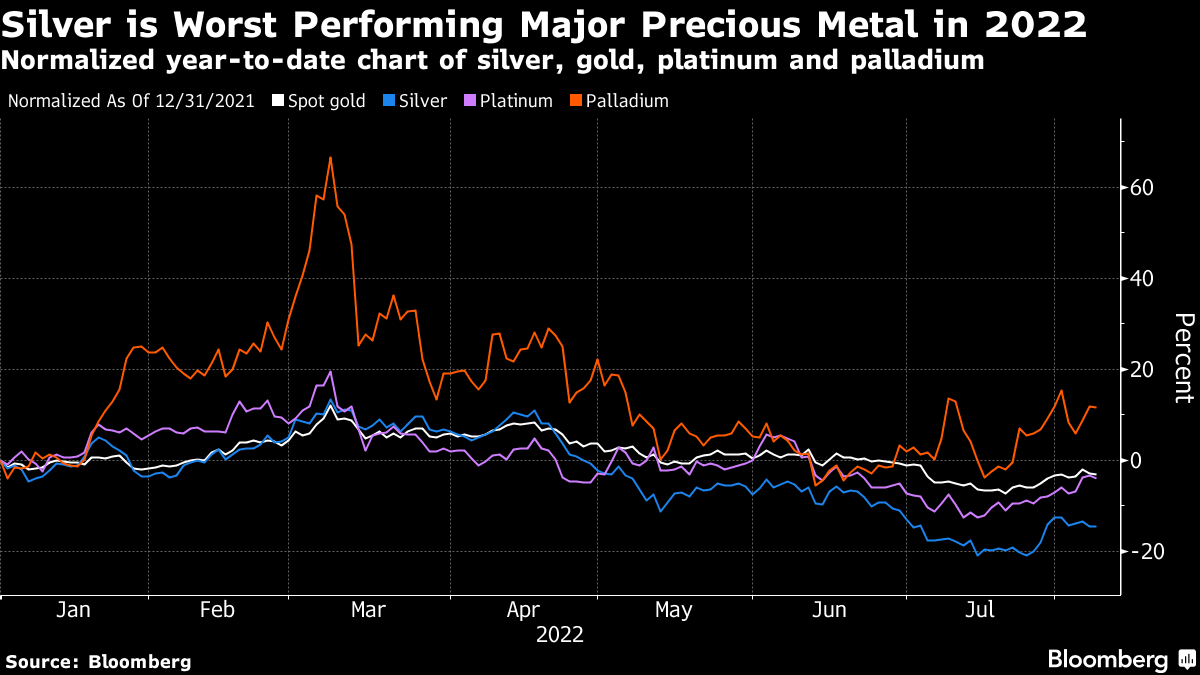

(Bloomberg) -- Silver's been the worst performer among major precious metals in 2022, but prices may have fallen far enough to spark a modest recovery.

The white metal has lost more than 12% since the beginning of the year, weighed down by the stronger US dollar, rising interest rates and slowing growth. But prices could turn higher from later this year as the electronics and photovoltaics sectors support industrial consumption, while retail and jewelry demand look strong, James Steel, chief precious metals analyst at HSBC Securities USA Inc., said in a note early this month.

“We believe silver is oversold,” Steel said. “Much of silver's industrial demand will be well supported and will not reflect overall industrial sluggishness,” while price declines will stimulate demand from key consumers China and India, he said.

Still, headwinds to the white metal's rally exist as the world braces for the withdrawal of stimulus and an economic downturn.

While HSBC remains positive, it has cut its forecasts as silver follows gold and copper lower. The bank now sees the average price at $22.25 an ounce for 2022 and at $23.50 for 2023. UBS Group AG expects silver to trade lower to $19 by early 2023.

Spot silver was trading at $20.51 an ounce at 1:39 p.m. in New York, after bouncing back from a two-year low in mid-July.

Silver's trajectory will closely follow gold, and investors should consider buying both metals when the Fed makes a proper dovish pivot and there's meaningful easing of policy to support growth, said Wayne Gordon, executive director for commodities and FX at UBS Group's global wealth management unit.

“Once we get to that recovery phase in gold, we believe silver can really outperform the yellow metal,” said Gordon.

Gold gained 0.3% to $1,794.86 an ounce as traders await a key report on US consumer inflation due Wednesday. Gold futures on the Comex traded 0.3% higher. Palladium fell 0.6% while platinum took a deeper dive, sliding 0.9%.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.