In the past two months, markets have been choppy as the Nifty corrected by 0.3% in November after a 6.2% decline in October. The benchmark index was extremely volatile, according to a note by Motilal Oswal as the index closed 74 points lower. Despite the air of uncertainty in the markets, the trend in the assets under management of mutual fund houses have seen a rise.

"The MF industry's total AUM scaled new heights to reach Rs 68 lakh crore in November, rising by 1.2% against October," the note said. The net assets under management in equity funds rose to Rs 67.8 crore.

The net AUM of fixed debt funds stood at Rs 16.8 lakh crore. While the AUM of hybrid funds was recorded at Rs 8.7 lakh crore in the month of November, according to data released by AMFI.

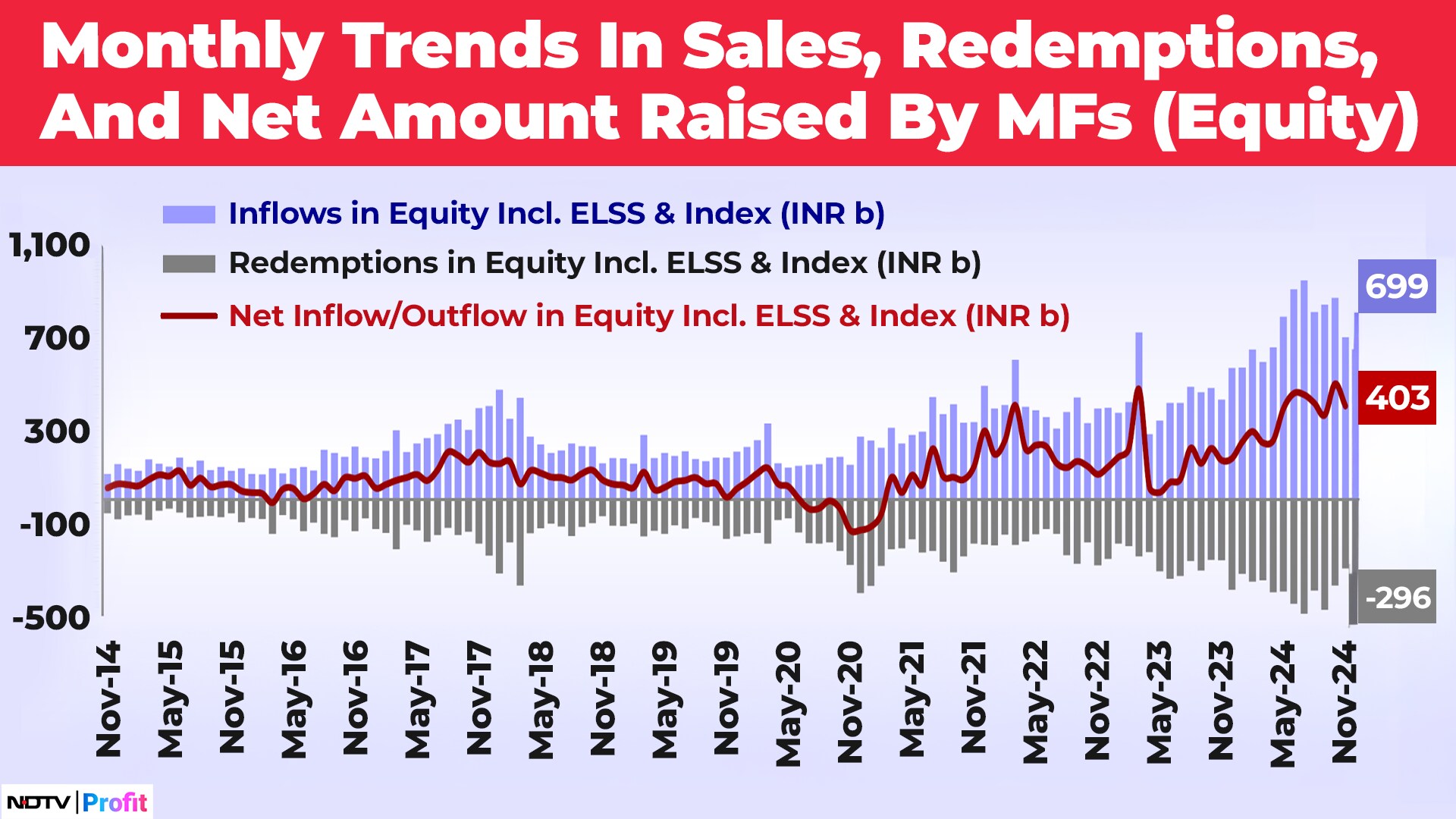

"Equity AUM of domestic MFs, including ELSS and index funds increased 1.6% from October. This was led by the slower pace of redemptions," stated the note. The redemptions were down by 19.8% as the market indices and the sales of equity schemes dipped 19.4%. Consequently, net inflows into the industry had also moderated this month as the total inflows stood at Rs 60,295 crore.

The notable slips in the AUM amount were in two categories, according to the note. Arbitrage funds and Gold ETF's recorded lower AUM this month compared to the previous month.

Fund Houses' Sector Picks

Compared to October, November saw an increase in the weightage of sectors like technology, capital goods, telecom, PSU banks, and retail according to the note. While sectors like automobiles, healthcare, consumer, oil and gas, NBFCs, utilities, metals, insurance, and real estate moderated.

Technology sector's weightage climbed for the second consecutive month in November to 9.2%, while PSU Banks' weightage rose, after touching a 45-month low in September, according to the note.

The weightage of banks rose for the second consecutive month in November to 3%. The automobile sector's weight continued to moderate in the month to 8.3%. While oil and gas' weight reduced for the eighth consecutive month to a 12-month low of 5.8% in November.

The stocks that saw the most increase in value were Zomato Ltd., Infosys Ltd., ICICI Bank Ltd., State Bank of India and Mahindra & Mahindra Ltd., according to Motial Oswal.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.