(Bloomberg) -- The European Central Bank may need to lift interest rates after the planned increase in July that many analysts expect to be the last in this cycle, according to Governing Council member Martins Kazaks.

While the 20-nation euro zone's economy is “on the soft side,” it's not weak enough to bring down inflation by itself, the Latvian official said. Borrowing costs will “by no means” be lowered in the first half of 2024 — as some investors have been betting — he said.

“I would not be comfortable in July to say, given the information I have currently on the economy, that we're done,” Kazaks told Bloomberg Television on Tuesday. “I think we would need to raise rates further.”

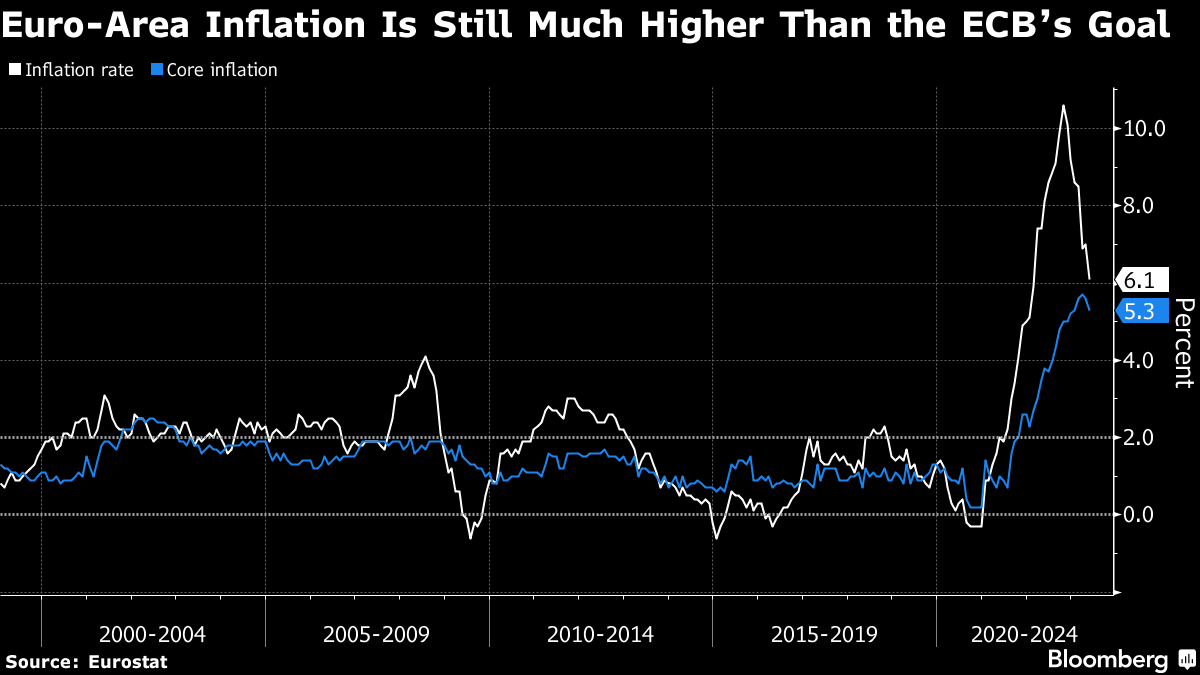

Policymakers are hammering out how much higher they need to push borrowing costs as they seek to return inflation to the 2% goal. While some have signaled that a pause in the ECB's historic cycle of rate hikes may be possible after July's planned increase, others have raised the prospect of monetary tightening extending beyond the summer.

Speaking at the ECB's annual retreat in Sintra, Portugal, Kazaks said policymakers will remain data-dependent for the meetings after July. “September will be decided in September, October in October,” he said.

Whatever the outcome of those gatherings, Kazaks said the ECB would retain the option to raise rates further even after it pauses.

“One important thing for the markets to take into account is that pausing does not mean stopping,” he said. “We can add on to the interest rates whenever it's necessary.”

--With assistance from Alexander Weber and Jana Randow.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.