Credo Brands Marketing Q1 Highlights (YoY)

Revenue down 3.2% to Rs 119.94 crore versus Rs 123.89 crore.

Net Profit down 36% to Rs 6.30 crore versus Rs 9.77 crore.

Ebitda down 7% to Rs 31.05 crore versus Rs 33.38 crore.

Margin at 25.9% versus 26.9%.

3i Infotech Q1 Highlights (Consolidated, QoQ)

Revenue down 8.56% at Rs 171 crore versus Rs 187 crore.

EBIT loss at Rs 2.65 crore versus profit of Rs 3.54 crore.

Net profit down 72.03% at Rs 7.55 crore versus Rs 27 crore.

Chalet Hotels Q1 Highlights (Consolidated, YoY)

Revenue up 147.8% to Rs 894.55 crore versus Rs 361.01 crore

Net Profit at Rs 203.15 crore versus Rs 60.67 crore

Ebitda at Rs 357.28 crore versus Rs 140.24 crore

Margin at 39.9% versus 38.8%

Pricol Q1 Highlights (Consolidated, YoY)

Revenue up 44.35% at Rs 895 crore versus Rs 620 crore.

Ebitda up 21.75% at Rs 99.02 crore versus Rs 81.33 crore.

Ebitda margin down 205 basis points at 11.06% versus 13.11%.

Net profit up 9.74% at Rs 50 crore versus Rs 45.56 crore.

PB Fintech Q1 Highlights (Consolidated, QoQ)

Revenue down 10.6% to Rs 1,348 crore versus Rs 1,508 crore.

Net Profit down 50.4% at Rs 84.6 crore versus Rs 171 crore.

PDS Q1 Highlights (Consolidated, YoY)

Revenue up 14.4% to Rs 2,999 crore versus Rs 2,621 crore.

Net Profit down 34.7% at Rs 13 crore versus Rs 19.9 crore.

Ebitda down 31.1% to Rs 50.5 versus Rs 73.3 crore.

Margin at 1.7% versus 2.8%.

Timken India Q1 Highlights (Consolidated, YoY)

Revenue up 3.2% to Rs 809 crore versus Rs 784 crore.

Net Profit up 8.2% at Rs 104 crore versus Rs 96.3 crore.

Ebitda up 1% to Rs 142 versus Rs 141 crore.

Margin at 17.6% versus 18%.

LG Balakrishnan & Bros Q1 Highlights (Consolidated, YoY)

Revenue up 15% to Rs 657 crore versus Rs 571 crore.

Net Profit up 2.7% at Rs 66.9 crore versus Rs 65.2 crore.

Ebitda up 8.9% to Rs 97.1 versus Rs 89.2 crore.

Margin at 14.8% versus 15.6%.

RR Kabel Q1 Highlights (Consolidated, YoY)

Revenue up 13.9% to Rs 2,059 crore versus Rs 1,808 crore.

Net Profit up 39.4% at Rs 89.8 crore versus Rs 64.4 crore.

Ebitda up 49.7% to Rs 142 versus Rs 94.9 crore.

Margin at 6.9% versus 5.3%.

Sanofi India Q1 Highlights (Consolidated, YoY)

Revenue down 12.4% to Rs 406 crore versus Rs 464 crore.

Net Profit at Rs 69.5 crore versus Rs 10.3 crore.

Ebitda down 18% to Rs 94.9 versus Rs 116 crore.

Margin at 23.4% versus 25%.

Great Eastern Shipping Q1 Highlights (Consolidated, YoY)

Revenue down 20.3% to Rs 1,201 crore versus Rs 1,508 crore.

Net Profit down 37.9% to Rs 505 crore versus Rs 812 crore.

Ebitda down 30.9% to Rs 628 versus Rs 908 crore.

Margin at 52.3% versus 60.2%.

Barbeque-Nation Hospitality Q1 Highlights (Consolidated, YoY)

Revenue down 2.8% to Rs 296.98 crore versus Rs 305.69 crore.

Net loss at Rs 16.41 crore versus loss of Rs 4.86 crore.

Ebitda down 10% to Rs 46.01 versus Rs 50.90 crore.

Margin at 15.5% versus 16.7%.

Indegene Q1 Highlights (Consolidated, YoY)

Revenue up 12.5% to Rs 761 crore versus Rs 677 crore.

Net Profit up 32.7% to Rs 116 crore versus Rs 87.7 crore.

Ebitda up 20.5% to Rs 155 versus Rs 129 crore.

Margin at 20.4% versus 19.1%.

Aarti Industries Q1 Highlights (Consolidated, YoY)

Revenue down 9.5% to Rs 1,675 crore versus Rs 1,851 crore.

Net Profit down 68.6% to Rs 43 crore versus Rs 137 crore.

Ebitda down 34.4% to Rs 196 versus Rs 299 crore.

Margin at 11.7% versus 16.2%.

JSW Energy Q1 Highlights (Consolidated, YoY)

Revenue up 78.6% to Rs 5,143 crore versus Rs 2,879 crore.

Net Profit up 42.4% to Rs 743 crore versus Rs 522 crore.

Ebitda up 96.7% to Rs 2,789 versus Rs 1,418 crore.

Margin at 54.2% versus 49.2%.

Sundram Fasteners Q1 Highlights (Consolidated, YoY)

Revenue up 2.4% to Rs 1,533 crore versus Rs 1,498 crore.

Net Profit up 4.6% to Rs 148 crore versus Rs 142 crore.

Ebitda flat at Rs 247 crore.

Margin at 16.1% versus 16.5%.

Chambal Fertilisers Chemicals Q1 Highlights (Consolidated, YoY)

Revenue up 15.5% to Rs 5,697.61 crore versus Rs 4,933.23 crore.

Net Profit up 22% to Rs 548.96 crore versus Rs 448.36 crore.

Ebitda up 1% to Rs 760.97 crore versus Rs 752.02 crore.

Margin at 13.4% versus 15.2%.

Niva Bupa Health Insurance Co Q1 Highlights (YoY)

Net premium income up 19.8% to Rs 1,220 crore versus Rs 1,018 crore.

Net loss at Rs 91.4 crore versus Rs 18.8 crore.

Mankind Pharma Q1 Highlights (Consolidated, YoY)

Revenue up 24.5% to Rs 3,570 crore versus Rs 2,868 crore.

Net Profit down 18.3% to Rs 438 crore versus Rs 536 crore.

Ebitda up 26.1% to Rs 847 crore versus Rs 671.56 crore.

Margin at 23.7% versus 23.4%.

TCPL Packaging Q1 Highlights (Consolidated, YoY)

Revenue up 4.7% to Rs 424.68 crore versus Rs 405.59 crore.

Net Profit down 30% to Rs 22.32 crore versus Rs 31.72 crore.

Ebitda up 2% to Rs 72.61 crore versus Rs 71.42 crore.

Margin at 17.1% versus 17.6%.

Eicher Motors Q1 Highlights (Consolidated, YoY)

Revenue up 14.8% to Rs 5,041.84 crore versus Rs 4,393.05 crore.

Net Profit up 9.4% to Rs 1,205 crore versus Rs 1,101 crore.

Ebitda up 3% to Rs 1,202.78 crore versus Rs 1,165.43 crore.

Margin at 23.9% versus 26.5%.

Coal India Q1 Highlights (Consolidated, YoY)

Revenue down 4.4% to Rs 35,842.19 crore versus Rs 37,503.87 crore.

Net Profit down 20% to Rs 8,743.38 crore versus Rs 10,959.47 crore.

Ebitda down 13% to Rs 12,521.42 crore versus Rs 14,338.53 crore.

Margin at 34.9% versus 38.2%.

JSW Holdings Q1 Highlights (Consolidated, YoY)

Total income grew 10.4% to Rs 30.1 crore versus Rs 27.2 crore.

Net profit down 35.7% to Rs 33.8 crore versus Rs 52.6 crore.

City Union Bank Q1 Highlights (YoY)

Net interest income grew 14.7% to Rs 625 crore versus Rs 545 crore.

Net profit up 15.7% to Rs 306 crore versus Rs 264 crore.

Operating profit grew 20.7% to Rs 451 crore versus Rs 373 crore.

Provisions grew 79.5% to Rs 70 crore versus Rs 39 crore.

Net NPA at 1.2% versus 1.25% (QoQ).

Gross NPA at 2.99% versus 3.09% (QoQ).

Neuland Labs Q1 Highlights (Consolidated, YoY)

Revenue down 33.4% to Rs 293 crore versus Rs 440 crore.

Net profit down 85.8% to Rs 13.9 crore versus Rs 97.9 crore.

Ebitda down 72% to Rs 34.4 crore versus Rs 123 crore.

Margin at 11.8% versus 28.1%.

Restaurant Brands Asia Q1 Highlights (Consolidated, YoY)

Revenue up 7.9% to Rs 698 crore versus Rs 647 crore.

Net loss of Rs 41.9 crore versus Rs 49.4 crore.

Ebitda up 15.5% to Rs 72.8 crore versus Rs 63 crore.

Margin at 10.4% versus 9.7%.

Swiggy Q1 Highlights (QoQ)

Food delivery business grew 18.1% YoY, 10% QoQ

Quick commerce grew 114% YoY, 17% QoQ

Thermax Q1 Highlights (YoY)

Revenue down 1.6% to Rs 2,150 crore versus Rs 2,184 crore.

Net Profit up 31.6% to Rs 152 crore versus Rs 116 crore.

Ebitda up 59.5% to Rs 225 crore versus Rs 141 crore.

Margin at 10.5% versus 6.5%.

Teamlease Services Q1 Highlights (Consolidated, YoY)

Revenue up 12.1% to Rs 2,891 crore versus Rs 2,580 crore.

Net Profit up 27.7% to Rs 26.5 crore versus Rs 20.8 crore.

Ebitda up 37.7% to Rs 30.6 crore versus Rs 22.3 crore.

Margin at 1.1% versus 0.9%.

Swiggy Q1 Highlights (Consolidated, QoQ)

Revenue up 12.5% to Rs 4,961 crore versus Rs 4,410 crore.

Net loss at Rs 1,197 crore versus loss of Rs 1,081 crore.

Ebitda loss of Rs 954 crore versus loss of Rs 962 crore.

Netweb Technologies Q1 Highlights (Consolidated, YoY)

Revenue down 27.4% to Rs 301.20 crore versus Rs 414.65 crore.

Net Profit down 28% to Rs 30.48 crore versus Rs 42.61 crore.

Ebit down 26% to Rs 41.47 crore versus Rs 56.08 crore.

Margin at 13.8% versus 13.5%.

Dabur Q1 Highlights (Consolidated, YoY)

Revenue up 1.7% to Rs 3,404.58 crore versus Rs 3,349.11 crore.

Net Profit up 3% to Rs 513.91 crore versus Rs 500.12 crore.

Ebitda up 2% to Rs 667.82 crore versus Rs 655.03 crore.

Margin flat at 19.6%.

Maruti Suzuki Q1 Highlights (Standalone, YoY)

Revenue up 8.1% to Rs 38,413.60 crore versus Rs 35,531.40 crore.

Net Profit up 2% to Rs 3,711.70 crore versus Rs 3,649.90 crore.

Ebitda down 11% to Rs 3,995.30 crore versus Rs 4,502.30 crore.

Margin at 10.4% versus 12.7%.

GHCL Q1 Highlights (Consolidated, YoY)

Revenue down 4.2% at Rs 796 crore versus Rs 830 crore.

Ebitda down 9% at Rs 197 crore versus Rs 217 crore.

Margin at 24.8% versus 26.1%.

Net Profit down 4.3% at Rs 144 crore versus Rs 151 crore.

Chola Investment Q1 Highlights (Consolidated, YoY)

Calculated NII up 23% at Rs 3,188 crore versus Rs 2,584 crore.

Impairment up 51.7% at Rs 882 crore versus Rs 582 crore.

Net Profit up 20.1% at Rs 1,138 crore versus Rs 947 crore.

Skipper Q1 Highlights (Consolidated, YoY)

Revenue up 14.8% at Rs 1,254 crore versus Rs 1,092 crore.

Ebitda up 21.5% at Rs 127 crore versus Rs 105 crore.

Margin at 10.1% versus 9.6%.

Net Profit up 39.5% at Rs 45.2 crore versus Rs 32.4 crore.

Adani Enterprises Q1 Highlights (Consolidated, QoQ)

Revenue down 18.6% at Rs 21,961 crore versus Rs 26,966 crore.

Ebitda down 10.8% at Rs 3,310 crore versus Rs 3,710 crore.

Margin at 15.1% versus 13.8%.

Profit Before Exceptional Items up 11.7% at Rs 1,466 crore versus Rs 1,313 crore.

Vedanta Q1 Highlights (Consolidated, QoQ)

Revenue down 6.5% at Rs 37,824 crore versus Rs 40,455 crore.

Ebitda down 13.5% at Rs 9,918 crore versus Rs 11,466 crore.

Margin at 26.2% versus 28.3%.

Net Profit down 8.6% at Rs 3,185 crore versus Rs 3,483 crore.

Sun Pharma Q1 Highlights (Consolidated, YoY)

Revenue up 9.5% at Rs 13,851 crore versus Rs 12,653 crore.

Ebitda up 11.3% at Rs 4,073 crore versus Rs 3,658 crore.

Margin at 29.4% versus 28.9%.

Net Profit down 19.6% at Rs 2,279 crore versus Rs 2,836 crore.

There was an exceptional loss in the quarter of Rs 818 crore.

ICRA Q1 Highlights (Consolidated, YoY)

Total Income up 12.2% at Rs 149 crore versus Rs 133 crore.

Net Profit up 19.5% at Rs 42.4 crore versus Rs 35.5 crore.

Wonderla Holidays Q1 Highlights (YoY)

Revenue down 2.7% at Rs 168 crore versus Rs 173 crore. (Bloomberg estimate: Rs 174.80 crore)

Ebitda down 16% at Rs 76.7 crore versus Rs 91.4 crore.

Margin at 45.57% versus 52.85%.

Net Profit down 16.9% at Rs 52.6 crore versus Rs 63.2 crore. (Bloomberg estimate: Rs 61.30 crore)

Ambuja Cements Q1 Highlights (YoY)

Revenue up 21.7% at Rs 5,521 crore versus Rs 4,538 crore.

Ebitda up 38.9% at Rs 878 crore versus Rs 632 crore.

Margin at 15.9% versus 13.9%.

Net Profit up 50.8% at Rs 855 crore versus Rs 567 crore.

Aptus Value Q1 Highlights (YoY)

Calculated NII up 7.9% at Rs 213 crore versus Rs 197 crore.

Impairment On Financial Instruments at Rs 9.1 crore versus Rs 2.4 crore.

Net Profit up 21.6% at Rs 155 crore versus Rs 127 crore.

TVS Motors Q1 Highlights (Standalone, YoY)

Revenue up 20.4% to Rs 10,081.00 crore versus Rs 8,375.50 crore. (Bloomberg estimate: Rs 9,973.02 crore)

Ebitda up 31.5% to Rs 1,263.00 crore versus Rs 960.10 crore.

Margin at 12.5% versus 11.5%.

Net profit up 34.9% to Rs 778.50 crore versus Rs 577.30 crore. (Bloomberg estimate: Rs 759.55 crore)

After posting the first quarter results, the company is set to pay an interim dividend of Rs 6 per share.

Dr Lal Pathlabs Q1 Highlights (Consolidated, YoY)

Revenue up 11.3% at Rs 670 crore versus Rs 602 crore. (Bloomberg estimate: Rs 669.61 crore)

Ebitda up 13.1% at Rs 192 crore versus Rs 170 crore.

Margin at 28.7% versus 28.2%.

Net Profit up 24.4% at Rs 132 crore versus Rs 106 crore. (Bloomberg estimate: Rs 124.81 crore)

Emami Q1 Highlights (Consolidated, YoY)

Revenue down 0.2% at Rs 904 crore versus Rs 906 crore. (Bloomberg estimate: Rs 892.68 crore)

Ebitda down 1.1% at Rs 214 crore versus Rs 217 crore.

Margin at 23.7% versus 23.9%.

Net Profit up 7.6% at Rs 164 crore versus Rs 153 crore (Bloomberg estimate: Rs 154.19 crore)

Jubilant Ingrevia Q1 Highlights (Consolidated, YoY)

Revenue up 1.3% at Rs 1,038 crore versus Rs 1,024 crore. (Bloomberg estimate: Rs 1,032.95 crore)

Ebitda up 29.8% at Rs 142 crore versus Rs 110 crore.

Margin at 13.7% versus 10.7%.

Net Profit up 54.2% at Rs 75.1 crore versus Rs 48.7 crore. (Bloomberg estimate: Rs 63 crore)

Gillette India Q1 Highlights (YoY)

Revenue up 9.5% at Rs 707 crore versus Rs 645 crore. (Bloomberg estimate: Rs 722.00 crore)

Ebitda up 19.8% at Rs 210 crore versus Rs 175 crore.

Margin at 29.7% versus 27.2%.

Reports Inventory Write-Back of Rs 42.5 crore in this quarter.

Net Profit up 25.6% at Rs 146 crore versus Rs 116 crore. (Bloomberg estimate: Rs 119.10 crore)

DCB Bank Q1 Highlights (QoQ)

Gross NPA at 2.98% versus 2.99%.

Net NPA at 1.22% versus 1.12%.

Provisions up 71.3% at Rs 115 crore versus Rs 67.2 crore.

DCB Bank Q1 Highlights (YoY)

Net Interest Income up 16.9% at Rs 580 crore versus Rs 497 crore.

Operating Profit up 59.2% at Rs 327 crore versus Rs 205 crore.

Provisions at Rs 115 crore versus Rs 28.4 crore.

Net Profit up 19.7% at Rs 157 crore versus Rs 131 crore.

Saregama India Q1 Highlights (Consolidated, YoY)

Revenue up 0.7% at Rs 207 crore versus Rs 205 crore.

Ebitda up 7.4% at Rs 55.3 crore versus Rs 51.5 crore.

Margin at 26.7% versus 25.1%.

Net Profit down 0.7% at Rs 36.7 crore versus Rs 36.9 crore.

Kalyani Steels Q1 Highlights (Consolidated, YoY)

Revenue down 4.1% at Rs 443 crore versus Rs 462 crore.

Ebitda up 7.8% at Rs 85.4 crore versus Rs 79.2 crore.

Margin at 19.8% versus 17.2%.

Net Profit up 18.2% at Rs 61.7 crore versus Rs 52.2 crore.

HUL Earnings Concall Highlights

We now have a 1000 crore portfolio for high growth category

On Aug. 12 we will hold shareholders meeting to approve ice cream demerger

Growth guidance remains unchanged

Expect sequential improvement in gross margins

HUL Earnings Concall Highlights

HUL announced that its high-growth category portfolio has now reached a valuation of Rs 1,000 crore. A shareholders' meeting is scheduled for August 12th to seek approval for the proposed ice cream business demerger.

The company's growth guidance remains unchanged, indicating a consistent outlook for future performance. HUL anticipates a sequential improvement in its gross margins in the upcoming periods.

HUL Earnings Concall Highlights

The management said that they are seeing encouraging macro environment. They noted that the demand trends seeing sequential improvement. They also note the softening of key raw materials seen sequentially.

The management noted that the growth trajectory has improved and that they have also strengthened market share via modern channels.

Auto giant Maruti Suzuki is likely to clock net profit at Rs 3,075.82 crore and revenue of Rs 36,371.33 crore for the quarter ended June, according to a survey of analysts' estimates done by Bloomberg.

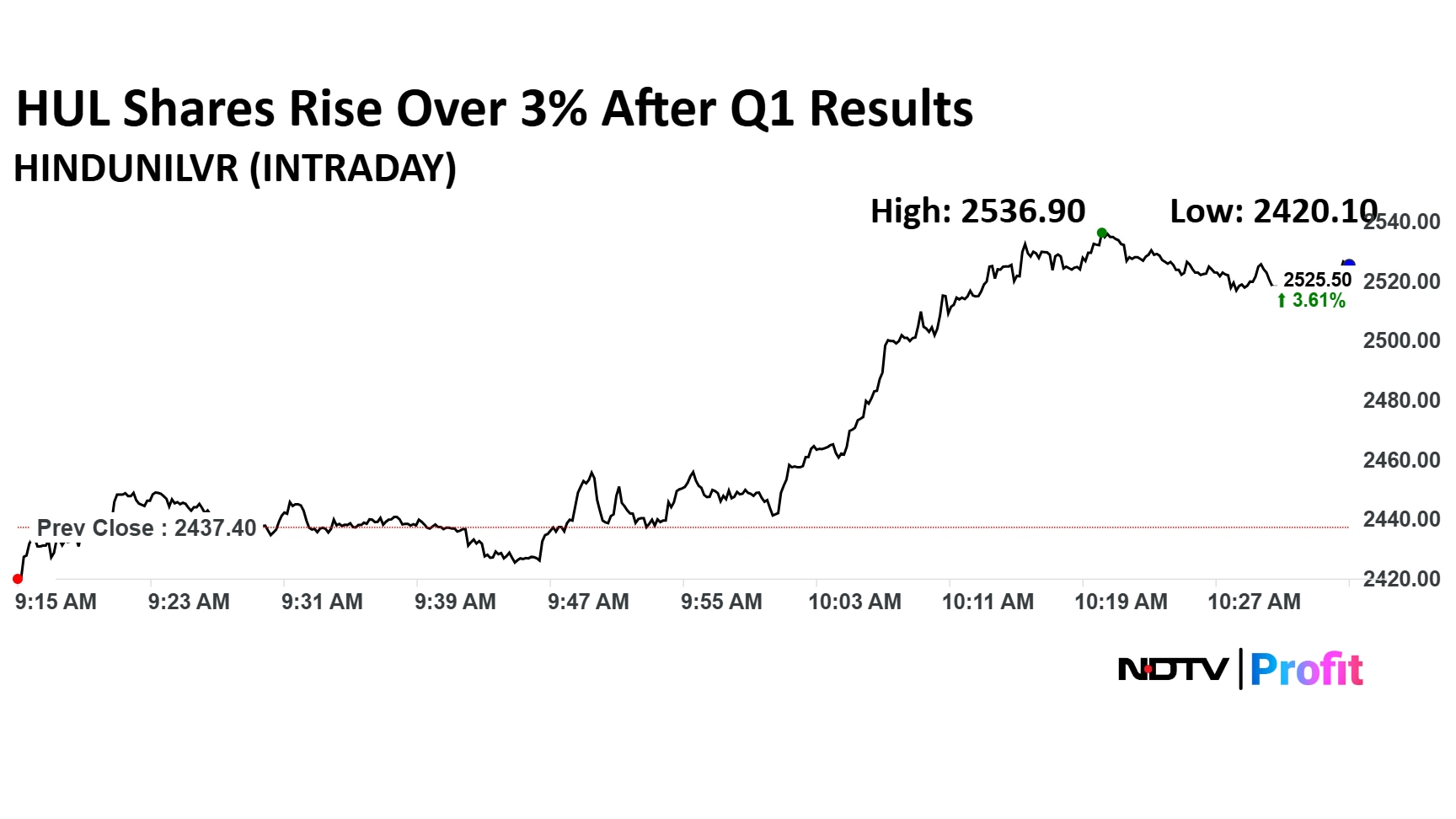

After posting strong first quarter results, the share price of HUL also saw a surge of over 3%.

The scrip was trading over 1.83% higher at Rs 2,482, compared to a 0.71% decline in the benchmark index Nifty 50 as of 10:38 a.m.

After posting strong first quarter results, the share price of HUL also saw a surge of over 3%.

The scrip was trading over 1.83% higher at Rs 2,482, compared to a 0.71% decline in the benchmark index Nifty 50 as of 10:38 a.m.

Along with the first quarter results, the company has also announced an update on Ice cream demerger. HUL has announced that the demerger is set to be completed by the fourth quarter of financial year 2026.

HUL Segmental Performance (Revenue, YoY)

Home Care Revenue is at Rs 5,783 crore versus Rs 5,675 crore.

Personal Care Revenue is at Rs 2,541 crore versus Rs 2,385 crore.

Beauty & Wellbeing Revenue is at Rs 3,349 crore versus Rs 3,199 crore.

Foods Revenue is at Rs 4,016 crore versus Rs 3,850 crore.

This is NDTV Profit's exclusive live coverage of the first-quarter earnings season. The financial landscape is buzzing today, as nearly five Nifty 50 companies, along with over 130 players are set to announce their performance for the June quarter. The results will cover their financial performance for the April to June quarter.

Maruti Suzuki India Ltd., Swiggy Ltd., and Eicher Motors Ltd. are among the top names that will announce their earnings for the first quarter.

This is your front-row seat to the earnings action, so stay with us for real-time updates, analysis of the numbers, and all the key details that companies will be putting out through the day!

HUL Q1 FY26 Highlights (Standalone, YoY)

Revenue up 3.9% at Rs 15,931 crore versus Rs 15,339 crore. (Bloomberg estimate: Rs 15,962.30 crore)

Ebitda down 1.3% at Rs 3,558 crore versus Rs 3,606 crore. (Bloomberg estimate: Rs 3,617.81 crore)

Margin at 22.3% versus 23.5%. (Bloomberg estimate: 22.7%)

Net Profit up 7.6% at Rs 2,732 crore versus Rs 2,538 crore. (Bloomberg estimate: Rs 2,583.38 crore)

HUL Q1 FY26 Highlights (Consolidated, YoY)

Revenue up 5.13% at Rs 16,514 crore versus Rs 15,707 crore.

Ebitda down 0.7% at Rs 3,718 crore versus Rs 3,744 crore.

Margin at 22.51% versus 23.83%, down 132 bps.

Net profit up 5.59% at Rs 2,756 crore versus Rs 2,610 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.