The share price of PepsiCo bottler Varun Beverages Ltd.'s share price rose in trade on Tuesday after brokerage firm Goldman Sachs initiated coverage on the counter. The firm has a 'buy' call on the stock, with a target price of Rs 600, implying a 22% potential upside.

India's low per capita consumption of ready-to-drink beverages leaves massive headroom for growth, which offers the bottler an opportunity to tap into, said the note. The firm has ramped up Pepsi's India market share from 28% in 2015 to 38% in 2024, making India one of PepsiCo's top-performing geographies, as per the note.

Goldman Sachs sees this momentum continuing, with new demand pockets like energy drinks and hydration fuelling the next leg. Notably, the firm sees no disruption from new entrant Campa Cola.

Varun Beverages had recently reported a 35% profit for the first quarter of this calendar year. Their Ebitda and revenue also rose on a yearly basis, while margins saw a slight contraction.

Varun Beverages Q1CY26 Highlights

Revenue up 29.2% at Rs 5,566.94 crore versus Rs 4,317.31 crore (Bloomberg estimates: Rs 5,476 crore).

Ebitda up 28% at Rs 1,263.96 crore versusRs 989 crore (Bloomberg estimates: Rs 1,235 crore).

Margin at 22.7% versus22.9%.

Net profit up 35% at Rs 726.49 crore versus Rs 537 crore (Bloomberg estimates: Rs 741 crore).

Varun Beverages Share Price Today

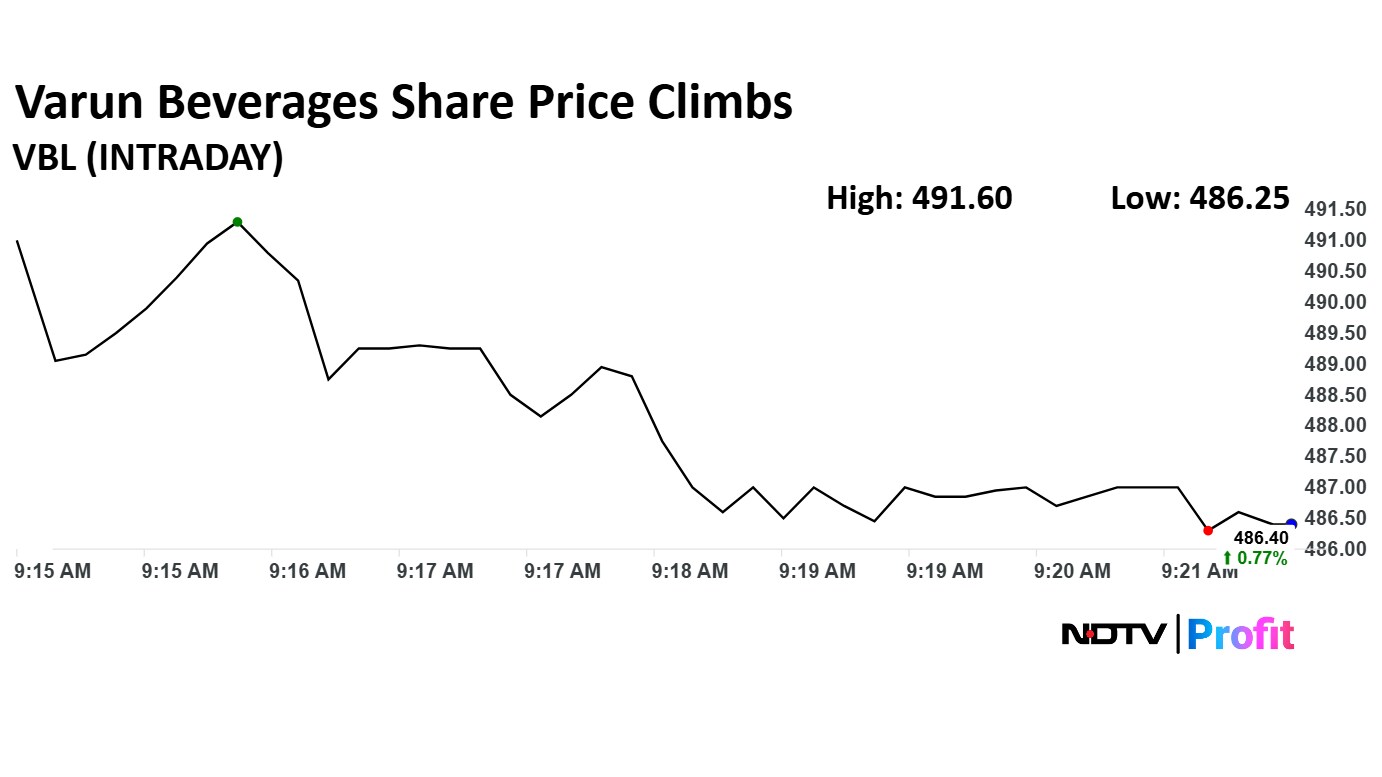

The scrip rose as much as 1.84% to Rs 491.60 apiece. It pared gains to trade 0.87% higher at Rs 486.90 apiece, as of 09:20 a.m. This compares to a 0.58% decline in the NSE Nifty 50 Index.

It has fallen 25.59% on a year-to-date basis and 19.36% in the last 12 months. The relative strength index was at 40.02.

Out of 28 analysts tracking the company, 26 maintain a 'buy' rating, and two recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 29.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.