Share price of Zydus Lifesciences Ltd. advanced in early trade on Tuesday after the company's announced its latest acquisition update. Moreover, the company has received approval to manufacture a particular corticosteroid medication.

The pharma major has entered into an agreement to acquire a controlling stake of 85.6% equity shares of Amplitude Surgical SA, France from the existing shareholders at a price of €6.25 per share, aggregating to a consideration value of €256.8 million, as per an exchange filing on April 11.

"Zydus MedTech Pvt. Ltd., a wholly owned subsidiary of the company, has incorporated a wholly owned subsidiary in the name of Zydus MedTech (France) SAS on April 10, 2025. Zydus MedTech (France) SAS will be acquiring the equity shares of the target entity," the filing stated.

The drugmaker stated in a separate filing that they received final approval from the United States Food and Drug Administration to manufacture particular corticosteroid medication. Zydus will now manufacture Jaythari® (Deflazacort) Tablets in 6 mg, 18 mg, 30 mg, and 36 mg.

Deflazacort is a corticosteroid indicated for the treatment of Duchenne muscular dystrophy in patients 5 years of age and older. The drug will be produced in the company's Italy facility, as per their press release.

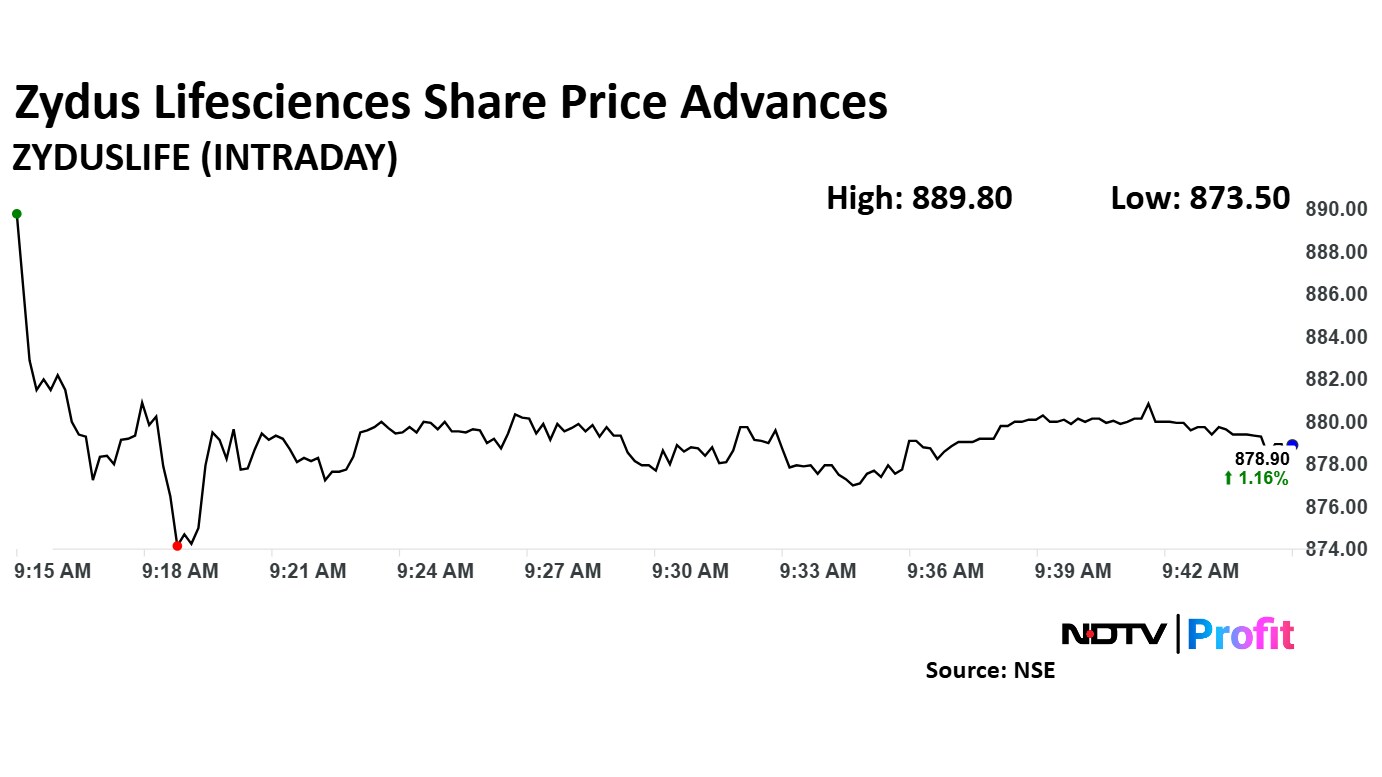

Zydus Lifescience Share Price Today

The scrip rose as much as 2.41% to Rs 889.80 apiece, up for two consecutive sessions. It pared gains to trade 1.21% higher at Rs 879.40 apiece, as of 09:43 a.m. This compares to a 2.08% advance in the NSE Nifty 50 Index.

It has fallen 7.09% on a year-to-date basis, and slipped 12.30% in the last 12 months. Total traded volume so far in the day stood at 0.8 times its 30-day average. The relative strength index was at 44.66.

Out of 33 analysts tracking the company, 17 maintain a 'buy' rating, 10 recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 6.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.