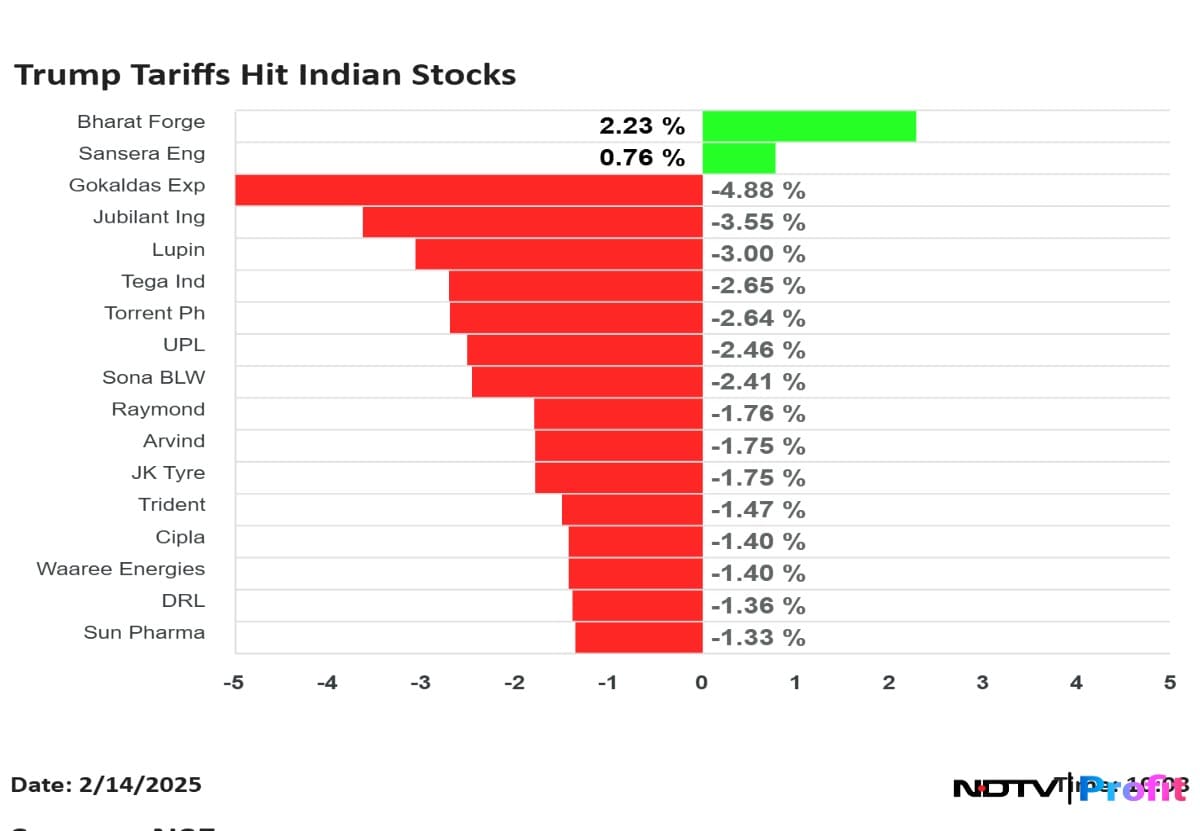

Shares of Indian companies having major exposure to the US market tanked during early trade on Friday, after US President Donald Trump announced a reciprocal tariff regime for all trade partners.

Chemicals-maker Jubilant Ingrevia Ltd. fell over 3%. UPL and PI Industries shares also declined.

The US imports five major molecules like Pydiflumetofen, Glufosinate, Glyphosate, Pyroxasulfone, and S-metolachlor from India. These molecules are made by PI Industries Ltd., UPL Ltd. and Jubilant Ingrevia.

In the solar manufacturing sector, Waaree Energies Ltd. derived 50% of its fiscal 2024 revenues from the US market. The stock fell 2% intraday.

Trump announced reciprocal tariffs that could take effect against US trading partners, including India, as soon as April. The tariffs would be customised for each country, offsetting not just their own levies, but also non-tariff barriers such as unfair subsidies, regulations, value-added taxes and other factors, Bloomberg reported.

India's tariff rates are at the higher end and likely more exposed to reciprocal tariffs if implemented, Morgan Stanley said. Food products and vegetables stand to be affected the most as India imposes higher average tariffs on the US on a relative basis.

Several Indian pharmaceutical companies have significant exposure to the US market. In terms of revenue contribution in fiscal 2024, Dr. Reddy's Laboratories Ltd. leads with 46% of its revenue coming from the US, followed by Lupin Ltd. at 37%, Sun Pharma Ltd. at 32%, Cipla Ltd. at 28%, and Torrent Pharma Ltd. with the lowest US exposure among this group at 10%.

In the auto ancillary sector, several companies derived a portion of their FY24 revenues from the US market. Sona BLW has the highest exposure to the North America market at 40%, followed by Samvardhana Motherson at 18%, and Sansera Engineering with 10%.

Within the forging sector, Bharat Forge got 25% of its FY24 revenues from the US market, while Ramkrishna Forgings had a significantly higher US exposure at 58%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.