Shares of Marico Ltd. will be in the spotlight on Friday as the FMCG firm's India business saw a surge in underlying volume to a multi-quarter high, the company informed through a disclosure to the stock exchanges on Thursday.

The company cited positive trends in the core franchises and continuous scale-up of new businesses as key drivers, amid improving trends in rural markets and steady urban sentiment.

Marico expects improvement in the quarters to come, with easing inflation, a favourable monsoon and policy stimulus to provide impetus.

Parachute's Mini Descent

Parachute witnessed a marginal dip in volumes, which the brand attributed to hyperinflationary input costs and pricing conditions.

"The brand's resilience, reflected in its pricing inelasticity and enduring equity, was evident in its ability to absorb substantial price hikes and ml-age reductions, including a notable increase in June 2025, with minimal impact on volumes," stated the company's filing.

After normalising for the volume reductions, the number of packs sold during the quarter remained consistent with the brand's growth trajectory, the filing further stated.

Saffola's Healthy Growth

Saffola Oils' revenue growth stood in the high twenties, backed by mid-single-digit volume growth. The brand has ensured that the benefits of the recent import duty reduction on vegetable oils has reached consumers, Marico said.

Other segments, including hair oils and personal care, also saw an uptick in growth, with the former seeing double-digit growth and the latter holding profitability parameters steady.

Marico's Offshore Endeavours

Marico's international business has delivered high constant-currency growth, driven by growth across most markets. "Bangladesh continued to exhibit visible resilience with high-teen constant currency growth," added the filing.

What Lies Ahead

Marico expects gross margin pressures to ease from the second half of the fiscal, owing to rangebound crude oil derivatives buoyed by easing oil prices amid reduction in import duty.

Despite the input cost push, the company's investments stay in line long-term equity strengthening and an acceleration in portfolio diversification, and Marico expects modest operating profit growth on an annual basis.

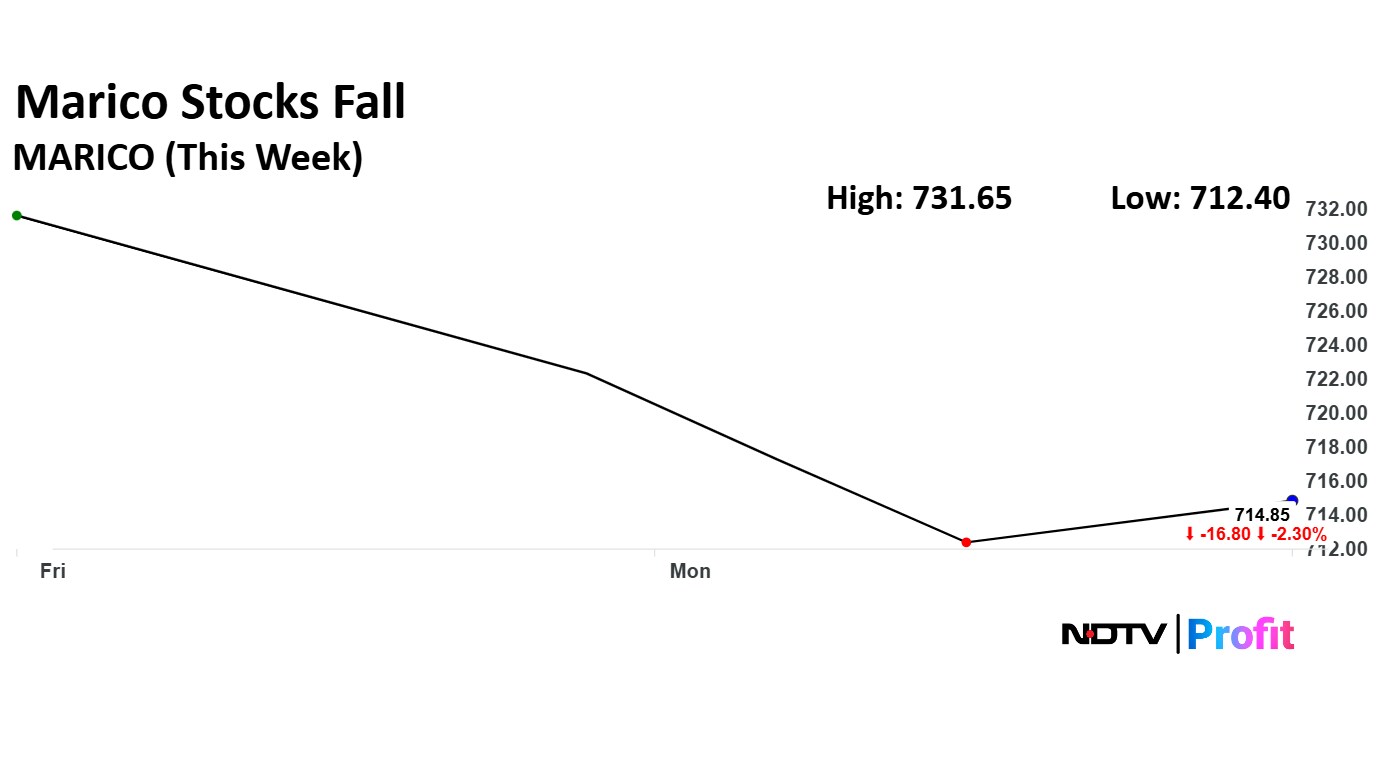

Marico Share Price

Share price of the company closed 0.34% higher at Rs 714.85 apiece on Thursday, as compared to a 0.19% slip in the NSE Nifty 50. In the current week, the company's share price has slipped over 2%, while its year-to-date and 12 month returns have advanced 11.78% and 17.67% respectively.

Out of 43 analysts tracking the company, 31 maintain a 'buy' rating, nine recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.