- State Bank of India’s Q3 net profit rose 24.5% to Rs 21,028 crore, beating estimates

- Net interest income grew 9% YoY to Rs 45,190 crore with NIM at 2.99%, likely above 3% next quarter

- Gross NPA improved to 1.57% and net NPA to 0.39%, showing better asset quality

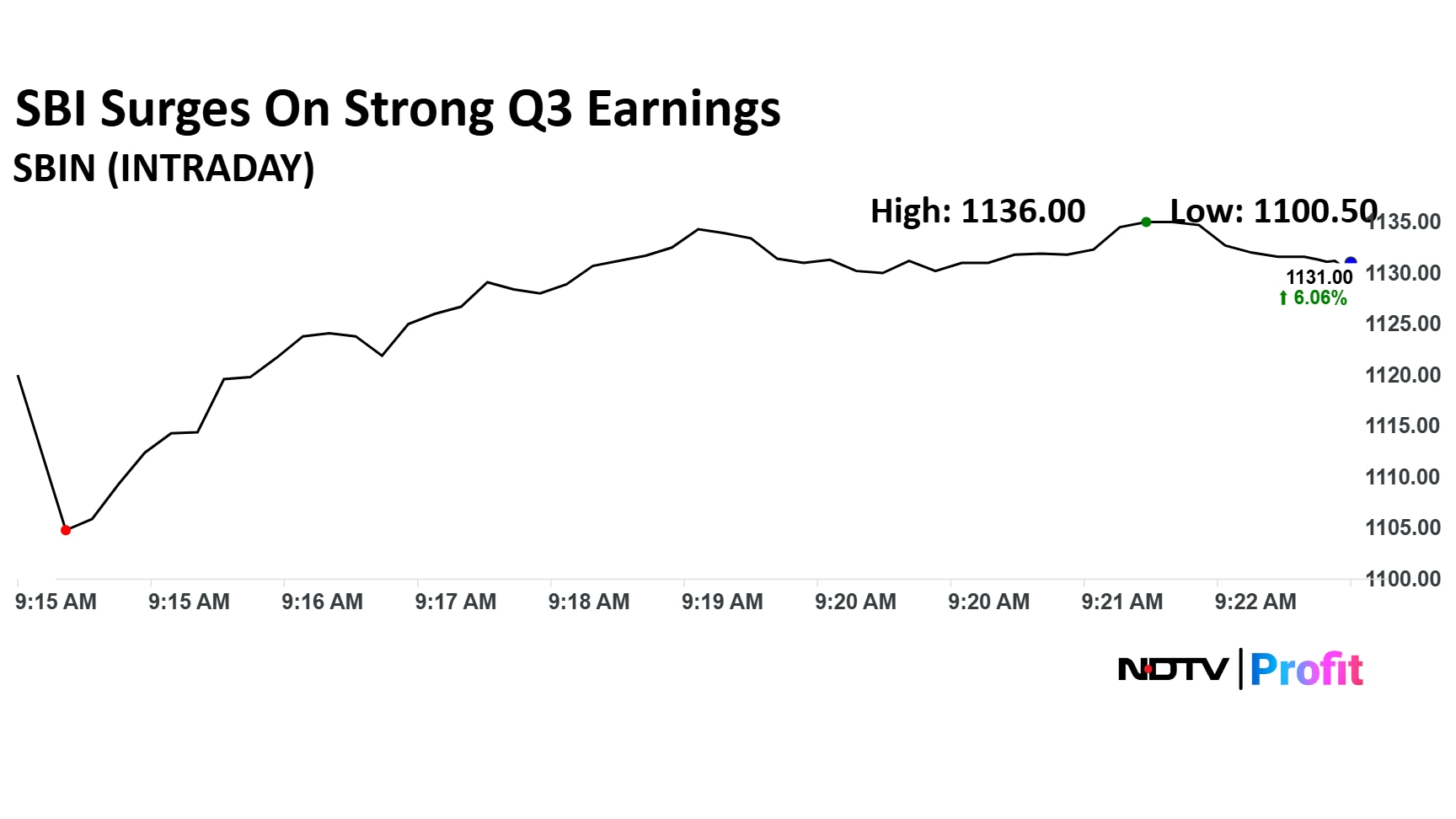

Shares of State Bank of India surged in trade today on the back of a strong set of December quarter results. The earnings also drew broadly positive commentary from brokerages, with strong loan growth, steady asset quality and improving margins underpinning the beat.

SBI's net interest income (NII) grew 9% year-on-year to Rs 45,190 crore, supported by an expanding loan book. Net interest margin (NIM) rose 2 basis points sequentially to 2.99% and is expected to move above 3% in the next quarter.

The share price of SBI rose over 6% and is trading at around Rs 1130 apiece. The shares have gained 15.20% just this year, and around 53% in the past 12 months. Of the 49 analysts tracking this stock, 42 have a buy rating, and seven have a hold call on it, as per Bloomberg data. The upside potential is 6.8%, with a 12-month target price of Rs 1196.46.

State Bank of India reported a net profit of Rs 21,028 crore in the December quarter of the financial year ending March 2026, representing a 24.5% jump from a year ago period and beating the street estimate of Rs 17,809 crore.

On the asset quality front, the bank showed significant improvement. The Gross Non-Performing Assets (NPA) ratio improved to 1.57% from 1.73% in the previous quarter, while net NPA improved from 0.42% to 0.39% during the same period.

The lender was able to trim its provisions 16.5% on a quarter-on-quarter basis to Rs 4,507 crore compared to Rs 5,400 crore in Q2.

"We believe that credit growth will remain robust, and the bank has accordingly revised its guidance to 14-15% for FY26, up from 12-13%," said CS Setty, Chairman of State Bank of India at the press briefing for the bank's Q3 earnings. Setty noted strong credit demand across all major banking segments, adding that SBI continues to see healthy traction in retail loans, MSME financing, and corporate credit pipelines, supported by broad-based economic activity.

ALSO READ: SBI Raises Its Credit Growth Guidance To 14-15% For FY26 Up From 12-13%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.