(Bloomberg) -- The dollar strengthened against most major peers after US President Donald Trump reiterated he was weighing a 10% tariff on China.

The offshore yuan edged lower and the risk-sensitive New Zealand dollar led losses against the greenback after Trump said he was mulling duties on China in retaliation for the flow of fentanyl from the country.

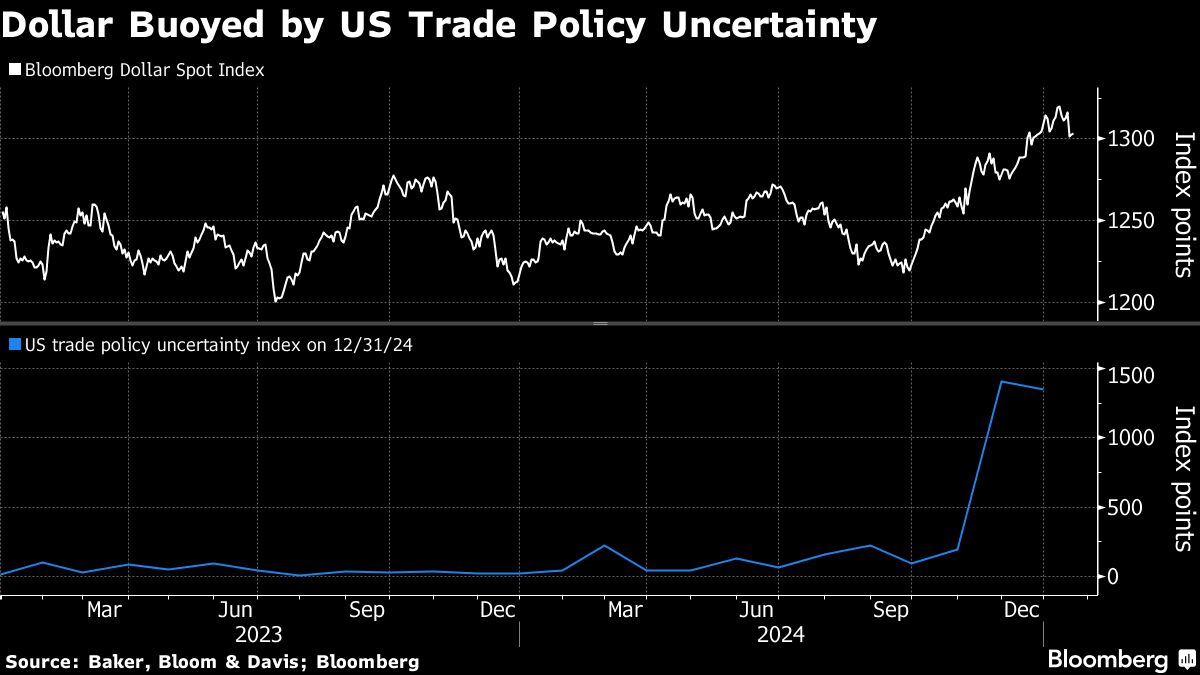

The dollar's advance is driven in part by demand for havens as policy uncertainty under Trump administration spurs jitters in the $7.5 trillion-a-day foreign-exchange market. A resilient US economy, high interest rates and the dollar's unrivaled status as the world's dominant reserve currency are also raising the prospect of further gains in the greenback.

The news is “an example of the intentional policy of uncertainty by the Trump administration,” said Rodrigo Catril, strategist at National Australia Bank Ltd. in Sydney. “Keeping the market and trading partners guessing is part of the game, adding to the uncertainty and dollar safe-haven bid.”

Expectations on Trump's action had dominated market moves in China heading into his inauguration. Stocks had run up in recent sessions as Bloomberg News reported last week that Trump's team was considering taking a gradual approach to raising tariffs. Prior to that, concerns about an escalation in trade tensions as well as China's economic slowdown had caused the MSCI China Index to enter a bear market.

The dollar whipsawed Tuesday after Trump comments on potential tariffs on Mexico and Canada from Feb 1, with his unpredictability on policies seen making currencies more volatile.

“The strong dollar narrative remains unchanged,” Brown Brothers Harriman & Co. strategists including Win Thin wrote in a note. “We continue to look through all this tariff noise and believe that whatever final tariff plan eventually emerges, it will only magnify the current drivers of the ongoing dollar rally.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.