(Bloomberg) -- An investment firm of conglomerate Tata Group with no analyst ratings and minuscule ownership by institutional investors has become the top-performing Indian stock this year, the latest showcase of the frenzy in local equities.

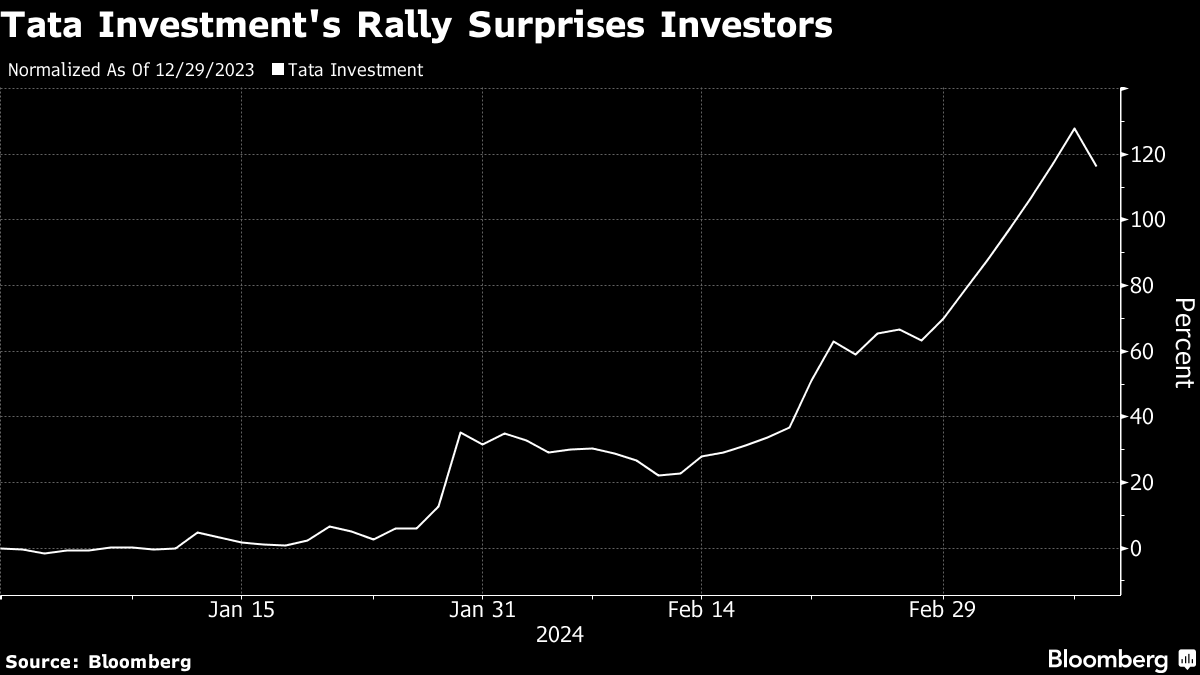

Tata Investment Corp. has soared 116% so far in 2024, the most among the Nifty 500 Index companies that represent more than 94% of India's market capitalization. The stock has led a $58 billion rally in Tata Group companies since the start of the year, with about a fifth of it coming last week alone, driven by expectations of Tata Sons' initial public offering next year.

There has been some excessive behavior in the bull run, and Tata Investment is a prime example, said Abhilash Pagaria, strategist at Nuvama Wealth Management Ltd. The stock's low liquidity and small market capitalization have amplified price swings, and a downturn can be expected, he said.

Read More: Tata Sons May Be Valued at Up to $96 Billion in IPO, Spark Says

The company's shares fell by the 5% daily limit Monday, their worst daily performance since Dec. 20, after the Times of India reported Tata Sons is exploring options to avoid an IPO.

The recent rally comes as the “froth” in small- and mid-cap stocks draws the attention of the Securities and Exchange Board of India. The market regulator last month asked mutual funds to protect investors amid concern that some parts of the nation's $4.5 trillion stock market have become overly exuberant.

Tata Sons holds 68.5% stake in Tata Investment, which has dividends from investments as its only source of revenue. It is valued at 2.4 times 12-month book value — on par with India's largest private sector lender HDFC Bank Ltd. and more than India's largest state-owned bank State Bank of India Ltd., data compiled by Bloomberg show.

Tata Investment's stake in several group companies has gone up this year, with stocks such as Tata Chemicals Ltd., Trent Ltd. and Tata Motors Ltd. rising more than 30%. The company's rally is mainly to catch up with the value of its holdings, said Omkar Kamtekar, research analyst at Bonanza Portfolio.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.