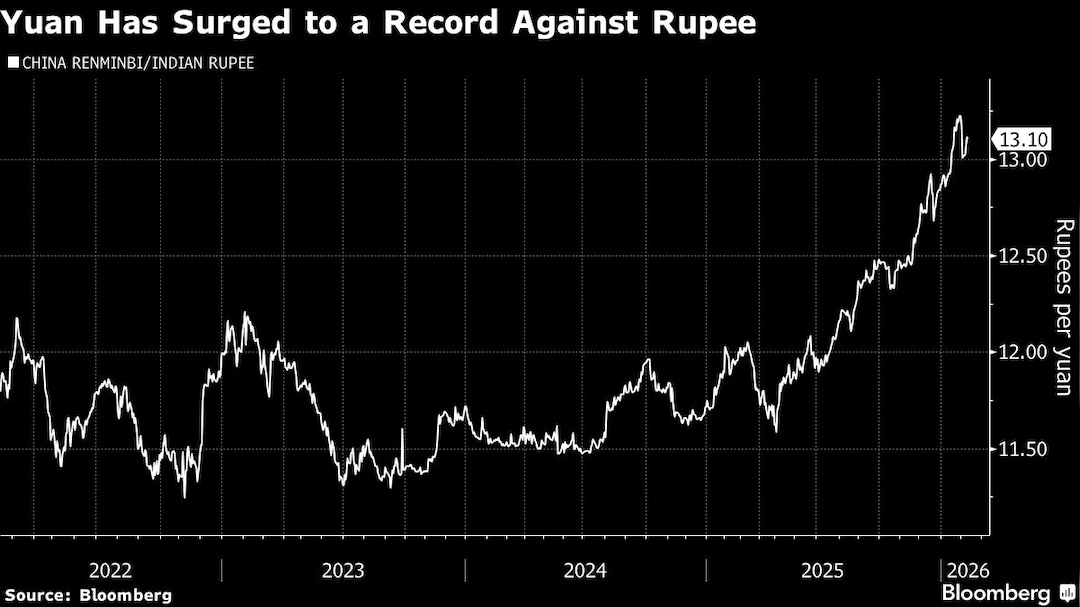

The yuan's rally against the rupee may have further to run, potentially boosting India's trade competitiveness, as authorities in the two nations diverge in how they manage their currencies, according to analysts.

Australia and New Zealand Banking Group Ltd. sees the rupee weakening to 13.58 per yuan by the year-end. Malayan Banking Bhd. expects the pair to move toward 13.30 by December, while Emkay Global Financial Services Ltd. sees it hitting that level in three to six months.

The yuan's moves matter for India as China is its largest source of imports and their bilateral trade continues to expand. Further strength in the yuan, which climbed to a record against the rupee last month, will raise the cost of Chinese goods for Indian importers. It could also make the South Asian nation's exports more competitive at a time when its trade deficit with China has widened to an all-time high.

“I expect the yuan to continue to appreciate as the authorities look favorably toward having a stronger currency,” said Khoon Goh, head of Asia research at ANZ in Singapore. For India, the need to have a more competitive currency to offset its “higher relative inflation rate to other Asian economies means the rupee's nominal exchange rate needs to weaken further.”

India's retail inflation is on an upward trajectory, while China has seen bouts of consumer-price deflation, keeping its real effective exchange rate competitive despite the yuan's advance. The widening price gap between the two economies will increase pressure on the rupee to adjust, particularly if the yuan's gains begin to slow.

The yuan surged nearly 10% against the rupee last year, the most in 12 years. It benefited from a surge in capital inflows, dollar weakness and the People's Bank of China's higher tolerance for a stronger currency. In contrast, the rupee hit successive lows against the dollar on foreign outflows, before erasing some of the losses after India-US trade deal.

While a spate of Wall Street banks have raised their forecasts for the yuan, analysts see limited room for the rupee to run from the current levels. Any pick up in portfolio inflows on the India-US trade deal is likely to be met with a gradual unwind of the short forward book, and further build-up of FX reserves by the Reserve Bank of India, according to Goldman Sachs Group Inc.

Strategists at Bank of America Corp. see the yuan's rally against the rupee plateauing as the Indian currency's weakness has pushed it into undervalued territory on a real-effective-exchange-rate basis. The pair was trading at 13.12 on Friday morning.

What Bloomberg's Strategists Say...

“The final PBOC fixing before China's one-week break sets dollar-yuan at the lowest level since May 2023, with clear intent for the renminbi to extend gains after the holidays. There is also positive signaling from the CFETS RMB Index, which is steadily climbing.”

— Mark Cranfield, Markets Live strategist.

The yuan's surge comes at a time when both the countries are trying to rebuild economic ties after a deadly border clash in 2020 strained their relations.

A record high for the cross should encourage more Chinese investment in India amid improving ties, while Indian firms are also better positioned to export to China due to the weaker rupee, according to Wei Liang Chang, a strategist at DBS Group Holdings Ltd.

India's trade deficit with China widened to a record $116 billion in 2025, according to China's customs data, the most among the former's trading partners.

“Gyrations in the yuan are far more important for India than are gyrations in the rupee from China's perspective,” said Mitul Kotecha, head of Asian FX and EM macro strategy at Barclays Bank Plc. “A weaker rupee clearly gives manufacturing advantage to India. Growing exports similarity with China means currency competitiveness will become even more important.”

ALSO READ: Why CEA Believes The Rupee Could Strengthen Against The Dollar

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.