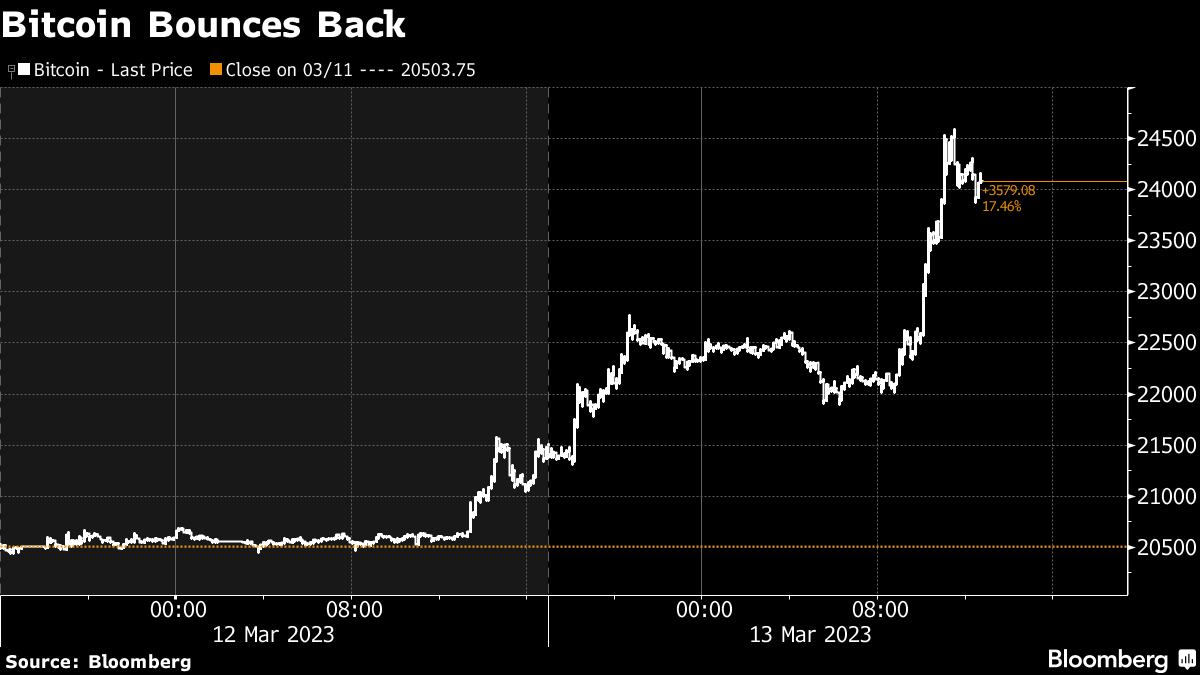

(Bloomberg) -- Bitcoin surged 13%, the biggest one-day increase since the wild price swings seen during November's market turmoil, and shares of crypto companies rallied following moves by US authorities to stem the spread of concern about the health of the nation's financial system.

The rally helped to extend the largest cryptocurrency's recovery from its worst week in about four months, where an equity selloff, jitters in the banking sector and an escalating US regulatory crackdown on crypto combined to hurt investor sentiment. The stablecoin USDC traded at par again with the dollar after depegging last week. Adding to the optimism was Binance's announcement that it would covert the remaining stablecoin funds from a $1 billion industry stability fund to Bitcoin, Ether and its BNB token.

Binance's move “helps the narrative that as confidence in stablecoins declines, the true ethos of cryptocurrency is starting to shine,” said Chris Newhouse, a crypto derivatives trader at crypto investment firm GSR. “Flows from stablecoins into the majors such as BTC and ETH definitely seem to be a popular narrative popping up.”

Bitcoin jumped 13% to $24,234 as of 5 p.m. in New York. The increase is the biggest since Nov. 10, when the collapse of FTX whipsawed markets. Over the weekend US agencies pledged to fully protect all depositors' money following the collapse of Silicon Valley Bank on Friday, while the bank's UK branch was sold to HSBC Holdings Plc for £1 on Monday morning.

Meanwhile Signature Bank — one of the most prominent US crypto-friendly banks left after Silvergate Capital Corp. shut down earlier this month — was closed by New York state financial regulators on Sunday with access to funds for depositors. The spate of bank closures had unnerved crypto markets, with several major crypto companies including Circle Internet Financial, Coinbase Global Inc. and Paxos Inc. exposed.

Coinbase rose 11%, MicroStrategy Inc. climbed 16% and Marathon Digital Holdings Inc. surged 26%.

Gains among smaller cryptoassets known as altcoins were mostly lower, with Cardano up about 6%, and Tron increasing around 9%. Ether gained 7.4%.

SVB's failure triggered a knock-on effect in crypto's crucial market of stablecoins after Circle, the operator of USDC, revealed it had $3.3 billion of reserves backing the token stored with the bank. Stablecoins are cryptocurrencies that aim to keep a one-to-one value with a less volatile asset like the US dollar, and are an integral safe haven for crypto investors seeking to maintain value without exiting into traditional currencies.

The news of SVB's shutdown caused Circle's USDC to slip far below its dollar peg — an event that's the stablecoin equivalent of a money market fund breaking the buck — and sent a shock through the broader sector. By Monday morning, USDC had recovered to trade at par again.

“For crypto markets that means stablecoins are correcting and investors are now looking to hedge potential stagflationary forces by buying a range of assets, including BTC, ETH and altcoins alongside more traditional hedges such as gold and silver,” said Darius Tabatabai, co-founder at decentralized exchange Vertex Protocol. “Given the headwinds faced over the last two years, this could be a significant turning point for the space.”

The token's depeg triggered a huge surge in volumes on decentralized exchanges on Saturday, thanks to its outsized prominence as a trading pair on such exchanges. Uniswap and Curve, the two leading decentralized exchanges, recorded their highest ever daily trading volume that day, according to data from DeFiLlama, with about $13.3 billion and $8 billion in volume respectively.

Curve's 3pool, a liquidity platform that allows traders to swap three of the market's top stablecoins like for like, accounted for $4.8 billion in trade volumes on Saturday. Users queued to swap USDC and DAI, a stablecoin backed by cryptoassets rather than actual dollars, for Tether's USDT, the largest stablecoin by market circulation, after both USDC and DAI lost their dollar pegs over the weekend.

The total value locked in decentralized finance protocols has dropped nearly 10% in just a day to $38.6 billion, according to data from tracker DeFi Llama.

At the same time the dominance of Tether, the only stablecoin that's benefited from the ructions in crypto markets, has risen further as traders seek safety in the least-regulated token. Tether accounted for $72.3 billion of the $135 billion stablecoin universe as investors yanked $3 billion from rival USDC since Friday, according to crypto price data site CoinGecko.

“Bitcoin is greatly helped by bailout of SIVB and Signature,” Peter Tchir of Academy Securities said. “Given the role the two banks and their customer base played in the crypto ecosystem, the fact that uncertainty is reduced for both is boosting sentiment.”

--With assistance from , , and .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.