Nvidia Corp. delivered a surprisingly strong revenue forecast and pushed back on the idea that the AI industry is in a bubble, easing concerns that had spread across the tech sector.

Sales will be about $65 billion in the January quarter, the chipmaker said in a statement on Wednesday. Analysts had estimated $62 billion on average, according to data compiled by Bloomberg.

The outlook signals that demand remains robust for Nvidia's artificial intelligence accelerators, the pricey and powerful chips used to develop AI models. Nvidia has faced growing fears that the runaway spending on such equipment isn't sustainable.

“There's been a lot of talk about an AI bubble,” Chief Executive Officer Jensen Huang said on a conference call with analysts. “From our vantage point, we see something very different.”

Nvidia shares gained about 4% in late trading after the report was released. They had been up 39% this year through the close.

Nvidia results have become a barometer for the health of the AI industry, and the news lifted a variety of related stocks. CoreWeave Inc., a provider of AI computing, gained more than 10% in extended trading. Its peer Nebius Group NV climbed more than 8%.

“Markets are reacting very positively to the news that there is no slack in AI momentum,” Brian Mulberry, senior client portfolio manager at Zacks Investment Management, said in a note. His firm owns Nvidia shares. “Demand for Nvidia hardware solutions remains strong,” he said.

In explaining AI's unabated growth, Huang paraphrased a recent movie title, saying that “AI is going everywhere, doing everything, all at once.”

The CEO had said last month that the company has more than $500 billion of revenue coming over the next few quarters. Owners of large data centers will continue to spend on new gear because investments in AI have begun to pay off, he said.

On Wednesday, Chief Financial Officer Colette Kress said there was an opportunity to go beyond that $500 billion target.

In the fiscal third quarter, revenue rose 62% to $57 billion. Profit was $1.30 a share. Analysts had predicted sales of $55.2 billion and earnings of $1.26 a share for the period, which ended Oct. 26.

Nvidia's main data center unit had revenue of $51.2 billion in the quarter, compared with an average estimate of $49.3 billion. Chips used in gaming PCs — once the company's chief source of revenue — delivered sales of $4.3 billion. That compares with an average estimate of $4.4 billion.

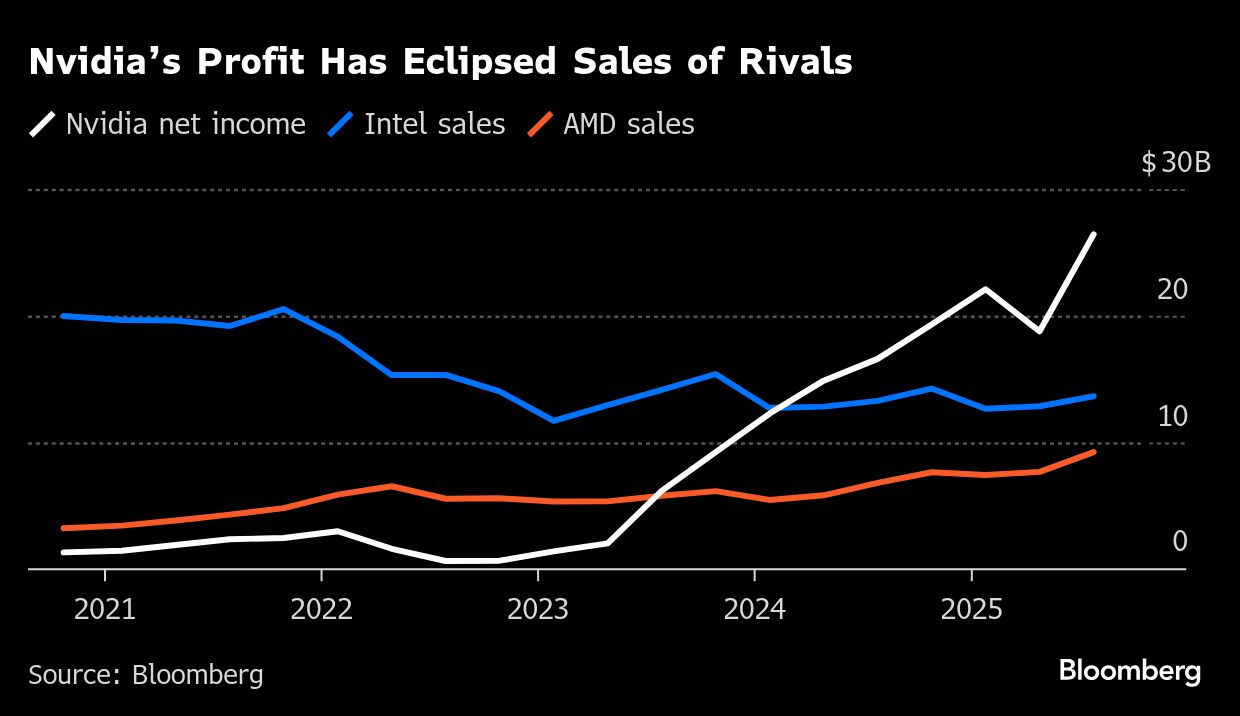

The forecast for the latest quarter reflects a staggering run for the company. Sales will be up about 10-fold from where they were in the same period just three years ago. And Nvidia is on course to deliver more annual net income than two longtime rivals — Intel Corp. and Advanced Micro Devices Inc. — will report in sales.

But Nvidia's expansion has faced challenges. US restrictions on the shipment of advanced chips to China have largely locked Nvidia out of a massive market for its products.

Huang has lobbied Washington to overturn those rules — arguing that they're counterproductive to the national security concerns they're meant to serve. But even after some rollback of the toughest elements, Nvidia isn't currently projecting any sales from AI accelerators in China.

Some investors also have expressed concerns about the structure of the megadeals that Nvidia has struck with customers. The transactions involve investments in startups such as OpenAI and Anthropic PBC, raising the issue of whether the pacts are creating artificial demand for computers.

Earlier this week, Nvidia and customer Microsoft Corp. said they've committed to invest as much as $15 billion in Anthropic. The startup has also pledged to purchase $30 billion of computing capacity from Microsoft's Azure cloud service and will work with Nvidia's engineers on fine-tuning chips and AI models.

Meanwhile, some of Nvidia rivals have grown more optimistic that they can finally challenge the company's dominance in AI accelerators. Earlier this month, Advanced Micro Devices Inc. predicted accelerating growth for its AI chip business and talked up the prospects for forthcoming products.

AMD, Broadcom Inc. and Qualcomm Inc. have all announced tie-ups with large users of Nvidia's chips. And data center operators are increasingly looking to use more in-house designs — an effort that would make them less dependent on Nvidia supply.

But Huang is also pushing to spread the use of AI across more of the worldwide economy. The CEO has embarked on a globe-trotting tour to persuade government bodies and corporations to deploy his technology.

Nvidia, founded in 1993, pioneered the market for graphics chips used to create realistic images for computer games. AMD is its only remaining major rival in that business.

Nvidia built its AI dominance by adapting that same chip architecture to crunch massive amounts of data — helping researchers create software that's begun to rival and resemble human capabilities.

The Santa Clara, California-based company still has more than 90% of the market for AI accelerator chips. It's added other products to that lineup to help solidify its edge, including networking, software and other services.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.