Credit rating Gopalpur Ports Ltd., a subsidiary of Adani Ports and Special Economic Zone Ltd., has seen its credit rating upgraded by CareEdge. The rating has been revised from CARE BBB (RWP) to CARE AA with a 'stable' outlook—a six-notch upgrade following the ports operator's acquisition of GPL in March 2024.

This move comes after the change in ownership from the Shapoorji Pallonji Group to Adani Ports.

CareEdge highlighted that the upgrade reflects the strong backing of Adani Ports, which has established a track record of turning around port operations. It cited the successful turnaround of Dhamra Port after its acquisition as an example. The agency also pointed to the improvement in operational efficiency and cargo handling at GPL under Adani Ports' ownership.

A key factor in the upgrade is the prepayment of external debt, with approximately 64% of GPL's external debt being cleared by the Adani Group unit, in line with the company's capital management strategy. This move is expected to strengthen the port's debt coverage ratios and further solidify its financial position.

Adani Ports, which operates across 10 ports and three terminals, handles nearly 27% of India's seaborne cargo.

CareEdge noted that the vast fleet of rakes and logistical equipment at APSEZ's disposal is expected to boost operational efficiency at GPL, addressing previous challenges related to cargo evacuation. The agency also highlighted the port's favourable location, tariff flexibility, and strong liquidity, supported by the creation of a Debt Service Reserve Account.

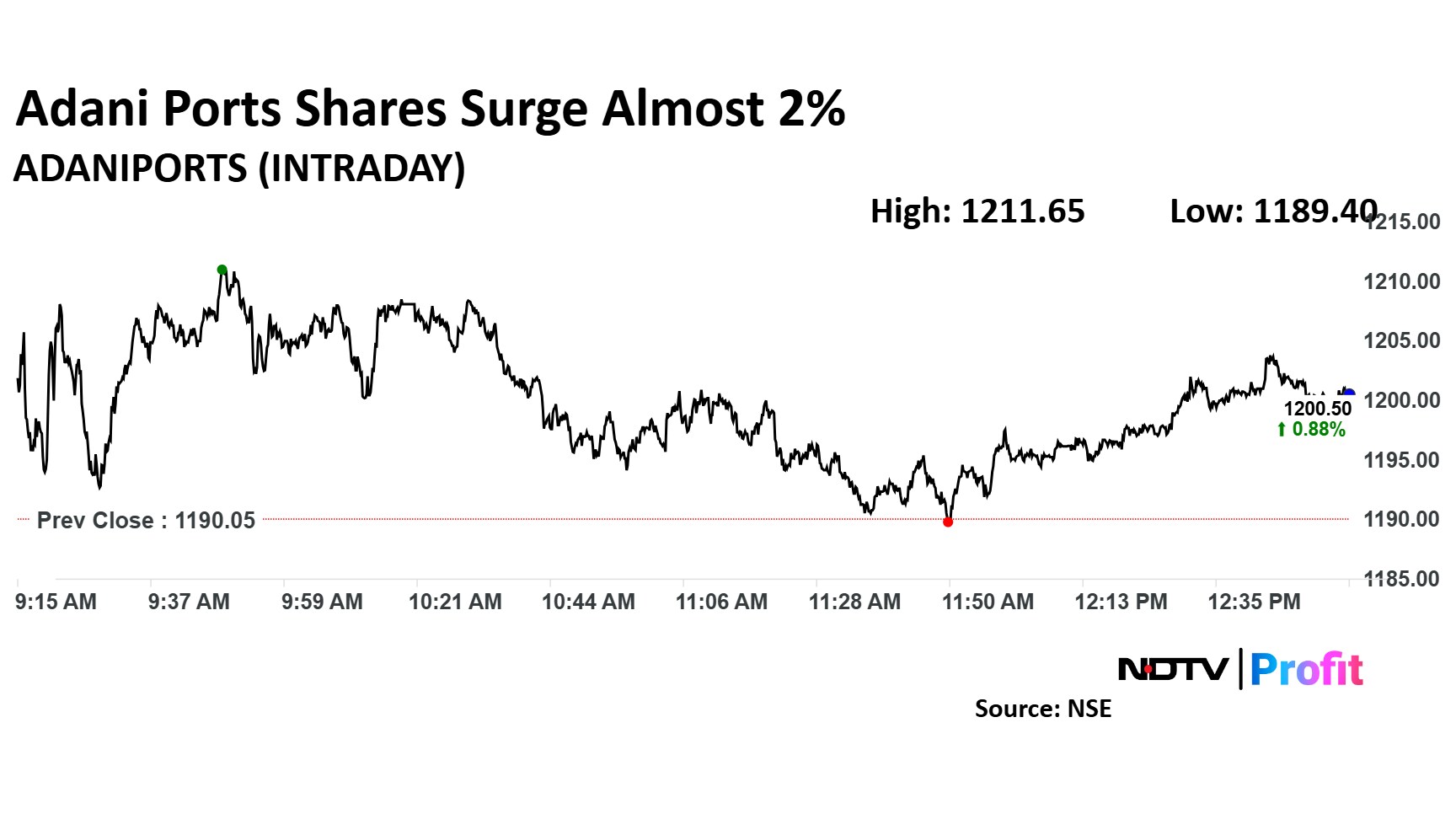

Adani Ports Share Price

The scrip rose as much as 1.82% to Rs 1,211.65 apiece. It pared gains to trade 0.89% higher at Rs 1,200.65 apiece, as of 01:00 p.m. This compares to a 0.20% advance in the NSE Nifty 50.

It has risen 36.65% in the last 12 months. Total traded volume so far in the day stood at 0.54 times its 30-day average. The relative strength index was at 41.65.

Out of 18 analysts tracking the company, 16 maintain a 'buy' rating, two recommend a 'hold' and none suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 43.7%.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.