Mutual fund investors' confidence seemed to have come back in January with net inflow of Rs 1.06 lakh crore compared with the record outflow in December. Total assets grew 5 percent to Rs 22.4 lakh crore.

Here's what the top three fund houses bought or sold in January:

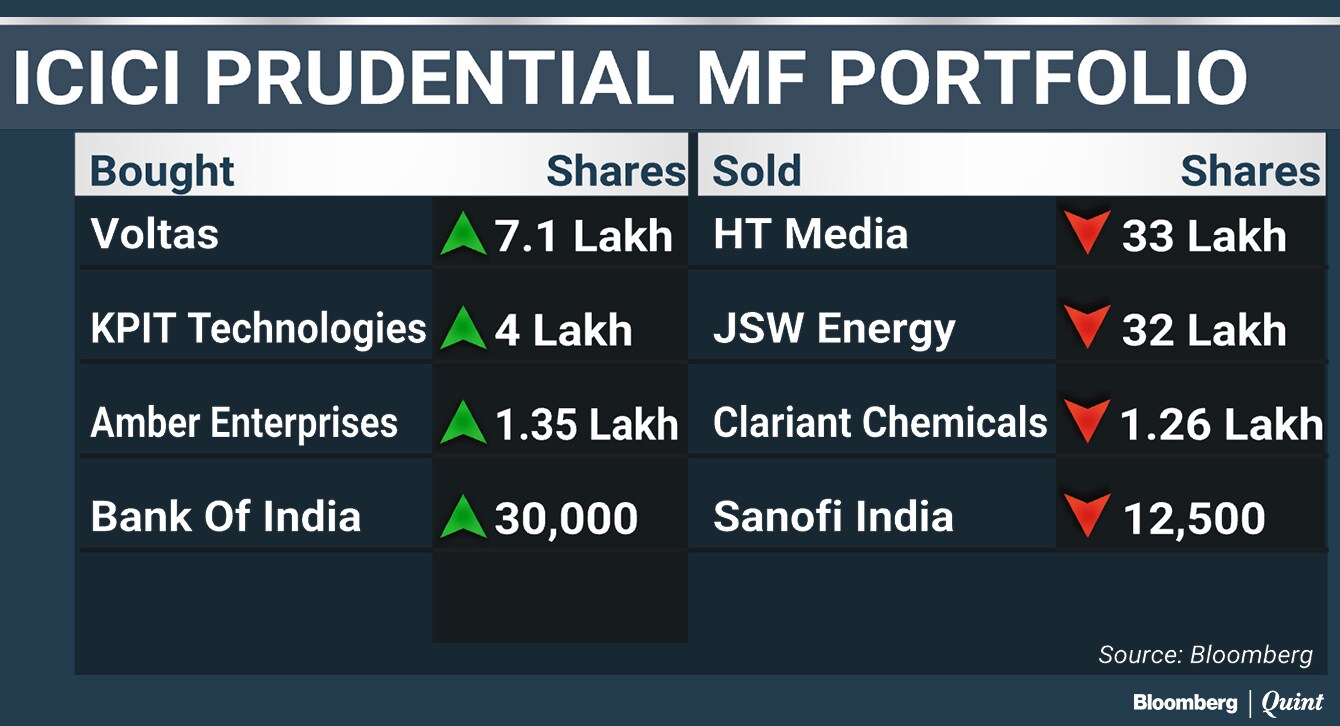

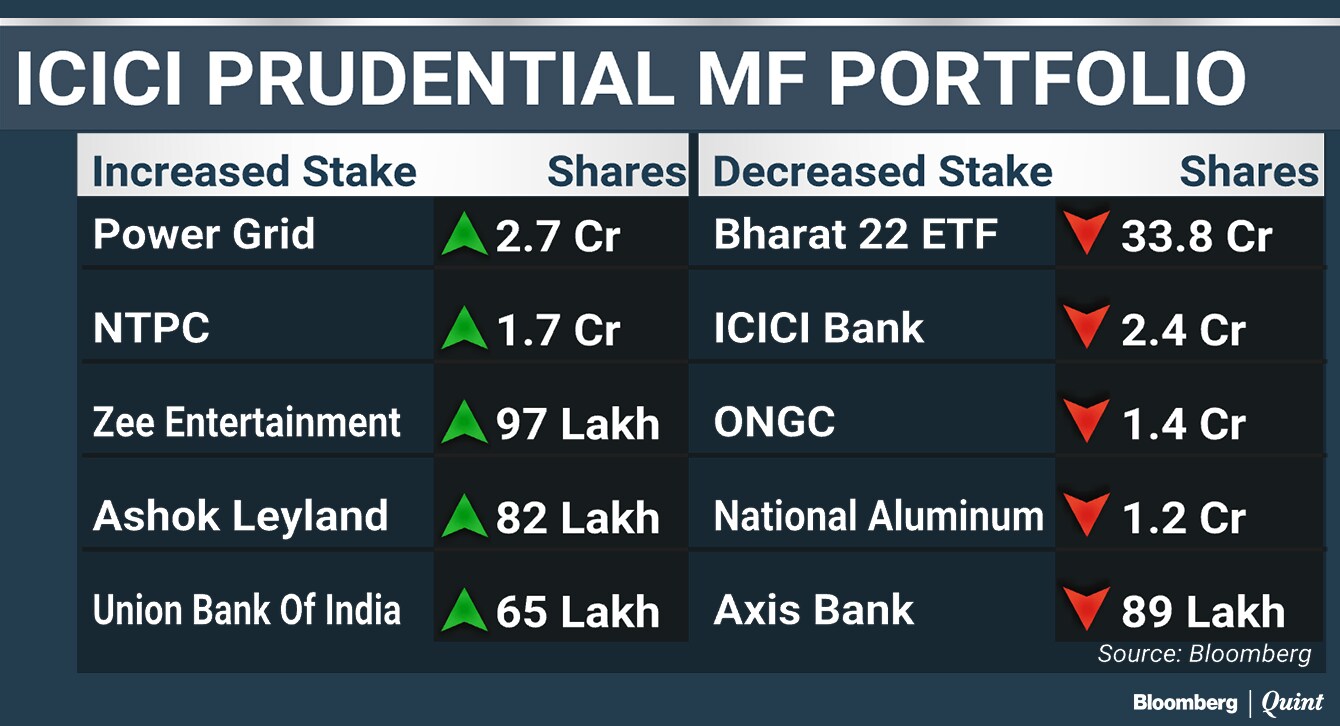

ICICI Prudential Mutual Fund

It holds equity assets worth $18.2 billion in 404 securities. Exposure to financials stood at 26.4 percent followed by industrials at 11.3 percent.

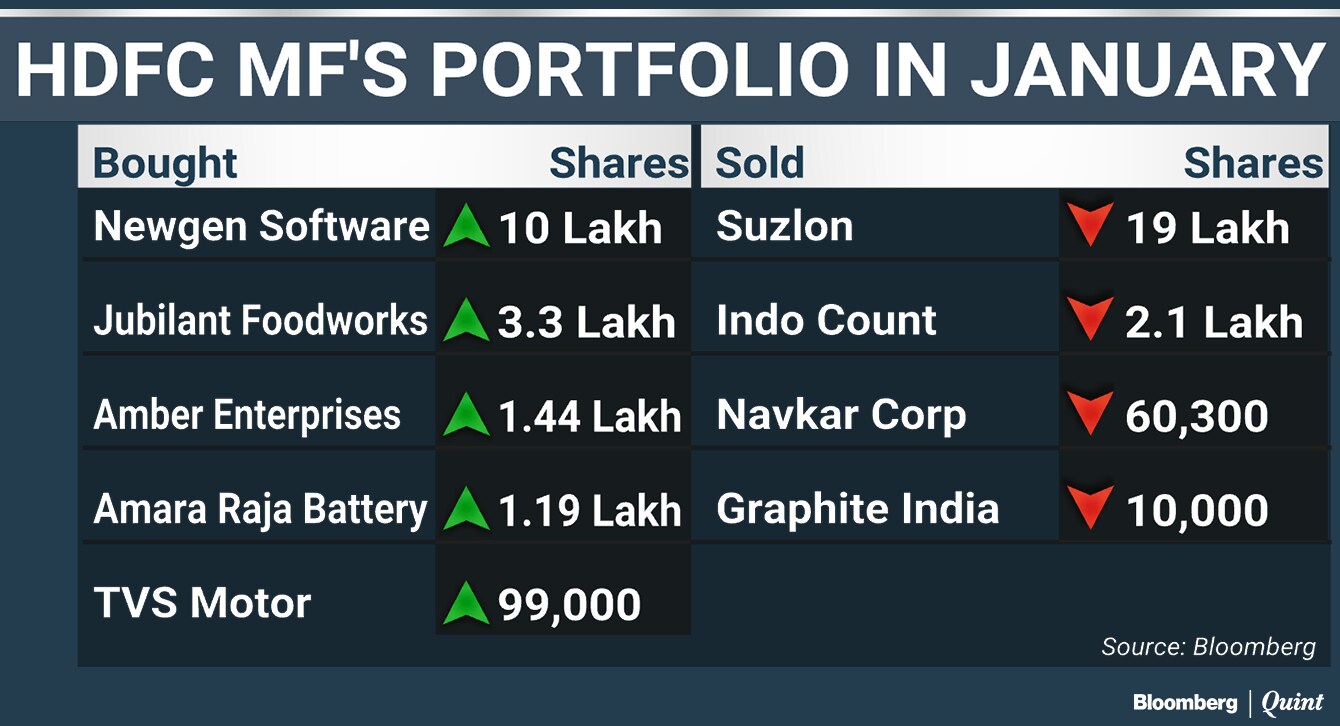

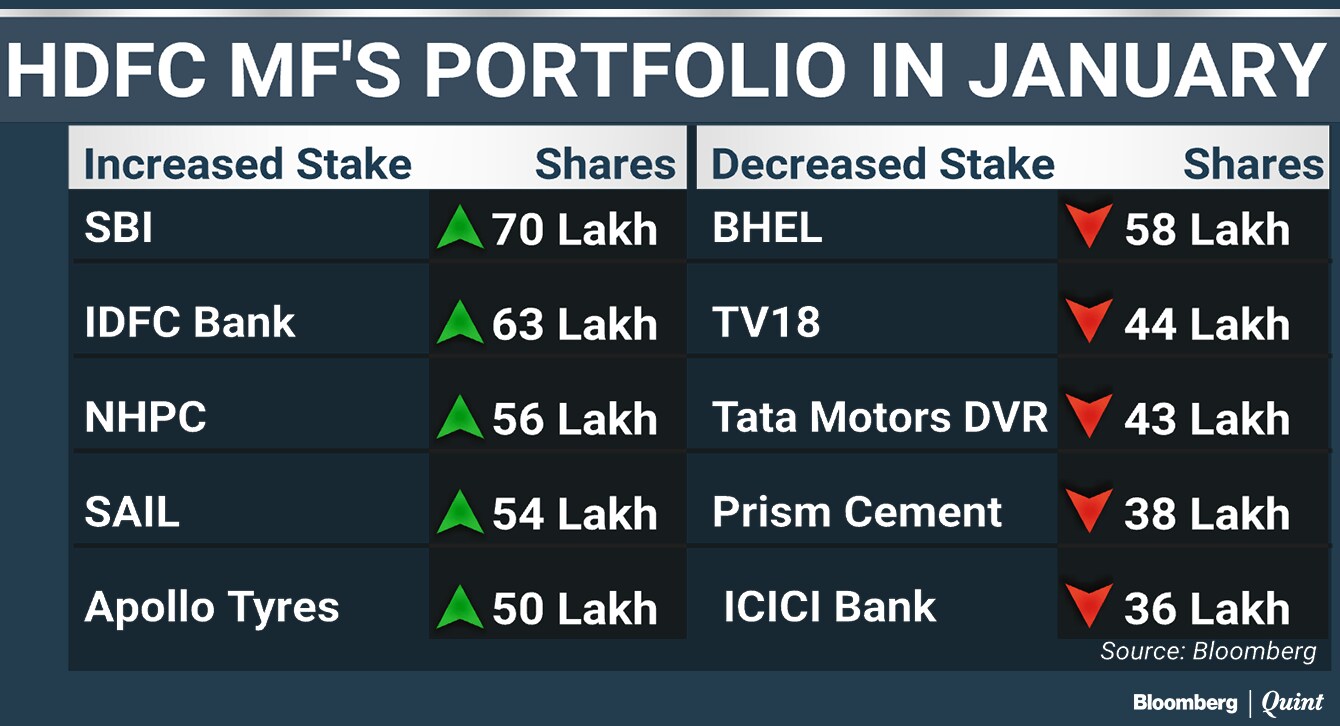

HDFC Mutual Fund

The fund house has equity assets worth $20.6-billion in 396 securities. The top exposure is towards financials at 33.1 percent and industrials at 16 percent.

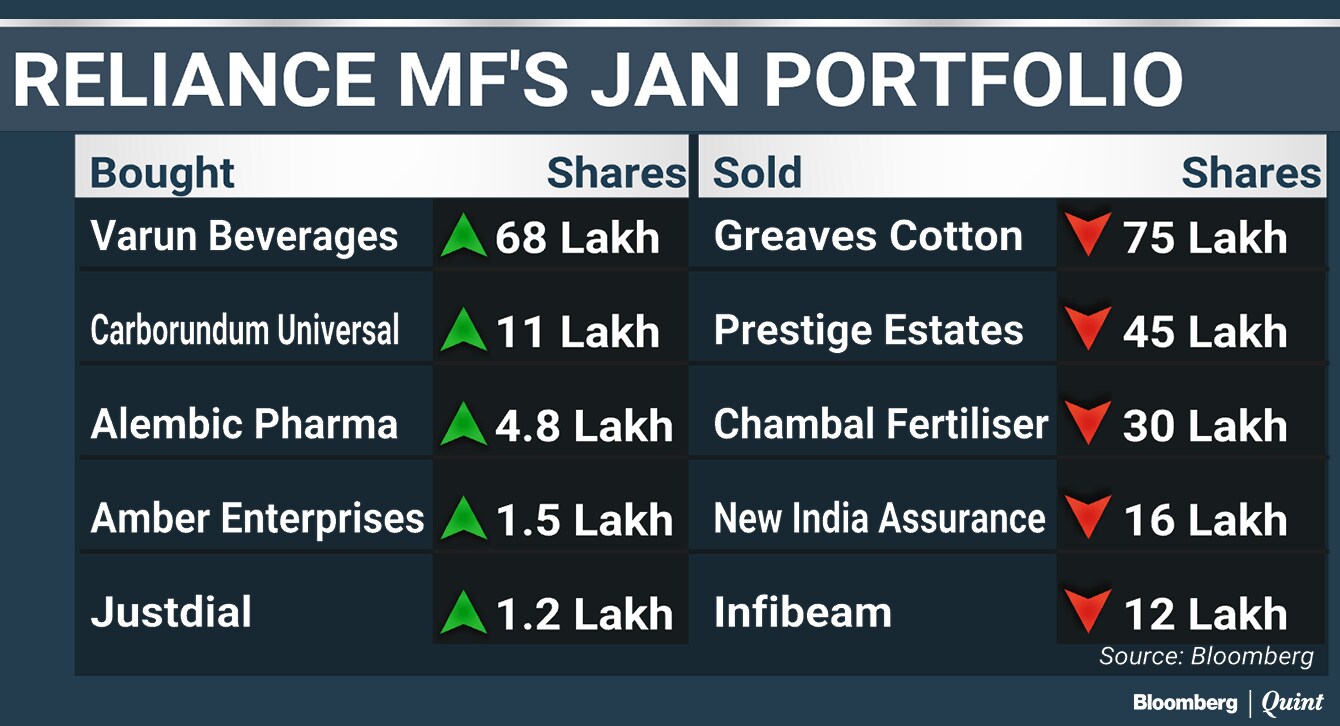

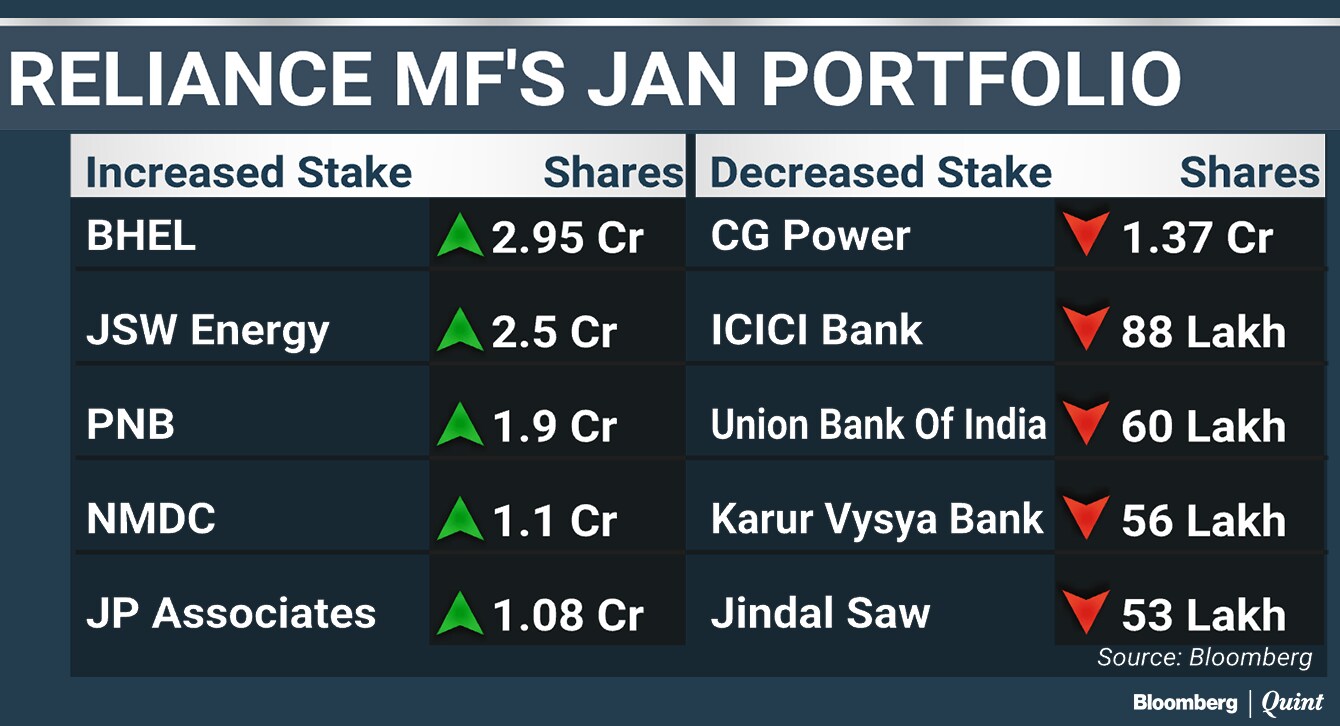

Reliance Mutual Fund

Total equity assets of $14.2 billion under management invested in 533 securities. By industry, the highest exposure is towards financials at 28.1 percent and industrials at 16.8 percent.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.