The Nifty 50 ended higher for second consecutive day

Top Nifty gainers were Tata Consumer Product and State Bank of India

Top Nifty losers Bajaj Finserv & Titan Co

The Nifty PSU Bank emerged as the top sectoral gainer. Bank of Maharashtra & Punjab National bank led gains

The Nifty Metal is the to oser, drag by Jindal steel & Hindustan copper

Smallcap 250 gains for the 4th consecutive day, led by TV18 broadcast & Garden reach

The Nifty Midcap 150 higher for the ninth day in a row

The Nifty Midcap 150's gains were lead by Bank of Maharashtra and KPIT TECH

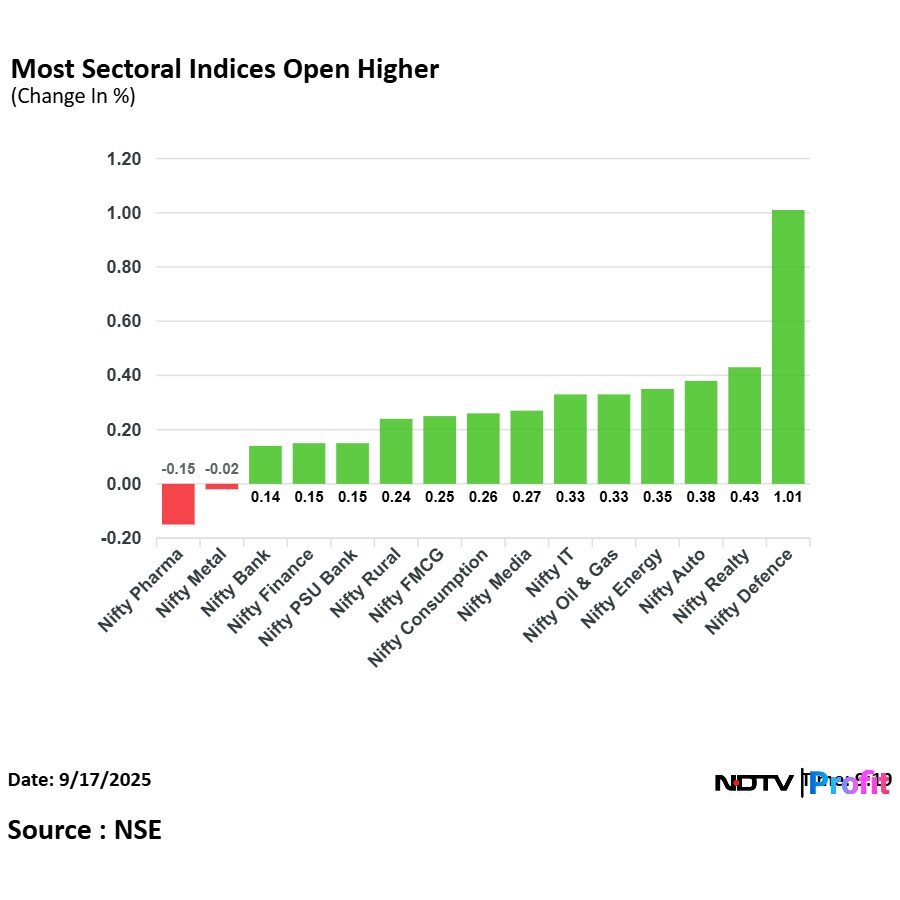

All sectors ended higher except the Nifty Pharma, FMCG

Nifty PSU Banks gains for the third day in a row.

Nifty Oil and Gas, Realty gain for the 6th day in a row.

Nifty Bank gains for the 11th consecutive day.

Nifty Auto gains for the 2nd consecutive day.

Nifty Financial Services gains for the 11th consecutive day.

The Nifty 50 ended higher for second consecutive day

Top Nifty gainers were Tata Consumer Product and State Bank of India

Top Nifty losers Bajaj Finserv & Titan Co

The Nifty PSU Bank emerged as the top sectoral gainer. Bank of Maharashtra & Punjab National bank led gains

The Nifty Metal is the to oser, drag by Jindal steel & Hindustan copper

Smallcap 250 gains for the 4th consecutive day, led by TV18 broadcast & Garden reach

The Nifty Midcap 150 higher for the ninth day in a row

The Nifty Midcap 150's gains were lead by Bank of Maharashtra and KPIT TECH

All sectors ended higher except the Nifty Pharma, FMCG

Nifty PSU Banks gains for the third day in a row.

Nifty Oil and Gas, Realty gain for the 6th day in a row.

Nifty Bank gains for the 11th consecutive day.

Nifty Auto gains for the 2nd consecutive day.

Nifty Financial Services gains for the 11th consecutive day.

Rupee strengthened 23 paise to 87.82 against US Dollar

It settled at 88.05 on Tuesday

Source: Cogencis

Indian economic reforms, with a particular focus on consumption, are setting the stage for significant growth across various sectors, according to Amisha Vora, Chairperson and Managing Director of Prabhudas Lilladher.

Vora highlights that the nation's economic strength is built on permanent domestic reforms like the Goods and Services Tax and not fazed temporary international trade disputes noting that Trump's tariffs are temporary.

Tega Industries's board to meet on September 18 to consider raising funds, the company said in the exchange filing.

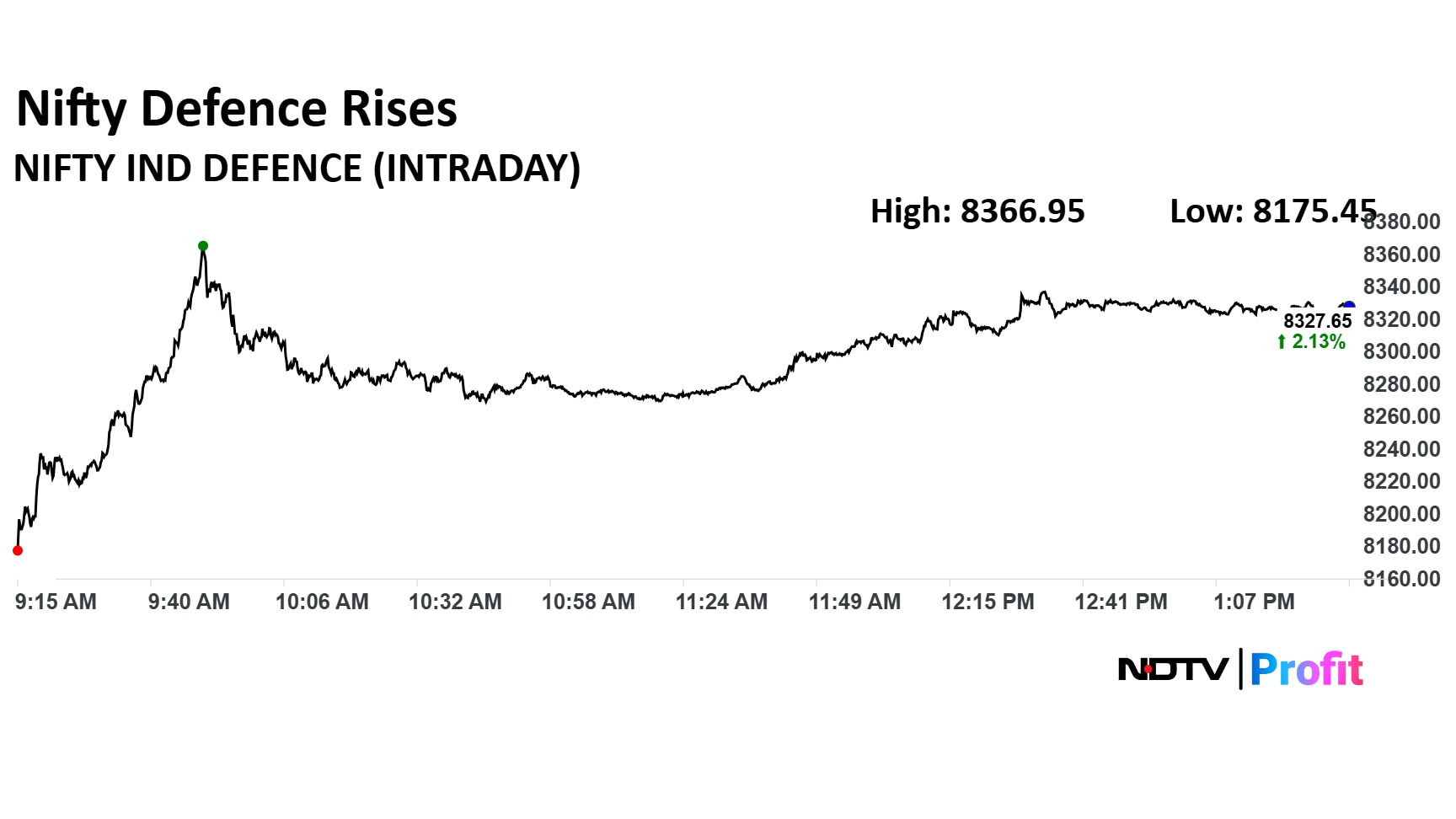

The NSE Nifty India Defence rallied for four sessions in a row and hit a two-month high. Garden Reach Shipbuilders and Engineers Ltd., Ideaforge Technology Ltd., and Zen Technologies Ltd. emerged as the top gainers.

Market-cap of defence stocks rose Rs 9,374.87 crore to Rs 10.22 lakh crore as of 1:48 p.m.

The NSE Nifty India Defence rallied for four sessions in a row and hit a two-month high. Garden Reach Shipbuilders and Engineers Ltd., Ideaforge Technology Ltd., and Zen Technologies Ltd. emerged as the top gainers.

Market-cap of defence stocks rose Rs 9,374.87 crore to Rs 10.22 lakh crore as of 1:48 p.m.

KNR Constructions share price rose as much as 13% during the day. The stock erased some of the gains and was trading 7.6% higher at Rs 209.61.

Trading volume was 150 times its 20-day average, according to Bloomberg data. The scrip has advanced 7% in the past five session and returned 5% in the past 30 days.

PC Jeweller share price rose as much as 12.9%, the most since July 7, to Rs 15.12. The stock extended gains for the second consecutive trading session.

Trading volume was almost quadruple its 20-day average, according to Bloomberg data. The scrip advanced 11% in the past five days and returned 13% in the past 30 days.

Urban Company's core business continues to grow profitably

The company's core business already at healthy margins

In financial year 2025, 82% of net transaction value was from repeat users

Cross selling becomes easy for Urban Company once customer uses one of our service

Number of transaction is going up for the company

Source: Abhiraj Bhal, Co-founder & CEO, Varun Khaitan Co-founder & COO, Raghav Chandra, CTPO & Co-Founder

Knowledge Marine approved approved to issue 14.2 lakh shares worth Rs 270 crore on preferential basis. The company has also approved 77,946 convertible warrants for Rs 14.8 crore on preferential basis.

Jagat Jiban Biswas resigned as non-executive, non-independent director effective on Oct 1.

TVS Motor Co introduces electric vheicle smartwatch integration with Lifestyle Brand Noise. EV-Smartwatch integration connects TVS iQube electric scooter with noise smartwatch, the company said in the exchange filing.

Indian markets are trading sideways due to mutual fund inflows.

Domestic influence is absorbing negative market sentiment.

The year 2025 is a year of healthy consolidation for Indian markets.

Foreign institutional investors are not concerned about tariffs.

Earnings and nominal GDP growth should pick up next year.

A pickup in nominal GDP remains a key factor.

India is not currently a top choice for foreign investors because other markets have outperformed.

Hopefully, GST rates will not derail fiscal plans.

A consumption boost should aid the auto and non-banking financial company sectors.

Investors want to avoid platform companies globally.

The rupee's bottom against the dollar is 89.

The Indian government has done everything possible to promote growth.

The Reserve Bank of India should not cut interest rates any further.

Source: Chris Wood, Jefferies

Export-oriented sectors like textiles, jewellery, seafood, automobile origianl equipment manufacturing sectors will likely see a shar rebound in case US tariffs come down to earlier expectation of 15–20%, said Prashant Khemka, WhiteOak Capital said. He also noted there was no significant correction in the export-oriented comapanies' stocks.

Tata Consultancy Services is in pact with Qaulcomm to develop artificial-intelligence driven smart, sustainable capabilities for industries. The company will set up innovation lab in Bengaluru, the comapny said in the exchange filing.

Prime Minister Narendra Modi turns 75 today. His tenure since May 2014 has coincided with a transformative phase in Indian financial markets. From benchmark indices to sectoral performances, and from the surge public sector undertaking stocks to growth in investor participation, markets have moved into a phase of growth and scale not seen earlier.

Rupee strengthened 33 pais to 87.72 against US Dollar

It's the highest level since Aug 29

The dollar index dollar index at 11-week low

It settled at 88.05 on Tuesday

Source: Cogencis

Johnson Control's board approved changing name to Bosch Home Comfort India, the company said in the exchange filing.

Mumbai Income Tax wing conducting survey action at Marico several offices and factories.

Survey operations across all Marico offices, manufacturing units, and major dealers.

The Survey action is linked to scrutiny of certain foreign funding transactions.

Source: People In The Know

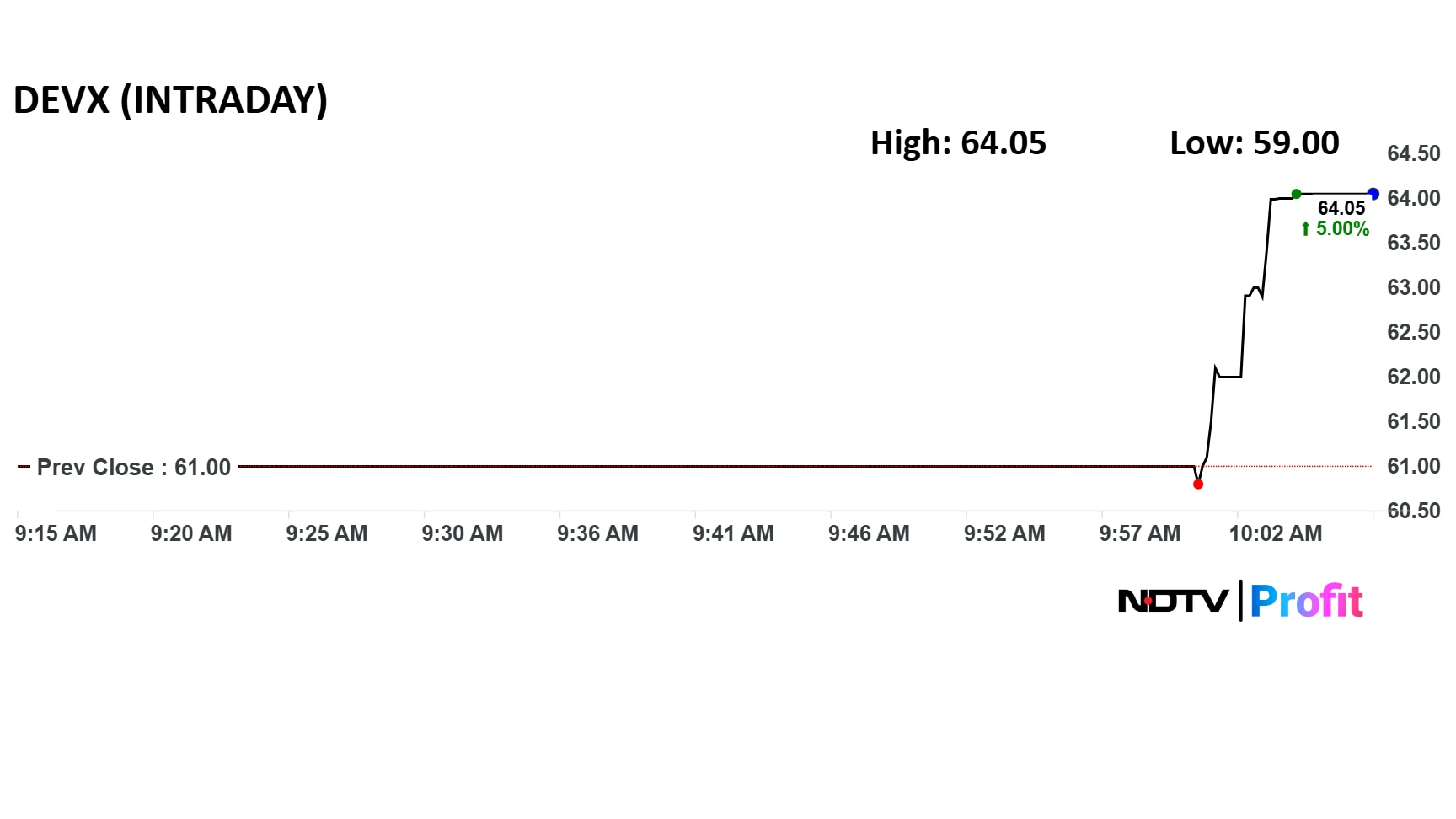

Dev Accelerator Ltd. made an underwhelming debut on the stock market on Wednesday, listing at its IPO price. The stock opened at Rs 61 on the NSE and Rs 61.3 on the BSE. The issue price was Rs 61 per share.

Dev Accelerator Ltd. made an underwhelming debut on the stock market on Wednesday, listing at its IPO price. The stock opened at Rs 61 on the NSE and Rs 61.3 on the BSE. The issue price was Rs 61 per share.

Urban Company Ltd. shares made a spectacular debut on the stock market on Wednesday, listing at a premium of 57 % over the IPO price. The share price opened at Rs 162.25 on the NSE and Rs 161 on the BSE. The issue price was Rs 103.

Nomura has initiated coverage on Prestige Estates Ltd., issuing a 'buy' rating and a target price of Rs 1,900, which implies a potential upside of nearly 17% from Tuesday's closing price.

The brokerage firm cited Prestige's strong execution, expansion beyond Bengaluru and a growing annuity-plus-hotel portfolio as key growth drivers for the company going forward.

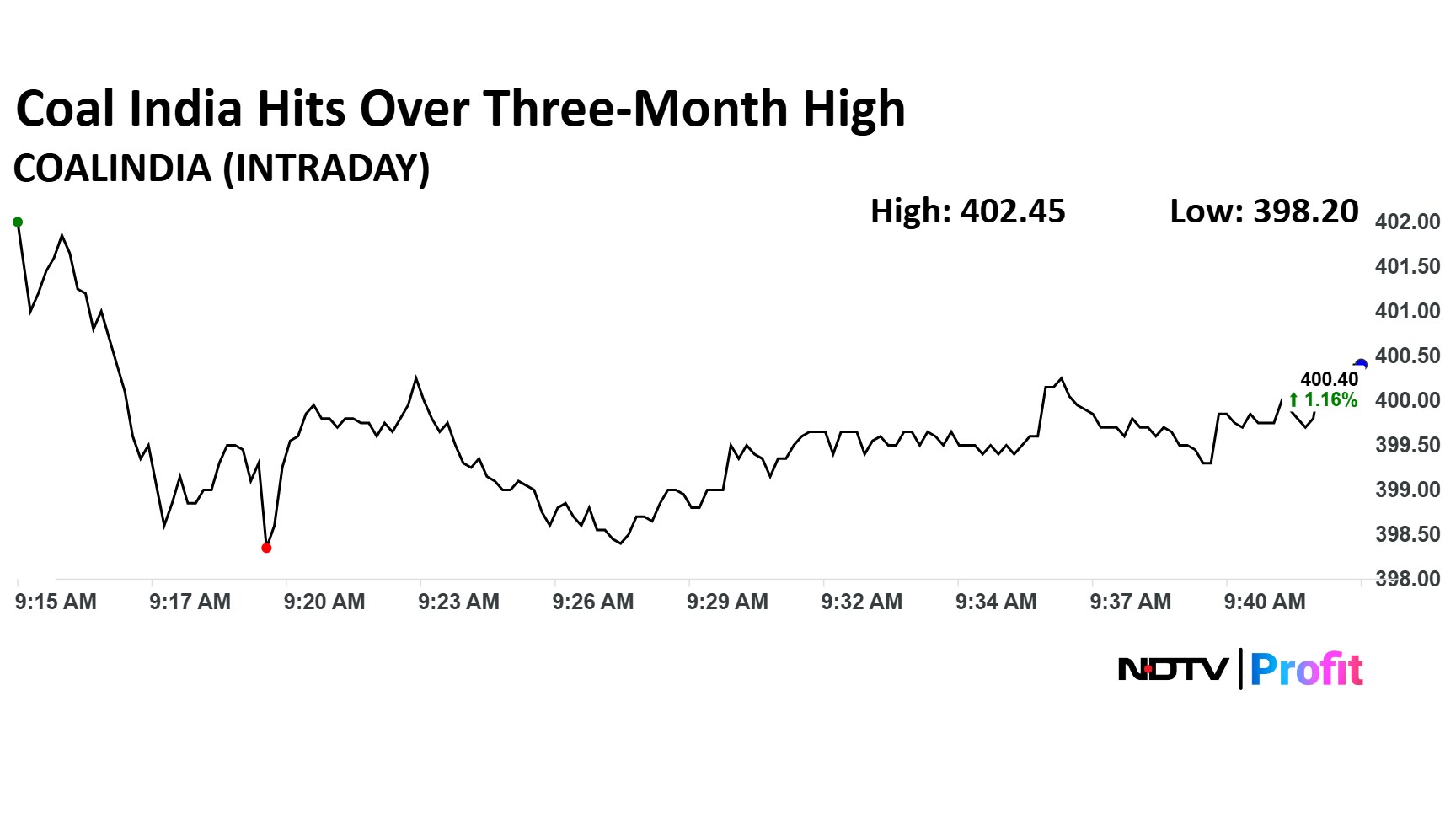

Coal India Ltd. share price rose 1.68% to Rs 402.45 apiece, the highest level since June 11. The company was declared as preferred bidder by the Ministry of Mines for Ontillu-Chandragiri rare earth element exploration block.

Coal India Ltd. share price rose 1.68% to Rs 402.45 apiece, the highest level since June 11. The company was declared as preferred bidder by the Ministry of Mines for Ontillu-Chandragiri rare earth element exploration block.

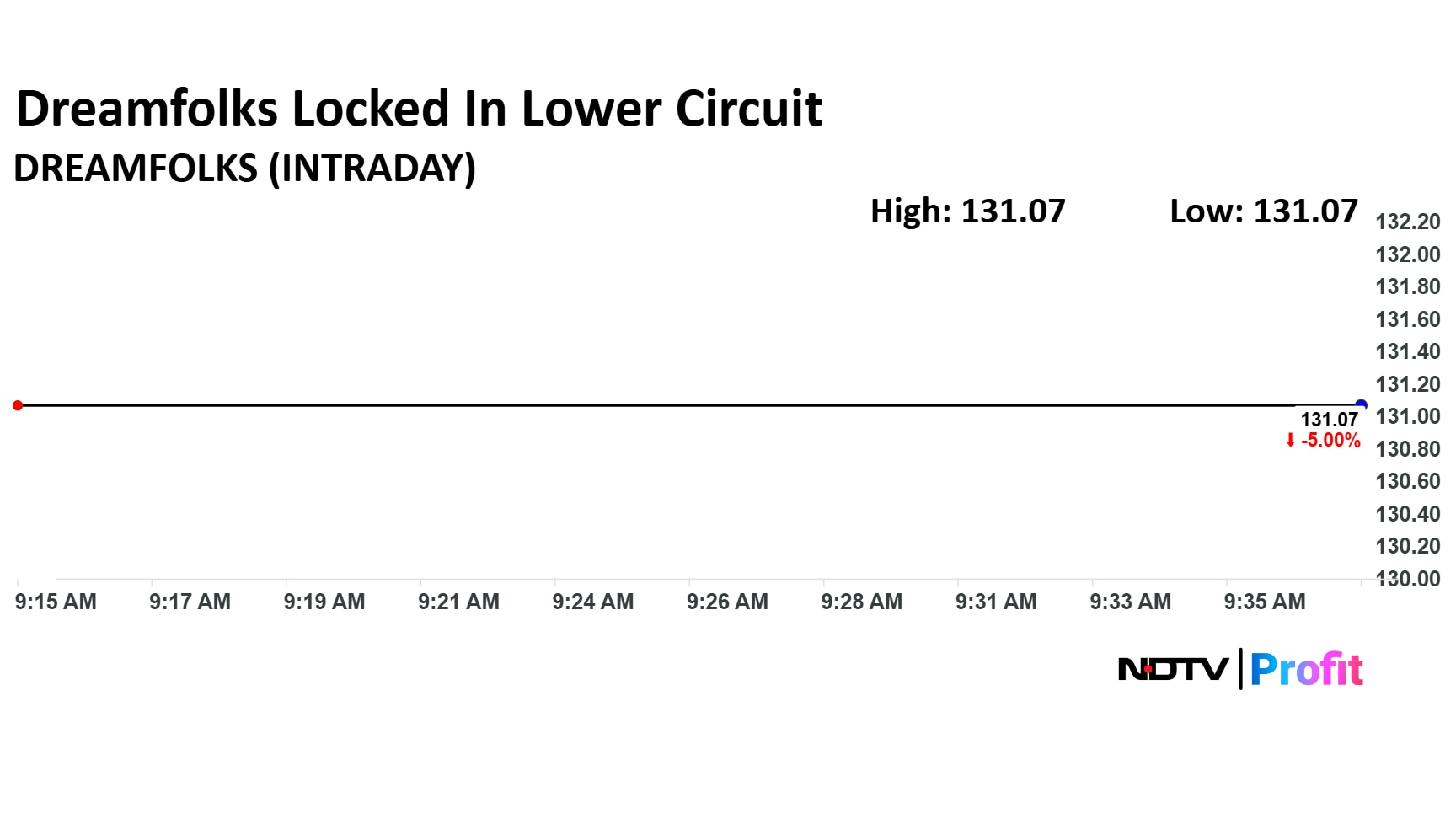

Shares of DreamFolks have hit lower circuit in trade on Wednesday, with cuts of 5%. This comes after the company announced it has shut down its domestic airport lounge services business - a key revenue generator.

This adds to investors' woes in DreamFolks, whose shares have fallen almost 67% on a year-to-date basis.

Shares of DreamFolks have hit lower circuit in trade on Wednesday, with cuts of 5%. This comes after the company announced it has shut down its domestic airport lounge services business - a key revenue generator.

This adds to investors' woes in DreamFolks, whose shares have fallen almost 67% on a year-to-date basis.

Shares of SJVN Ltd., Hindustan Copper Ltd., Shakti Pumps Ltd., and 42 other companies will be of interest on Wednesday, as it marks the last session for investors to buy shares to qualify for receiving the dividend before the stock goes ex/record-date.

The record date determines shareholder eligibility to receive a dividend.

On National Stock Exchange, 13 sectoral indices advanced out of 15 with the NSE Nifty Defence outperforming. The NSE Nifty Metal remained flat while the NSE Nifty Pharma declined.

On National Stock Exchange, 13 sectoral indices advanced out of 15 with the NSE Nifty Defence outperforming. The NSE Nifty Metal remained flat while the NSE Nifty Pharma declined.

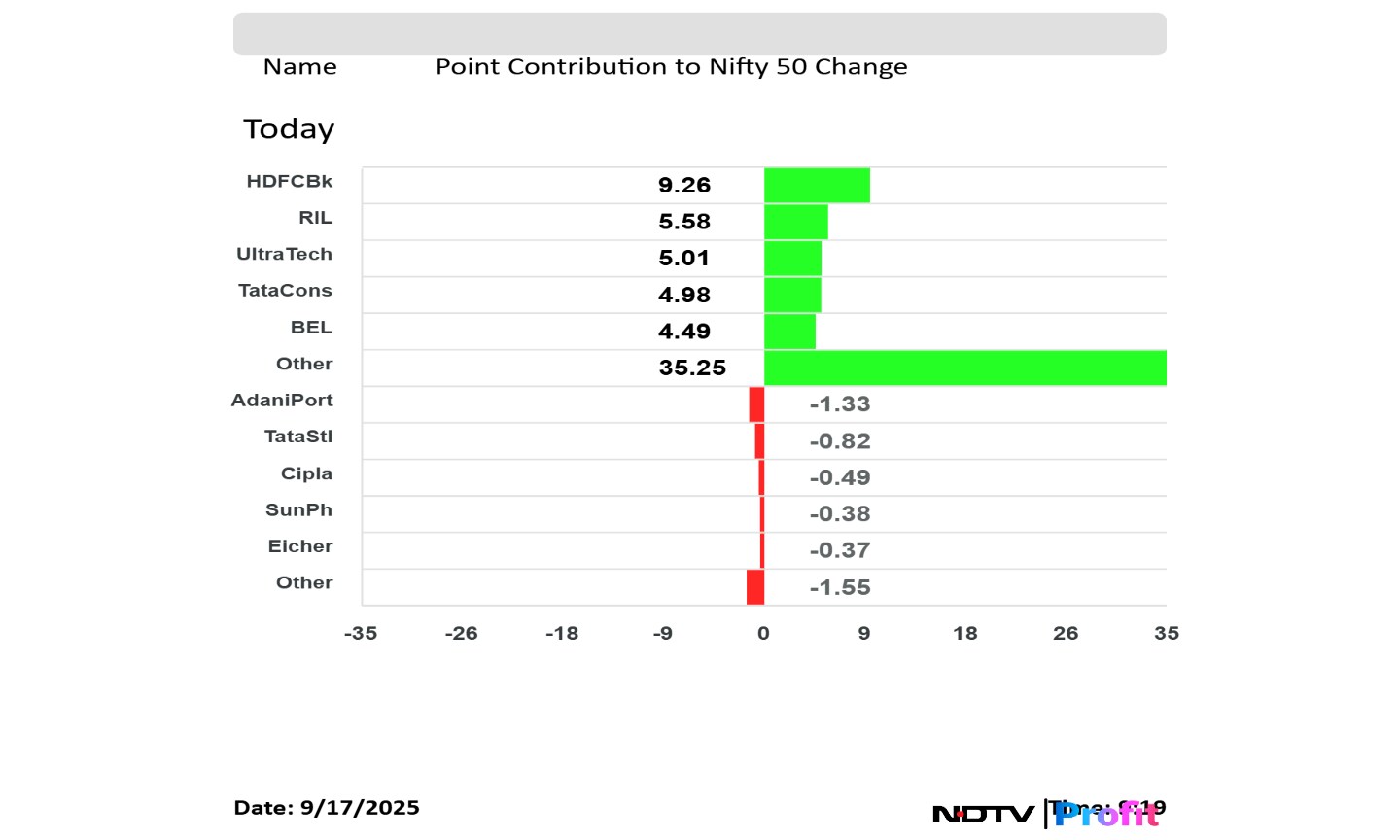

HDFC Bank Ltd., Reliance Industries Ltd., UltraTech Cement Ltd., Tata Consumer Products Ltd., and Bharat Electronics Ltd. added to the NSE Nifty 50.

Adani Ports and Special Economic Zone Ltd., Tata Steel Ltd., Cipla Ltd., Sun Pharmaceutical Industries, and Eicher Motors Ltd. weighed on the NSE Nifty 50 index.

HDFC Bank Ltd., Reliance Industries Ltd., UltraTech Cement Ltd., Tata Consumer Products Ltd., and Bharat Electronics Ltd. added to the NSE Nifty 50.

Adani Ports and Special Economic Zone Ltd., Tata Steel Ltd., Cipla Ltd., Sun Pharmaceutical Industries, and Eicher Motors Ltd. weighed on the NSE Nifty 50 index.

The NSE Nifty 50 and BSE Sensex continued their rally at open on Wednesday. Heavyweight HDFC Bank Ltd. and Reliance Industries Ltd. supported the benchmark indices. The indices were trading 0.32% and 0.17% higher, respectively as of 9:23 a.m.

The NSE Nifty 50 and BSE Sensex continued their rally at open on Wednesday. Heavyweight HDFC Bank Ltd. and Reliance Industries Ltd. supported the benchmark indices. The indices were trading 0.32% and 0.17% higher, respectively as of 9:23 a.m.

The yield on the 10-year bond opened flat at 6.48%

Source: Bloomberg

Rupee opened 23 paise stronger at 87.83 against US Dollar

It settled at 88.06 on Tuesday

Source: Bloomberg

The month of August 2025 witnessed a sharp divergence in India’s primary market trends, with qualified institutional buyers consolidating their dominance in mainboard offerings, while retail investors increasingly steered momentum in small and medium enterprise listings, revealed NSE's Market Pulse report.

The share of QIBs in mainboard IPO allocations rose to 57% in August, up from 51% in July, as per the report. Retail individual investors moderated slightly to 28.5% from 29.2%, while non-institutional Investors edged higher. In contrast, SME listings on the NSE Emerge platform saw a more retail-driven profile.

All eyes are on the primary market as the highly anticipated stock market debut of Urban Company, a name that's been making waves is to happen on Wednesday. Urban Company is India’s most subscribed public issue in 2025, closing with a staggering 109x subscription rate.

Apart from Urban Company, Dev Accelerator, Shrinagar House of Mangalsutra are going to list on exchanges today. Track live updates on today's listing with NDTV Profit here.

Asian markets held back their record run amid caution before the US Federal Reserve's policy outcome, scheduled for later today. The Nikkei 225 was trading 0.20%, while the KOSPI fell 1.04% down.

The central bank is widely expected to reduce rates by 25 basis points.

"Nifty 50 closed at 25,239, continuing to display strong short-term bullish momentum as the index trades above both its 9-day and 15-day EMAs. However, global cues remain cautious as Wall Street closed lower ahead of the US Fed’s policy announcement. Asian markets opened lower, mirroring the global wait-and-watch sentiment."Hariprasad K, Research Analyst and Founder, Livelong Wealth

"A strong close above 25,200 reinforces a bullish short-term outlook, with investors eyeing fresh near term highs in the 25,400–25,600 range. Importantly, the 25,150 zone—once a stiff resistance—has now turned into a strong support, bolstering confidence among market participants."Ponmudi R, CEO, Enrich Money

NTPC Ltd., Marico Ltd., Eureka Forbes Ltd., Ashok Leyland Ltd., Aadhar Housing Ltd., HDFC Life Insurance Co. are among the companies garnering brokerage commentary today.

Analysts have shared their insights and, in several cases, revised their target prices based on their updated fundamental outlooks for these firms. Here are the key analyst calls to watch out for today.

Analysts forecast a bullish outlook for the Nifty 50 after Tuesday's strong 0.68% higher close at 25,239.10.

"The index has formed a sizable bull candle with a higher high and higher low, signalling extension of the up move. Index witnessed a follow through strength post a bullish crossover of the 20- & 50-days EMA in the daily chart as highlighted in last edition," Bajaj Broking Research said.

The benchmark will find key resistance at 25,500 and even beyond, as per Rupak De, senior technical analyst at LKP Securities. On the downside, support is placed at 25,000.

The GIFT Nifty was trading 0.06% or 14 points higher at 25,350 as of 6:34 a.m. which indicated a higher open for the NSE Nifty 50 index.

Traders will keep an eye on Bharat Electronics Ltd., Dr. Reddy's Laboratories Ltd., Coal India Ltd., HCLTech Ltd., Premier Explosives Ltd. shares because of the overnight news flow.

The indices closed sharply higher on Tuesday tracking a gain in Larsen & Toubro Ltd., Bharti Airtel Ltd., and Kotak Mahindra Bank Ltd. shares.

The Nifty 50 ended 0.68% higher at 25,239.10, and the Sensex ended 0.73% higher at 82,380.69.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.