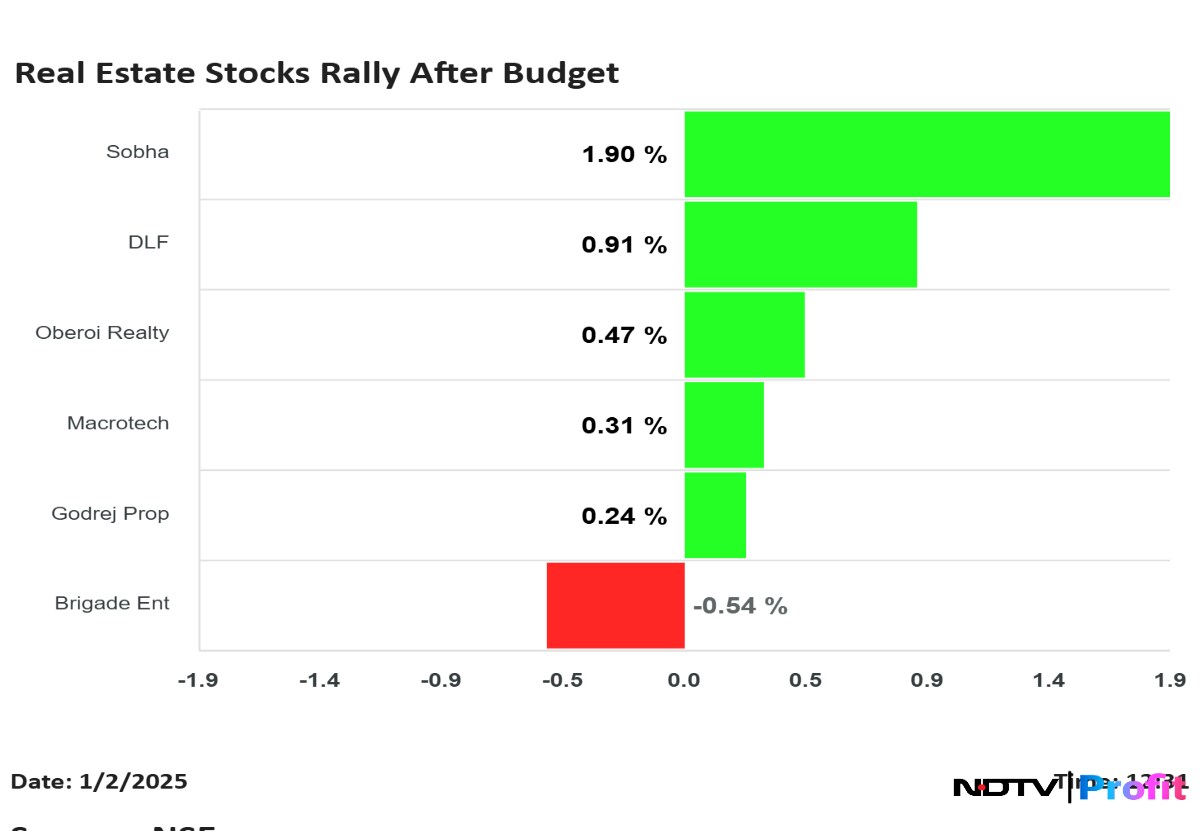

Shares of DLF Ltd., Godrej Properties Ltd., Oberoi Realty Ltd., Sobha Ltd. and Macrotech Developers Ltd. advanced on Saturday after the presentation of the Union Budget.

In her budget speech, Finance Minister Nirmala Sitharaman allowed taxpayers relief on a second self-occupied property too. Previously, tax relief was only available for one self-occupied house.

Earlier, only one property was exempted from tax, while the second property was taxed based on its market value. However, the new proposal will allow both properties to be valued at nil. This will ease some of the financial strain on taxpayers with multiple self-occupied homes.

Sobha was leading the rally as it surged 4.65% to the day's high of Rs 1,387.5 apiece. It was trading 2.05% higher at Rs 1,355 apiece as of 12:33 p.m.

Shares of Godrej Properties surged 1.55% to Rs 2,365.5 apiece after it fell over 3% on Saturday. It was trading 1.39% lower as of 12:34 p.m.

Shares of Oberoi Realty advanced 2.03% to an intraday high of Rs 1,849.35 apiece. It was trading 0.54% higher at Rs 1,823.35 per share as of 12:35 p.m. Shares of DLF rose 2.31% to the intraday high of Rs 762.25 apiece.

The shares of Brigade Enterprises and Macrotech also fell over 1.96% and rose over 2.20%, respectively, after the budget.

According to EY, there is a negative for real estate players, mainly for shopping malls. According to the clarifications made via amendment, the companies that record their shopping mall/commercial properties as 'plant' will no longer get GST credit.

In addition, the government clarifies that companies will no longer get GST credit on construction activity/previous projects, EY told NDTV.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.