Adani Ports and Special Economic Zone Ltd. has given an order to Cochin Shipyard for eight state-of-the-art harbour tugs, with a total contract value estimated at Rs 450 crore.

The initiative aligns with the government's Make in India and Aatmanirbhar Bharat initiatives by boosting local manufacturing and enhancing self-reliance in the maritime sector, as per a media release.

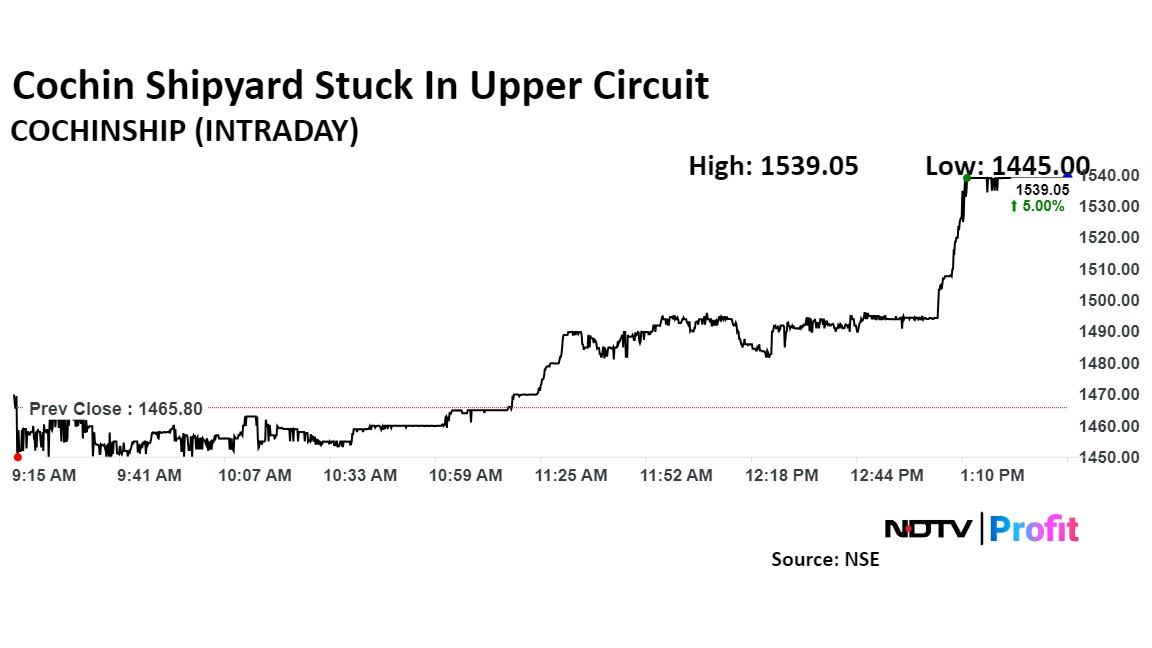

Shares of Cochin Shipyard were stuck in an upper circuit on Friday after the company received an order from Adani Ports The order by Adani Ports is the largest ever for eight harbour tugs under the Make In India scheme.

Delighted to share that @Adaniports has placed India's largest ever order for harbour tugs with Cochin Shipyard Ltd. The 8 state-of-the-art tugs worth ₹450 Cr will expand our fleet to 152. This record order reinforces our commitment to self-reliance while adhering to… pic.twitter.com/kn8iMGQsbv

December 27, 2024"By leveraging local manufacturing capabilities, which are world-class, we aim to contribute to the ‘Make in India' initiative while ensuring that our operations meet international standards of safety and efficiency," said Ashwani Gupta, chief executive officer and whole-time director of Adani Ports.

Previously, Adani Ports contracted the construction of two 62-tonne tugs to Cochin Shipyard, both of which were delivered ahead of schedule and deployed at Paradeep Port and New Mangalore Port. The construction of three additional ASD tugs is currently underway, bringing the total order to 13 tugs.

Cochin Shipyard Share Price Today

The scrip is stuck in a 5% upper circuit at Rs 1,539.05 apiece, as of 01:33 p.m. This compares to a 0.38% advance in the NSE Nifty 50 Index.

It has risen 126.49% in the last twelve months. Total traded volume so far in the day stood at 0.7 times its 30-day average. The relative strength index was at 49.23.

Out of five analysts tracking the company, four maintain a 'buy' rating, and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 21.1%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.