Inflows in equity mutual funds, including equity-linked savings schemes, fell to their lowest in nearly two years in December as rising volatility and uncertainties ahead of the general election hurt investor sentiment.

Equity inflows dropped 21.5 percent over the previous month to Rs 6,606 crore in December—the lowest since February 2017, according to data released by the Association of Mutual Funds in India.

Across all schemes, the mutual fund industry witnessed a net outflow of Rs 1.36 lakh crore—the most since September when the IL&FS crisis spurred the biggest monthly withdrawal from money market schemes in at least a decade.

Here's what India's top five asset managers bought and sold in December:

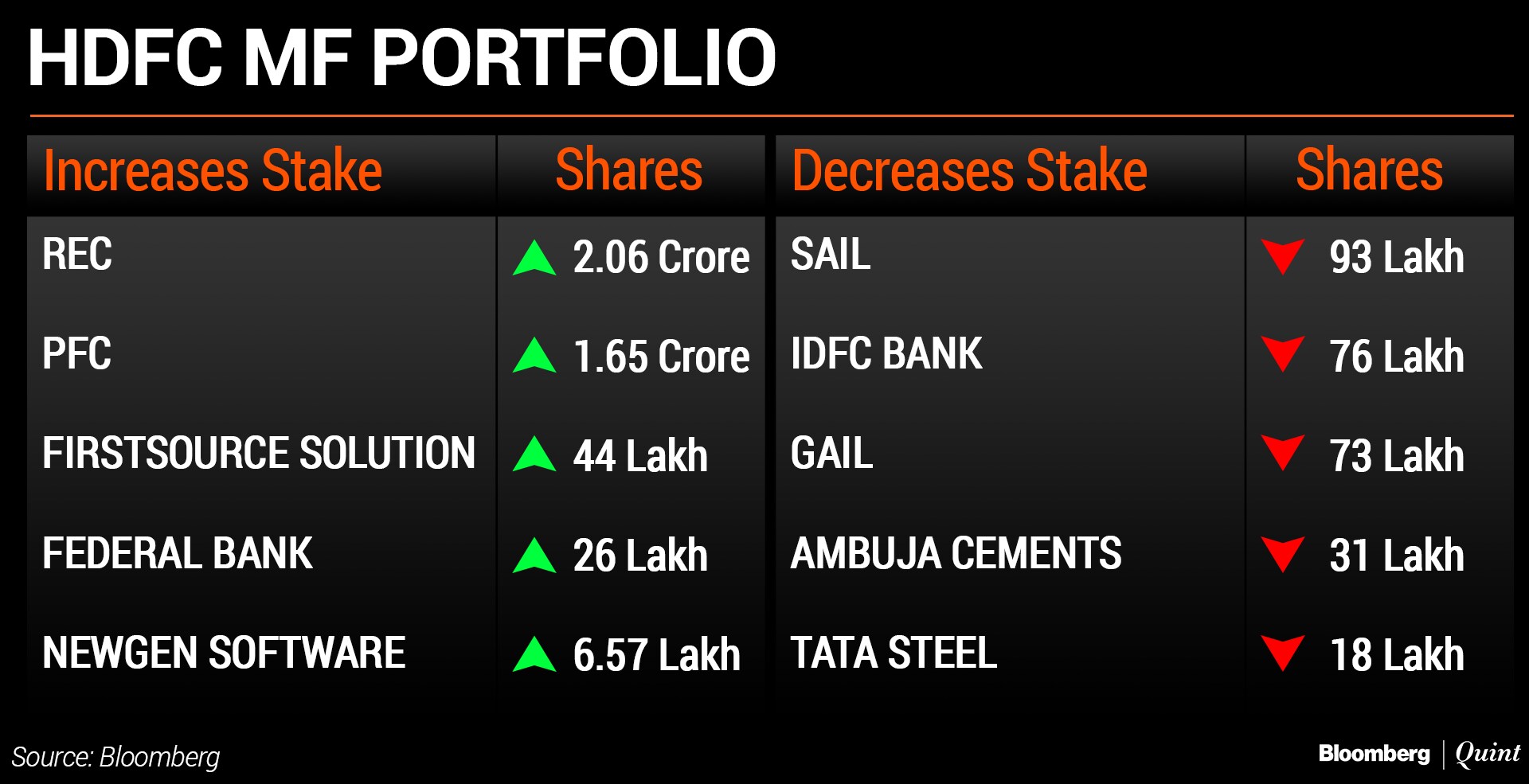

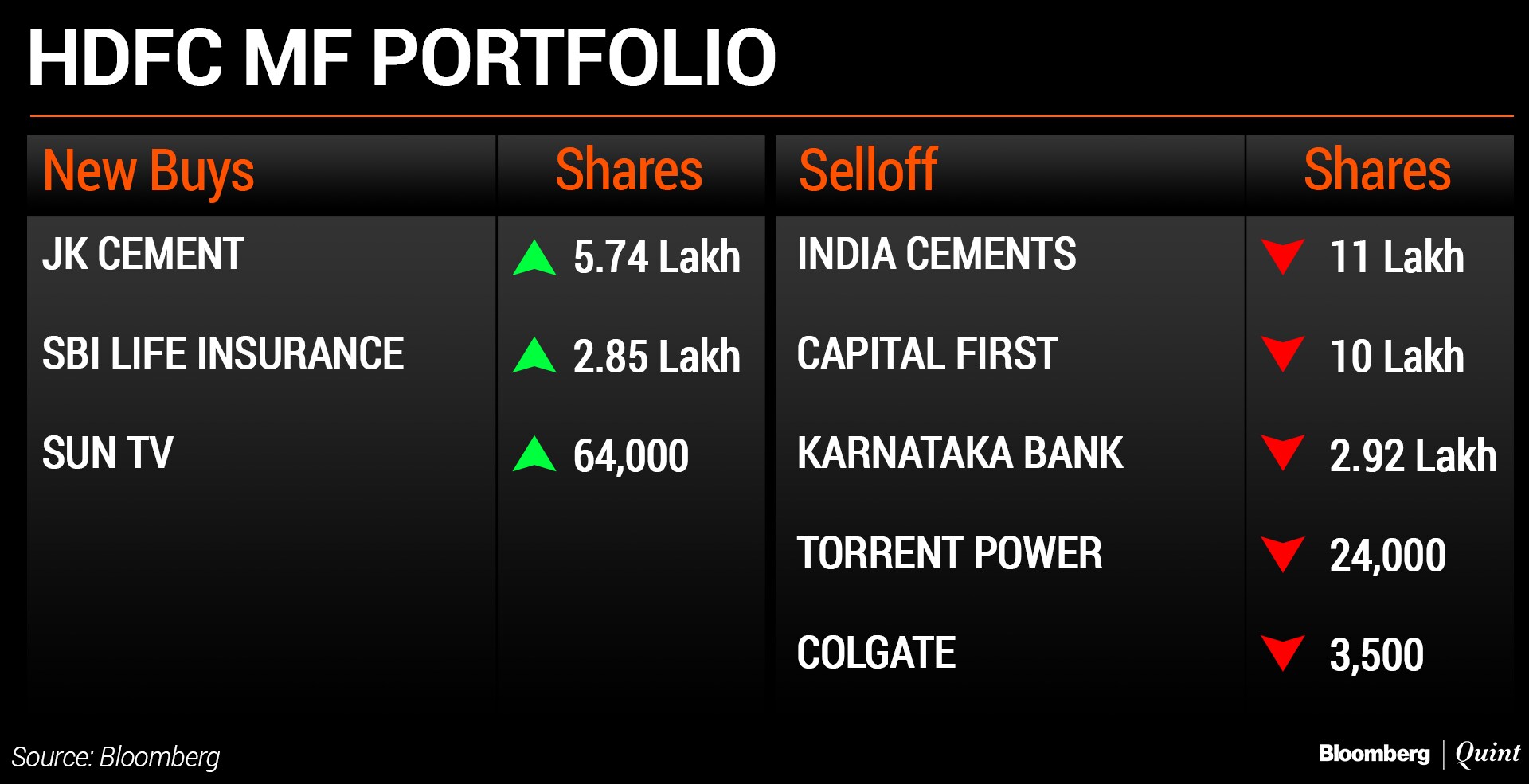

HDFC Mutual Fund

HDFC Mutual Fund pipped ICICI Prudential MF to reclaim its position as the country's largest asset management company after three years. The assets under management of HDFC MF grew over 9 percent in the three months ended December to Rs 3.35 lakh crore. Its largest exposure is to financials at 32.7 percent, followed by industrials at 14 percent.

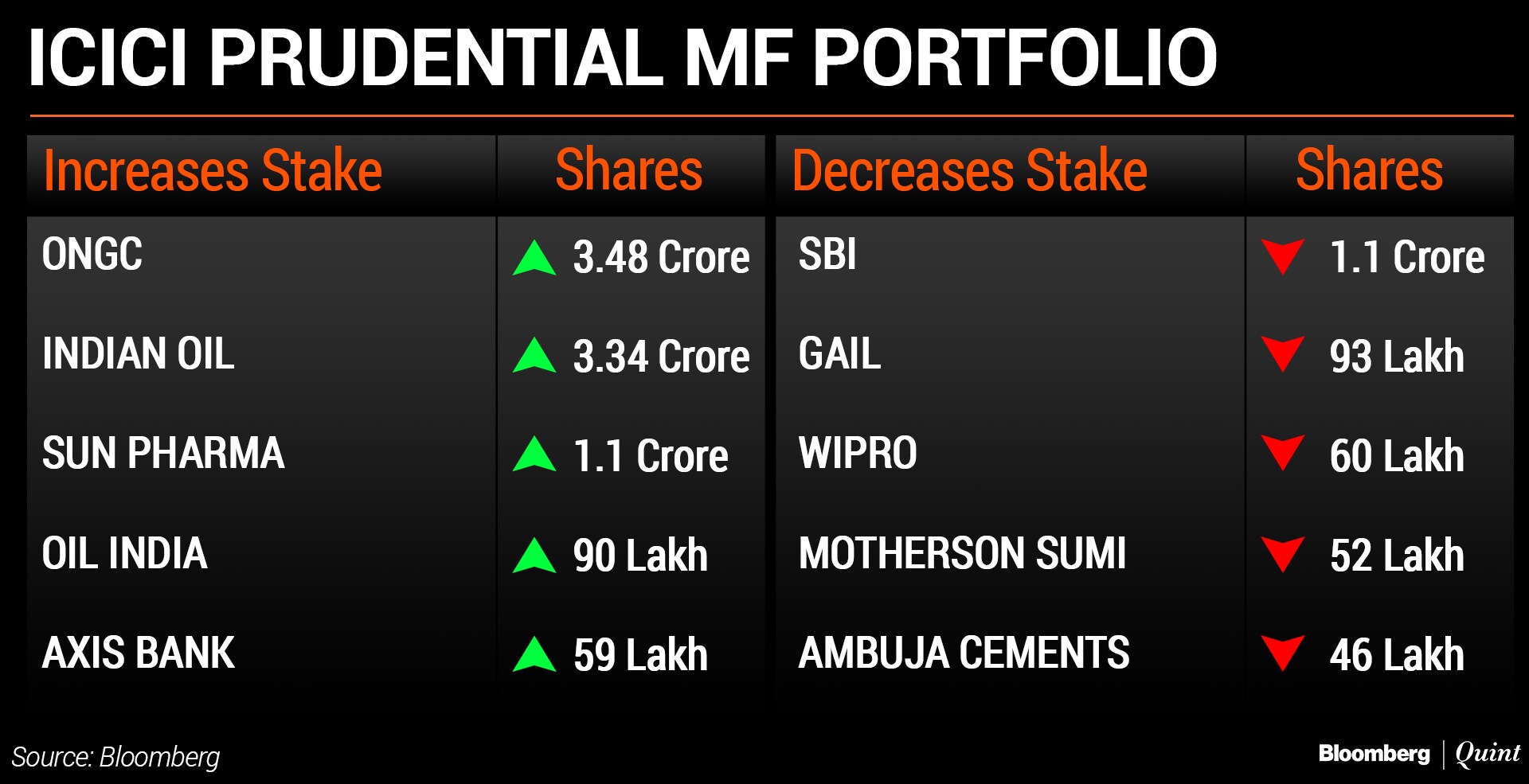

ICICI Prudential Mutual Fund

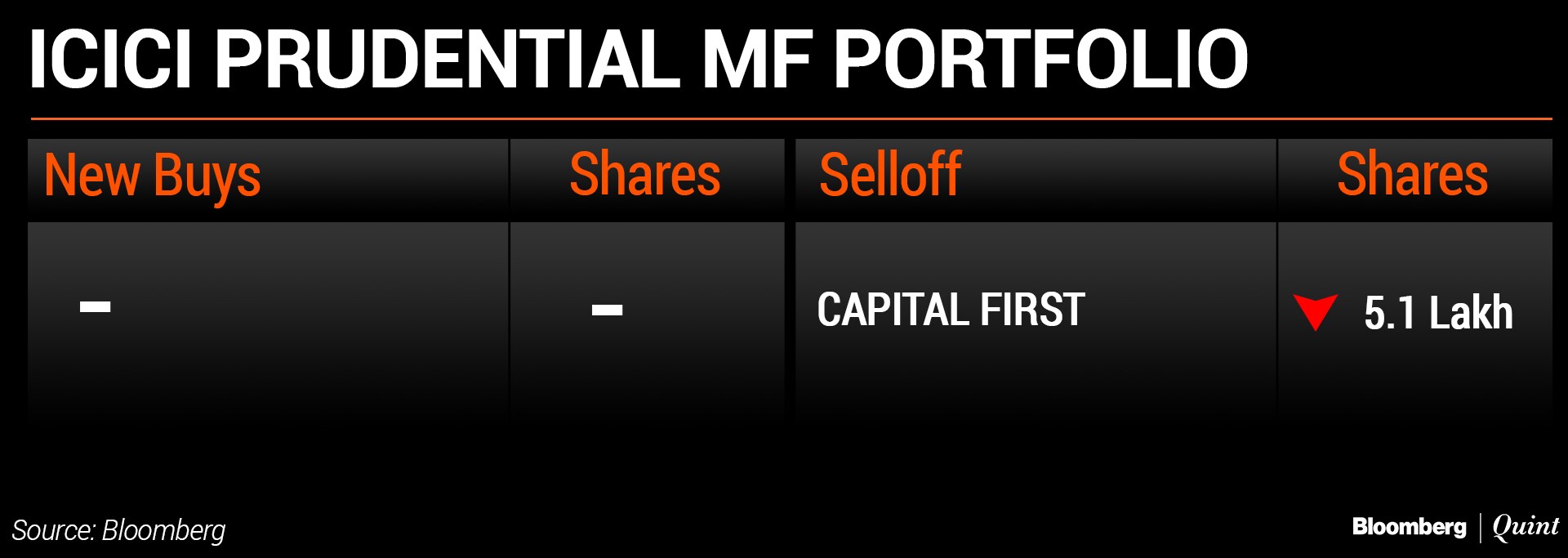

The fund manager's assets under management fell 0.6 percent over the previous quarter to more than Rs 3.08 lakh crore as of December. More than 65 percent of its funds are invested in the top 100 companies by market capitalisation and it has the highest exposure towards financials at 26.4 percent.

The fund house has made no new purchases in December.

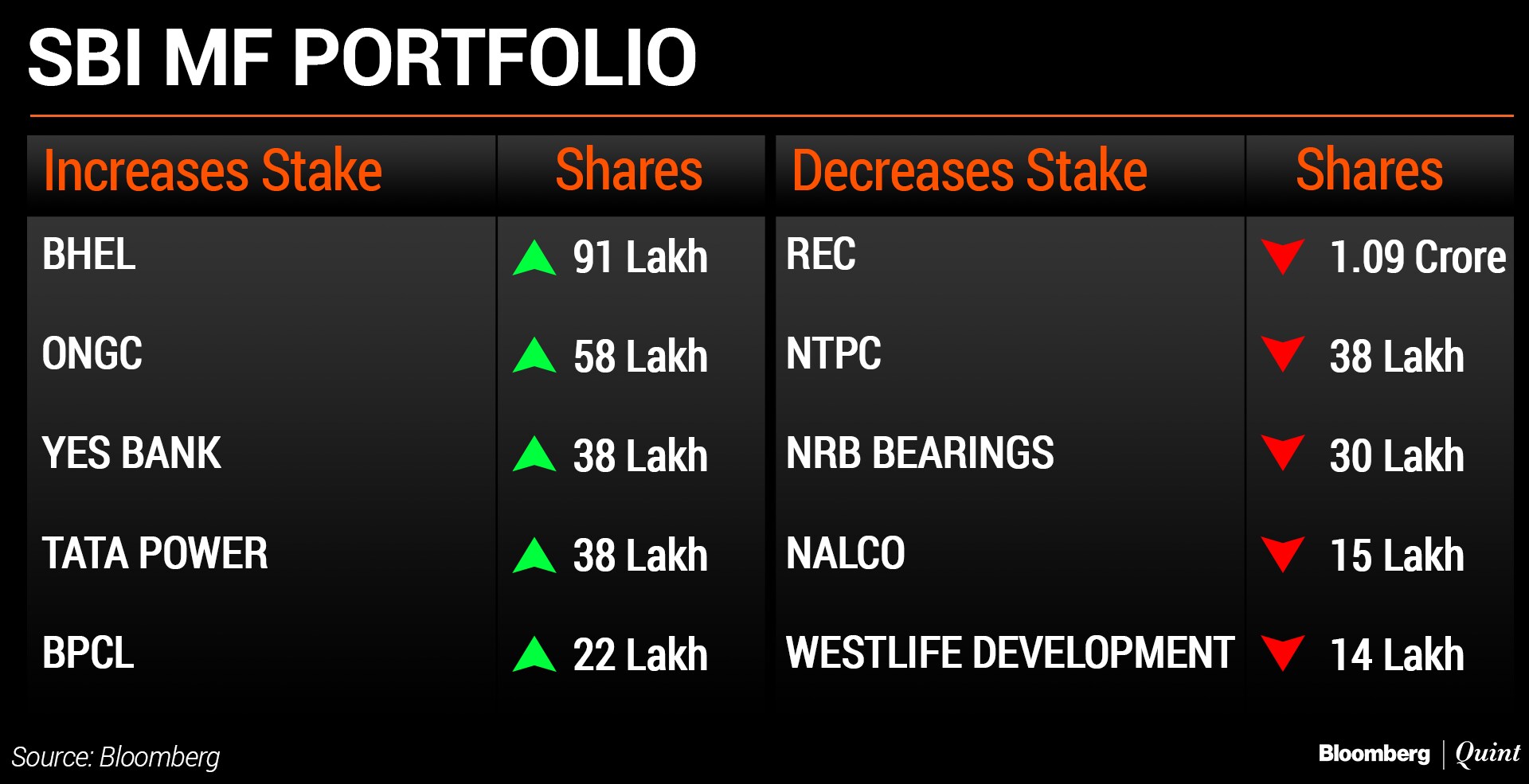

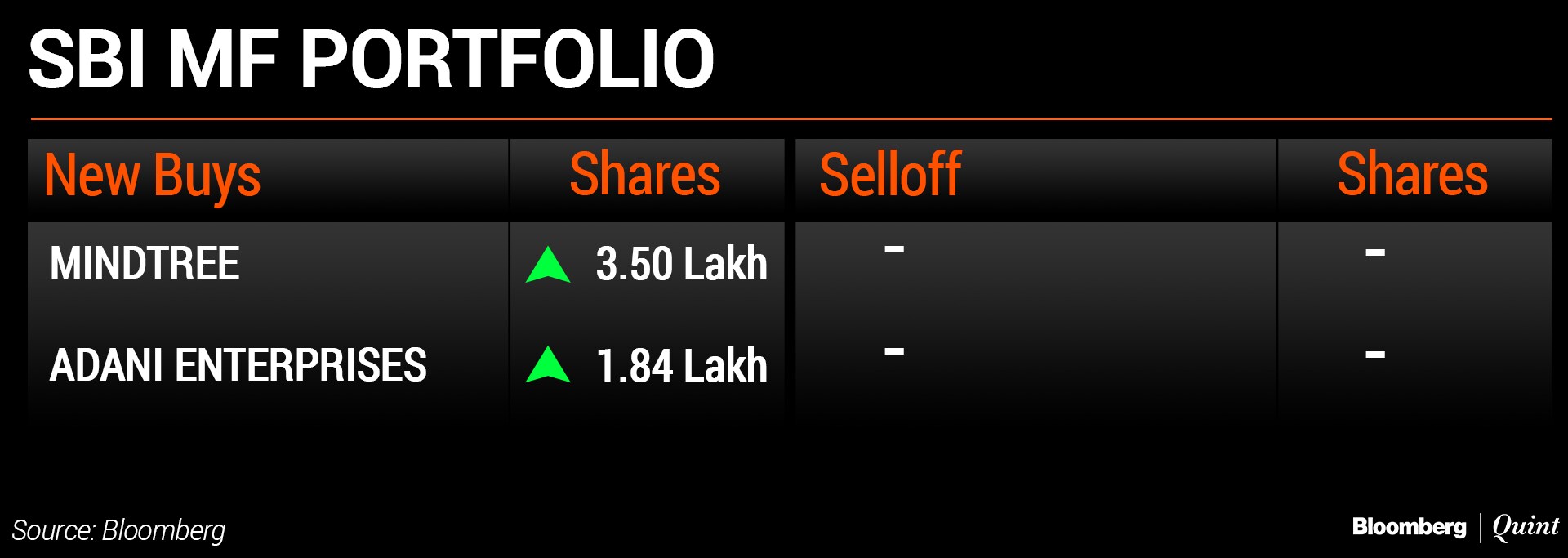

SBI Mutual Fund

SBI MF overtook Aditya Birla Sun Life MF to occupy the third slot with assets under management worth Rs 2.64 lakh crore. The fund house invests in 369 securities, having the highest exposure in financials at 35.9 percent, followed by technology at 9.4 percent.

The fund house did not exit any company in December.

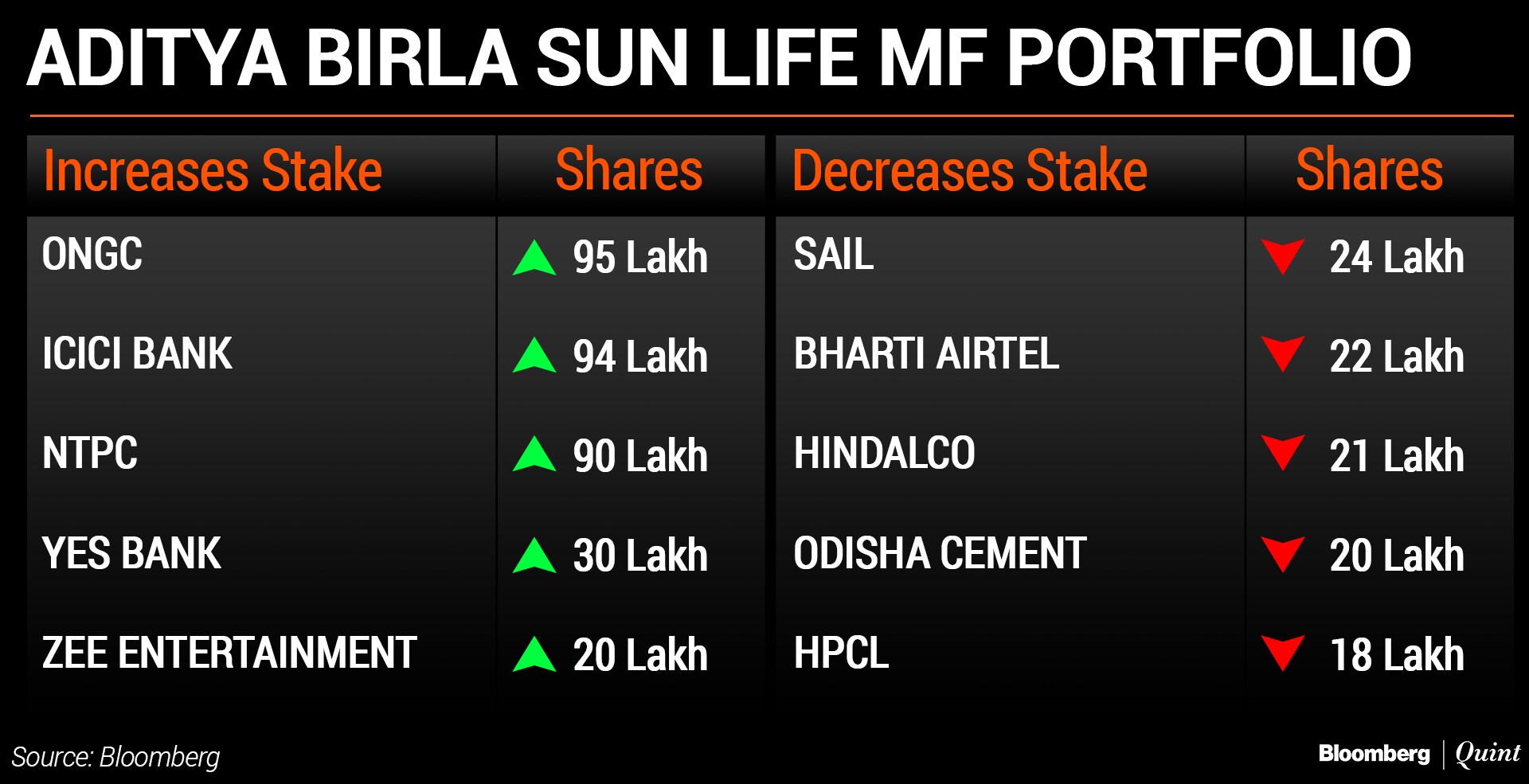

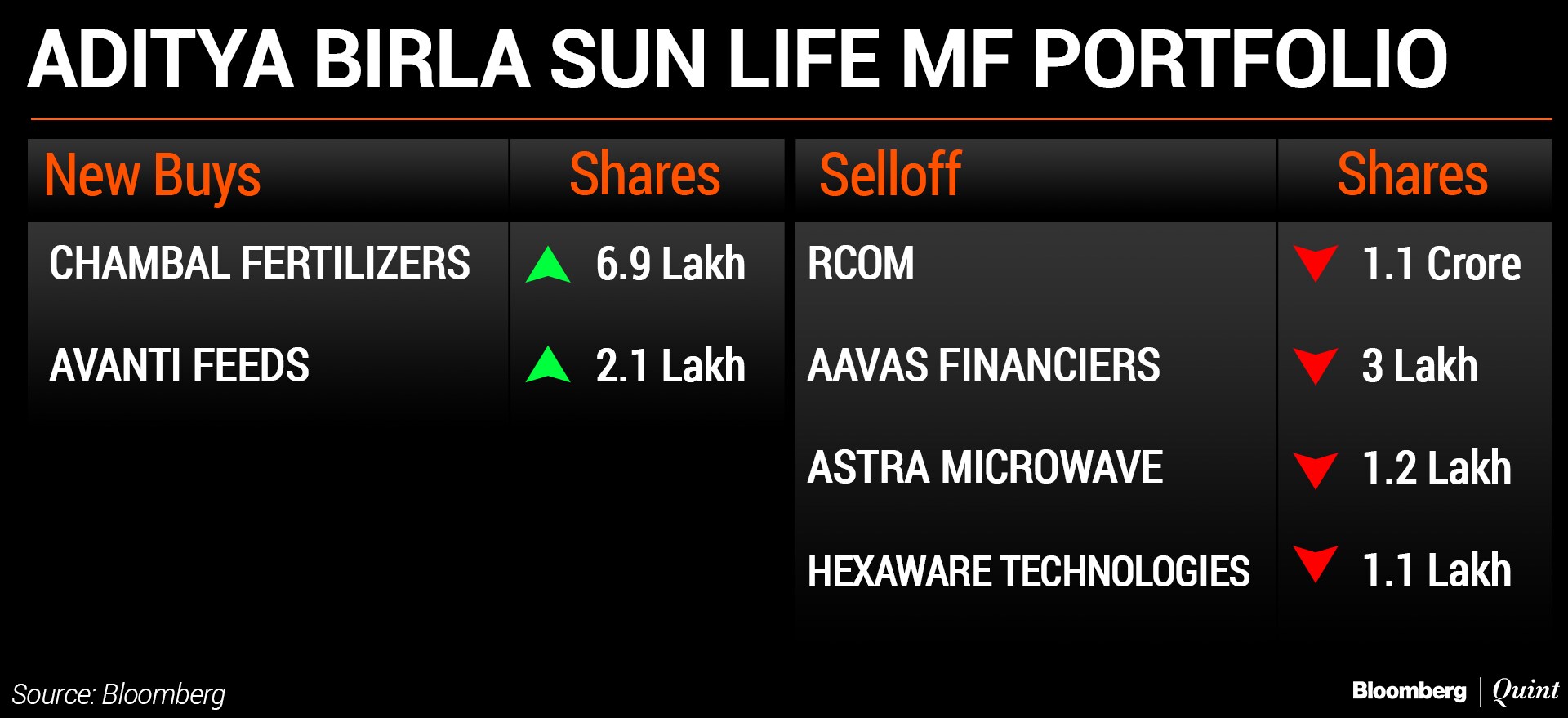

Aditya Birla Sun Life Mutual Fund

The fund house manages equity assets worth more than Rs 2.4 lakh crore invested in 500 securities. Its allocated 32.4 percent to financials, followed by 12.2 percent in materials.

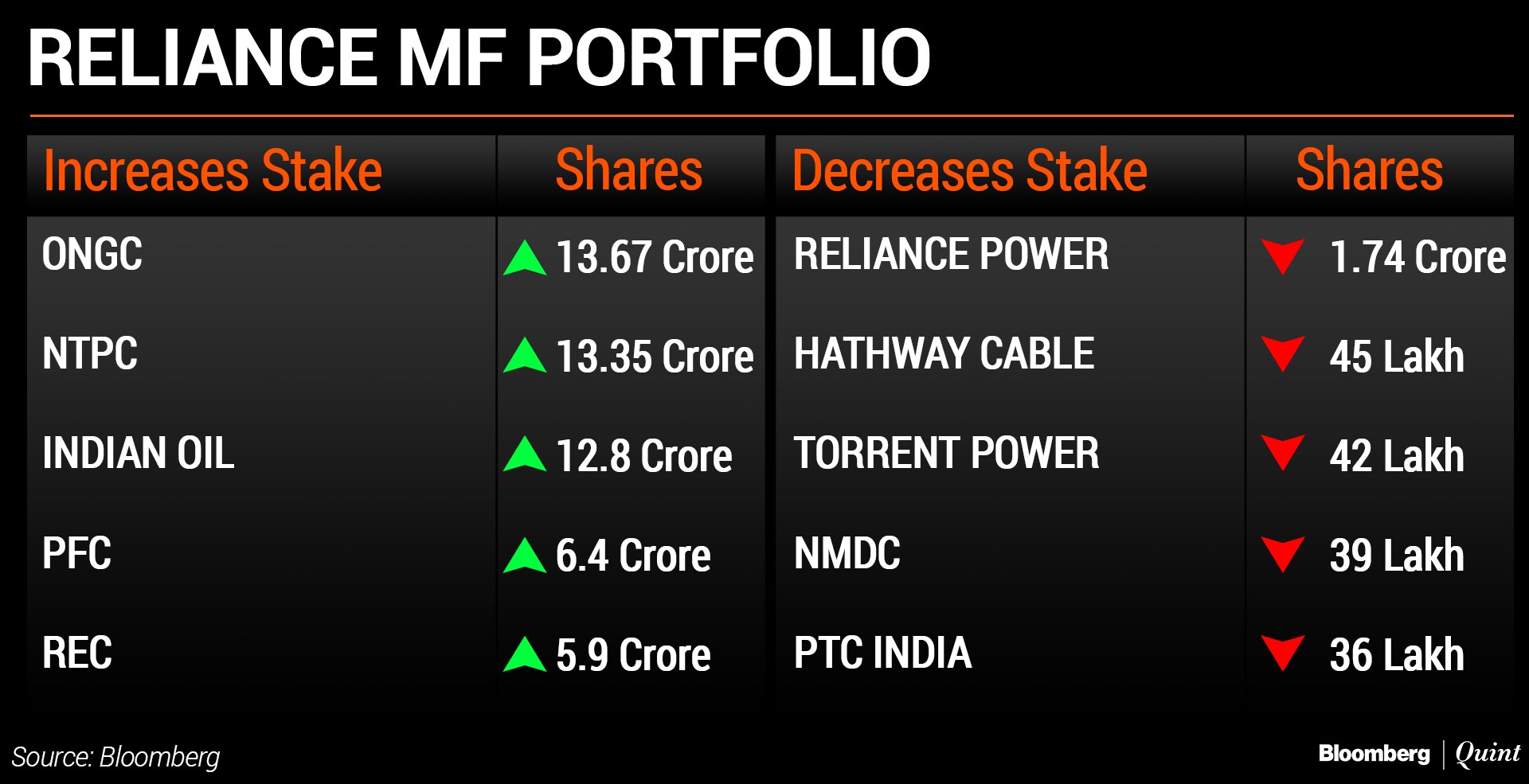

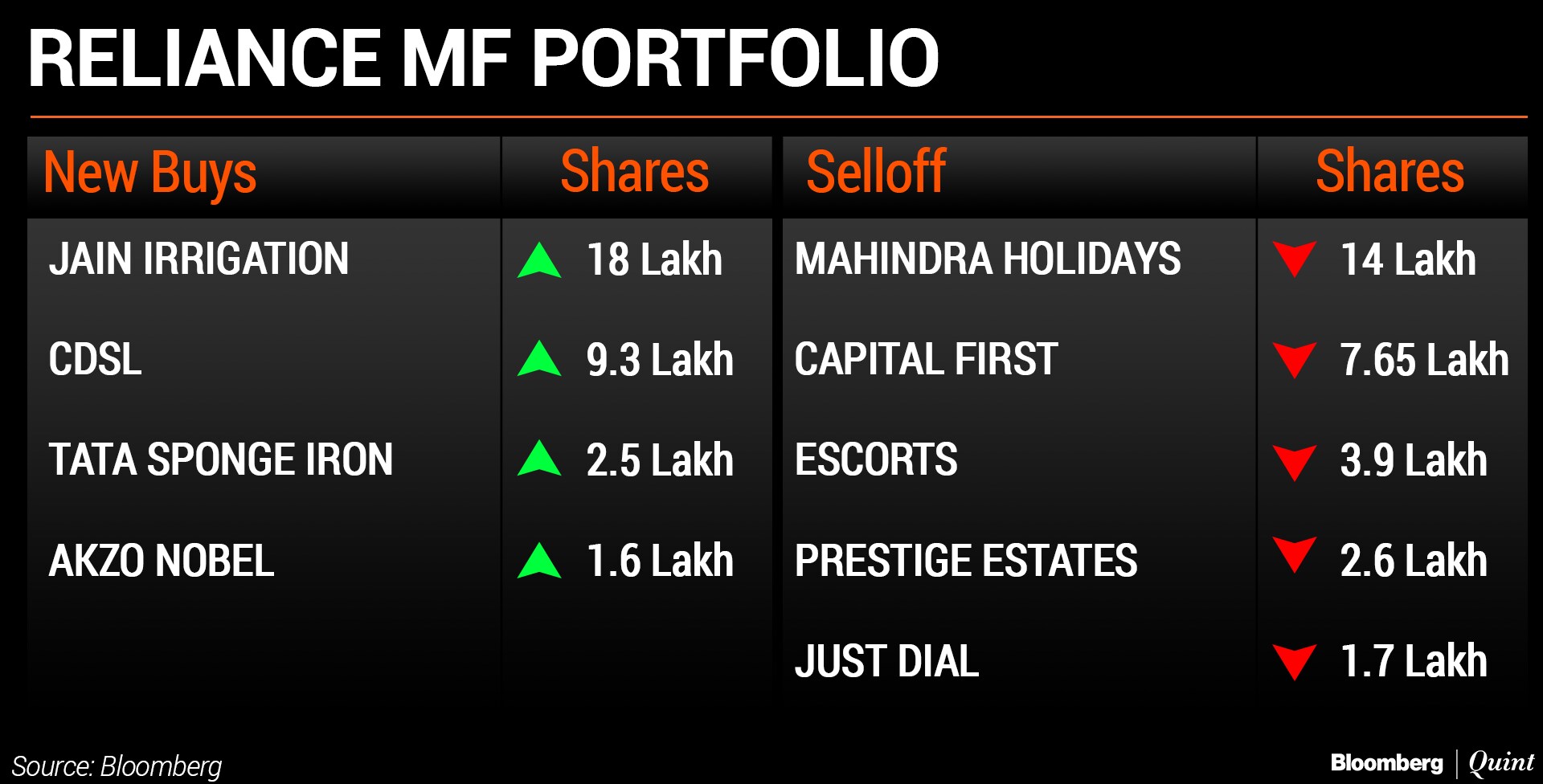

Reliance Mutual Fund

The fifth-largest fund house manages assets worth Rs 2.36 lakh. It allocated 32.7 percent of its portfolio to financials and 13.5 percent to industrials.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.