Varun Beverages Ltd. got an 'outperform' rating from JPMorgan as the brokerage initiated coverage on the stock. It expects a rise in India volumes and better overseas delivery to aid growth. The brokerage gave a target price of Rs 650 apiece, which implies 19.12% upside from the current market price.

Varun Beverages' execution and market share gain led growth strategy makes it one of the few staple names to record healthy double-digit revenue growth over the medium term, according to JPMorgan.

The brokerage forecasts revenue and earning per share CAGR of 18% and 21% for calendar year 2024 and 2027. The brokerage sees 11% growth in India volume CAGR over 2024 and 2027 for Varun Beverages.

While Varun Beverages' India volume has moved up to healthy mid-level 20%, scope remains for overseas margin to improve with enhanced scale and mix. The company has underperformed the broader market in last six months amid lower-than-expected revenue growth, competitive concerns, and crowded investor positioning.

Varun Beverages' operating margins are among the highest in the bottling industry, according to JPMorgan. The highest OPM is driven by backward integration, operating efficiencies, and strategic buying practices. The brokerage forecasts Ebitda margin of 22.9-23.4% over the calendar year 2025 and 2027.

As Varun Beverages has used proceeds from the qualified institutional placement to pay debt, JPMorgan expects the company to have net cash of Rs 1,920 crore as of December 2024. The metric should rise slowly post moderation in return metrics in calendar year 2025.

A weak summer, high competition, overseas volatility, high capex on EPS, return-dilutive merger and acquisition; and regulations may pose risks to Varun Beverages' growth, according to JPMorgan.

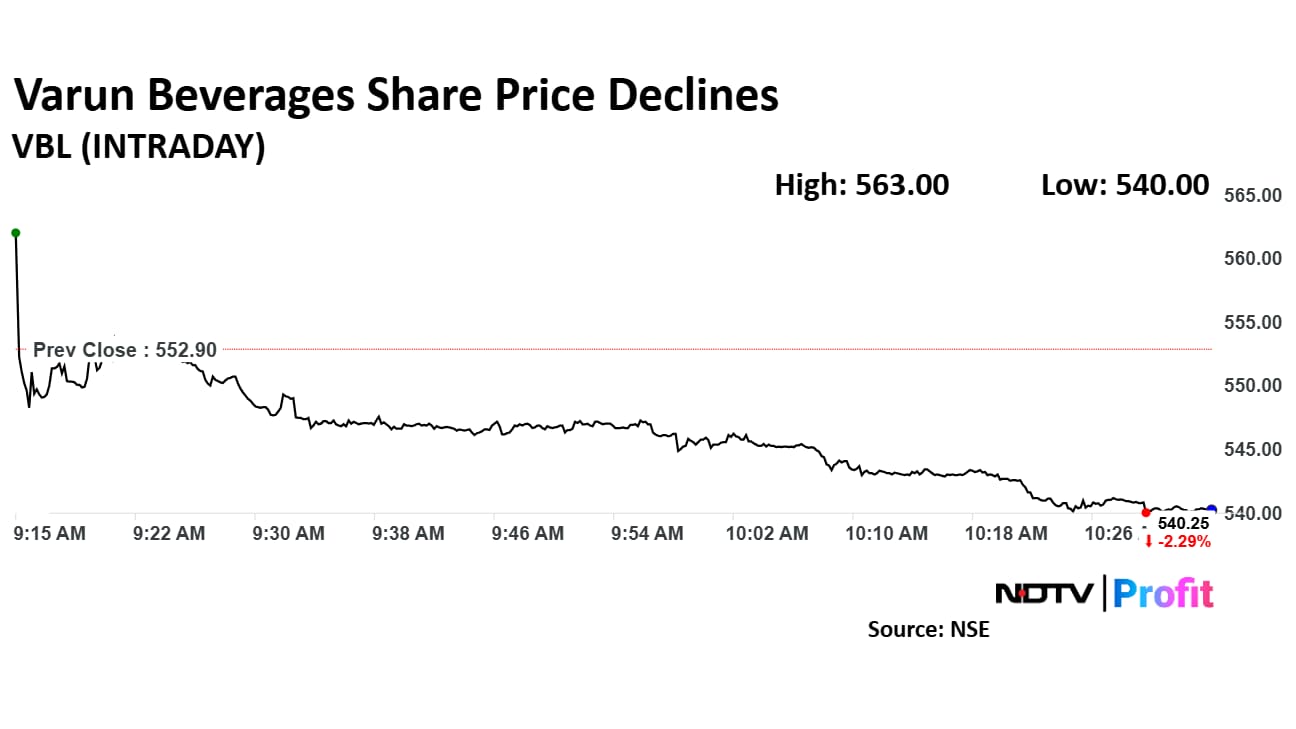

Varun Beverages Share Price

Varun Beverages share price declined 2.32% to Rs 540.05 apiece. It was trading 2.17% down at Rs 540.90 apiece as of 10:31 a.m., as compared to a 0.81% decline in the NSE Nifty 50.

The stock has risen 6.33% in 12 months. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 26.19, which implied the stock was oversold.

Out of 26 analysts tracking the company, 23 maintain a 'buy' rating, three recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 31.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.