Vedanta Ltd. share price traded lower during early trade on Tuesday, ahead of the meeting of creditors to vote on a plan to split the mining conglomerate into five different businesses.

The demerger plan, approved by its board on Sept. 29, 2023, is part of Vedanta's broader strategy to streamline operations and enhance shareholder value, allowing each entity to pursue its respective growth opportunities more effectively. This plan requires approval from both secured and unsecured lenders, with a majority representing three-fourths of the debt value needing to vote in favour.

The demerger, which has received no-objection certificates from the BSE and NSE, will create Vedanta Aluminium Ltd., Vedanta Oil & Gas Ltd., Vedanta Power Ltd., Vedanta Steel and Ferrous Materials Ltd., and the existing Vedanta Ltd. Originally planned as a six-way demerger, the structure was revised to five.

Shareholders of the parent will receive one share in each of the four new companies for every existing share they hold. This demerger offers several benefits to shareholders, including exposure to five distinct "pure play" companies, each with a strong potential for re-rating.

Essentially, investors who were previously invested in Vedanta and Vedanta Aluminum will now gain stakes in the other three demerged entities at virtually no additional cost.

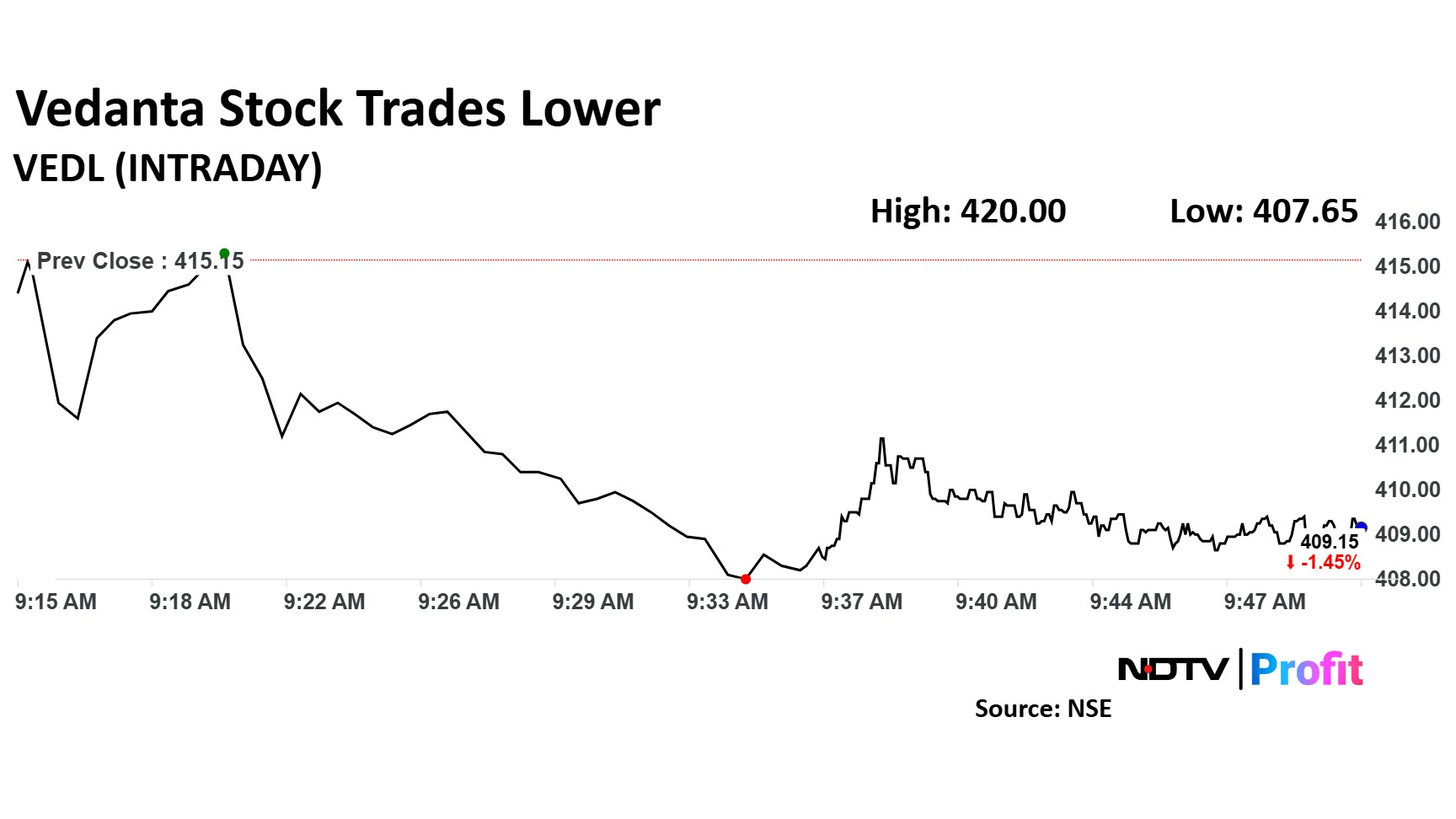

Vedanta Share Price Movement

Vedanta share price declined 1.55% intraday to Rs 420 apiece. The scrip was trading 1.45% lower by 409.15 a.m.

Vedanta share price declined 1.55% intraday to Rs 420 apiece. The scrip was trading 1.45% lower at Rs 409.15 by 9:50 a.m. The benchmark NSE Nifty 50 was down 0.06%.

The stock has risen 53% in the last 12 months and fell 8% on a year-to-date basis. The relative strength index was at 36.

Nine of the 15 analysts tracking Vedanta have a 'buy' rating on the stock, five recommend a 'hold' and one suggests a 'sell', according to Bloomberg data. The average of 12-month analysts' price target of Rs 519 implies a potential upside of 26%.

Vedanta Demerger Explained | Watch

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.