(Bloomberg) --

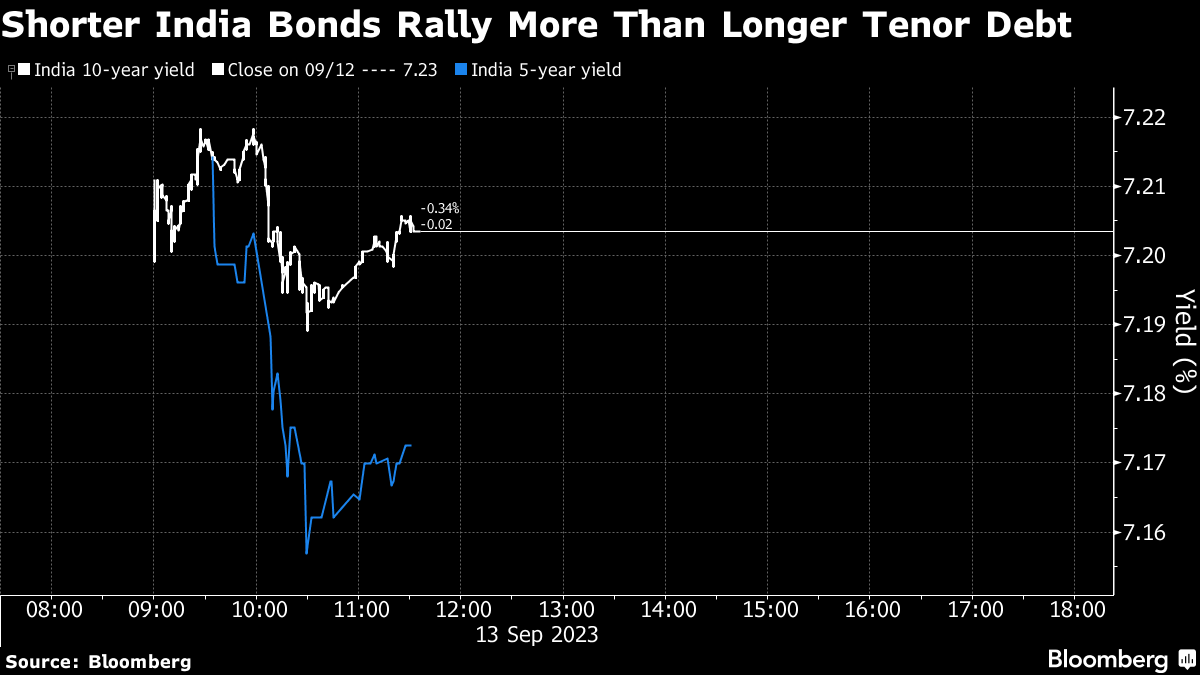

India's bond yield curve steepened with shorter bonds rallying more than longer-tenor debt after the central bank tweaked investment guidelines for lenders in line with global standards.

The revised rules require the Reserve Bank of India's approval for any change in classification of bond holdings out of the held-to-maturity book. This reduces volume in bond-market trading, making it harder to sell longer tenor debt in the secondary market and boosting demand for shorter bonds, according to traders.

Yield on five-year bonds fell as much as 8 basis points to 7.16%, the most since May before paring slightly, while benchmark 10-year yields dropped 3 basis points to 7.2%. The spread between 10- and 5-year yields has been below 5 basis points this quarter and even turned negative late last week as investors priced in a long pause by the central bank.

“Some steepening of the yield curve will definitely happen,” said Rajeev Pawar, head of treasury at Ujjivan Small Finance Bank, “Now for the held-to-maturity book you can't do a one-time shift every April. There will be less volume in the market, and traders will not buy as much of very long tenor paper.”

The RBI will allow banks to reclassify bond holdings only in very specific cases, when it is necessary due to major changes in the way the lender manages investments. The rules aim to improve the quality of banks' financial reporting and boost their overall risk management, the RBI said Tuesday.

--With assistance from Subhadip Sircar.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.