ITC Ltd. saw its net profit fall during the quarter-ended March 2024, but it was in line with street expectations.

The standalone net profit of the Kolkata-headquartered company dipped 1.1% to Rs 5,020 crore in the January-March period, according to an exchange filing on Thursday. That compares with the Rs 5,150-crore consensus estimate of analysts tracked by Bloomberg.

ITC Q4 Results Highlights (Standalone, YoY)

Revenue rose 1.1% to Rs 16,579 crore versus Rs 16,398 crore (Bloomberg estimate: Rs 17,191 crore).

Ebitda falls 0.8% to Rs 6,162 crore versus Rs 6,209 crore (Bloomberg estimate: Rs 6,307 crore).

Margin at 37.2% versus 37.9% (Bloomberg estimate: 36.7%).

For the entire fiscal, ITC's net profit rose 8.9% to Rs 20,421.97 crore, while revenue growth came in flat at Rs 70,105.29 crore.

"While consumption demand remained subdued in Q4 FY24, improving macroeconomic indicators, prospects of a normal monsoon and green shoots witnessed in rural demand recovery after several quarters augur well for revival in consumption demand in the near-term," ITC said.

Segmentwise, hotels sustained strong growth, with revenue rising 15%, while the cigarette business revenue rose 8%. The FMCG-other business grew 7.2%.

The agri and paper businesses remained under pressure.

The agri business has declined 13.4% due to restrictions on exports of rice , wheat, etc., while the paper business fell 6.7% on the back of low-priced Chinese supplies and muted domestic demand.

The board recommended a final dividend of Rs 7.50 per share.

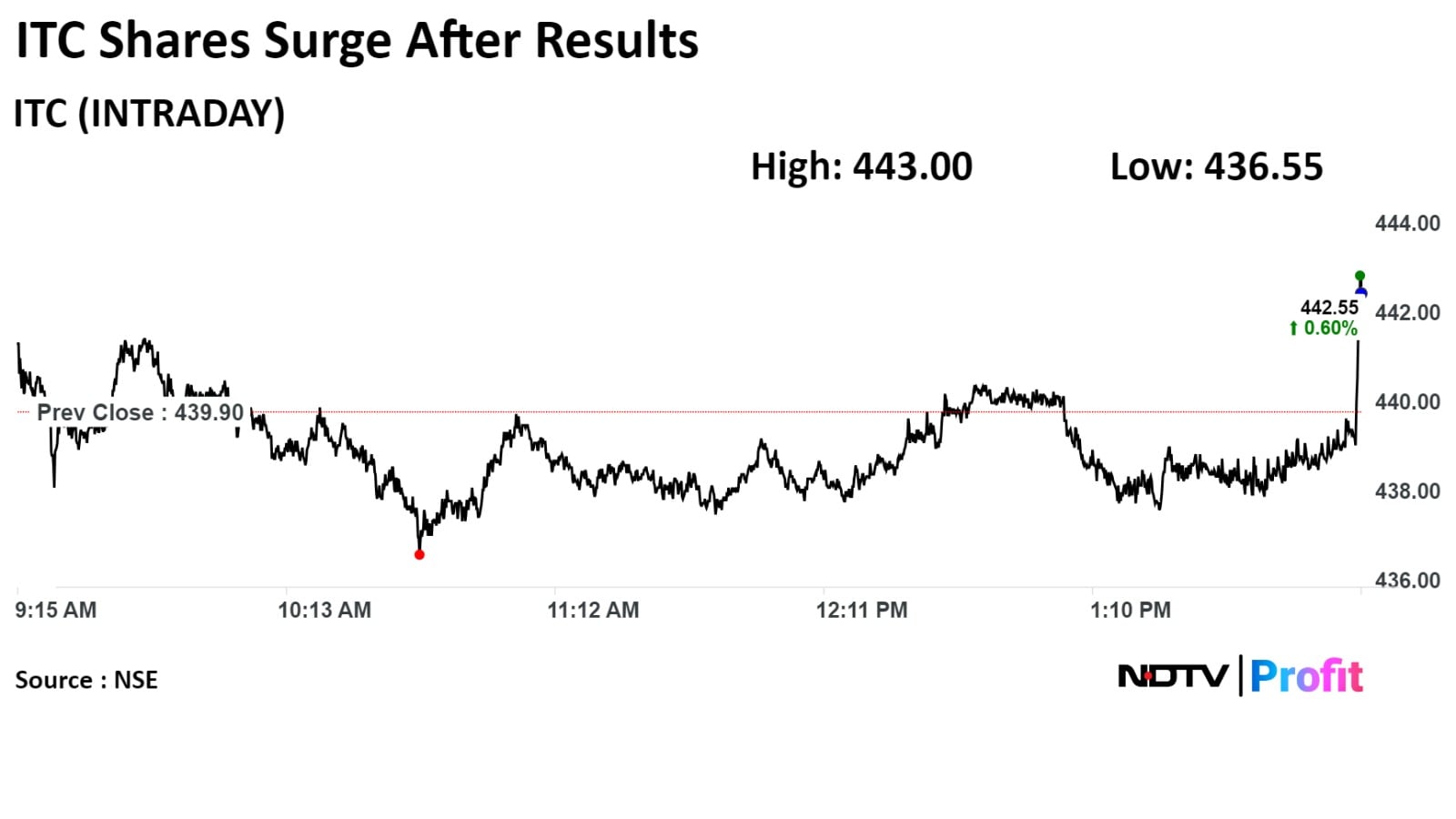

ITC shares rose as much as 0.94% to Rs 444.05 apiece after the results were announced, the highest level since May 8. It pared gains to trade 0.66% higher at Rs 442.60 apiece, as of 2:02 p.m. This compares to a 1.33% advance in the NSE Nifty 50 index.

It has fallen 4.10% on a year-to-date basis and 2% in the last 12 months. Total traded volume on the NSE so far in the day stood at 0.97 times its 30-day average. The relative strength index was at 61.24.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.