JPMorgan has raised its target price for Zomato Ltd. as it is positive on the food delivery platform's significant strides in the quick commerce sector and its ambitious expansion plans. The brokerage has also retained its 'overweight' rating on the company.

The target price was increased to Rs 340 per share, from Rs 208 apiece, implying a 40% upside from previous closing price.

In a recent note, the brokerage emphasised Zomato's role in driving a rapid transformation in retail consumer behaviour through its quick commerce arm. The company's subsidiary, Blinkit, is set to outpace its competitors with plans to establish 1,500 stores across major metros over the next 2.5 years. This strategic expansion is expected to bolster Zomato's scale, enabling better monetisation through channel margins and increased advertising revenue.

JPMorgan's revised forecast includes a 15-41% increase in estimates for fiscal 2025-27. It has also upgraded its valuation for quick commerce by 115% to Rs 150 per share. The food delivery segment's fiscal 2026 Ebitda estimates have been revised up 11%.

Zomato is well-positioned to disrupt modern trade and e-commerce sectors further. The company's incremental store economics are projected to improve, leading to more favourable Ebitda margins, the brokerage said. With these developments, JPMorgan expects Zomato to continue leading charge in the evolving retail landscape.

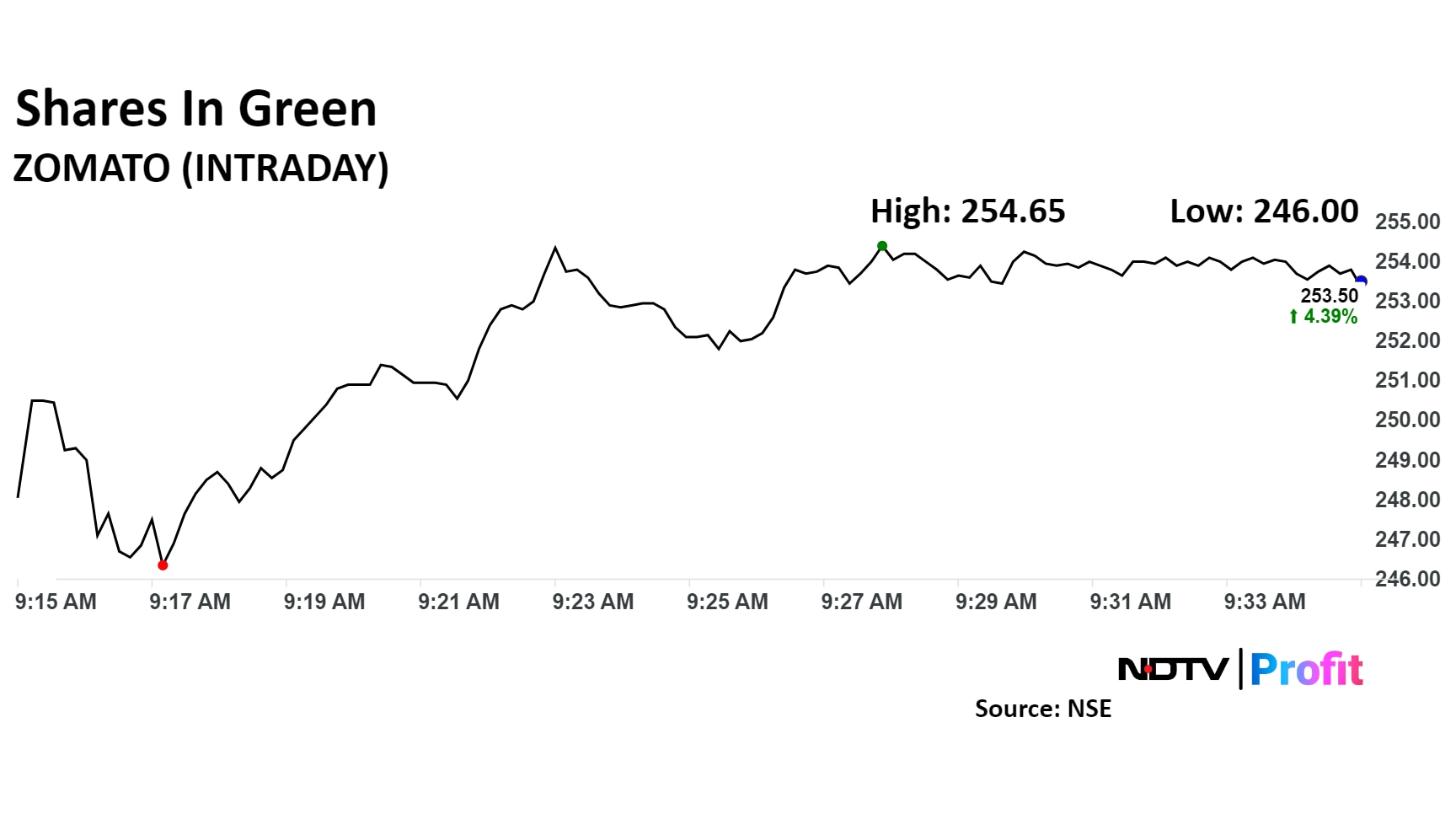

The scrip on Thursday rose as much as 4.86% to 254.65 apiece. It pared gains to trade 4.49% higher at Rs 253.75 apiece, at 09:30 a.m. This compares to a 0.30% advance in the NSE Nifty 50 index.

It has risen 158.40% in the last 12 months. Total traded volume so far in the day stood at 0.9 times its 30-day average. The relative strength index was at 54.

Out of 27 analysts tracking the company, 24 maintain a 'buy' rating, zero recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.