BEML Ltd. on Friday announced second interim dividend of Rs 15 per equity share for fiscal 2025. The company announced distribution of Rs 62.47 crore to shareholders.

The board has fixed May 15 as the record date for the purpose of dividend payment, the company said in an exchange filing on Friday.

In comparison, the company had issued an interim dividend of Rs 5 apiece on Feb. 14, 2025 and a final dividend of Rs 15.50 on Sept. 13, 2024.

BEML in March won an order worth Rs 405 crore from Bengaluru Metro Rail Corp. The order also includes maintenance of metro cars for up to 15 years.

The Bengaluru Metro Rail Corp. has placed an order for design, manufacturing, supply, installation, testing and commissioning of Standard Gauge Metro Cars and training of Personnel.

The public sector undertaking's net profit fell 49% to Rs 24.4 crore in the third quarter of the current financial year, while revenue slipped 16% to Rs 876 crore.

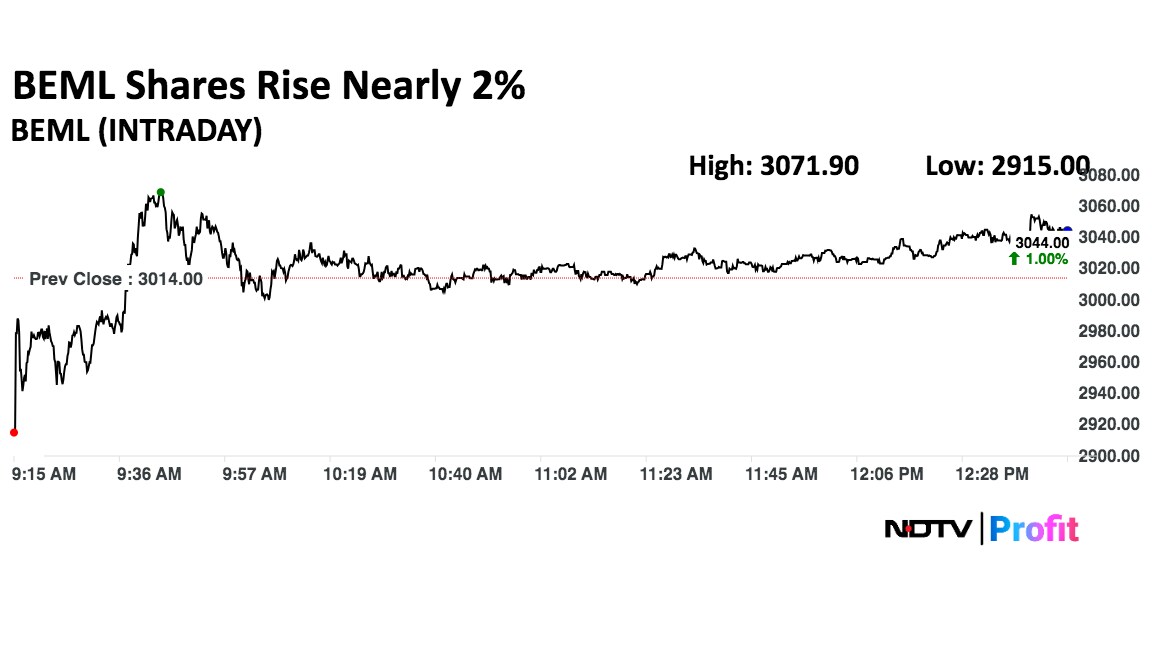

BEML Share Price Rises

Shares of BEML rose as much as 1.92% to Rs 3,071.90 apiece. It pared gains to trade 0.91% higher at Rs 3,042 apiece, as of 12:47 a.m. This compares to a 1.07% decline in the NSE Nifty 50.

The stock has fallen 5% in the last 12 months and 25.23% year-to-date. Total traded volume so far in the day stood at 8.4 times its 30-day average. The relative strength index was at 0.27.

All four analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 15.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.