(Bloomberg) -- Liz Truss's UK government announced a sweeping package of measures to contain spiraling energy bills, seeking to ease a historic squeeze on the cost of living that's likely to define her premiership.

Truss's plan would cap the average cost of energy for households at £2,500 a year from October, well below the £3,548 they would have paid without the intervention. Consumers also get a £400 subsidy that's already been announced. The program will last for two years, and businesses will get what the government described as an equivalent intervention lasting an initial six months.

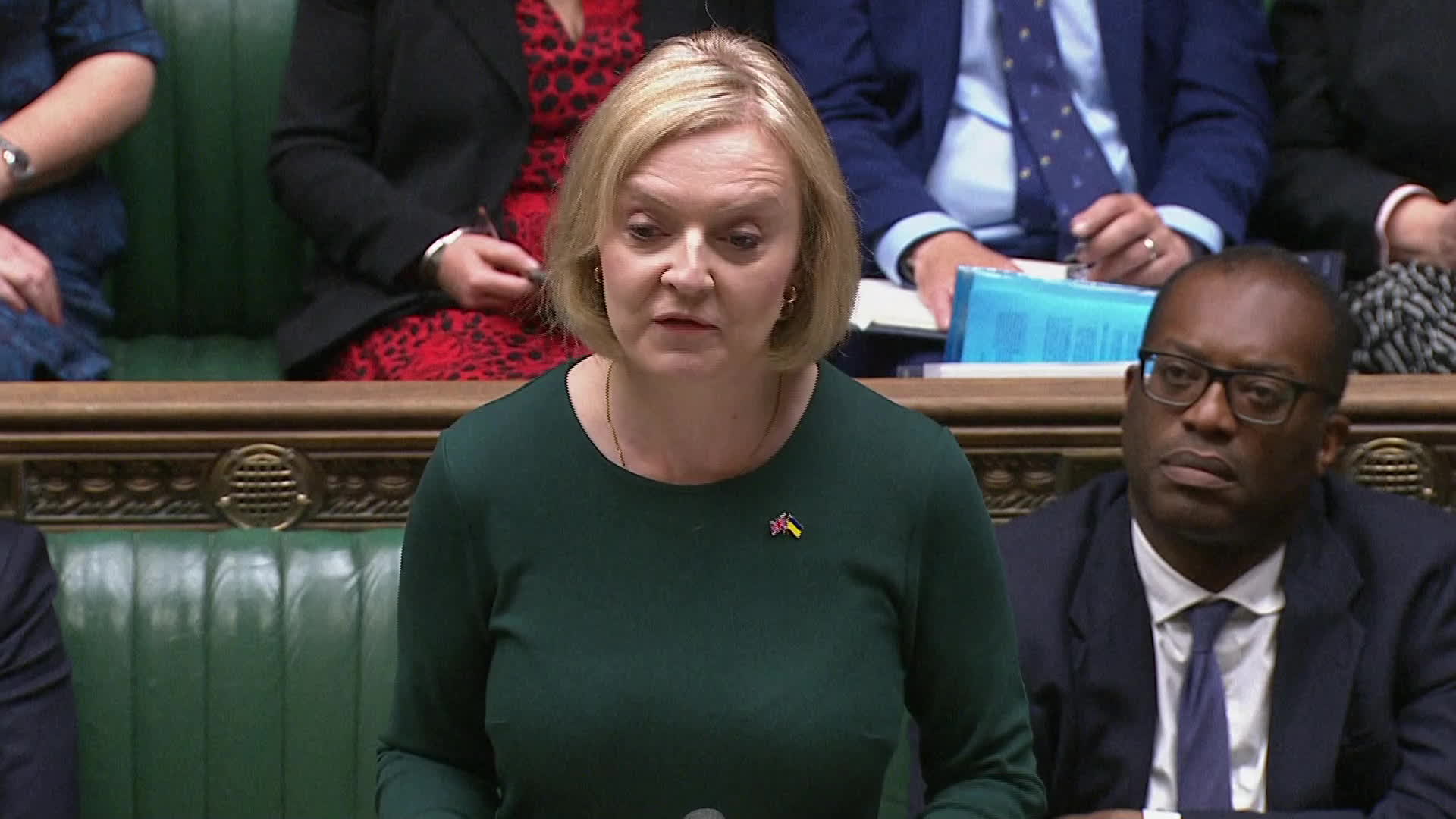

“I recognize that people are struggling with their energy bills,” the new British prime minister said in the House of Commons on Thursday. “This is the moment to be bold. We are facing a global energy crisis, and there are no cost-free options.”

https://t.co/fUmGNolelv pic.twitter.com/Ho24wx94pS

The program will cap the amount consumers pay for natural gas and electricity at a cost of billions of pounds to the Treasury. The government estimates it will reduce inflation by 4 to 5 percentage points from a peak that the Bank of England says may be above 13% and others say may be much higher.

Truss said the measures will boost economic growth, which will bolster tax receipts to the Treasury. The Debt Management Office will publish an estimate for the impact on 2022-23 bond sales later this month when the Chancellor of the Exchequer delivers his emergency fiscal statement and estimates for what the program will cost.

https://t.co/Z6WW7xe3ir pic.twitter.com/NPThQlgGJJ

It marks the biggest effort yet to contain a surge in energy prices triggered when Russia slashed supplies to Europe. That along with soaring inflation is likely to push the UK economy into a recession this year, with little growth expected before the next election due in 2024.

Even with such a massive handout, domestic bills this winter will be about triple the level of a year ago. In addition to jolting financial markets alarmed about the scale of additional spending, Truss's package also is likely to trigger a major political row.

Bloomberg reported this week that UK taxpayers could be on the hook for as much as £200 billion ($230 billion) were the intervention to last 18 months. The exact figures depend on prices in gas markets. That's approaching the scale of the £310 billion handed out in response to the Covid-19 outbreak.

The problem for the government is that while the pandemic is largely finished as drain on Treasury, there's no end in sight for the gas shortages that came with the war between Russia and Ukraine.

That risks putting Truss on a collision course with members of the ruling Conservative Party who supported her leadership bid based on her promises for tax cuts and smaller-state -- the sort of policies Margaret Thatcher delivered in the 1980s. Truss's supporters say action was essential.

“If we fail to act, if we don't protect the economy against the shock of the size and scale we are talking about, then there is going to be enormous damage,” cabinet minister Simon Clarke told Sky News when asked about borrowing.

But it also lays out clear battle lines with the oppositiion Labour Party, which leads the Tories in polls. On Wednesday, leader Keir Starmer accused Truss of making a “political choice” in choosing to make taxpayers “foot the bill” for the support while energy companies profit from the surge in prices since Russia's invasion of Ukraine.

Starmer called for a fresh windfall tax on excess profits in the energy industry, something Truss and many of her backers rule out.

The package announced Thursday also has longer term measures to address the energy crisis that could roil the political waters. Those include:

- Lifting a ban on “fracking,” a drilling technique to tap unconventional oil and gas deposits. It had been restricted since 2019 because of its impact on the countryside and potential to cause earthquakes

- Speeding up nuclear power projects, which also would require huge taxpayer support and tends to generate opposition from people living near the sites

- Licensing at least 100 more oil and gas drilling projects in the North Sea, a policy that seems to rub against a broader government goal to cut net fossil fuel emissions to zero by 2050

- A review of energy regulation to “address underlying problems” in the way power and gas companies work

Even Kwasi Kwarteng, Truss's Chancellor of the Exchequer, has expressed his opposition to fracking, telling the Mail on Sunday newspaper in March it “would come at a high cost for communities and our precious countryside.”

Read more:

- UK, BOE Set Up £40 Billion Liquidity Fund for Energy Traders

- Liz Truss's Relief for Energy Bills Is Uncapped Liability for UK

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.