As we wrap up the key earnings of the day, here are the companies that will be in focus on Wednesday:

HDB Financial Services

HDFC Life Insurance Co

ICICI Lombard General Insurance Co

ICICI Prudential Life Insurance Co

Himadri Specialty Chemicals

Just Dial

This live blog has ended.

Just Dial Q1 FY26 Key Highlights (YoY)

Revenue up 6.2% at Rs 297.80 crore versus Rs 280.50 crore.

Ebitda up 7% at Rs 86.40 crore versus Rs 80.60 crore.

Margin at 29% versus 28.7%.

Net Profit 13% at Rs 159.60 crore versus Rs 141.20 crore.

HDFC Life's solvency ratio increased to 192%, compared to 186% in the year-ago quarter.

The 13th month persistency ratio stood at 86%, whereas the 61st month persistency ratio improved to 64%.

Vibha Padalkar, MD and CEO:

Aggressive pricing has resulted in non-par share coming down.

Industry will be slow in the first half on strong base.

Expecting growth to pick up from second half onwards.

Margins will be range bound for this year.

In the next 3-5 years there is a scope of growth expansion.

Source: Earnings Con Call

The net premium earned during the quarter under review climbed 14% to Rs 5,136 crore, compared to Rs 4,503.88 crore in the corresponding quarter of the previous fiscal.

The gross premium has risen by 1.5% to Rs 8,052.55 crore, as compared to Rs 7,931.05 crore in the year-ago period.

The underwriting loss stood at Rs 293.14 crore, narrower as compared to Rs 346.6 crore in the corresponding quarter of the past fiscal.

The combined ratio, which serves as a key metric to measure insurers' profitability and financial health, stood at 102.9%, higher by 60 basis points as compared to 102.3% in the year-ago period.

ICICI Lombard Q1 Highlights (YoY)

Net Profit rises 28.7% to Rs 747 crore versus Rs 580 crore.

Total Income rises 13.7% to Rs 6,083 crore versus 5,352 crore.

Read full story here.

Vibha Padalkar, MD and CEO:

Product and distribution strategy is well positioned to meet houshold demands.

HDFC Life outperforms private insurers.

ULIP Demand remained strong.

Participating product have gained attraction.

Non-par annuity grew by 20%.

Agent additions remain strong.

Source: Earnings Con Call

Analysts at JPMorgan and Nuvama downgraded the stock, while Jefferies upgraded it after the results were announced on Monday. Out of the 47 analysts tracking the company, 18 each have a 'buy' and 'hold' rating. Eleven have a 'sell' call on the stock, according to Bloomberg data. The average of 12-month price targets of Rs 1,675, implies a return potential of 3.4%.

HDB Financial Services Q1 Highlights (YoY)

Total income up 15% at Rs 4,465 crore versus Rs 3,884 crore.

Profit down by 2.4% at Rs 568 crore versus Rs 582 crore.

Net interest income up 18% at Rs 2,092 crore versus Rs 1,768 crore.

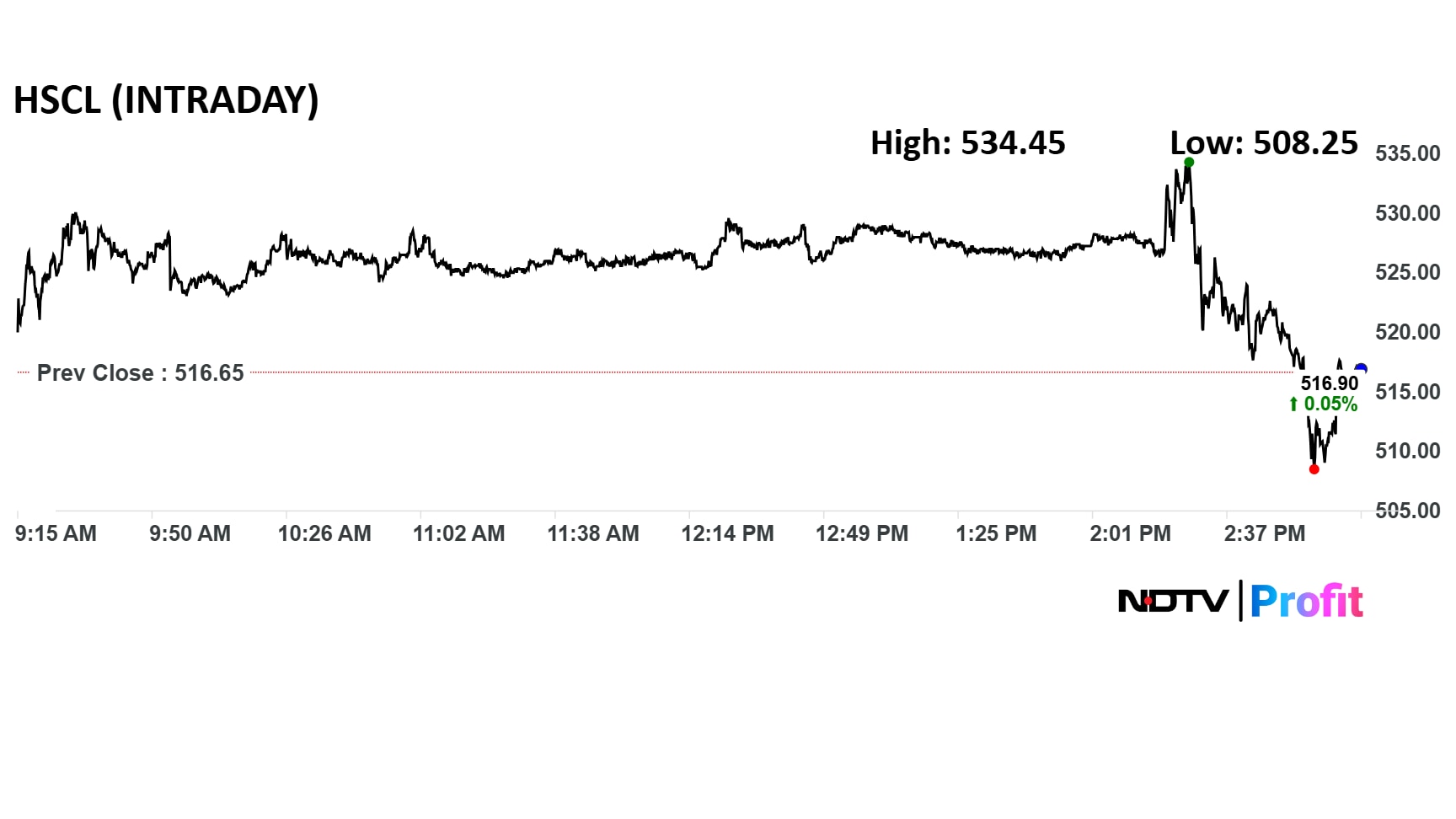

HCLTech narrowed its full-year revenue guidance and lowered its margin forecast for FY26 after reporting an 11% drop in first-quarter profit that missed analysts’ expectations.

The company now expects constant currency revenue growth of 3% to 5% year-on-year for the financial year ending March 2026, against its earlier projection of 2% to 5%, according to its notification to the exchanges. It expects its services revenue guidance at 3% to 5%.

Goldman Sachs raised its 12-month price target for Ola Electric to Rs 63, citing sequential improvement in volume and gross margin expectations. "We acknowledge management's efforts in trying to pivot the business towards positive Ebitda and FCF breakeven," the firm noted.

Kotak Securities also noted that the company has improved its profitability "significantly." Volume offtake remains below expectations given muted industry growth and increased competitive intensity, which remains an area of concern.

HDFC Life Insurance Co Q1 Highlights (Standalone, YoY)

APE up 12.52% at Rs 3,225 crore versus Rs 2,866 crore.

Value of new business up 12.7% at Rs 809 crore versus Rs 718 crore.

VNB margin at 25.08% versus 26.53%.

HDFC Life Insurance Co Q1 Highlights (Standalone, YoY)

Net Premium income up 15.64% at Rs 14,466 crore versus Rs 12,509 crore.

PAT up by 14% at Rs 546 crore versus Rs 478 crore.

Solvency ratio at 192% versus 186%.

Persistency 13th month flat at 82.7% (QoQ)

Persistency 61st month 61% versus 61.9% (QoQ)

Tata Technologies is not expecting a V-shaped recovery any time soon after US tariff policies and trade tensions weighed on the June quarter performance, Chief Executive Officer and Managing Director Warren Harris said.

"We don't anticipate a V-shaped recovery in part because of uncertainty due to trade tensions," Harris told NDTV Profit.

Read the whole story here.

HDFC's life insurance arm is likely to clock a net profit of Rs 678 crore and an annual premium equivalent of Rs 3,124 crore for the quarter ended June, according to a survey of analysts' estimates done by Bloomberg.

Himadri Speciality Chemical Q1 FY26 (Consolidated, YoY)

Revenue down 7% at Rs 1,118 crore versus Rs 1,200 crore.

Ebitda up 27.7% at Rs 245 crore versus Rs 192 crore.

Margin at 22% versus 16%.

Net profit up 48.2% at Rs 182 crore versus Rs 123 crore.

Himadri Speciality Chemical Q1 FY26 (Consolidated, YoY)

Revenue down 7% at Rs 1,118 crore versus Rs 1,200 crore.

Ebitda up 27.7% at Rs 245 crore versus Rs 192 crore.

Margin at 22% versus 16%.

Net profit up 48.2% at Rs 182 crore versus Rs 123 crore.

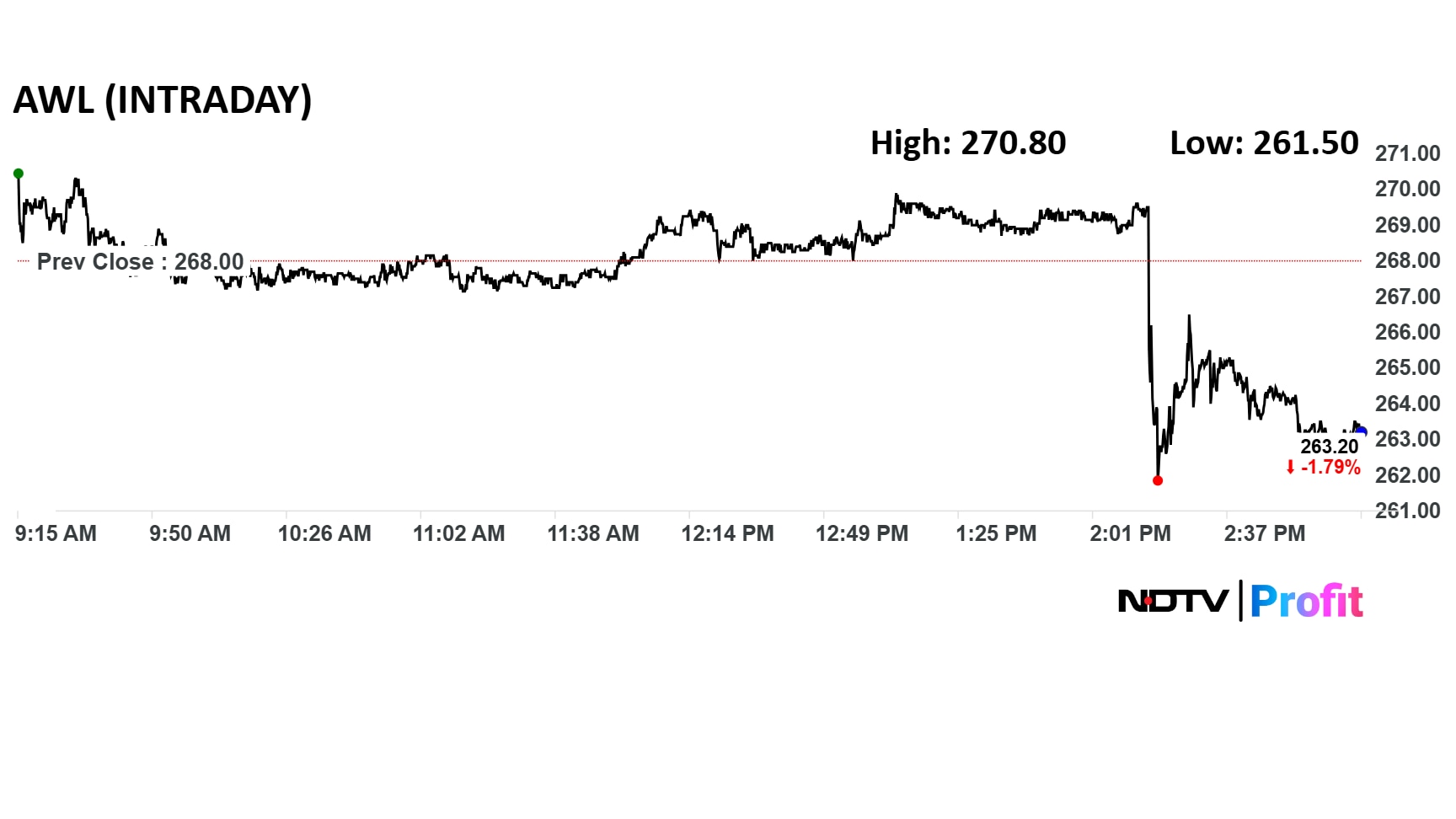

AWL Agri Business Q1 FY26 (Consolidated, YoY)

Revenue up 20.5% at Rs 17,059 crore versus Rs 14,154 crore.

Ebitda down 41.6% at Rs 366 crore versus Rs 626 crore.

Margin at 2.1% versus 4.4%.

Net Profit down 24.5% at Rs 236 crore versus Rs 313 crore.

AWL Agri Business Q1 FY26 (Consolidated, YoY)

Revenue up 20.5% at Rs 17,059 crore versus Rs 14,154 crore.

Ebitda down 41.6% at Rs 366 crore versus Rs 626 crore.

Margin at 2.1% versus 4.4%.

Net Profit down 24.5% at Rs 236 crore versus Rs 313 crore.

The brokerage maintains an 'equal-weight' rating with a target price of Rs 625 on the stock, noting the slight value of new business beat as compared to estimates.

Morgan Stanley however sees a downside risk to the fiscal 2026 consensus VNB forecasts.

ICICI Lombard is likely to report a net profit of Rs 520 crore and a net interest income of Rs 802 crore for the first quarter, according to estimates.

Persistency at 13th month at 80.8% versus 78.3%.

Persistency at 61st month at 63.4% versus 61.6%.

Solvency ratio at 212.3% versus 212.2%.

ICICI Prudential Q1 Highlights (Consolidated, YoY)

Net Premium Income up 8% to Rs 8,503 crore versus Rs 7,875 crore.

Net Profit up 34% to Rs 301 crore versus Rs 224 crore.

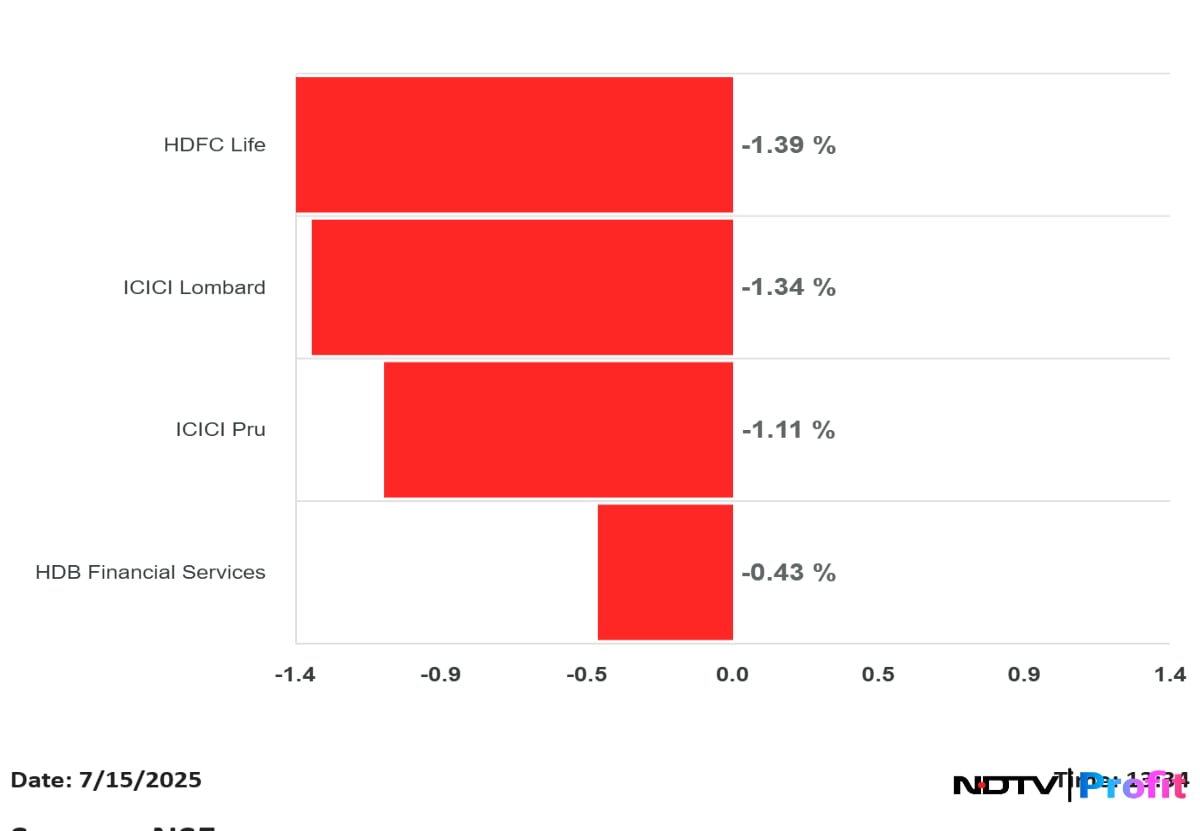

Shares of HDFC Life, ICICI Prudential Life, ICICI Lombard GIC and HDB Financial Services are trading lower ahead of their Q1 earnings.

Shares of HDFC Life, ICICI Prudential Life, ICICI Lombard GIC and HDB Financial Services are trading lower ahead of their Q1 earnings.

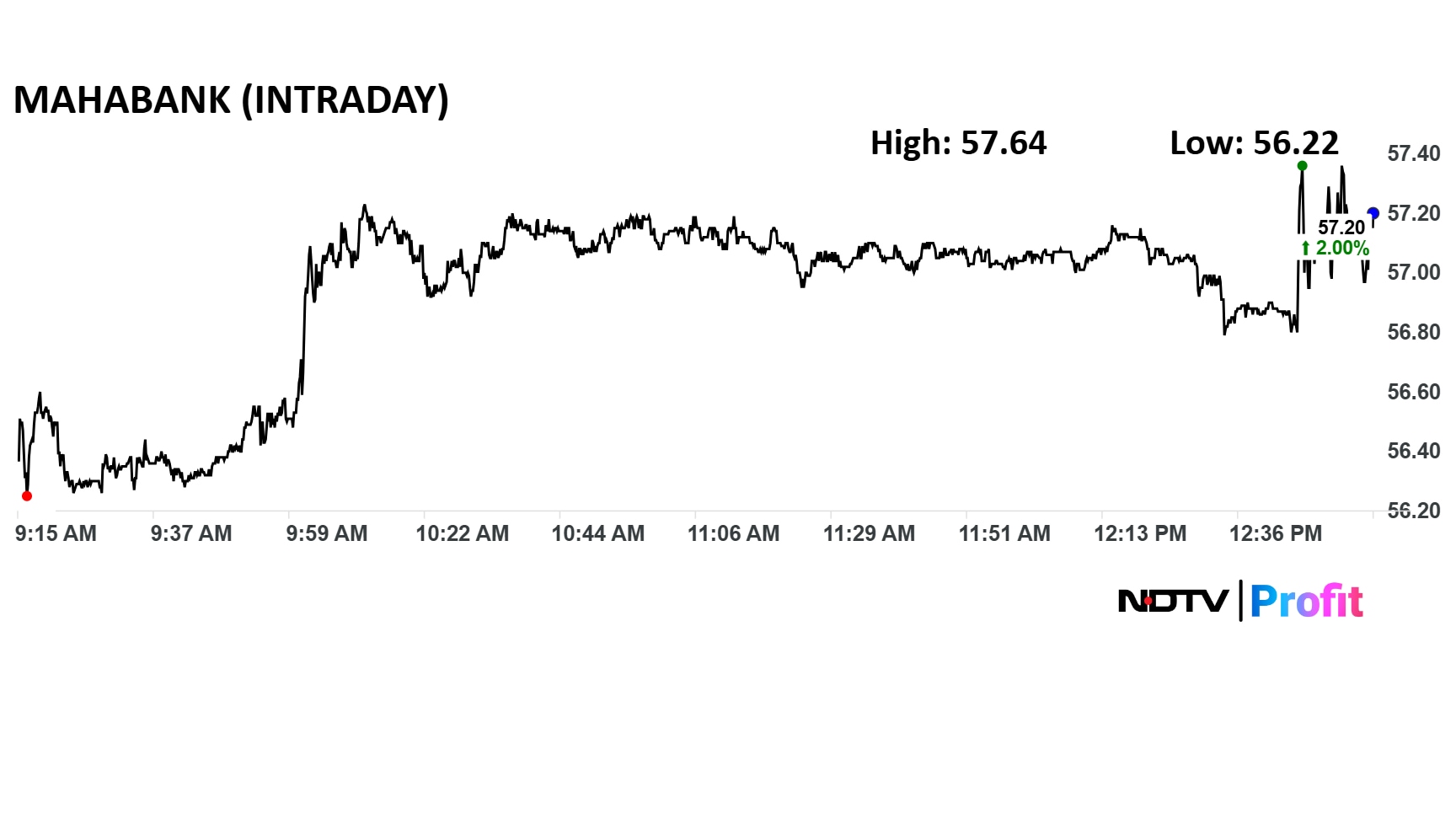

Shares of Bank of Maharashtra rose 2% after the first quarter results.

Shares of Bank of Maharashtra rose 2% after the first quarter results.

Bank Of Maharashtra Q1 FY26 (Standalone, YoY)

Net interest income up 17.6% at Rs 3,292 crore versus Rs 2,799 crore.

Net profit up 23% at Rs 1,593 crore versus Rs 1,293 crore.

Gross NPA flat At 1.74% (QoQ).

Net NPA flat At 0.18% (QoQ).

Operating profit up 12% at Rs 2,570 crore versus Rs 2,294 crore.

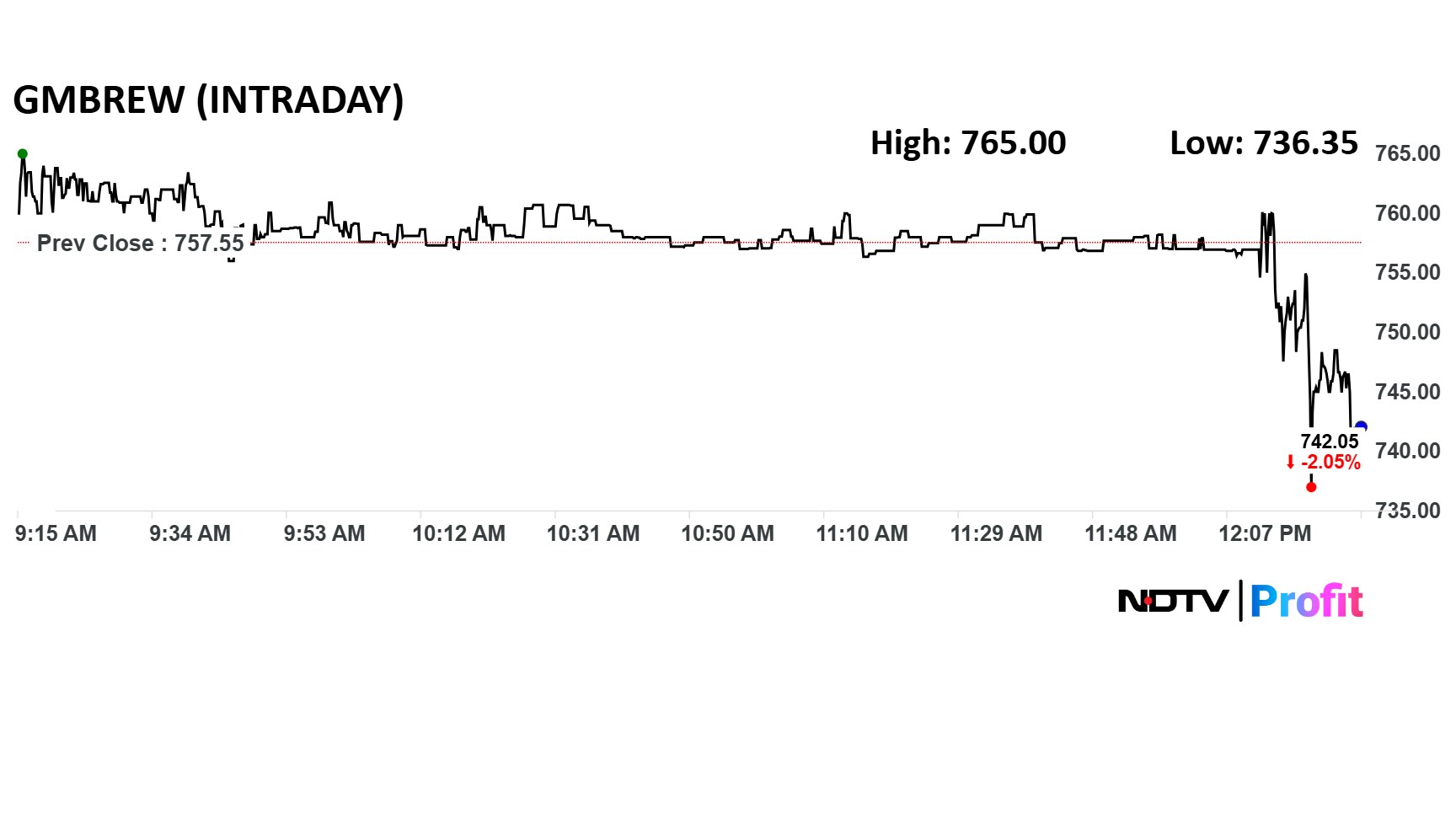

GM Breweries share price traded lower after Q1 results.

GM Breweries share price traded lower after Q1 results.

GM Breweries Q1 FY26 (Consolidated, YoY)

Revenue up 6.9% at Rs 163 crore versus Rs 152 crore.

Ebitda down 1.8% at Rs 30.9 crore versus Rs 31.5 crore.

Margin was at 19% versus 20.6%.

Net profit up 3.7% at Rs 26 crore versus Rs 25 crore.

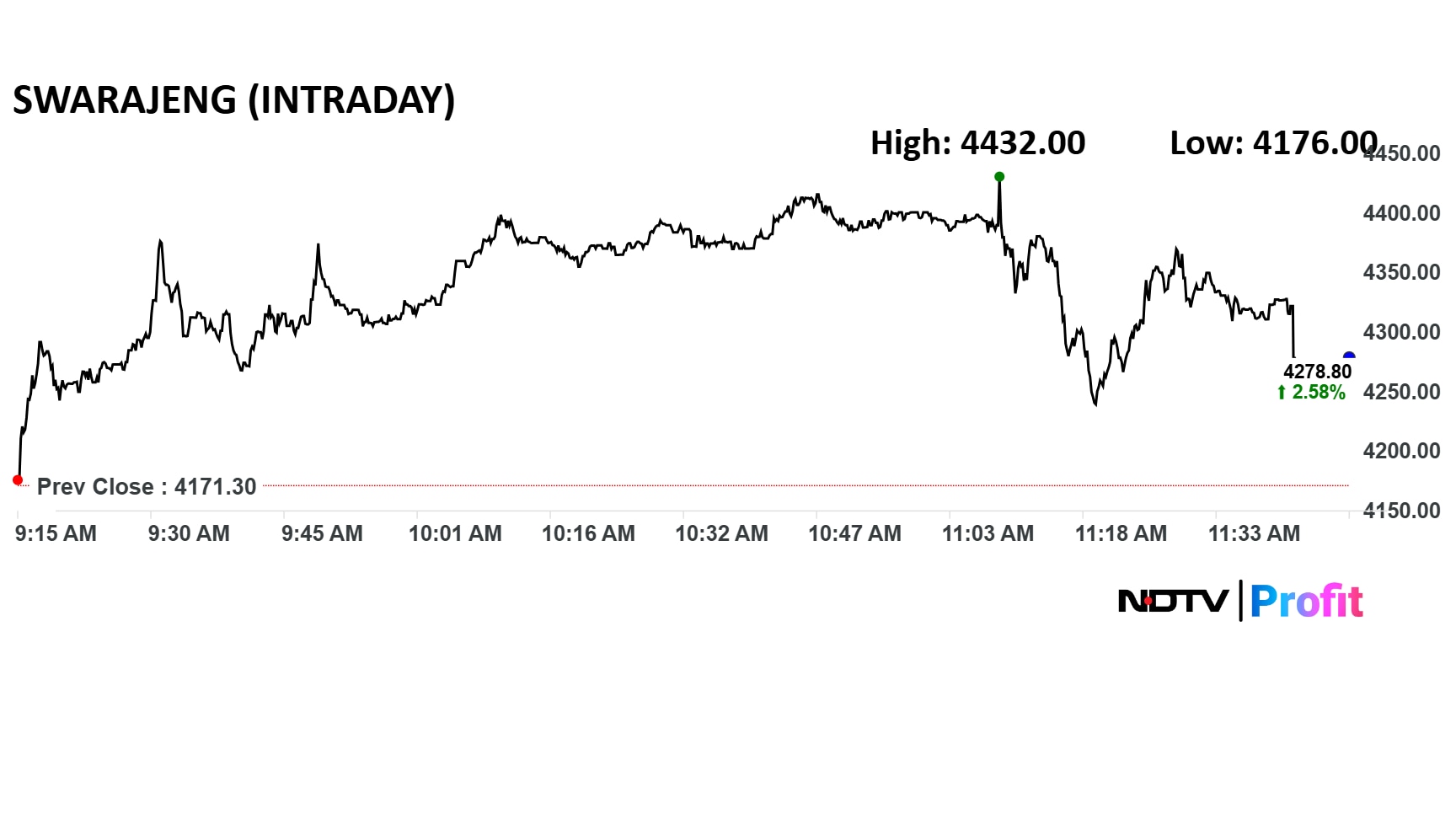

Swaraj Engines stock rose after its June quarter results.

Swaraj Engines stock rose after its June quarter results.

Swaraj Engines Q1 FY 26 Highlights (Consolidated, YoY)

Revenue up 15.8% at Rs 484 crore versus Rs 418 crore.

Ebitda up 15.4% at Rs 67.1 crore versus Rs 58.2 crore.

Margin was at 13.86% versus 13.91%.

Net profit up 16% at Rs 50 crore versus Rs 43.2 crore.

As many as 23 companies are scheduled to announce their financial results for the quarter ended June 2025 on July 15. The companies set to release their earnings reports for the first quarter of FY 2025-26 include many major players across sectors.

The notable names include the newly listed HDB Financial Services, which raised Rs 12,500 crore in June through the biggest IPO of FY26 so far. The upcoming result will mark HDB Financial Services’ first earnings report since its market debut on July 2.

Geojit Financial Services Ltd., HDB Financial Services Ltd., HDFC Life Insurance Company Ltd., ICICI Lombard General Insurance Company Ltd., ICICI Prudential Life Insurance Company Ltd., Just Dial Ltd., Network 18 Media & Investments Ltd., Bank of Maharashtra, Tokyo Finance Ltd., Plastiblends India Ltd., VK Global Industries Ltd., AWL Agri Business Ltd., Hathway Cable & Datacom Ltd., RR Financial Consultants Ltd., Vijay Textiles Ltd., Nureca Ltd. and Kamadgiri Fashion Ltd.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.