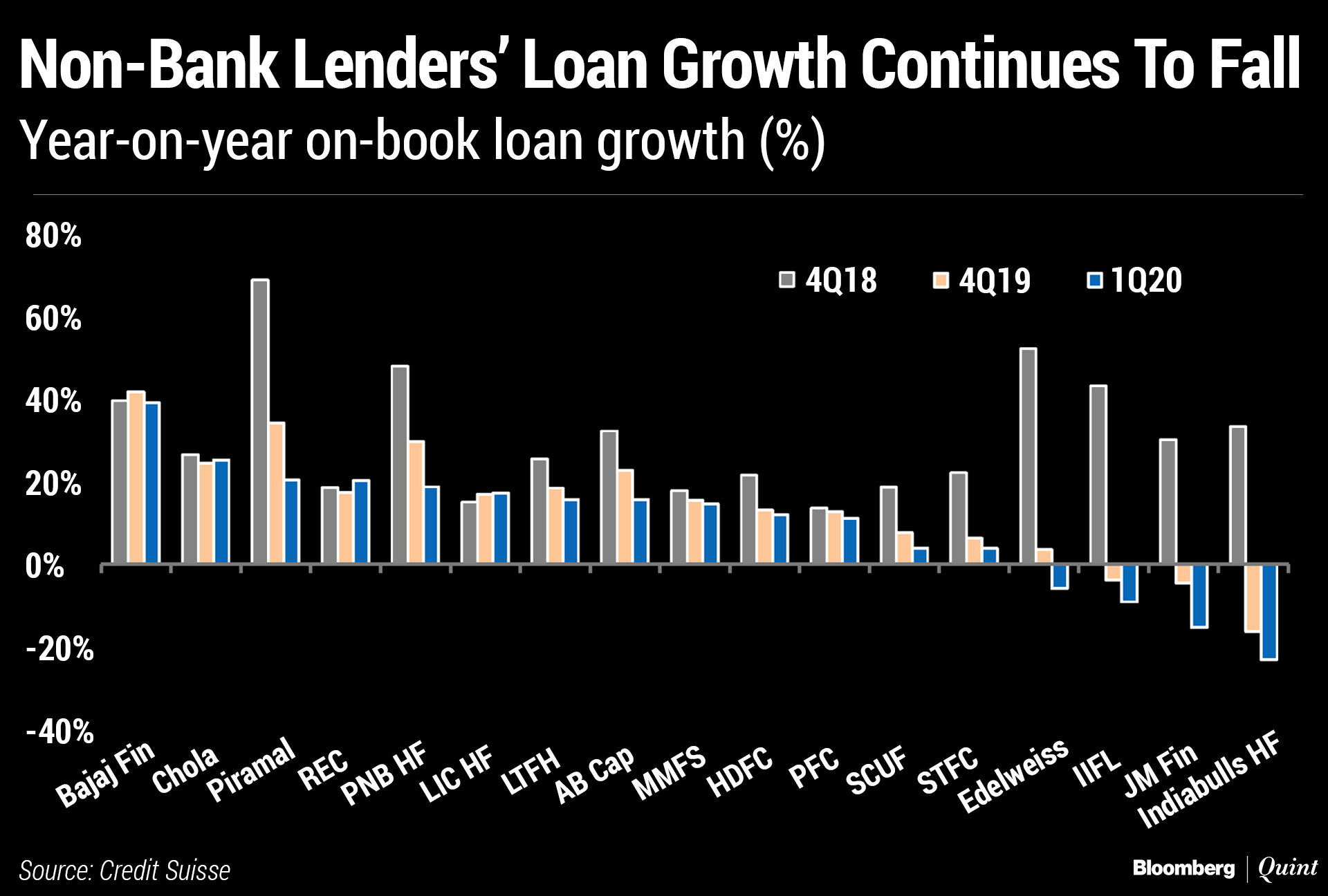

Loan growth of non-bank lenders continued to fall in the quarter ended June as the liquidity crisis in the economy intensified and lending to automobile sector fell amid a slowdown.

The aggregate loan growth of non-bank financial companies and housing financiers fell 11 percent year-on-year and 1.8 percent sequentially in the April-June period, according to a report by Credit Suisse. Of the non-bank lenders analysed by the research firm, Indiabulls Housing Finance Ltd., JM Financial Ltd., IIFL, Edelweiss Financial Services Ltd., Piramal Enterprises Ltd. and PNB Housing Finance Ltd. are the worst hit.

Cholamandalam Investment & Finance Company Ltd., REC Ltd., LIC Housing Finance Ltd. witnessed a marginal improvement over the quarter ended March, the report said.

“Loan growth for NBFCs continued to trend down as funding crunch continued, coupled with a slowdown in automobile and commercial vehicle sector,” Credit Suisse said in the report reviewing India's financial sector in the first quarter. “NBFCs having access to liquidity and not subject to demand slowdown maintained their pace of growth. Whereas loan growth continued to decelerate or shrink for those facing demand slowdown (vehicle financiers) and liquidity constraints.”

Growth of NBFCs, the report said, continued to trend down amid credit differentiation by bond markets, with healthier ones, or those with strong parent backing, being able to tap comfortably into bond markets.

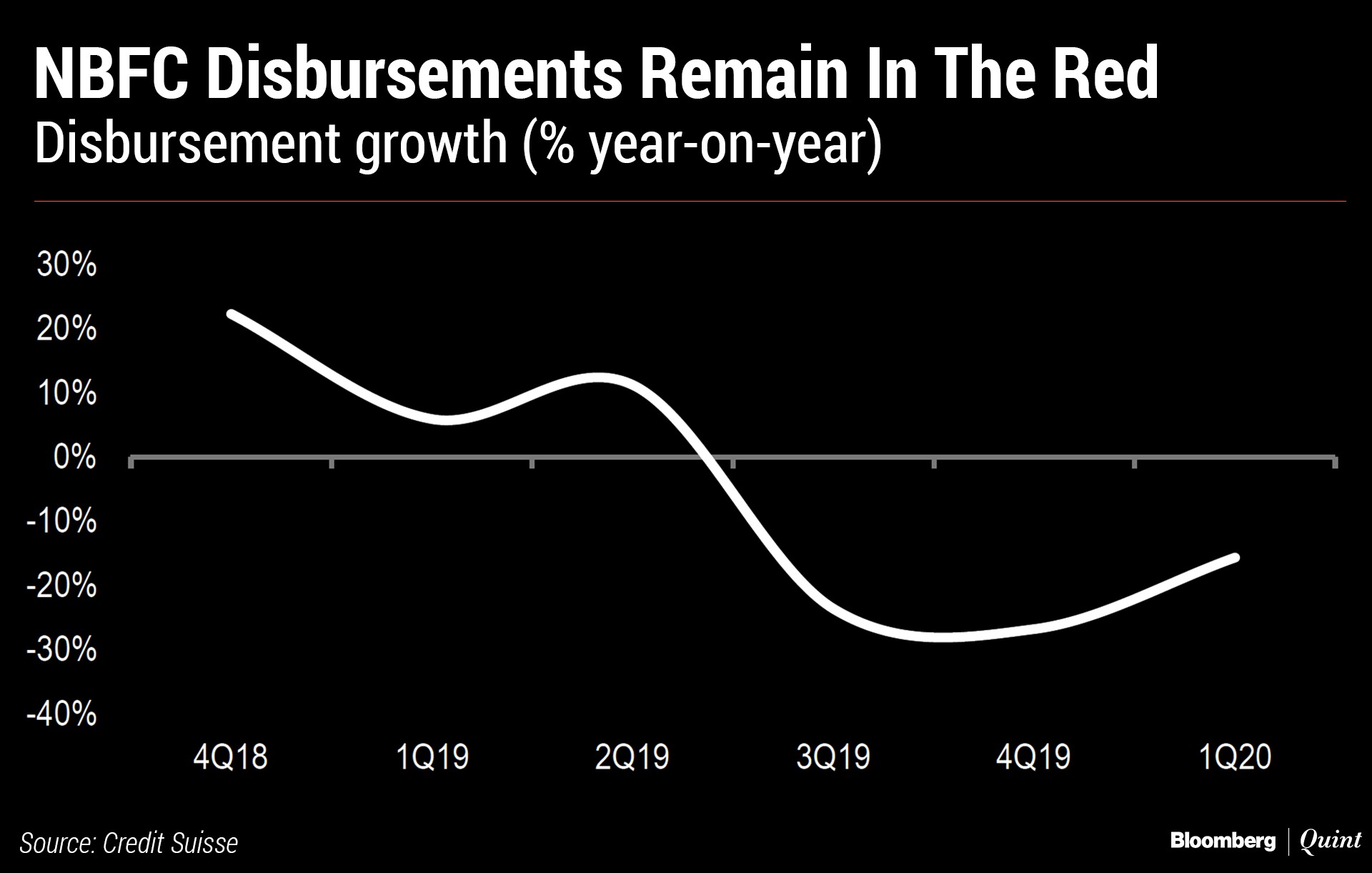

Fresh disbursement, too, remained in the negative. It contracted 17-18 percent in the three months ended June against about 5 percent growth a year ago, the report said.

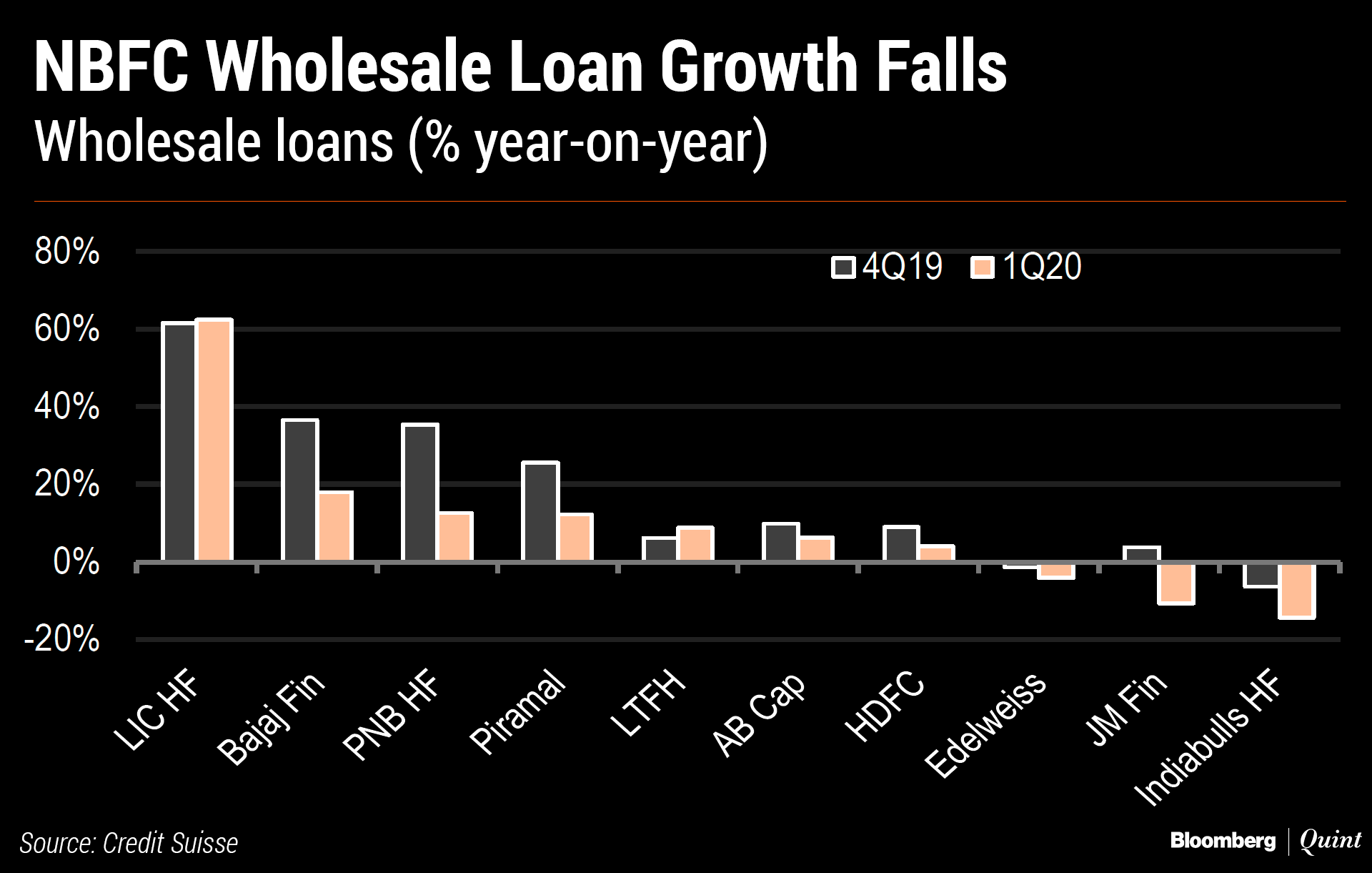

The slowdown was more evident in the wholesale segment as NBFCs looked to reduce corporate exposure (mainly developer funding). On the retail side, loan growth started showing signs of moderation on account of demand slowdown, especially in the vehicle segment and for companies turning cautious in lending to small and medium enterprises, it said.

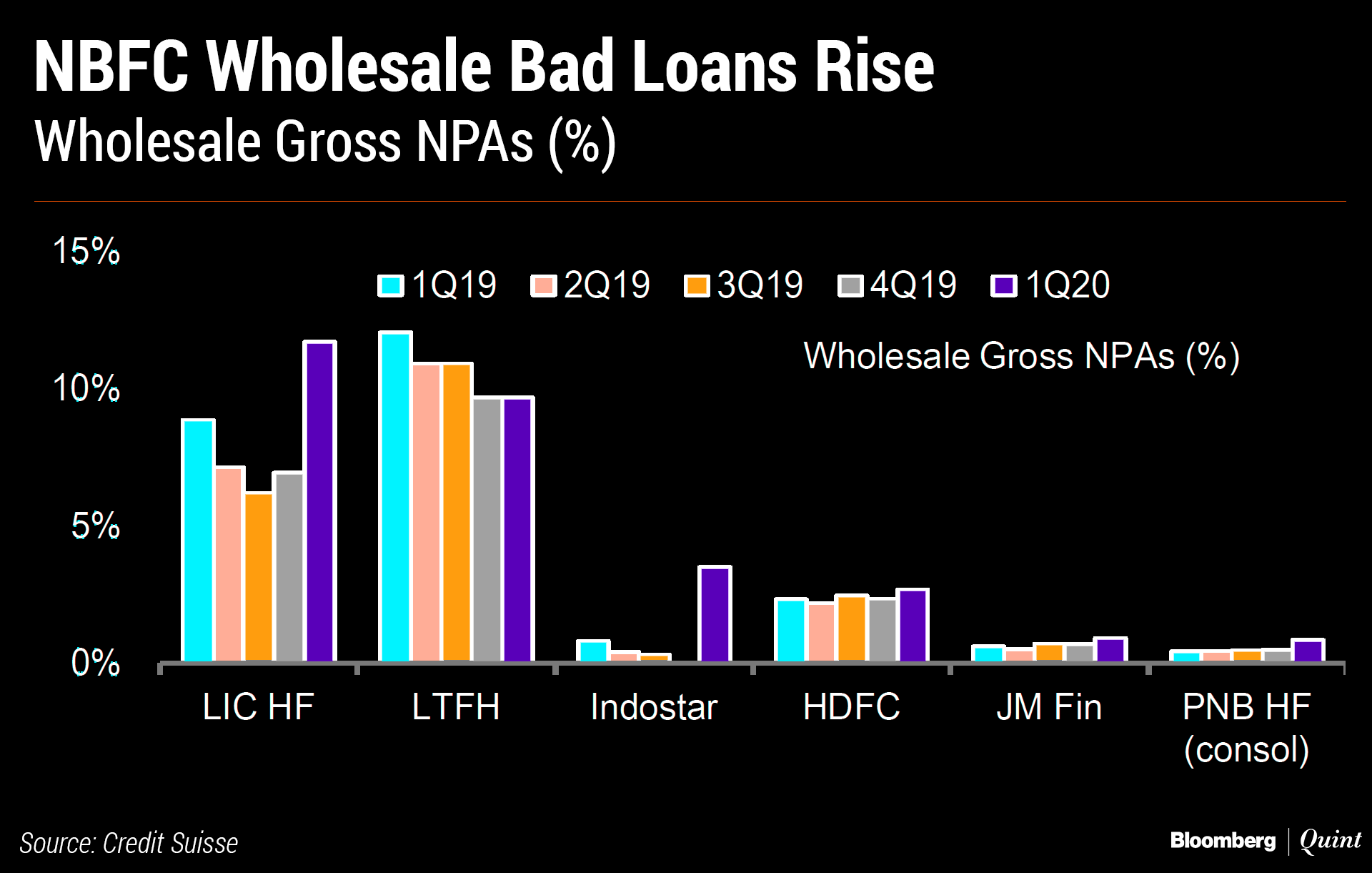

Wholesale loans at NBFCs also deteriorated with 10-11 percent of these turning bad. Recoveries were lower, as expected resolutions in the bankruptcy code were delayed, the report said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.