(Bloomberg) -- Treasuries advanced in their first trading session since Donald Trump's inauguration as US president, underscoring relief on the lack of sweeping announcements on trade tariffs.

“Markets were fixated on big tariffs bazookas from day one,” said Shoki Omori, chief global desk strategist at Mizuho Securities. “The absence of that, especially on China, is driving a relief rally for Treasuries.”

Ten-year US Treasury yields fell as much as nine basis points in Asia on Tuesday, reflecting cautious optimism that Trump may take a more measured approach to trade relations. Notably investors are latching on to the absence of new tariffs on the US' three biggest trading partners — a development that's likely to spur relief rallies across everything from bonds to stocks and corporate debt.

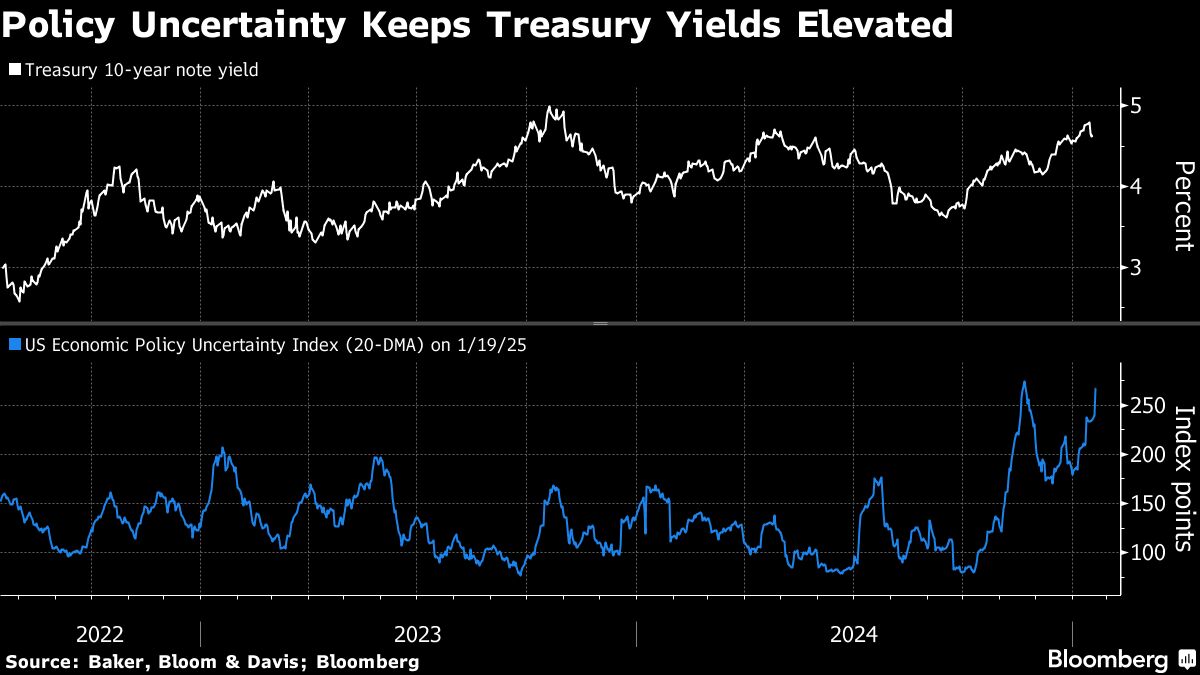

Treasuries lost 3.1% in the final three months of 2024, the worst quarterly performance in two years, amid concern Trump's policy of higher tariffs and tax cuts would drive up US inflation, in turn preventing the Federal Reserve from lowering the policy rate. US debt has since traded steady as investors waited to see how the new president will execute his policies.

Overnight-indexed swaps signal a 69% chance of the Fed cutting the benchmark rate more than once this year, up from 46% on Friday.

“The market took the speech as an encouragement as the most feared scenario of immediate and large tariffs was not realized,” John Hardy, chief macro strategist at Saxo Bank, wrote in a note.

However, analysts are uncertain if gains will persist as they remain in wait-and-watch mode on tariffs.

“Will the move stick? Way too early to tell — markets are hungry for more messaging from Trump and fiscal cues from Scott Bessent,” Omori said, referring to the Treasury Secretary nominee.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.