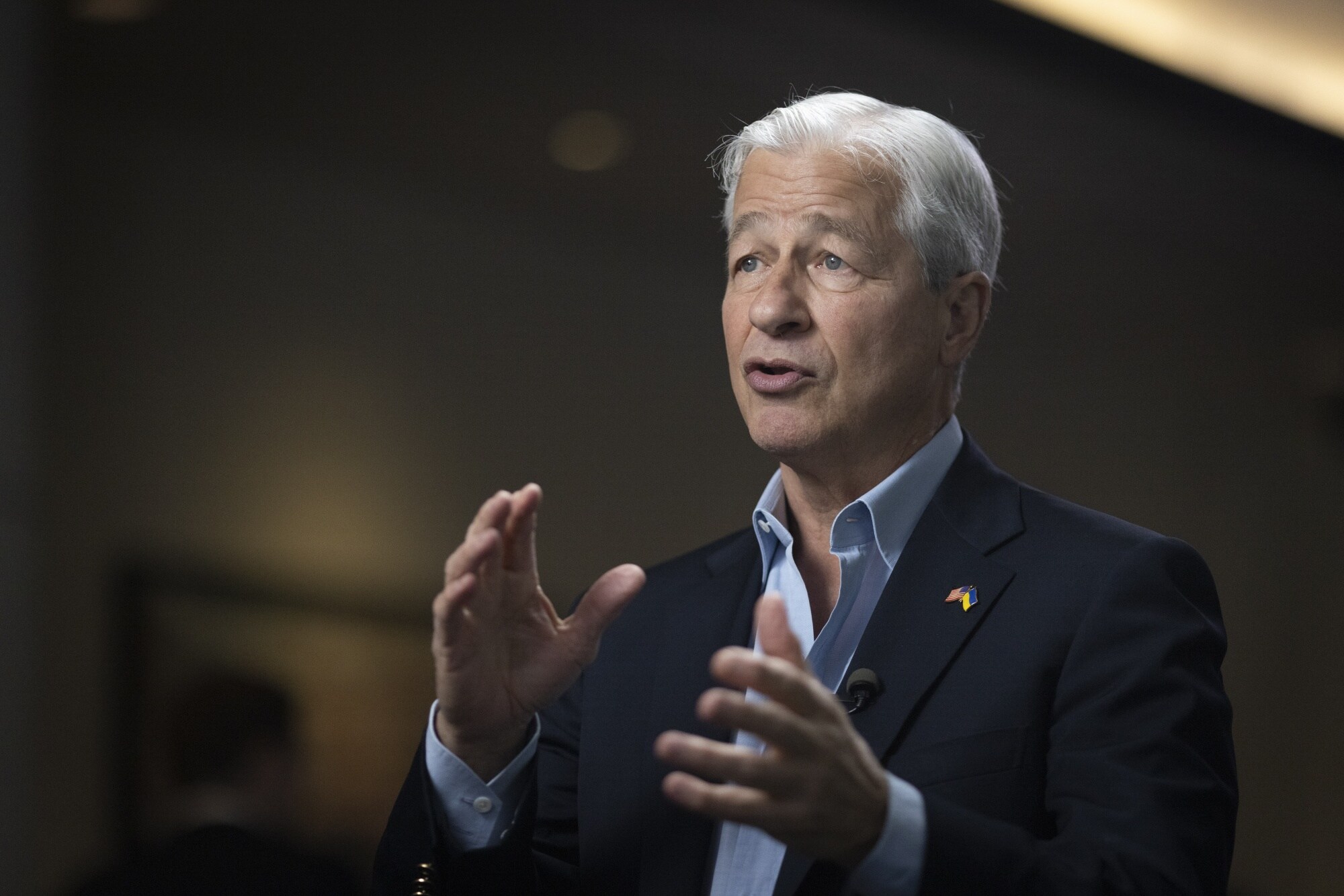

(Bloomberg) -- Jamie Dimon and Janet Yellen were on a call Tuesday, when she floated an idea: What if the nation's largest lenders deposited billions of dollars into First Republic Bank, the latest firm getting nudged toward the brink by a depositor panic.

Dimon was game — and soon the chief executive officer of JPMorgan Chase & Co. was reaching out to the heads of the next three largest US lenders: Bank of America Corp., Citigroup Inc. and Wells Fargo & Co.

All month, the nation's banking giants have been raking in deposits from nervous customers at smaller firms — and now those behemoths would be taking some of their own money and handing it to a San Francisco bank in distress, trying to stanch a widening crisis.

Over two days of frantic phone calls, meetings and some arm-twisting, the CEOs of 11 banks agreed to chip in a total of $30 billion for First Republic, promising to park the money there at least 120 days.

The hope is that's enough to save First Republic, known for its outsize business catering to wealthy tech executives. Or perhaps at the least, the cash will give the firm enough time to find another solution, such as a sale.

Read more: First Republic goes from Wall Street raider to rescue target

Such is the new-new-new line in the sand as the authorities in the US and Europe try to quell the Panic of 2023.

Already the rescue spearheaded by Dimon is sparking comparisons to the Panic of 1907, when J. Pierpont Morgan — who built up the company Dimon now leads — corralled Wall Street financiers into his private library and browbeat them into propping up the Trust Company of America, seeking to stop a string of bank runs that threatened to upend the industry.

One reason strong banks stepped forward then was that US authorities had little ability to do so, which led to the creation of the Federal Reserve. This time regulators were already scrutinizing First Republic, raising the prospect of emergency government intervention — and political blowback for years to come.

“If this works, it is a brilliant two-fer,'” said Todd Baker, a senior fellow at Columbia University's Richard Paul Richman Center for Business, Law, and Public Policy. Big banks already were coming under fire for soaking up deposits from smaller lenders. Now they can show they're part of the solution, while the Biden administration worries about one less bank, he said.

Regulators took their own shot at assuaging US banking customers last weekend, promising to fully pay out uninsured deposits after the failure of two US lenders — SVB Financial Group and Signature Bank. The Fed also made a pair of facilities available to help other banks keep up with any demands for withdrawals.

Read more: US backstops deposits to avert crisis after SVB's failure

But that's not guaranteed to work. And there already are signs that the strains in the financial system have yet to abate.

Early Thursday in Zurich, the Swiss National Bank offered Credit Suisse Group AG a $54 billion liquidity lifeline to keep the firm in business as it tries to overhaul operations.

Then later on Thursday, the Fed published data showing how heavily banks are drawing on its assistance.

They borrowed a combined $164.8 billion from two backstop facilities in the most recent week ended March 15. That includes a record $152.85 billion from the discount window, the traditional liquidity backstop for banks. The prior all-time high was $111 billion reached during the 2008 financial crisis.

In a statement after the official close of US exchanges, First Republic said its borrowings from the Fed varied from $20 billion to $109 billion from March 10 to March 15. The bank's shares, which rose 10% during regular trading on Thursday, sank 17% after hours.

Read more: Banks rush to backstop liquidity, borrow $164.8 billion from Fed

Given the tumult of the past week, most big US banks were eager to show their interest in pitching in, according to people who described the behind-the-scenes talks, who asked not to be named because the deliberations were confidential.

Treasury Secretary Yellen discussed the idea early on with senior officials including Fed Chair Jerome Powell and FDIC Chairman Martin Gruenberg.

The flurry of phone calls among bankers kept widening on Wednesday as more firms agreed to join the group. Still, some CEOs required cajoling, questioning the necessity of the rescue or whether it's enough to work. Yellen spoke to some directly, also keeping White House Chief of Staff Jeff Zients and National Economic Council Director Lael Brainard in the loop.

By Thursday, much of the group was taking shape. It's possible that at least some laggards were invited late, or just needed more time to get internal approvals. Goldman Sachs Group Inc. was among the last few.

Another call Thursday morning between regulators and CEOs helped finalize the plan.

“This show of support by a group of large banks is most welcome, and demonstrates the resilience of the banking system,” Yellen, Powell, Gruenberg and acting Comptroller of the Currency Michael Hsu said in a joint statement.

Not everyone is convinced it's a good idea. Billionaire investor Bill Ackman said in a tweet on Thursday that the rescue is “bad policy” and gives a false sense of confidence. He called for the US to announce a temporary guarantee for all bank deposits, saying “we are beyond the point where the private sector can solve the problem.”

In some ways, the rescue resembles the 1998 plan devised to bail out Long Term Capital Management without using public money, after the hedge fund made disastrous wrong-way bets. Back then, the Fed convened a meeting of Wall Street executives from Merrill Lynch, Goldman Sachs and about a dozen others. They agreed to pump $3.65 billion into the fund to keep it afloat and avert a collapse in financial markets.

As with LTCM, the banks saw saving First Republic as ultimately in their best interests, as it's better than risking a widening panic that might engulf more of them, one of the people said.

“This is the banking system taking care of itself,” said Todd Phillips, a former FDIC attorney now at the Roosevelt Institute.

One delicate aspect of the $30 billion lifeline is portioning out the credit. Though Dimon played the role of J. Pierpont Morgan behind the scenes, the banks crafted a joint statement, sorting their names into a groups based on the size of their contributions, and then listing them alphabetically.

That put Bank of America at the front.

Then in a chaotic rush of press releases, Citigroup's happened to go out first.

--With assistance from , , , , , , and .

(Adds after-hours trading and Ackman tweet from 15th paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.