Zomato Ltd.'s share price jumped 3.32% on Friday following the announcement that its inactive Netherlands subsidiary, Zomato Netherlands B.V., had initiated liquidation.

Zomato, now known as Eternal Ltd., disclosed the liquidation process began on April 9.

Zomato Netherlands, a step-down subsidiary of Eternal, has been inactive and does not contribute to the company's turnover or revenue. The dissolution of this non-material subsidiary is not expected to impact the company's financial performance, the company said. Details of the liquidation were provided in compliance with SEBI regulations.

In a related development, Zomato officially changed its name to Eternal Ltd. on the stock exchanges on Wednesday, following approval from the Ministry of Corporate Affairs.

Zomato was founded in 2008 by Deepinder Goyal and Pankaj Chaddah. The company has grown rapidly, offering services such as online ordering, restaurant reservations, and reviews.

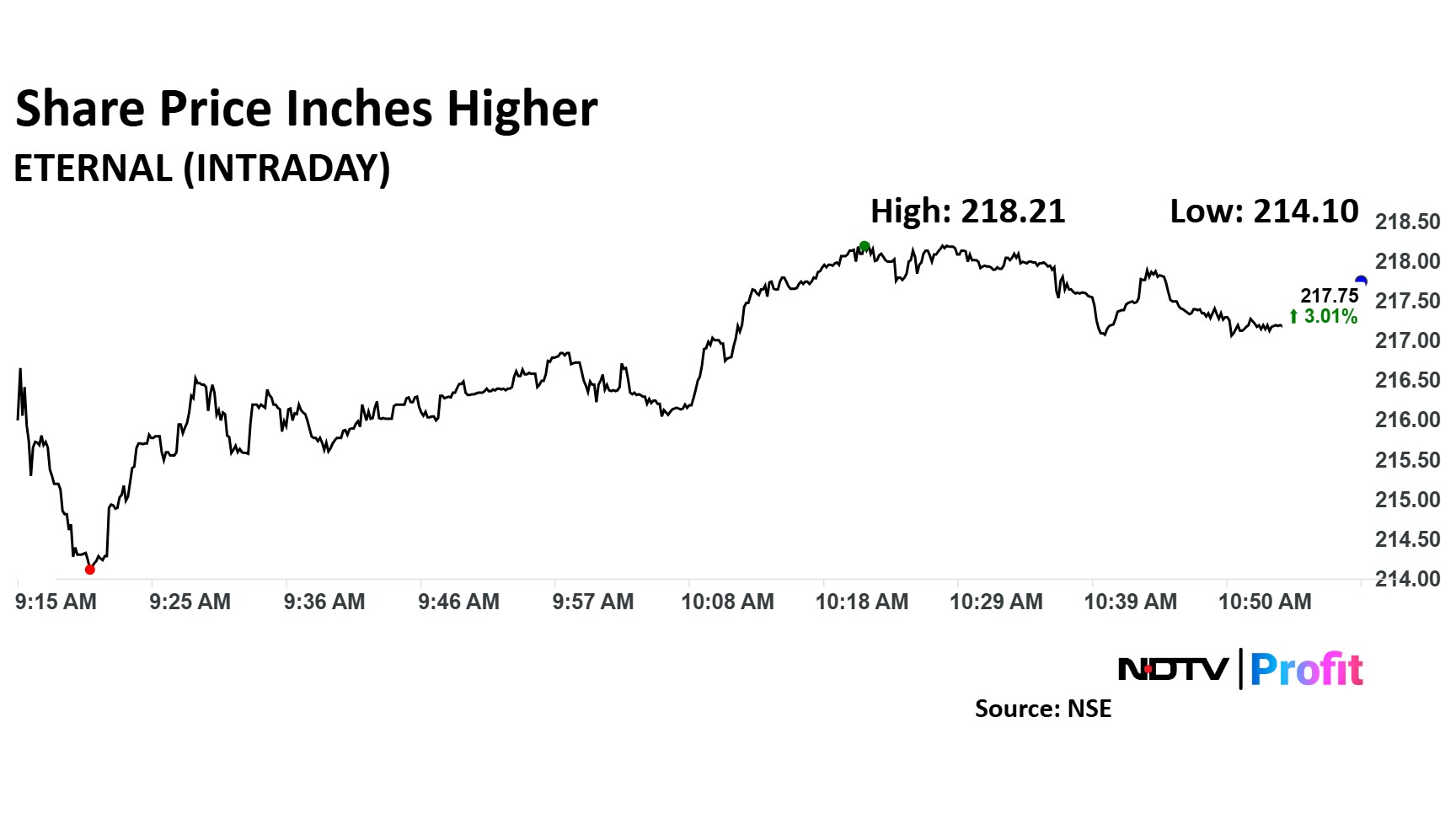

Zomato Share Price

The scrip rose as much as 3.23% to Rs 214 apiece. It pared gains to trade 2.89% higher at Rs 217.50 apiece, as of 10:58 a.m. This compares to a 1.83% advance in the NSE Nifty 50.

It has risen 10.55% in the last 12 months. Total traded volume so far in the day stood at 0.14 times its 30-day average. The relative strength index was at 46.5.

Out of 29 analysts tracking the company, 24 maintain a 'buy' rating, two recommend a 'hold' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 28.9%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.