The rupee weakened on Wednesday after opening lower, tracking global risk aversion and domestic policy cues. Investors digested the Reserve Bank of India's rate decision, while also bracing for heightened global trade tensions.

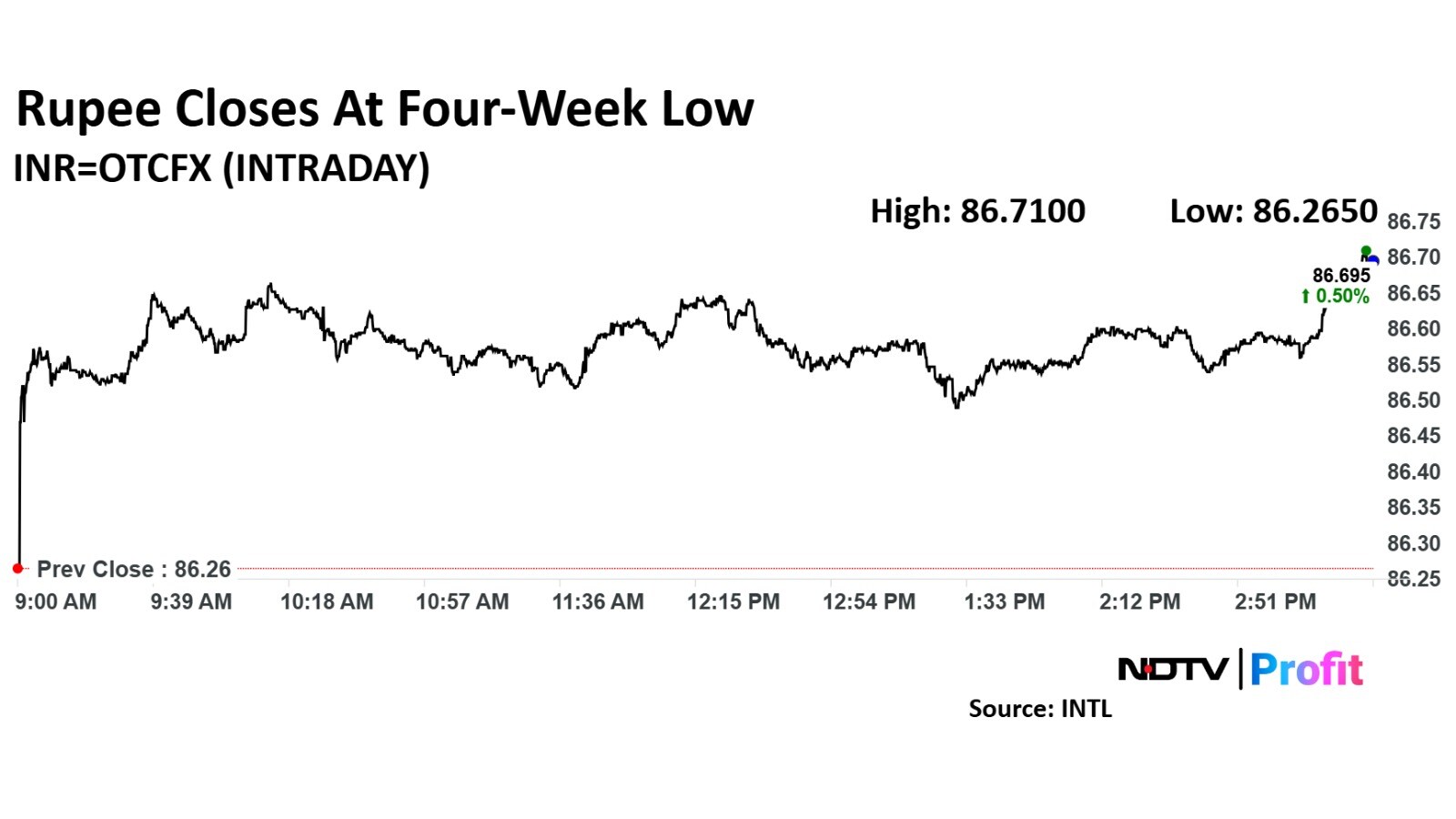

The rupee fell 45 paise to close at 86.70 against the US dollar, compared to 86.25 in the previous session. This marks the local currency's lowest closing level since March 17. Intraday, it dropped as much as 47 paise to 86.72 a dollar. Shortly after market open, it had slipped 41 paise to 86.66—its lowest level since March 19.

India's Monetary Policy Committee, led by RBI Governor Sanjay Malhotra, cut the benchmark repo rate by 25 basis points to 6% and shifted its stance from ‘neutral' to ‘accommodative'. The standing deposit facility rate now stands at 5.75%, while the marginal standing facility rate is at 6.25%. This is the central bank's second consecutive cut, following a reduction in February.

"The RBI's repo rate cut and shift to an accommodative stance signal easier borrowing conditions, potentially weakening the rupee. This benefits exporters through improved competitiveness but could raise input costs for importers due to a softer currency," said Abhishek Goenka, founder and chief executive officer of IFA Global.

Tarun Singh, managing director and founder of Highbrow Securities, said the 25-basis-point rate cut is “more than just a monetary policy adjustment. It's a calculated gamble on India's ability to defy global headwinds," he said.

However, Singh warned that inflation and currency risks loom large. “A consumption surge that relies on imported goods such as electronics or energy could backfire by widening the trade deficit and pressuring the rupee,” he added.

Globally, sentiment remained jittery after the United States moved forward with a 104% tariff on Chinese goods. As trade tensions escalated, the offshore yuan fell to a record low, following China's decision to loosen its grip on the currency. Brent crude prices dropped 3.34% to $60.72 per barrel, while the spot dollar index slipped 0.58% to 102.3560.

Indian currency and equity markets will remain closed on Thursday on account of Mahavir Jayanti.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.