India's record year for initial public offerings so far hasn't made the companies richer. It's the promoters and investors who cornered the bulk of the gains.

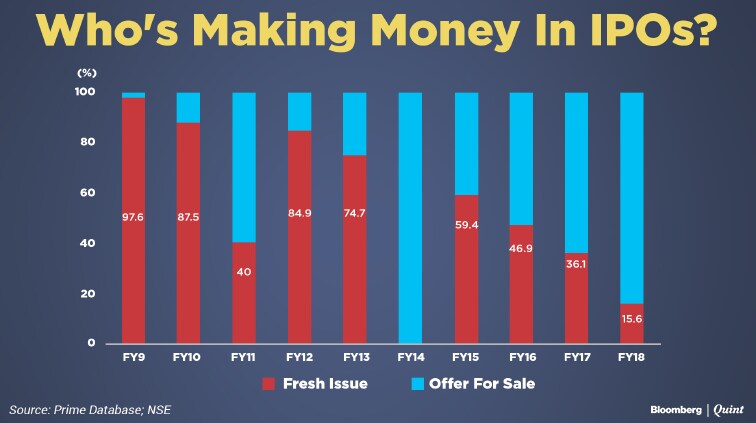

Of the Rs 29,000 crore raised in more than two dozen IPOs, 84 percent came from stake sales by existing shareholders. Companies got the remaining 16 percent by issuing new stock, the lowest in at least 29 years.

The year 2014 was the only aberration when entire proceeds came through issuing fresh shares. That's because only one company launched an IPO that year: Just Dial Ltd.

When companies raise funds via the offer for sale route, the proceeds are used to pay existing shareholders who are looking to dilute their holding or exit the firm.

On the other hand, when a company issues fresh shares, the proceeds can be used as a capital investment to grow the company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.