Historically, the June quarter is a soft quarter, said C Vijayakumar, the CEO. The company had multiple ramp downs on the account of mismatch in skills and geography, he added.

Source: Earnings Con Call

Strong demand continues in financial & technology, with utilisation impact to continue in the second quarter, as per HCLTech management.

Overall, a 100 basis points impact is expected on September quarter numbers.

Source: Earnings Con Call

30 basis points margin drop was on the account of investment in GenAI.

80 basis points margin drop was linked to utilisation drop on the account of specialised hiring, skill and location mismatch & one of the clients filed for bankruptcy.

Rest was change in the mix of services.

Source: Earnings Con Call

The company focuses on AI driven initiatives, and compliment multiple offerings with regards to AI in the current quarter.

Source: Earnings Presser

Q1FY26 results miss EBIT margin estimates at 16.3% versus estimate of 17.4%.

Lower end of FY26 guidance revised from 2-5% earlier to 3-5% now.

FY26 EBIT margin guidance lowered from 18%-19% to 17%-18% now.

Deal wins lower than estimate at $1.8 billion versus estimate of $2.3 billion.

Employee expenses up 2% QoQ versus revenue growth of 0.3%.

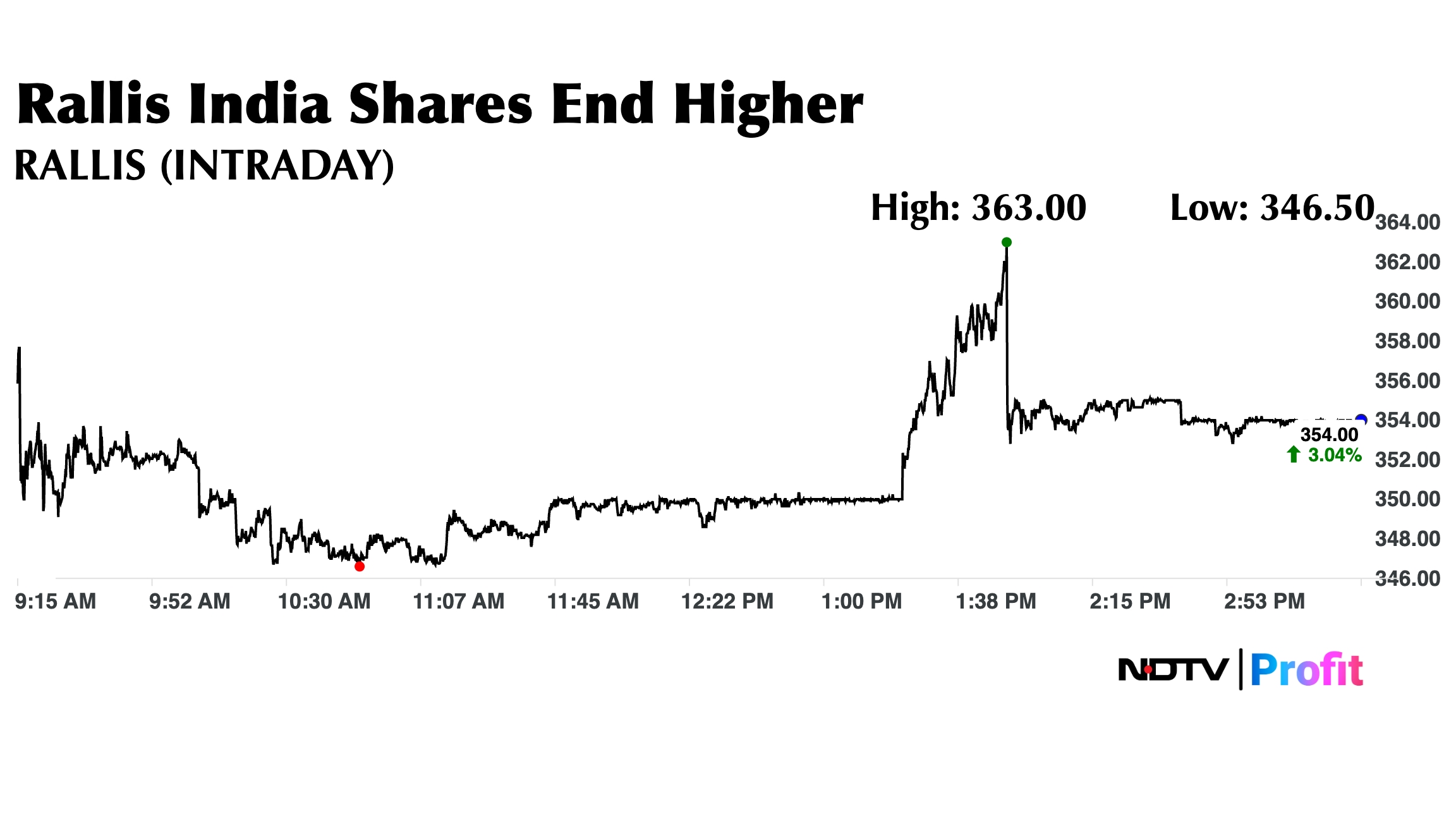

Rallis India Q1 FY26 Highlights (YoY)

Revenue up 22.2% at Rs 957 crore versus Rs 783 crore.

Ebitda up 56.3% at Rs 150 crore versus Rs 96 crore.

Margin at 15.7% versus 12.3%.

Net profit up 98% at Rs 95 crore versus Rs 48 crore.

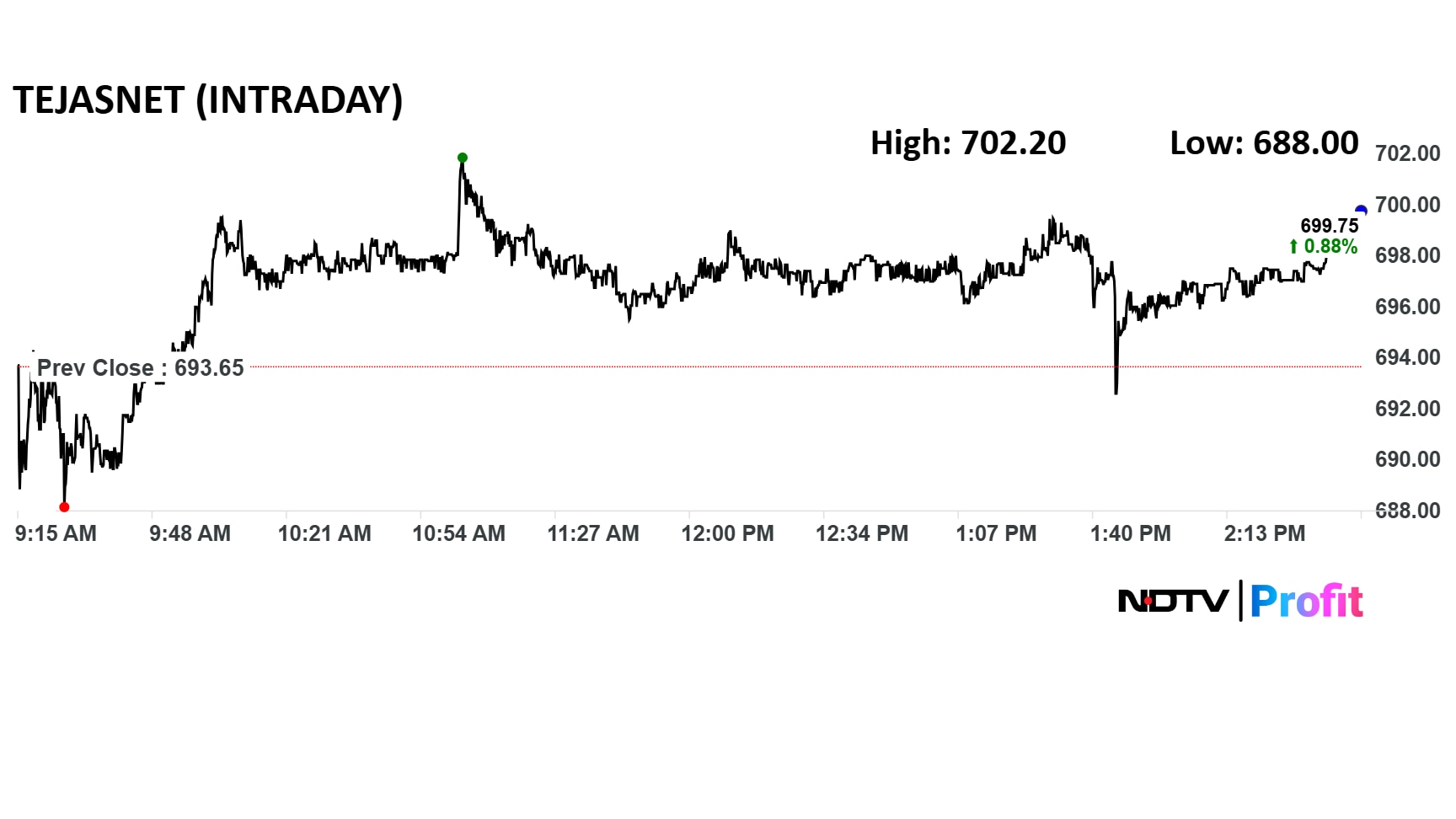

Tejas Networks Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 87% at Rs 202 crore versus Rs 1,563 crore.

Ebitda loss of Rs 135.67 crore versus profit of Rs 230 crore.

Net loss of Rs 193.87 crore versus profit of Rs 77.5 crore.

The board has fixed July 18 as the record date for the purpose of dividend payment. Additionally, the company will pay the interim dividend on July 28, according to an exchange filing.

Read the whole story here.

HCL Technologies Q1 FY26 Highlights (Consolidated, QoQ)

Revenue flat at Rs 30,349 crore versus Rs 30,246 crore (Bloomberg: Rs 30,287 crore).

Ebit down 9% at Rs 4,942 crore versus Rs 5,442 crore (Bloomberg: Rs 5,286 crore).

Margin at 16.3% versus 18% (Estimate: 17.45%).

Net profit down 11% at Rs 3,843 crore versus Rs 4,307 crore (Bloomberg estimate: Rs 4,258 crore).

In an exchange filing dated July 10, Bank of Maharashtra said that a meeting of its Board of Directors is scheduled on July 15 to consider and approve the financial results for Q1FY26.

Key focus will remain on the newly listed HDB Financial Services, set to announce results on July 15. This will be the NBFC's first quarterly results after its market debut on July 2.

The shares of Rallis India ended over 3% higher ahead of the company's first quarter results.

The shares of Rallis India ended over 3% higher ahead of the company's first quarter results.

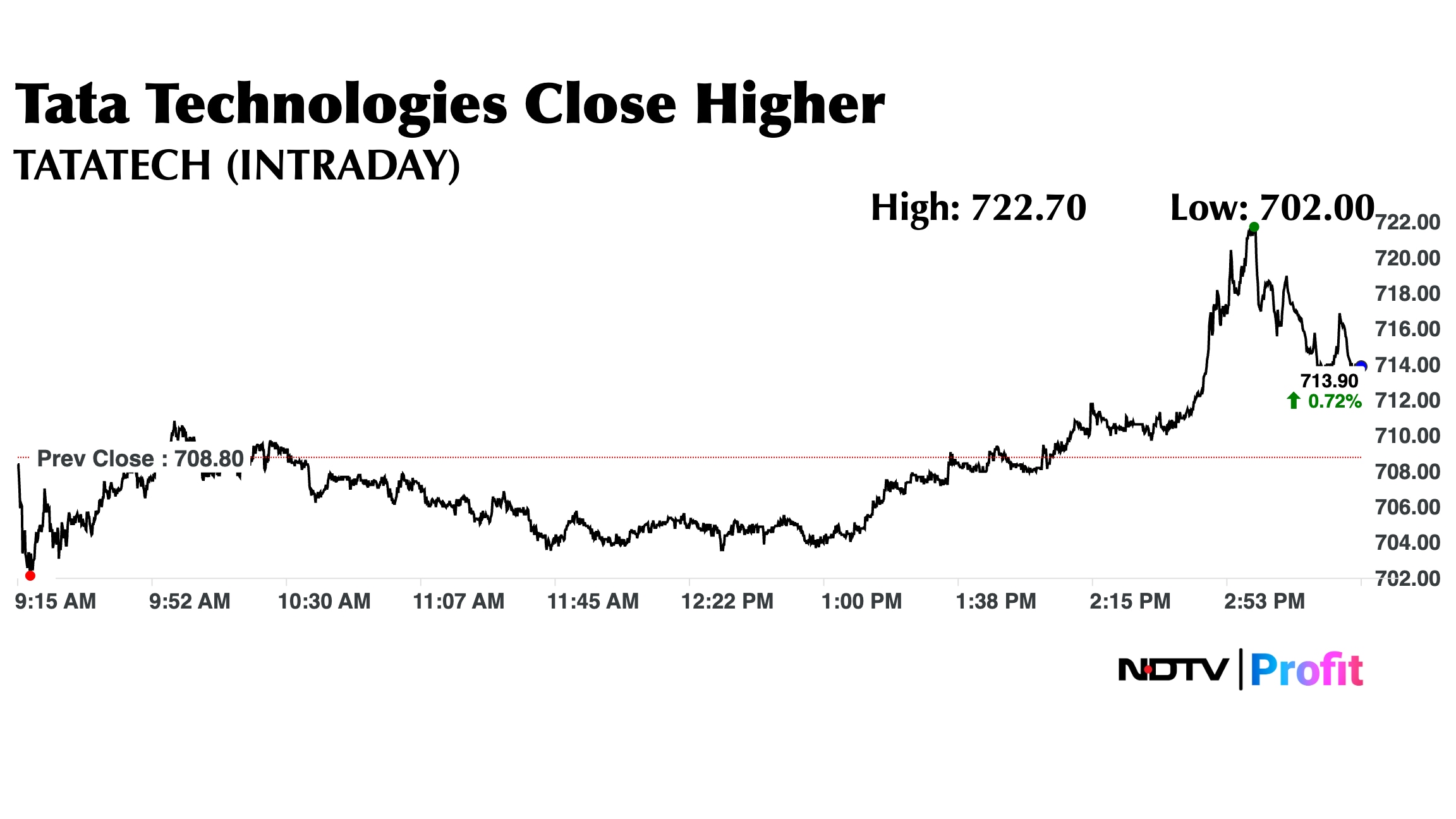

Tata Tech Q1 Highlights

Revenue down 3.2% to Rs 1,244.29 crore versus Rs 1,285.65 crore.

Net Profit down 10% to Rs 170.28 crore versus Rs 188.87 crore.

EBIT down 17% to Rs 168.81 crore versus Rs 202.26 crore.

Margin at 13.6% versus 15.7%.

The shares of Tata Technologies ended nearly 1% higher ahead of the company's first quarter results.

The shares of Tata Technologies ended nearly 1% higher ahead of the company's first quarter results.

Kesoram Industries Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 9.3% at Rs 61 crore versus Rs 67.3 crore.

Net loss at Rs 99.3 crore versus loss of Rs 61.4 crore.

EBITDA loss at Rs 10.5 crore versus loss of Rs 8.41 crore.

Exceptional loss of Rs 89.8 crore.

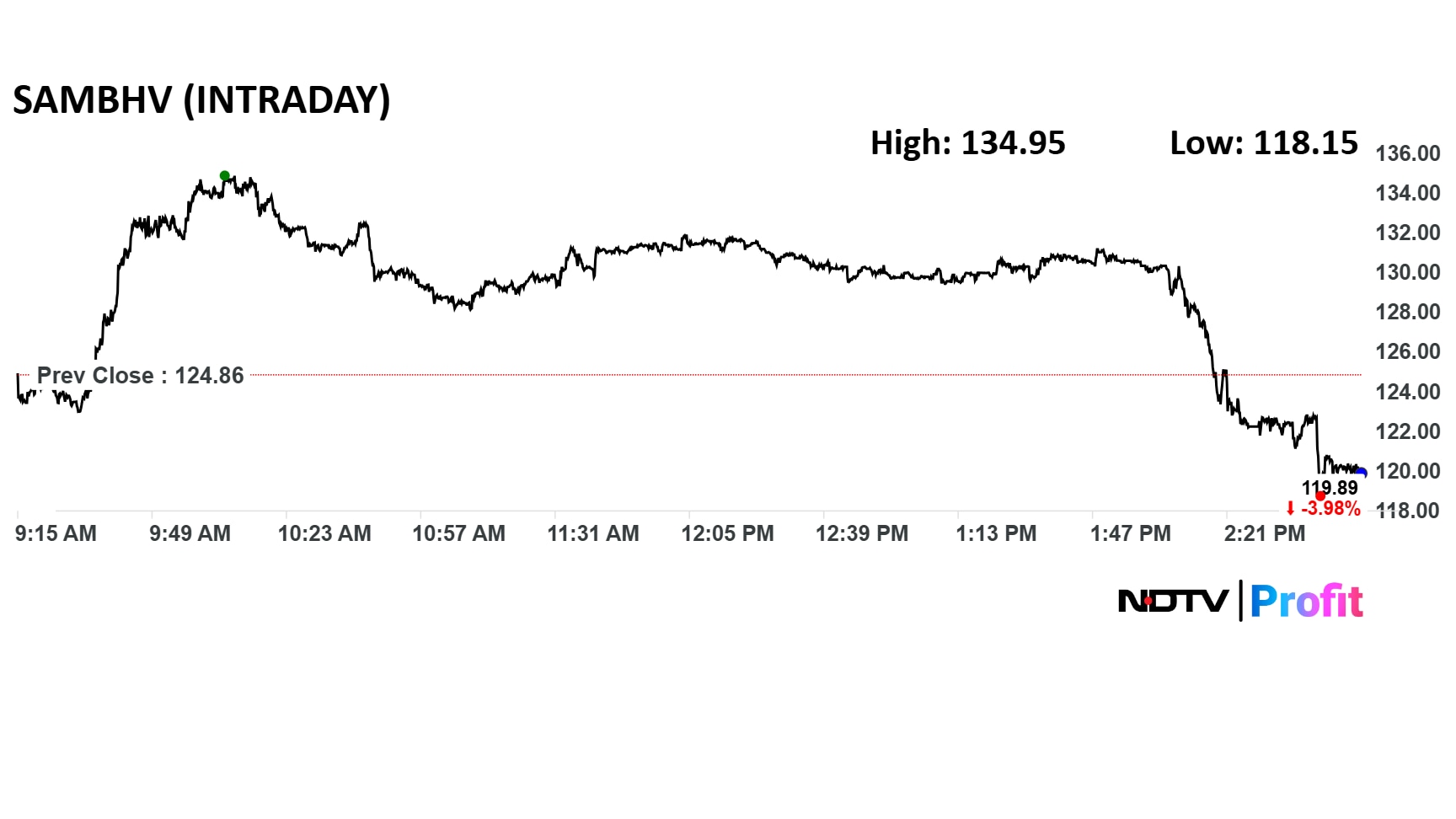

Shares of Sambhv Steel Tubes were trading lower after Q1 margin contracted by three percentage points.

Shares of Sambhv Steel Tubes were trading lower after Q1 margin contracted by three percentage points.

Sambhv Steel Tubes Q1 FY26 Highlights (Consolidated, YoY)

Revenue was up 34.2% at Rs 495 crore versus Rs 369 crore.

Ebitda was up 2.62% at Rs 48.1 crore versus Rs 46.9 crore.

Margin was at 9.7% versus 12.7%.

Net profit was up 57.2% at Rs 16.6 crore versus Rs 10.6 crore.

The shares of Tejas Networks were trading nearly 1% higher ahead of the company's first quarter results.

The shares of Tejas Networks were trading nearly 1% higher ahead of the company's first quarter results.

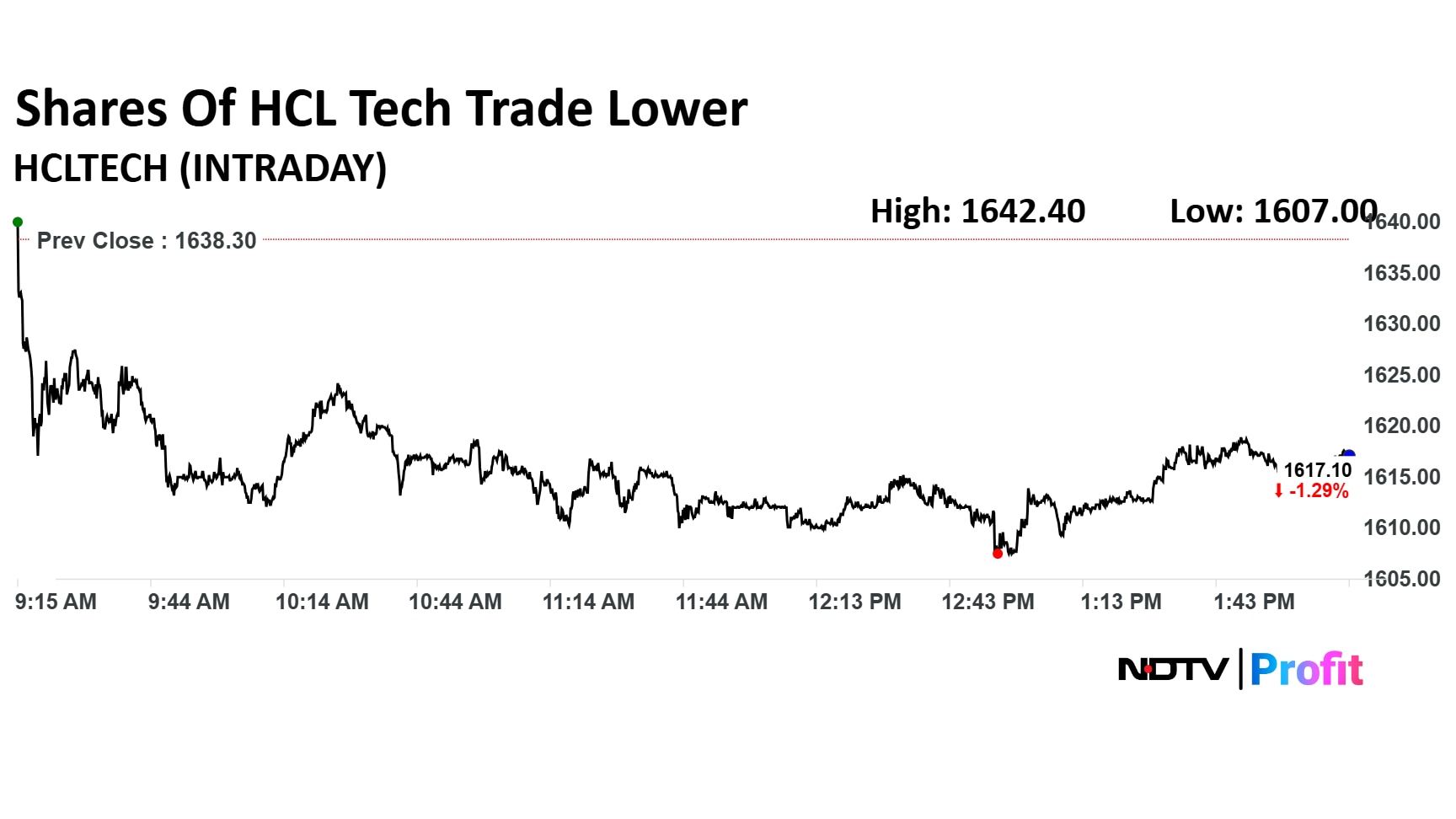

The shares of HCL Tech were trading over 1% lower ahead of the company's first quarter results. The scrip was trading 1.28% lower at Rs 1,617. This compares to the 0.42% decline in the benchmark index Nifty 50 as of 2:16 p.m.

The shares of HCL Tech were trading over 1% lower ahead of the company's first quarter results. The scrip was trading 1.28% lower at Rs 1,617. This compares to the 0.42% decline in the benchmark index Nifty 50 as of 2:16 p.m.

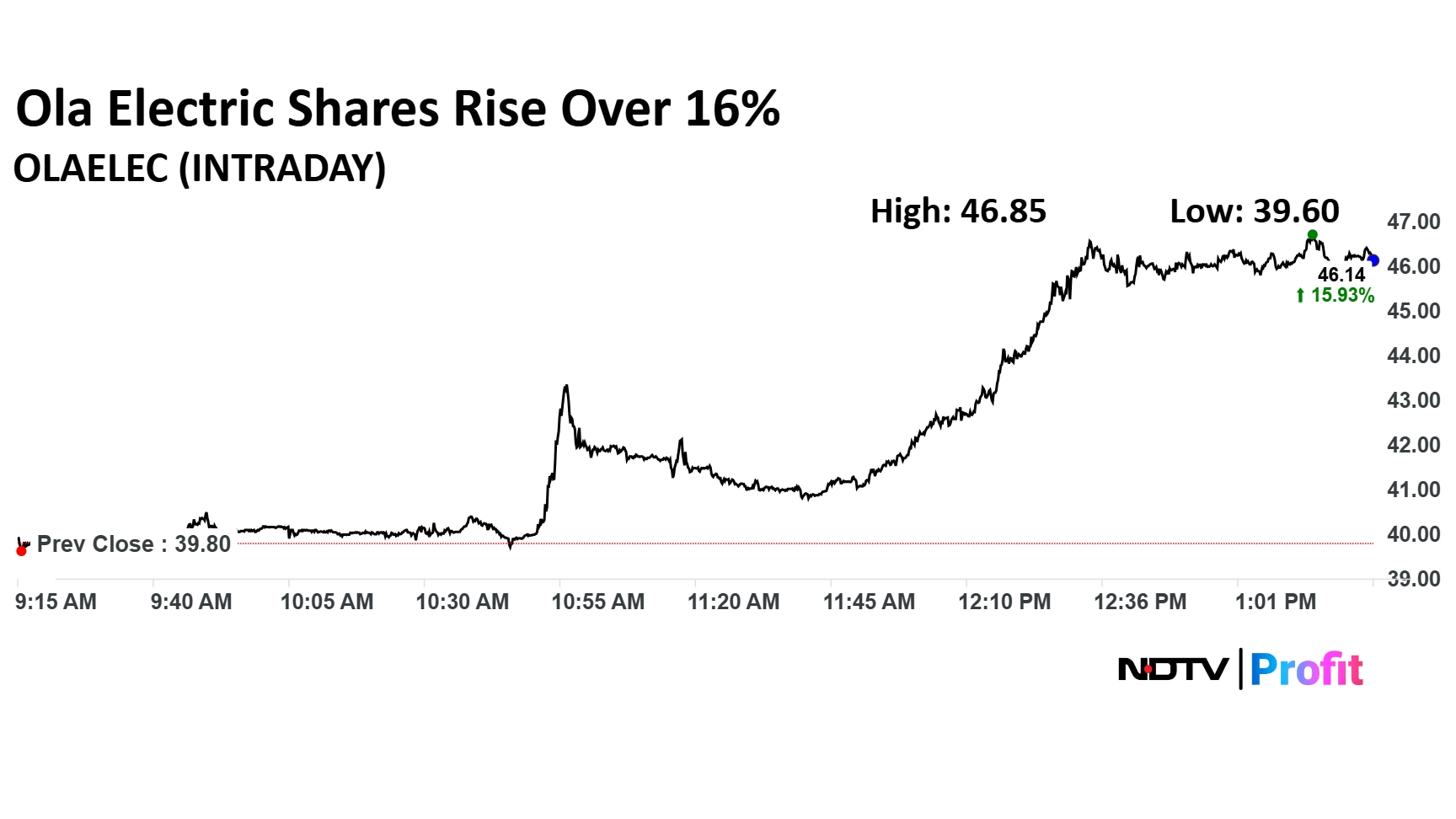

Shares of Ola Electric have risen over 16% in trade so far. The company had earlier during the day posted its first quarter results. Despite a widening or loss and halving of revenue, the losses were however lower than expected.

The scrip had risen as much as 9.47% during trade so far to Rs 43 and is currently trading 8.34% higher. These gains compare to the 0.37% decline in the benchmark index Nifty 50 as of 1:30 p.m.

Shares of Ola Electric have risen over 16% in trade so far. The company had earlier during the day posted its first quarter results. Despite a widening or loss and halving of revenue, the losses were however lower than expected.

The scrip had risen as much as 9.47% during trade so far to Rs 43 and is currently trading 8.34% higher. These gains compare to the 0.37% decline in the benchmark index Nifty 50 as of 1:30 p.m.

Tata Technologies will also be reporting its results for the quarter on Thursday. The company is likely to report a net profit of Rs 157 crore and revenue of Rs 1,208.39 crore for the first quarter, according to estimates. Tata Tech's EBIT is expected at Rs 171 crore, while margin will be at 14.15%.

HCLTech Ltd. is set to report its June quarter earnings on Monday and most brokerages expect a soft set of numbers due to seasonal weakness and subdued client spending.

While revenue and margins are likely to decline sequentially, analysts anticipate the company will narrow the lower end of its revenue growth guidance for the financial year ending March 2026.

Several brokerages including Goldman Sachs and PhillipCapital expect HCLTech to revise its revenue growth outlook for FY26 to a 3–5% range from the earlier 2–5%, while others like Motilal Oswal and HSBC see the company retaining its existing guidance.

Read HCLTech Q1 Preview here.

Ola Electric Mobility has outlined a positive FY26 outlook, projecting strong volume growth and a path toward profitability.

The company expects FY26 volumes to reach between 3.25-3.75 lakh vehicles, contributing to an anticipated revenue of Rs 4,200-4,700 crore.

Ola Electric is seeing strong momentum for its Gen 3 Scooters and Roadster Bike leading into the festive season.

A key target for the fiscal year is for the auto Ebitda to turn positive later in FY26, with the auto business also expected to generate operating cashflow during the same period.

The company anticipates auto capital expenditure (capex) to be around Rs 300 crore for the remaining FY26 and has stated that it does not plan any major new product or manufacturing capex this year.

(Source: Press release)

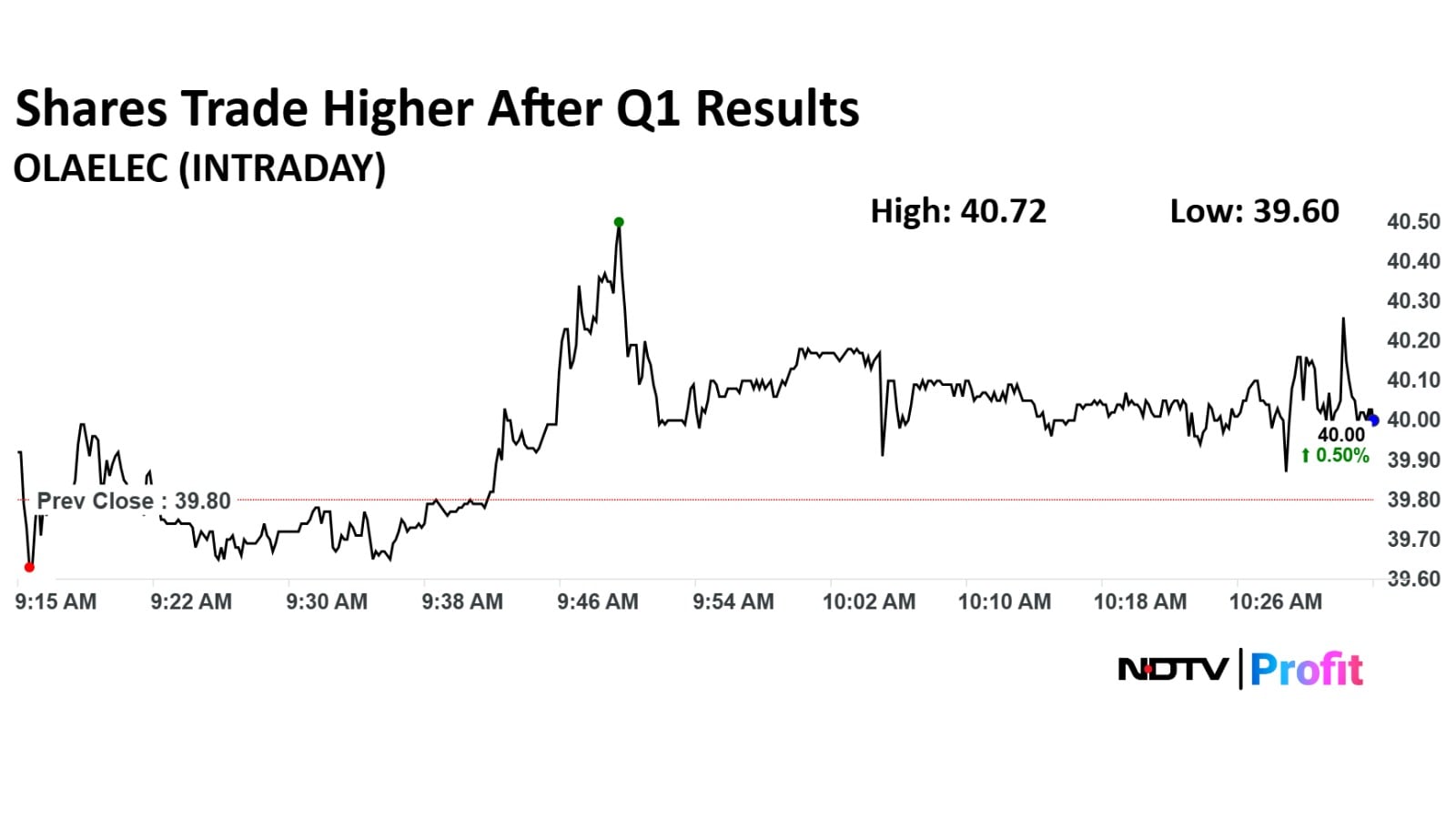

Shares of Ola Electric were trading in green after Q1 results.

Shares of Ola Electric were trading in green after Q1 results.

Ola Electric Mobility Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 49.6% to Rs 828 crore versus Rs 1,644 crore (Bloomberg estimate: Rs 735 crore).

Ebitda loss at Rs 237 crore versus Rs 205 crore (Bloomberg estimate: Rs 287 crore).

Net loss widens to Rs 428 crore versus Rs 347 crore (Bloomberg estimate: Rs 452 crore).

The company's inventory spiked to Rs 153 crore from Rs 12 crore.

At least 25 companies are scheduled to announce their first quarterly (Q1) results for the financial year 2025-26 on Monday. These companies, spanning across various sectors such as hospitality, vehicles, media, finance, among others, will disclose their financial performance for the April to June quarter.

Authum Investment & Infrastructure Ltd., Benares Hotels Ltd., Citadel Realty and Developers Ltd., HCL Technologies Ltd., Hathway Bhawani Cabletel & Datacom Ltd., Infomedia Press Ltd., Ola Electric Mobility Ltd., Royal India Corporation Ltd., Sambhv Steel Tubes Ltd., Tata Technologies Ltd., Tejas Networks Ltd., Sharp Investments Ltd., Space Incubatrics Technologies Ltd., Shree Steel Wire Ropes Ltd., RGF Capital Markets Ltd., and Kesoram Industries Ltd.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.