Zee Entertainment Enterprises Ltd. share price rose 10.01% to reach a ten-month high on Monday after the company, in its investor presentation, announced plans of breaking even from its Zee5 Earnings Before Interest Tax Depreciation and Amortisation or losses in the current financial year.

Nifty Media piggybacked on to Zee Entertainment to rise as high as 3.48% after lagging behind in previous sessions.

Additionally, the company is also looking into the maximisation of its risk-free treasury income; creating significant cash reserves to compete with rivals; and enhancing digital offerings in a profitable manner domestically and internationally without going beyond the content ecosystem, among other development strategies.

The media giant also plans on developing new business verticals to expand its target audience and augment revenue streams, curating a new distribution business model to capture and retain a larger pool of eyeballs, diversifying content offerings (long-form to short-form) addressing all age cohorts, and investing in media tech to enhance the viewership experience, it stated in its investor presentation.

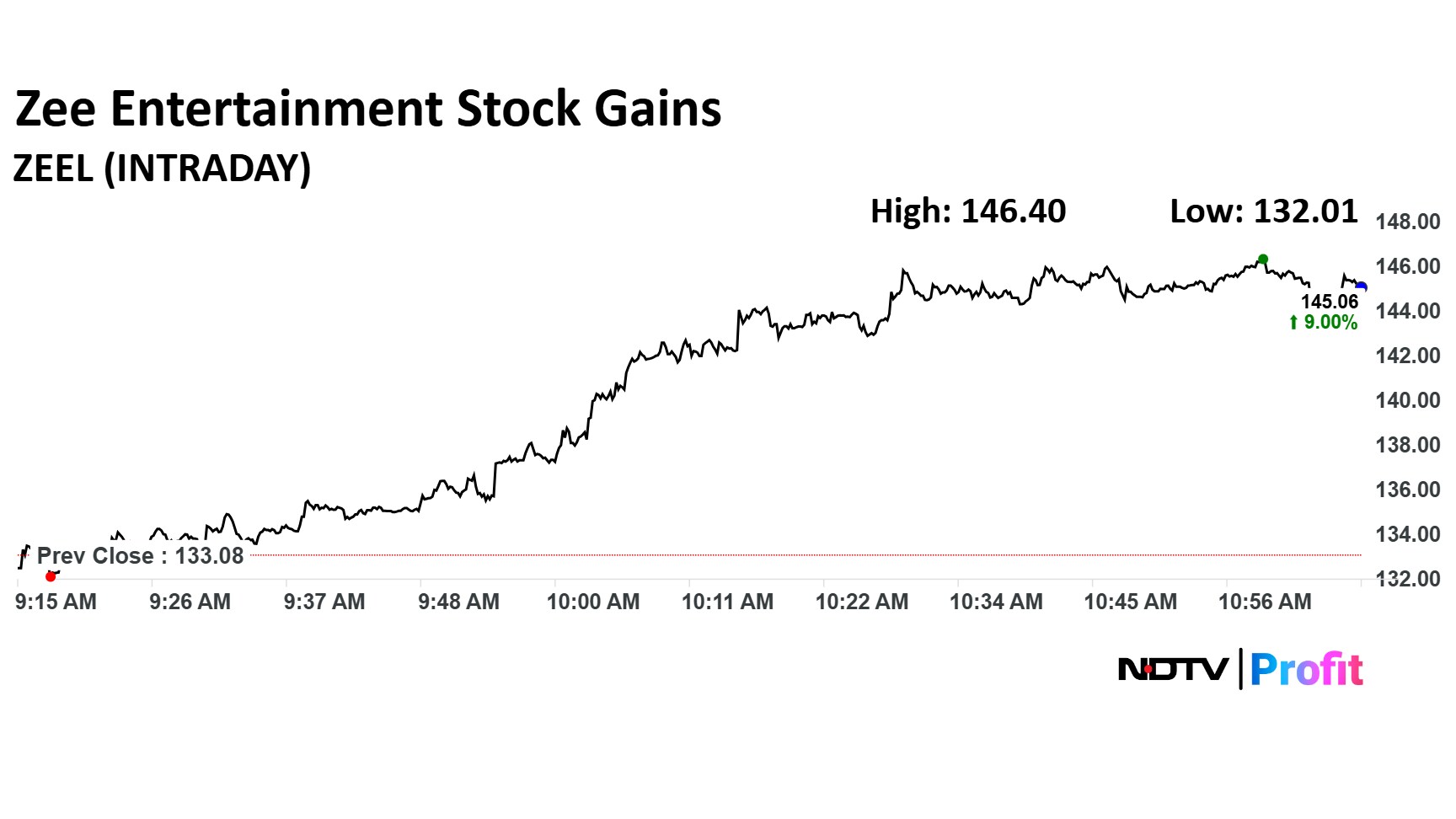

Zee Entertainment Share Price

The scrip rose as much as 10.01% to 146.40 apiece, the highest level since Aug 29, 2024. It pared gains to trade 9.30% higher at Rs 145.17 apiece, as of 11:04 a.m. This compares to a 0.80% decline in the NSE Nifty 50 Index.

The share price has risen 18.97% on a year-to-date basis and is down 6.48% in the last 12 months. Total traded volume so far in the day stood at 7.4 times its 30-day average. The relative strength index was at 50.46.

Out of 20 analysts tracking the company, 11 maintain a 'buy' rating, four recommend a 'hold', and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.