Varun Beverages Ltd. reported a higher-than-expected increase in its net profit during April–June. Its consolidated net profit came at Rs 1,317 crore against Bloomberg's estimate of Rs 1,216.3 crore.

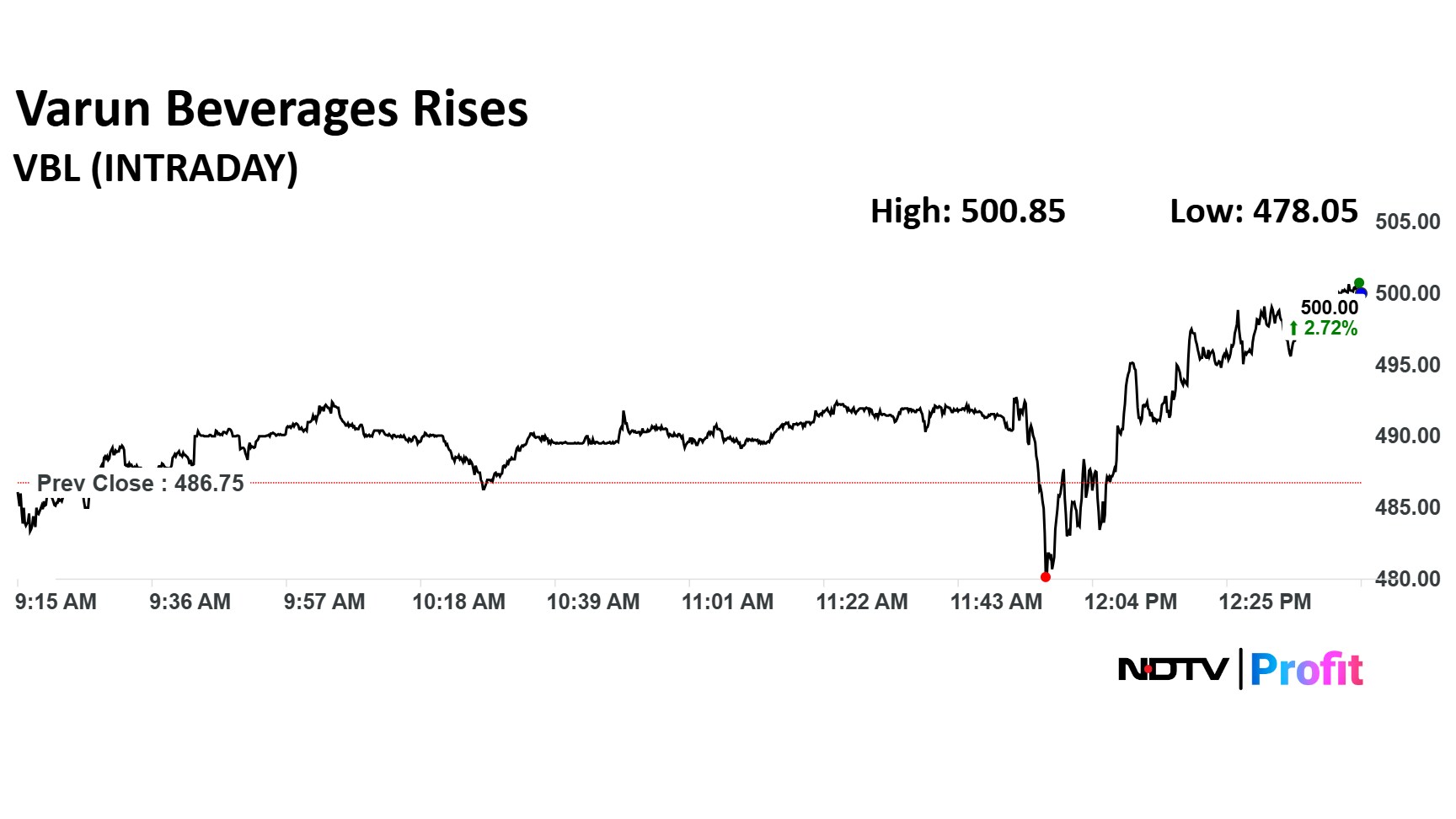

The company reported a rise in operating profit in contrast to an expected decline, which pushed the stock price to the highest level since May 20.

Varun Beverages follows calendar year format for financial results reporting.

Q2 Earnings Key Highlights (Consolidated, YoY)

Revenue down 2.5% to Rs 7,017 crore from Rs 7,197 crore (Bloomberg estimate: Rs 7,358.9 crore)

Ebitda rose 0.4% at Rs 1,999 crore from Rs 1,991 crore (Bloomberg estimate: Rs 1,893.3 crore)

Margin rose 110 bps to 28.8% from 27.7% (Bloomberg estimate: 25.7%)

Net profit up 5.1% at Rs 1,317 crore from Rs 1,253 crore (Bloomberg estimate: Rs 1,216.3 crore)

Previous Quarter Performance

Revenue up 29.2% at Rs 5,566.94 crore versus Rs 4,317.31 crore (Bloomberg estimates: Rs 5,476 crore).

Ebitda up 28% at Rs 1,263.96 crore vs Rs 989 crore (Bloomberg estimates: Rs 1,235 crore).

Margins at 22.7% vs 22.9%.

Net profit up 35% at Rs 726.49 crore vs Rs 537 crore (Bloomberg estimates: Rs 741 crore).

Varun Beverages share price rose as much as 2.90% to Rs 500.85 apiece, the highest level since May 20. It was trading 2.79% higher at Rs 500.1 apiece as of 12:51 p.m., as compared to 0.10% advance in the NSE Nifty 50 index.

The stock declined 25.81% in 12 months, and 21.63% on year-to-date basis. Total traded volume so far in the day stood at 2.4 times its 30-day average. The relative strength index was at 63.84.

Out of 29 analysts tracking the company, 27 maintain a 'buy' rating, and two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 22.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.