Earnings growth and market capitalisation of business-to-business companies will overtake that of non business-to-business peers in the next decade, according to ICICI Prudential Asset Management Co.

The asset manager expects the market cap of non-B2C companies to expand at 18% compounded annual growth rate compared to 14% CAGR for B2C companies, according to its presentation.

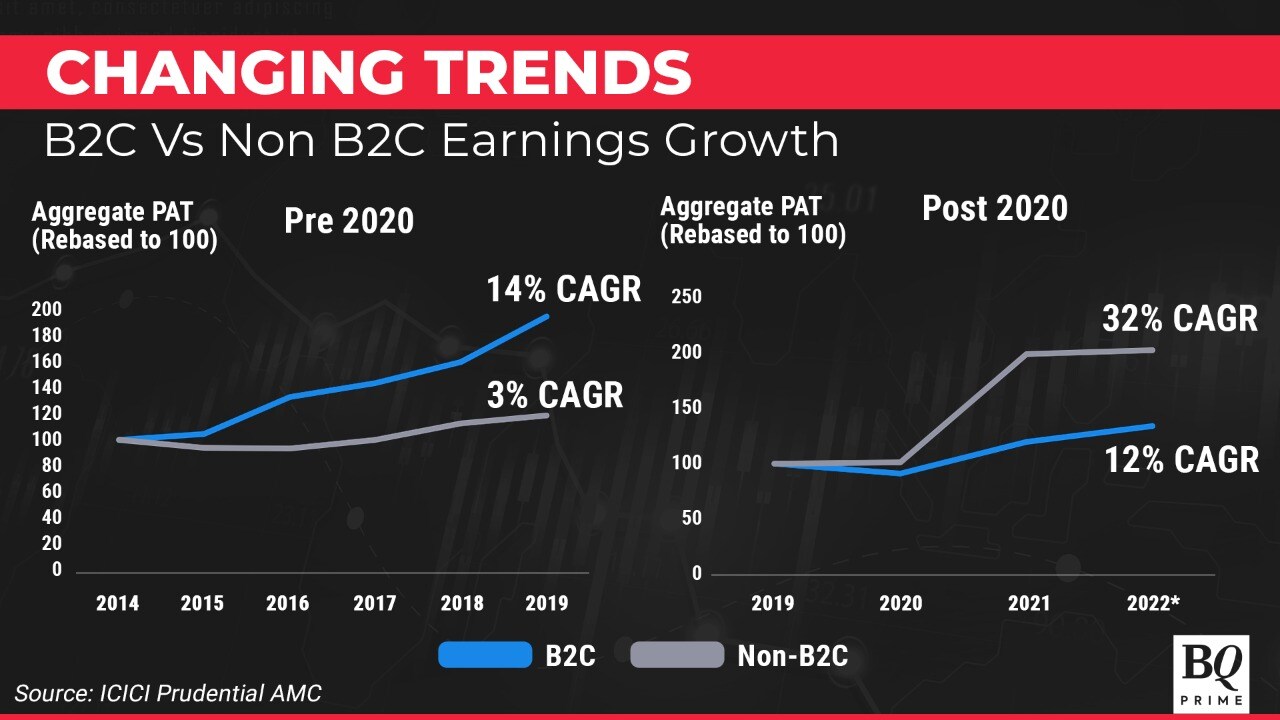

The company expects net profit growth of non-B2C companies to overtake that of B2C peers.

In terms of profitability metrics of B2B vs non-B2B companies, Anand Shah of ICICI Prudential AMC said that at the micro level, they have had a lot of challenges like bank profitability, NPAs, and slowdown in economy post-NBFC crisis.

"Overall, we had negligible earning growth for years, from 2015-2020," Shah, head–PMS & AIF Investments at ICICI Prudential AMC, told BQ Prime's Niraj Shah in an interview.

"We had almost a decade where B2C were doing good," Shah said. "The B2B business was suffering for almost a decade and that has changed in the last 2-3 years; we see manufacturing doing really well."

That, he said, is helping the B2B sector.

"In manufacturing, there are multiple layers. We have the commodity manufacturing which was the most hit, because that was the easiest to export," Shah said.

Watch the full conversation here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.