Mutual fund inflows into equity funds reversed two straight months of declines in February as redemptions fell.

Inflows rose 5.7 percent to Rs 16,268 crore in February as compared to the previous month, even as overall inflows fell nearly 90 percent. The total assets under management declined 0.9 percent to Rs 22.2 lakh crore sequentially last month and equity assets were down 1.3 percent at Rs 7.76 lakh crore.

Market participants chose to stay away from cashing out last month which led to redemptions falling sharply by 42.3 percent over the previous month, according to a Motilal Oswal research report. Mutual funds increased weightage in key sectors such as technology, telecom and utilities, while decreased that of banks and capital goods stocks, the report added.

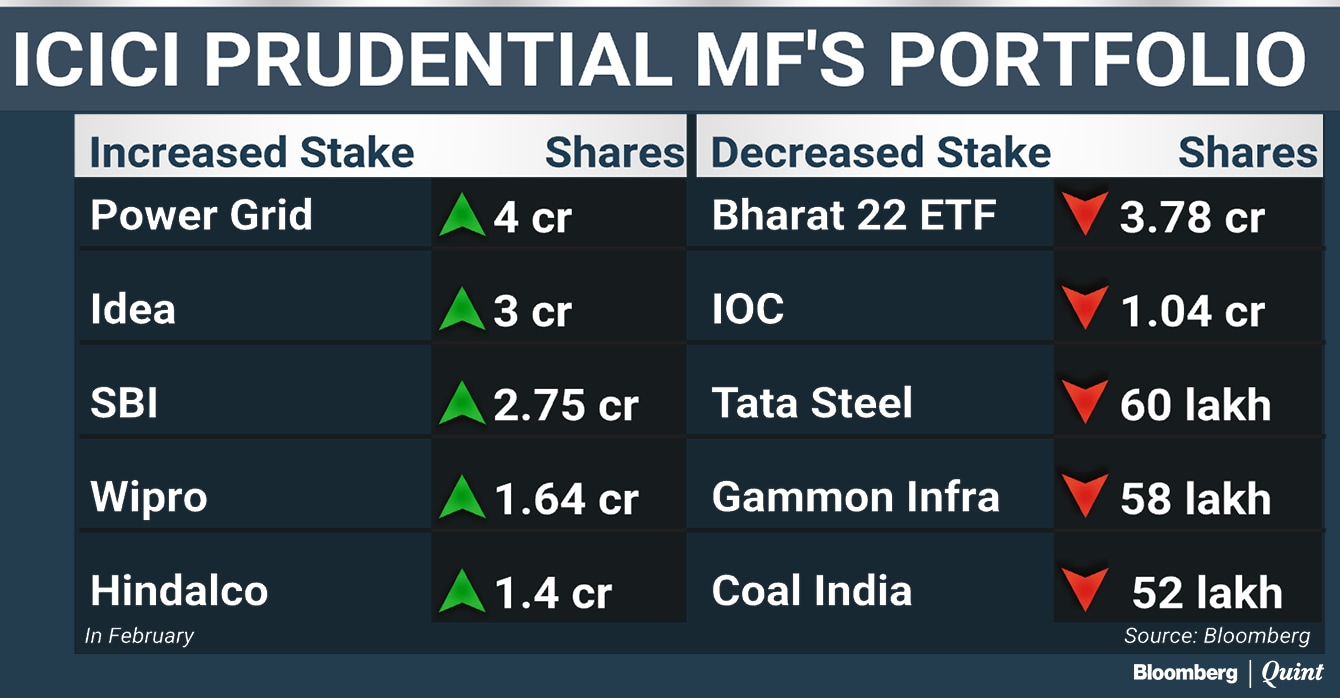

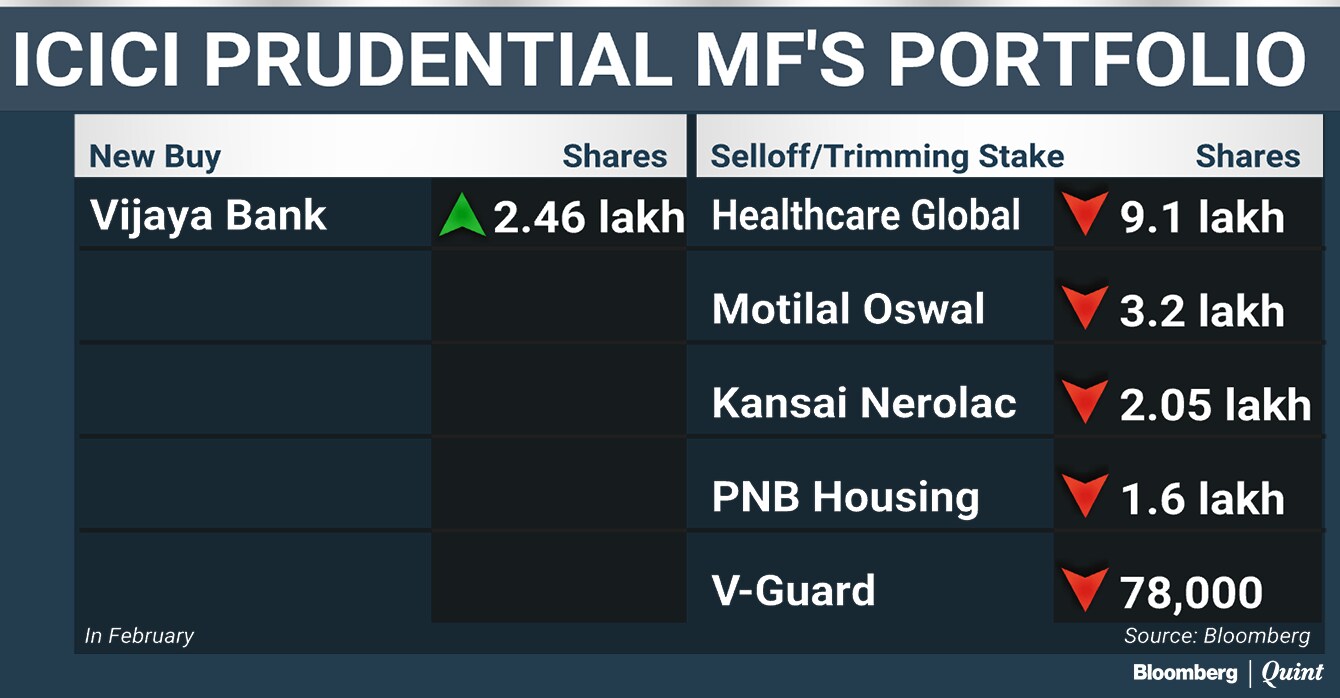

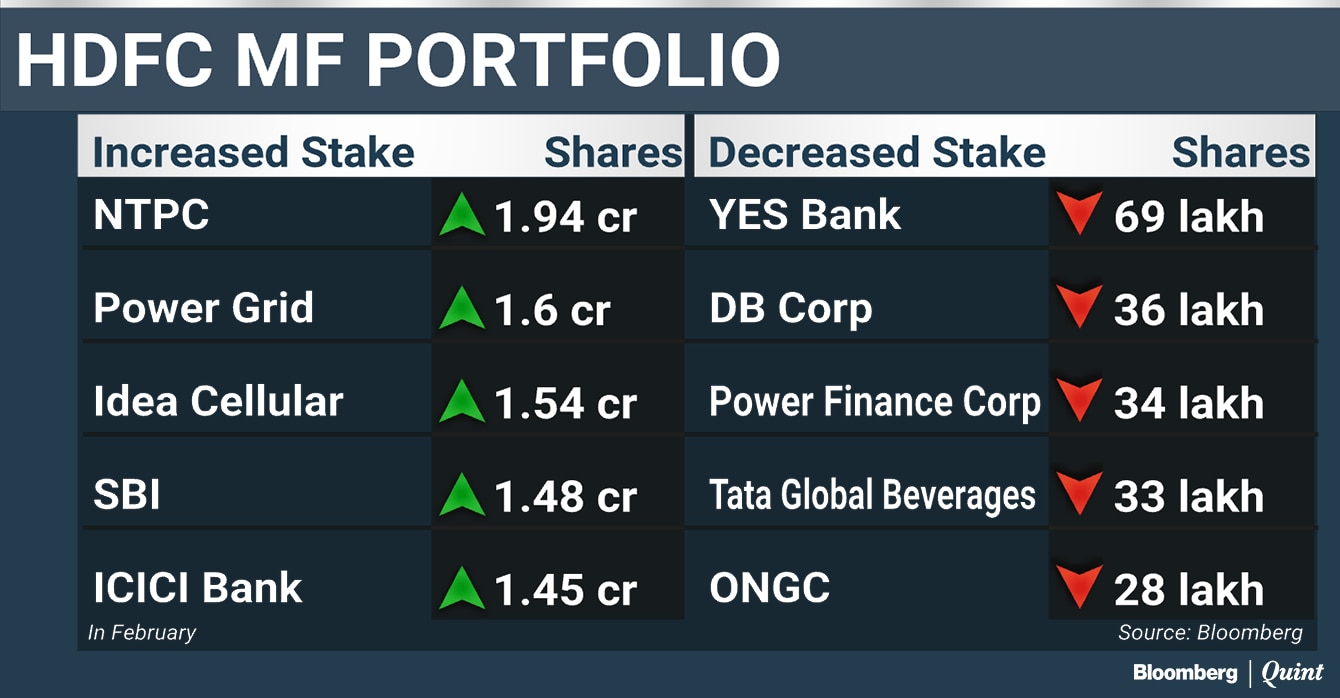

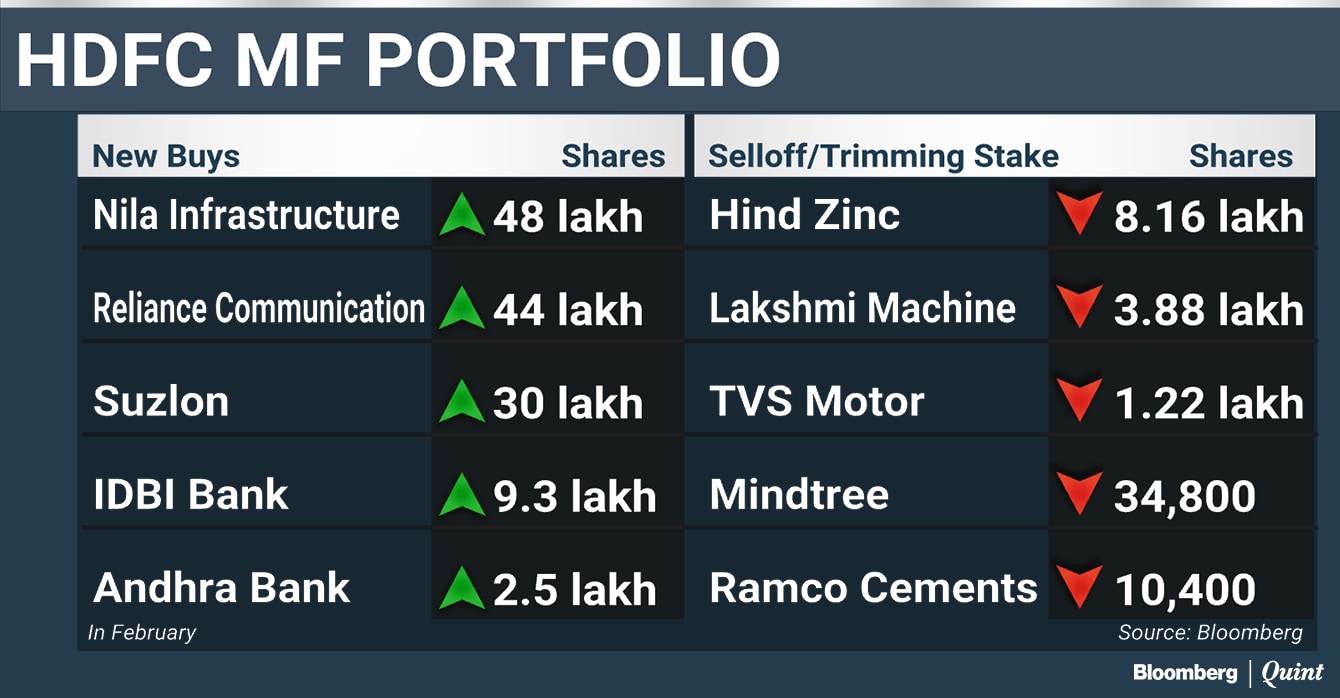

Here's what the top three fund houses bought and sold last month:

ICICI Prudential Mutual Fund

Total assets managed by the fund house stands at nearly Rs 1.16 lakh crore. It has the highest exposure to financials at 25 percent, followed by industrials at 10.7 percent.

Also Read: Indian Mutual Funds' Assets Erode For The First Time In 14 Months

HDFC Mutual Fund

The total asset under management stand at Rs 1.29 lakh crore. The top exposure is towards financials at 32.1 percent and industrials at 15.5 percent.

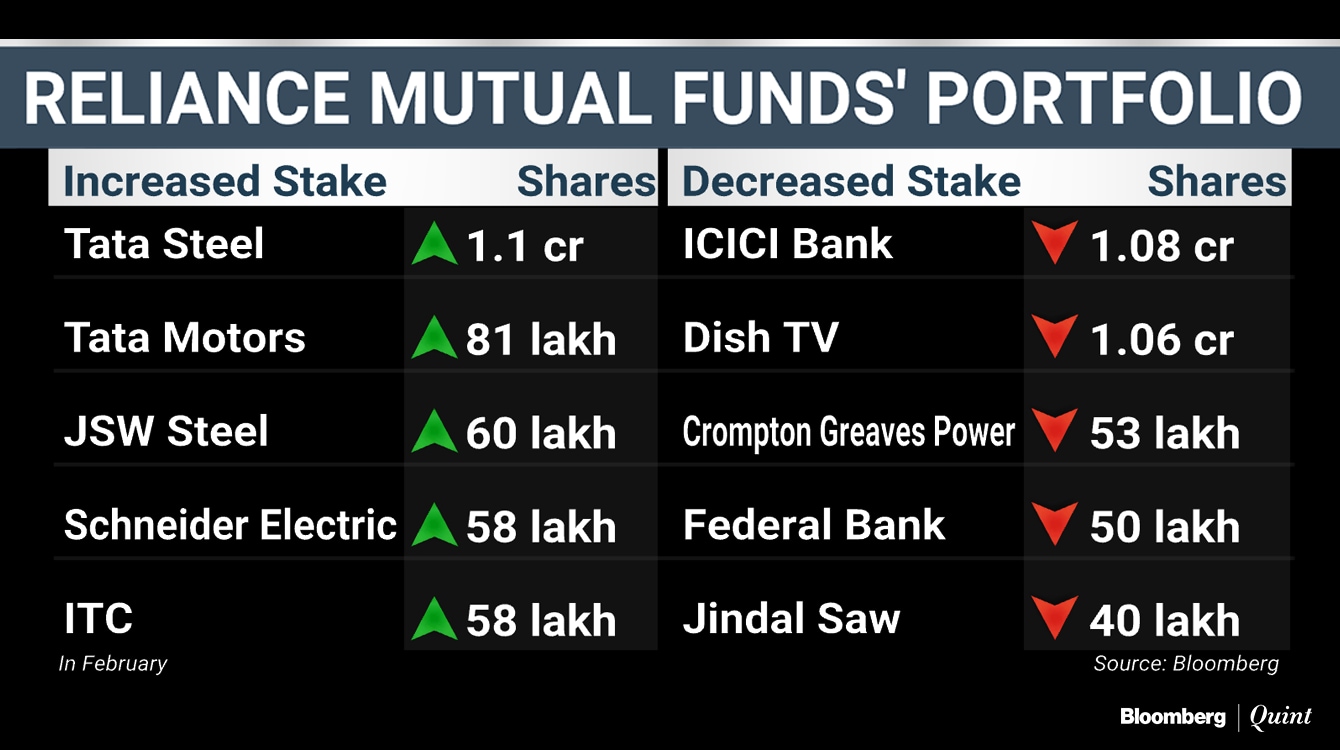

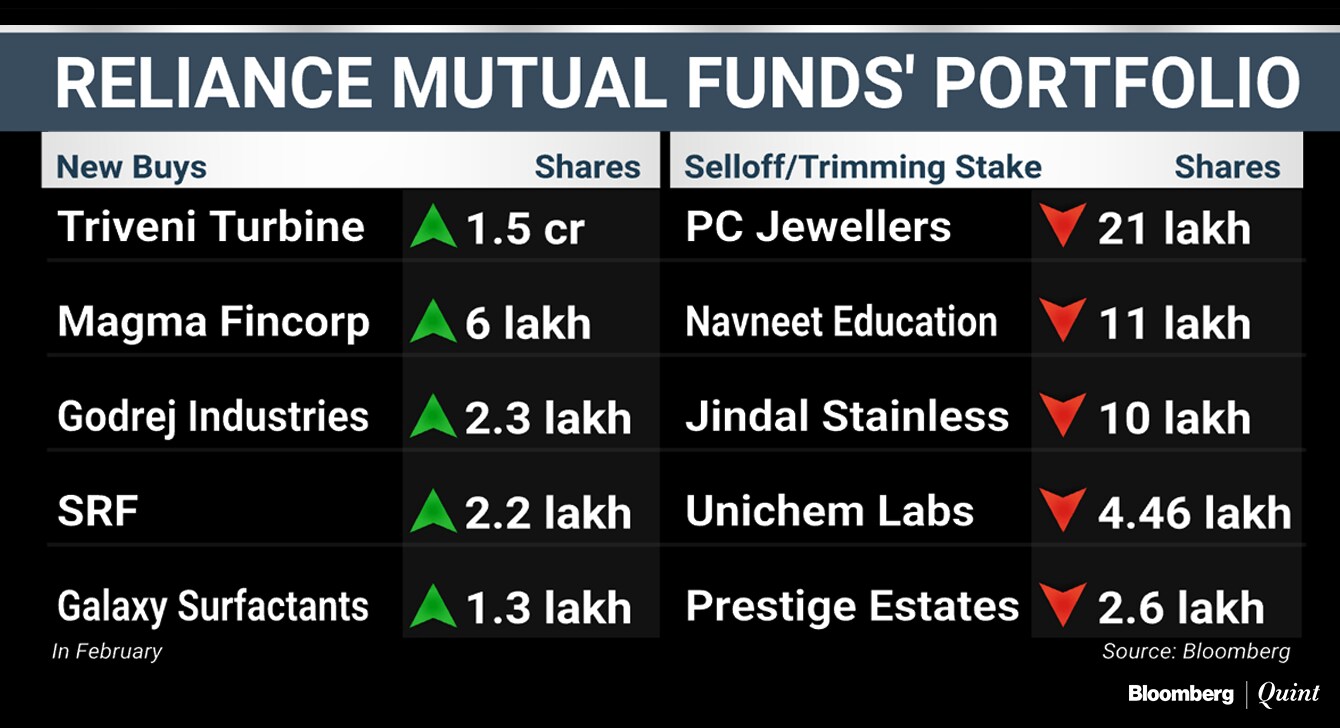

Reliance Mutual Fund

It has equity assets of approximately Rs 87,750 crore under management. Sector-wise, its largest current exposures are in financials at 27.7 percent and industrials at 16.7 percent, respectively.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.