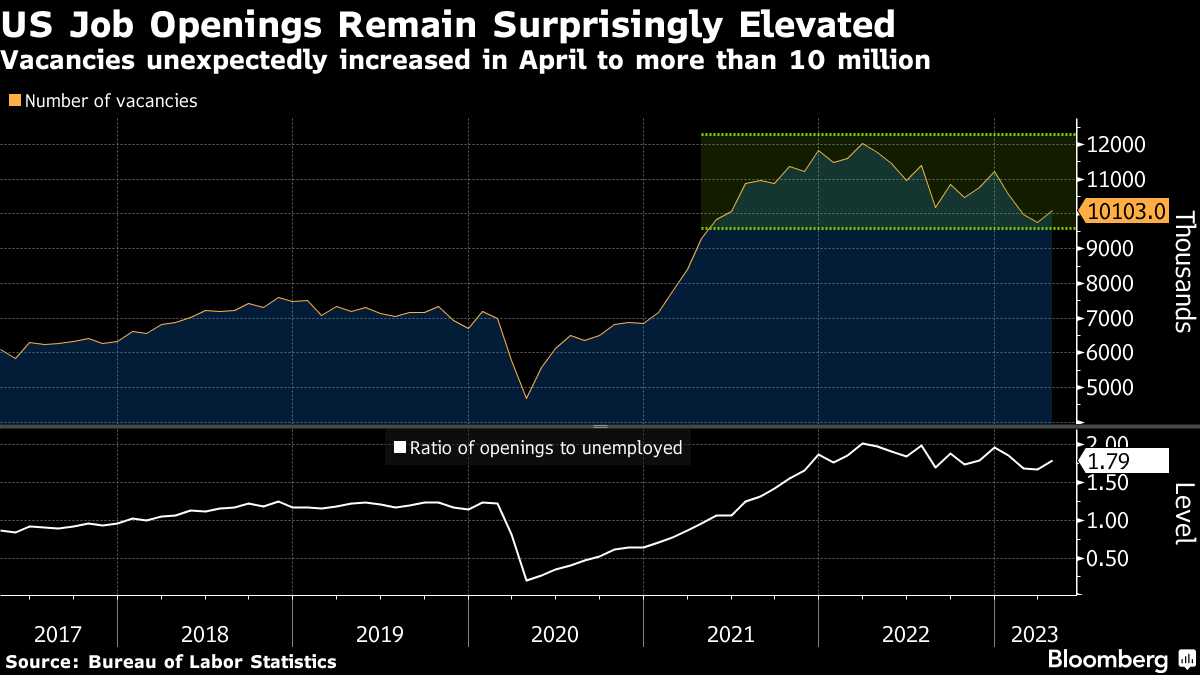

(Bloomberg) -- Vacancies at US employers unexpectedly surged in April to the highest in three months, giving the Federal Reserve more reason to consider hiking interest rates again soon.

The number of available positions increased to 10.1 million from an upwardly revised 9.75 million in March, the Labor Department's Job Openings and Labor Turnover Survey, or JOLTS, showed Wednesday. The figure beat all estimates in a Bloomberg survey of economists, which called for 9.4 million openings.

Market expectations for a rate hike in June recovered to price in a more than 70% probability following the report, after earlier taking a slight knock following a worse-than-forecast Chicago PMI reading. The yield on the two-year Treasury initially spiked and the S&P 500 fell further.

The advance was led by retail trade, health care and transportation and warehousing. Openings fell in accommodation and food services, business services and manufacturing. At the same time, hiring edged up.

Demand for labor has remained largely resilient even though tighter financial conditions have forced some employers to hit the brakes on hiring. While job cuts that began in white-collar sectors including technology and banking are starting to spread to other industries, some companies are still struggling to find workers.

The figures show demand for workers continues to outstrip supply, and the Fed has stressed it's key to get the two back into balance to cool wage growth. The data, combined with inflation that's still running well above target, may tilt officials to press on with another interest-rate hike when they meet in two weeks.

On the other hand, some officials are leaning toward a pause given stress in the banking sector and the debt-ceiling drama. Policymakers will also get the government's monthly jobs report on Friday, which is forecast to show hiring slowed and the unemployment rate ticked up in May.

What Bloomberg Economics Says...

“We expect the jump in job openings to prove temporary, as other indicators show the labor market slowly cooling. That said, the April job-openings data mean the Fed likely will continue leaning against the labor market to sustainably achieve its 2% long-run average inflation target.”

— Stuart Paul, economist

To read the full note, click here

Layoffs declined, led by construction as well as leisure and hospitality. The so-called quits rate, which measures how many workers voluntarily left their jobs as a share of total employment, dropped to a more than two-year low of 2.4%. That equates to about 3.8 million Americans and reflected large declines among workers in health care and business services.

The quits level is often seen as a proxy of how workers feel about their job security. A separate report out Tuesday showed consumer confidence fell to a six-month low in May amid deteriorating views on the labor market. The share of respondents expecting more employment opportunities in the next six months declined to the lowest since 2016.

The ratio of openings to unemployed people — which is closely watched by the Fed — rose to 1.8 in April, the highest in three months, according to the JOLTS data. In the firm labor market that preceded the pandemic, that ratio was about 1.2.

Some economists have questioned the reliability of the JOLTS statistics given the survey's low response rate. By year-end, it had fallen to about 31%, roughly half the rate just three years earlier.

--With assistance from Jordan Yadoo and Benjamin Purvis.

(Adds Fed expectations, Bloomberg Economics comment)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.