percent.

- Interim dividend at Rs 30 per share.

Syndicate Bank (Q2, YoY)

- Net interest income down 4.7 percent at Rs 1,572.3 crore.

- Net loss at Rs 1,542.5 crore versus net profit at Rs 105.2 crore.

- Other Income at Rs 489.6 crore versus Rs 860.2 crore.

- Provisions at Rs 1,622.5 crore versus Rs 1,774.1 crore. (QoQ)

- GNPA at 12.98 percent versus 12.59 percent. (QoQ)

- NNPA at 6.83 percent versus 6.67 percent. (QoQ)

United Spirits (Q2, Standalone YoY)

- Revenue up 14.2 percent at Rs 2,228.1 crore.

- Net profit up 69 percent at Rs 258.7 crore.

- Ebitda up 36.1 percent at Rs 432.4 crore.

- Margin at 19.4 percent versus 16.3 percent.

Narayana Hrudalaya (Q2, Consolidated YoY)

- Revenue up 27.2 percent at Rs 711.3 crore.

- Net profit down 17.6 percent at Rs 13.6 crore.

- Ebitda up 25.6 percent at Rs 73 crore.

- Margin at 10.3 percent versus 10.4 percent.

Dixon Technologies (Q2, YoY)

- Revenue down 16 percent at Rs 739 crore.

- Net profit down 21 percent at Rs 16.4 crore.

- Ebitda down 6 percent at Rs 33 crore.

- Margin at 4.5 percent versus 4 percent.

- Revenue lower due to fall in mobile segment; Net profit lower due to lower other income and higher tax rate.

ITD Cementation (Q2, YoY)

- Revenue up 31 percent at Rs 620 crore.

- Ebitda up 26 percent at Rs 78 crore.

- Margin at 12.6 percent versus 13.2 percent.

- Net profit up 42 percent to Rs 27.4 crore.

- Net profit growth aided by higher other income and lower tax rate.

IndoStar Capital (Q2, YoY)

- NII up 47 percent at Rs 184 crore.

- Net profit down 8 percent at Rs 64 crore.

- Impairment of financial instruments impacted September quarter.

- Impairment loss stood at Rs 11 crore versus Impairment gain stood at Rs 12 crore in the base quarter.

- Net Interest Margin rose 220 basis points QoQ and stood at 8.6 percent, says company.

- Positive ALM, month on month, for the next 18 months, says company.

- Cost to Income ratio has declined 650 basis points QoQ to 37.6 percent, says company.

KEI Industries (Q2, YoY)

- Revenue up 33 percent at Rs 997 crore.

- Net profit up 45 percent at Rs 41.4 crore.

- Ebitda up 32 percent at Rs 101 crore.

- Margin at 10.1 percent versus 10.2 percent.

Bulk Deals

- Solara Active Pharma Sciences: HBM Healthcare Investments Cayman acquired 5.3 lakh shares or 2.15 percent equity at Rs 302.9 each.

- Strides Pharma Science: MSD India Fund sold 8 lakh shares or 0.89 percent equity at Rs 412.01 each.

Who's Meeting Whom

- CAN Fin Homes to meet Investec on Nov. 11.

- Mahindra Holidays and Resorts to meet DHFL Pramerica MF on Nov. 2.

Insider Trading

- Axis Bank promoter LIC sold 8.5 lakh shares on Oct. 30.

- EROS International Media promoter acquired 1.5 lakh shares on Oct. 31.

(As reported on Oct. 31)

Trading Tweaks

- Jindal Worldwide record date for share split from Rs 5 to Re 1.

- Mercator price band revised to 5 percent.

- Talwalkars Better Value Fitness price band revised to 5 percent.

Money Market Update

Rupee closed at 73.96/$ on Wednesday versus 73.68/$ On Tuesday.

F&O Cues

- Nifty October futures closed trading at 10,398, premium of 12 points.

- Nifty November open interest down 5.5 percent; Nifty Bank November OI up 1.7 percent.

- Max open interest for November series at 10,700 strike value call option (Open interest at 22.2 lakh shares).

- Max open interest for November series at 10,000 strike value put option (open interest at 44.9 lakh shares).

Put Call Ratio

- Nifty PCR at 1.56 from 1.49.

- Nifty Bank PCR 1.27 at from 0.89.

Brokerage Radar

On L&T

CLSA

- Maintained ‘Buy' with a price target of Rs 1,730, implying a potential upside of 33 percent from the last regular trade.

- September quarter was a stellar quarter, surpassing estimates in all front.

- Execution pickup without balance-sheet sacrifice was commendable.

- Hydrocarbon remains star business; RoE crosses 15 percent after six years.

Investec

- Maintained ‘Buy'; hiked price target to Rs 1,725 from Rs 1,620, implying a potential upside of 33 percent from the last regular trade.

- Stellar quarter; ticks all boxes.

- Improved execution environment; large order pipeline.

- Guidance likely to be met on all fronts.

Macquarie

- Maintained ‘Outperform'; raised price target to Rs 1,880 from Rs 1,825, implying a potential upside of 45 percent from the last regular trade.

- L&T delivered spotless set of numbers; handsome beat on all fronts.

- Revenue growth shifted into next gear, led by sharply better infrastructure order execution.

- Margins and order inflows have potential to surprise positively on guidance.

JPMorgan

- Maintained ‘Overweight' with a price target of Rs 1,570, implying a potential upside of 21 percent from the last regular trade.

- Large topline beat led by strong execution in flagship Infra segment and core business overall.

- Working capital not deteriorated, despite strong pick-up in execution.

- After H1 see upside risks to estimates.

On Tata Motors

CLSA

- Maintained ‘Sell'; cut price target to Rs 170 from Rs 200, implying a potential downside of 5 percent from the last regular trade.

- Weak September quarter: JLR reported loss for second consecutive quarter.

- India business better but risk of the truck cycle turning.

- Cut FY19-21 EPS estimates by 10-28 percent on lower volume and margin estimates for JLR.

Macquarie

- Maintained ‘Outperform'; cut price target to Rs 325 from Rs 485, implying a potential upside of 82 percent from the last regular trade.

- India business delivered strong performance, JLR reported an EBIT loss.

- Shift in focus to profitability and cash-flows as a positive development.

- Price target cut on reduced operating income estimates for the current and the next financial year.

On Vedanta

Macquarie

- Maintained ‘Outperform'; cut price target to Rs 254 from Rs 272, implying a potential upside of 20 percent from the last regular trade.

- September quarter's operating income was below consensus led by higher costs in aluminium and zinc international division.

- Negative: Higher cost guidance for aluminium and lower volume guidance for oil.

- High upstream capex to limit deleveraging; Dividend the only positive should restrict downside.

JPMorgan

- Maintained ‘Overweight' with a price target of Rs 345, implying a potential upside of 63 percent from the last regular trade.

- In weak quarter, lower net debt and large dividend positive.

- Expect second half to see meaningful pickup in earnings led by volume growth, lower cost and weaker rupee.

- Overall macro sentiment and environment remain challenging for metal stocks.

On United Spirits

Macquarie

- Maintained ‘Underperform' with a price target of Rs 443, implying a potential downside of 23 percent from the last regular trade.

- September quarter results were significantly ahead on account of higher volume growth and margin.

- Operating margin boosted by lower-than-expected other expenses and employee cost.

- Believe cost savings program is yielding results, but surprised by quarterly variations.

JPMorgan

- Maintained ‘Overweight' with a price target of Rs 550, implying a potential downside of 4 percent from the last regular trade.

- Strong all-around performance in second quarter; multi-quarter high margins.

- Strong margin delivery led by gross margin expansion, lower staff costs and productivity gains.

- Debt and Interest costs moderate further.

On Lupin

Nomura

- Maintained ‘Buy' with a price target of Rs 997, implying a potential upside of 12 percent from the last regular trade.

- September quarter was muted but operationally inline quarter.

- Expect revival in the U.S. in the second half due to seasonality and launch of key products.

- Ramp-up in Solosec to have positive impact on margins.

CLSA

- Maintained ‘Sell' with a price target of Rs 780, implying a potential downside of 12 percent from the last regular trade.

- Despite favourable currency, margin pressure continued.

- U.S. revival depends on approval/ramp-up of certain big products.

- See downside risk to FY20 EPS if the U.S. business does not revive

Macquarie

- Maintained ‘Underperform'; cut price target to Rs 775 from Rs 788, implying a potential downside of 13 percent from the last regular trade.

- Lacklustre show despite forex tailwind.

- Expect medium-term U.S. sales to remain muted, with a laborious road to recovery.

- Even with improved traction in the second half, valuations are expensive.

On Dabur

Jefferies

- Maintained ‘Buy'; cut price target to Rs 460 from Rs 520, implying a potential upside of 19 percent from the last regular trade.

- September quarter was a muted quarter as margins below par.

- Shift in festive season impacted domestic volume growth.

- Cut estimates to factor in lower margins.

CLSA

- Maintained ‘Buy'; cut price target to Rs 500 from Rs 570, implying a potential upside of 30 percent from the last regular trade.

- September quarter's Ebitda missed but earnings came inline.

- Domestic stable but international under pressure.

- Management retained double-digit volume growth guidance but sounded cautious.

More Calls

Macquarie on HEG

- Maintained ‘Outperform'; hiked price target to Rs 5,823 from Rs 5,200, implying a potential upside of 37 percent from the last regular trade.

- September quarter's Ebitda was above estimates led by higher realisation.

- Higher needle coke costs from the second half to impact margins marginally.

- With higher availability of needle coke, expect 90 percent utilisation in the second half.

Nomura on Reliance Nippon

- Maintained ‘Neutral' with a price target of Rs 210, implying a potential upside of 26 percent from the last regular trade.

- September quarter was inline, but uncertain times ahead.

- Lower opex due to reducing new business drag supporting core EBIT.

- TER cuts change the entire business model; Would wait and see if flows remain stable.

Deutsche Bank Research on Castrol India

- Maintained ‘Buy'; cut price target to Rs 195 from Rs 217, implying a potential upside of 31 percent from the last regular trade.

- September quarter reported a steady volume growth and margins.

- Gross margins impacted by higher crude and weaker rupee.

- Expect robust margins and volume growth led by auto and industries.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.