- Urban Company shares debuted at a 57% premium over the Rs 103 IPO price

- The IPO was subscribed nearly 109 times with bids worth Rs 1.13 lakh crore

- Qualified Institutional Buyers subscribed more than 140 times to the IPO

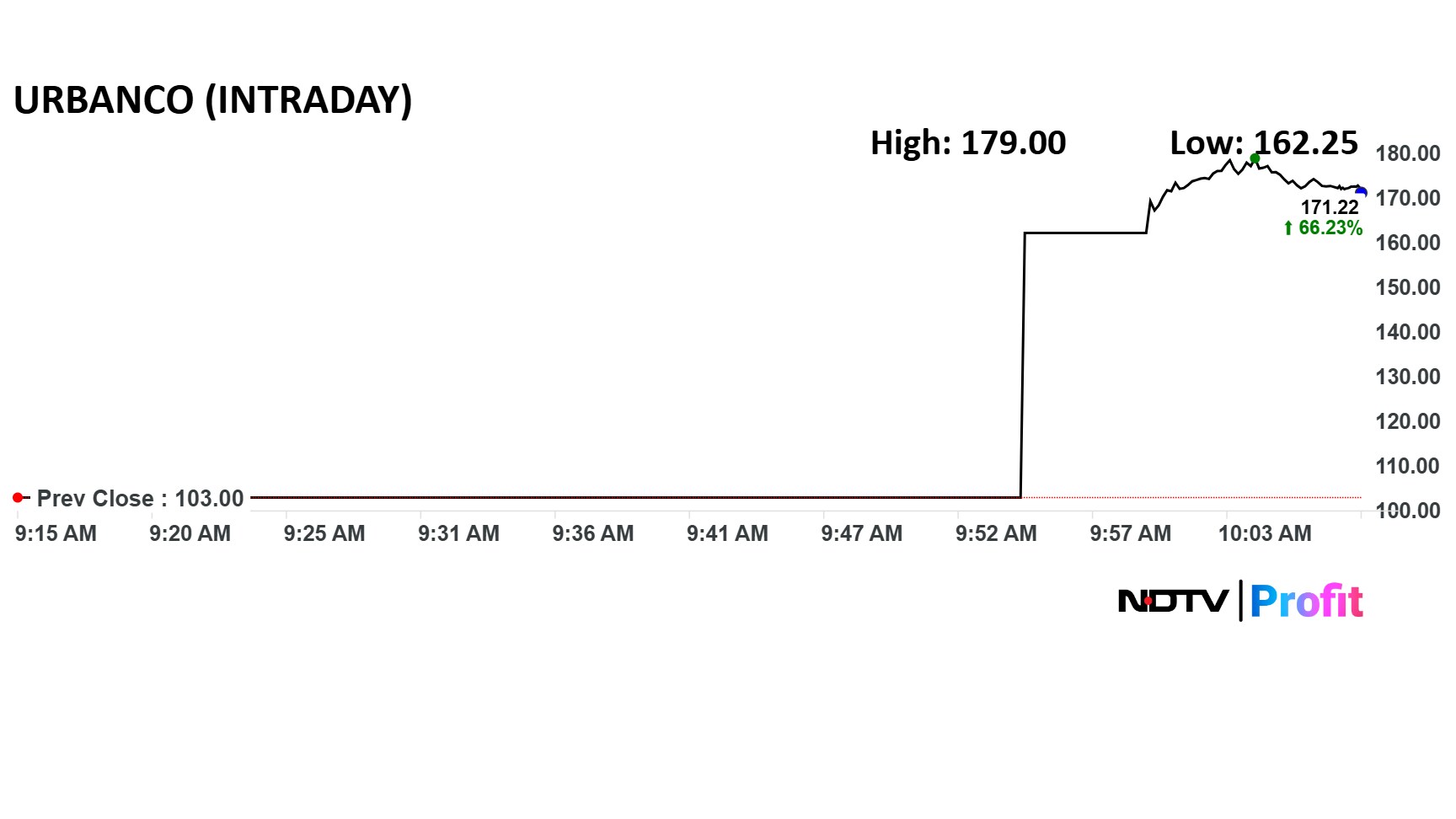

Urban Company Ltd. shares made a spectacular debut on the stock market on Wednesday, listing at a premium of 57 % over the IPO price. The share price opened at Rs 162.25 on the NSE and Rs 161 on the BSE. The issue price was Rs 103.

The Rs 1,900.24-crore mainboard issue emerged as one of the most subscribed IPO of 2025 so far. The Urban Company IPO saw massive subscription as investors applied for more than 1,106 crore shares against 10.67 crore shares on offer. The final total subscription was nearly 109 times.

The Qualified Institutional Buyers' (QIB) category was subscribed more than 140 times, while the Non-Institutional Investors' (NIIs) segment was booked 74 times. The retail portion was booked 39.25 times.

Overall, the IPO attracted bids worth around Rs 1.13 lakh crore against the issue size of Rs 1,900 crore, which is the largest bid amount recorded in 2025 so far.

While the Urban Company IPO saw robust demand, it is not alone in drawing overwhelming investor interest. So far this year, at least 12 IPOs have seen subscriptions above 100 times.

Given that Urban Company was subscribed over 100 times, the grey market premium suggested a strong listing could be expected, potentially exceeding 60% on the first day.

Institutional Interest

In its pre-IPO anchor round, Urban Company raised Rs 854 crore from institutional investors. These included Goldman Sachs, SBI Life Insurance, Nomura, Aditya Birla Sun Life, ICICI Prudential Life Insurance, Bajaj Allianz, Florida Retirement System, UTI, Government Pension Fund Global, Helios Mutual Fund, and Citigroup Global.

Out of the total anchor allocation, shares were allocated to 13 mutual funds through a total of 29 schemes. These include SBI Mutual Fund, ICICI Prudential Mutual Fund, HDFC Mutual Fund and Nippon Life India Mutual Fund.

Gig Economy Player

Urban Company, previously known as UrbanClap, has a business model built around gig workers, barbers, electricians, beauticians, and technicians. In the June 2025 quarter, the company reported 54,347 average monthly active service professionals, up from 50,992 in June 2024.

The company has operated without serious competition for nearly a decade, unlike quick commerce (Blinkit, Instamart, Zepto), fintech (Paytm, PhonePe, BharatPe), or e-grocery (BigBasket and Tata Neu). Notably, the company has no listed peers.

Catch all the live markets here for real-time updates, stock movements, and broader market trends throughout the day.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.