- Japan's Q4 2025 GDP grew 0.2% annually, below the 1.6% forecast

- Consumer spending rose 0.1%, showing weak domestic demand amid inflation

- Capital spending increased 0.2%, housing investment grew 4.8% after prior slump

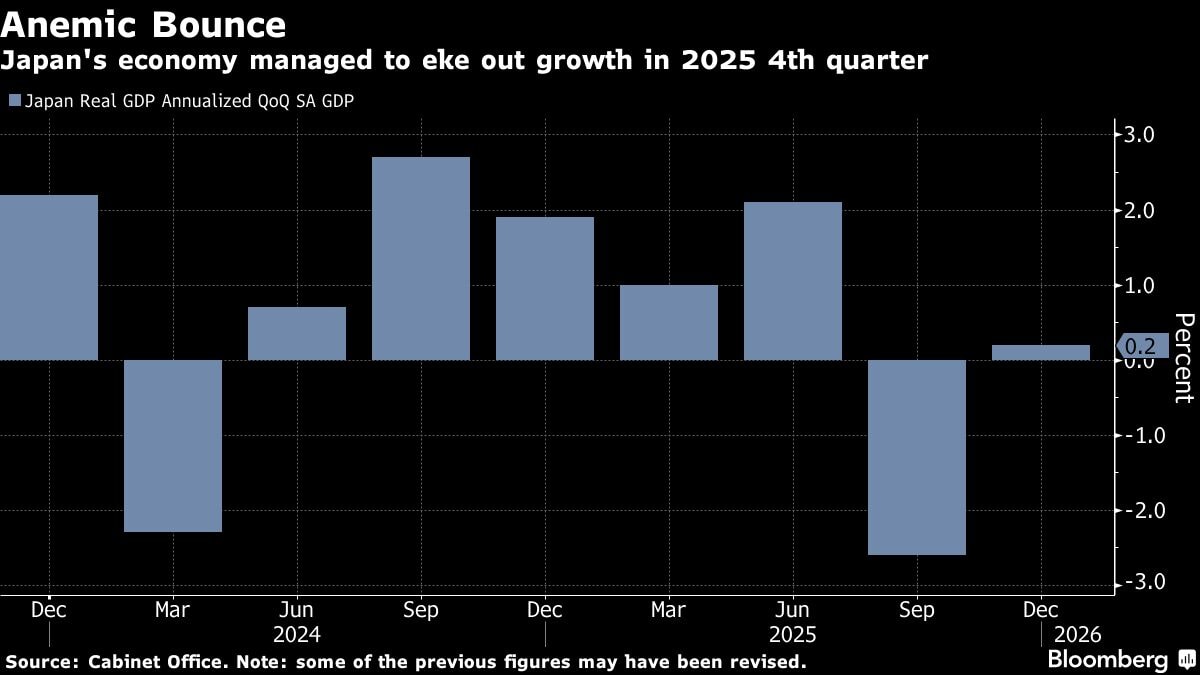

Japan's economic output in the fourth quarter of 2025 was much weaker than expected, registering anemic growth after a deep contraction in the previous period, underscoring the case for Prime Minister Sanae Takaichi's proactive spending policies following her election triumph.

Japan's real gross domestic product grew 0.2% on an annualized basis in the three months through December, according to a Cabinet Office report Monday. That was weaker than economists' median estimate of 1.6% growth.

Photo Credit: Bloomberg

Consumer spending, the biggest component of GDP, grew 0.1%, showing the fragility of domestic demand as households continue to cope with inflation that hovered above the Bank of Japan's 2% target for four years through 2025. Capital spending rose 0.2%. Private housing investment rose 4.8% in real terms from the previous quarter, an expected outcome after a rout in the third quarter that resulted from regulatory changes.

“Personal consumption showed resilience, but whether this resilience can be sustained will depend on whether price relief measures will make an impact and whether real wages will turn positive,” according to Shinichiro Kobayashi, chief economist at Mitsubishi UFJ Research and Consulting. “Rising interest rates and wage increases could pose a risk to small and medium-sized enterprises, potentially limiting their ability to do capital investment.”

Inbound tourism, counted as service exports in the data, provided support for much of 2025, but took a hit more recently. The number of visitors from China slumped after Beijing issued a travel warning against traveling to Japan following Takaichi's controversial comments on Taiwan in November. Net exports didn't contribute to growth in the latest quarter, even though exports alone rose every month in the fourth quarter.

“The negative impact of Trump tariffs has run its course, leading to positive economic growth as expected, though the recovery was weaker than I had anticipated,” said Kobayashi.

Monday's figures underscore the patchy nature of an economic recovery that lacks a strong driver beyond one-off factors. Even so, the signs of tepid activity aren't likely to derail the BOJ from raising the benchmark interest rate later this year.

What Bloomberg Economics Says...

“Japan's surprisingly weak fourth-quarter GDP rebound appears temporary, leaving the Bank of Japan's stimulus path intact. The softness largely reflected declines in volatile inventories and public investment. Prime Minister Sanae Takaichi is likely to ramp up public spending.”

— Taro Kimura, Economist

On the fiscal side, the report may add momentum to Takaichi's push to support growth with government spending and targeted investments. Earlier this month the premier led her Liberal Democratic Party to the biggest post-war victory for a single-party in a general election, securing a mandate to push her expansionist policies.

The scale of her election victory quieted concerns preceding the vote that passage of the regular budget for the fiscal year starting in April might be delayed. With the LDP having garnered two-thirds of the powerful lower house, smooth passage of the budget is virtually assured.

Takaichi plans to expedite discussions on whether to temporarily suspend the sales tax on food and has said she'll cover the lost revenue without relying on deficit-covering government bonds.

Going forward, the economy is expected to be sustained during the first quarter of 2026 in part by the large stimulus package that Takaichi pushed through parliament in December. Another key factor will be wage growth. Unions are seeking pay increases roughly in line with the robust results seen in recent years in negotiations with employers expected to culminate in March.

Still, wage momentum is uneven. Large exporters that have benefited from the weak yen have tended to be more generous than smaller companies whose margins have been squeezed by rising import costs. Moreover, even with steady growth in nominal pay, real wages fell every month last year due to persistent inflation.

The BOJ has said inflation will likely moderate in coming months, and data due Friday will likely be consistent with that view.

“While exports of goods appear to have bottomed out, the concern is that exports of inbound services are turning negative,” Kobayashi said. “With fewer Chinese visitors expected during the Chinese new year period in the first quarter, this trend is likely to worsen.”

ALSO READ: Is AI Stopping You From Meeting Your Soulmate?

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.