Yes Bank's share price surged over 8% on Monday following the announcement that Japanese financial giant Sumitomo Mitsui Banking Corp. had acquired a 20% stake in the bank. This transaction marks a significant investment in the mid-sized lender, with State Bank of India divesting a 13.19% share for approximately Rs 8,890 crore.

SMBC's acquisition includes shares from several prominent Indian banks. The Japanese investor, which holds a majority stake in SMFG India Credit (formerly Fullerton India), now becomes the largest shareholder in Yes Bank. As of Dec. 31, SMFG India Credit reported assets under management worth Rs 53,100 crore, a capital adequacy ratio of 23.9%, and a net non-performing asset ratio of 1.4%.

In addition to SBI, other lenders selling their stakes to SMBC include HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Axis Bank, IDFC First Bank, Federal Bank, and Bandhan Bank. This diverse group of banks had initially invested in Yes Bank during its reconstruction phase in 2020.

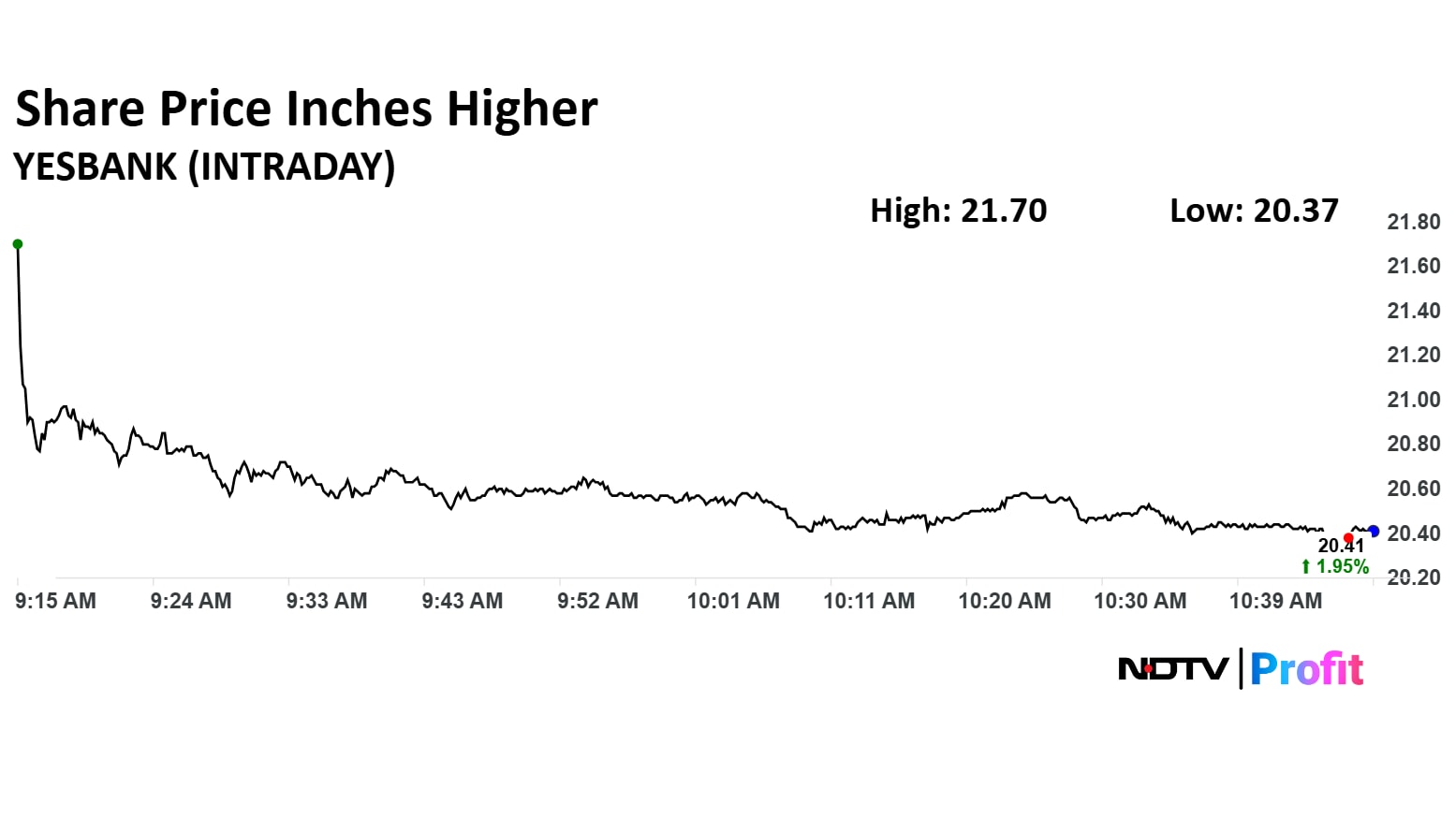

Yes Bank Share Price Today

Shares of the lender rose as much as 8.39% to Rs 21.70 apiece. They pared gains to trade 1.80% higher at Rs 20.38 apiece, as of 10:46 a.m. This compares to a 2.81% advance in the NSE Nifty 50.

The stock has fallen 8.40% in the last 12 months. Total traded volume so far in the day stood at 6.5 times its 30-day average. The relative strength index was at 74.

Out of 12 analysts tracking the company, two recommend a 'hold' and 10 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 19.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.