(2).jpeg?downsize=773:435)

The shares of Vedanta Ltd. rose nearly 5% in the last two sessions after a decline of a day. This comes as the market rallies over 2% on positive global cues and easing trade tensions.

The shares so far in April have ended in green for only four sessions, whereas they have ended in red for five sessions.

The Assam Chief Minister, Himanta Biswa Sarma, on Monday had held discussions with the private sector energy major to prepare a detailed plan for the announced investment of Rs 50,000 crore in the state.

In February, Vedanta Group Chairman Anil Agarwal had announced that the firm would pump in Rs 50,000 crore in Assam and Tripura's oil and gas sector over the next three to four years.

Additionally, Vedanta Aluminium on Monday said it has delivered its first-ever Aluminium Stewardship Initiative Chain of Custody-certified aluminium shipment to Capral Aluminium, Australia's largest extruder and distributor of aluminium products.

Vedanta Share Price Rises

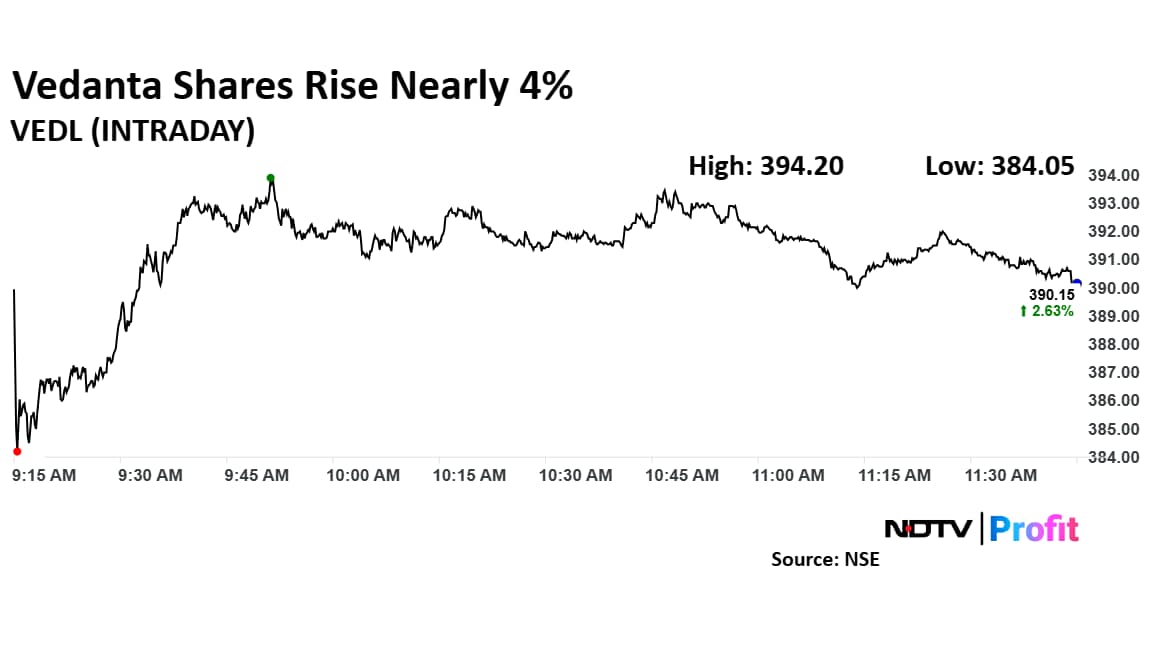

Vedanta share price rose as much as 3.7% to Rs 394.20 apiece, the highest level since April 4. It pared gains to trade 2.81% higher at Rs 390.85 apiece, as of 11:46 a.m. This compares to a 2.08% advance in the NSE Nifty 50 Index.

It has risen 5.19% in the last 12 months and fallen 12.31% year-to-date. Total traded volume so far in the day stood at 1.1 times its 30-day average. The relative strength index was at 36.

Out of 15 analysts tracking the company, 10 maintain a 'buy' rating, four recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 32.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.