The NSE Nifty 50 may find support at 24,700 levels, while it may see strong resistance at 25,000–25,100, according to analysts.

The index formed a bearish candle on daily charts on a technical level, indicating weakness, according to Hrishikesh Yedve, technical and derivatives research analyst at Asit C. Mehta Investment Interrmediates Ltd. "However, the index is still placed above its 21-day exponential moving average, which is positioned near 24,556."

As long as the index holds above the aforementioned level, there is a likelihood of a pullback move that cannot be dismissed. The Nifty may see strong resistance at 25,000–25,100, according to Yedve.

Mandar Bhojane, equity research analyst at Choice Broking, found the support for the Nifty to be at 24,700, and immediate resistance at the 25,000-25,150 zone. "A sustained close above 25,200 could trigger fresh buying interest, potentially pushing the index towards 25,600 and 25,800."

He said range-bound action is likely to continue until a decisive move occurs. He also advised traders to remain cautious and watch for a confirmed breakout.

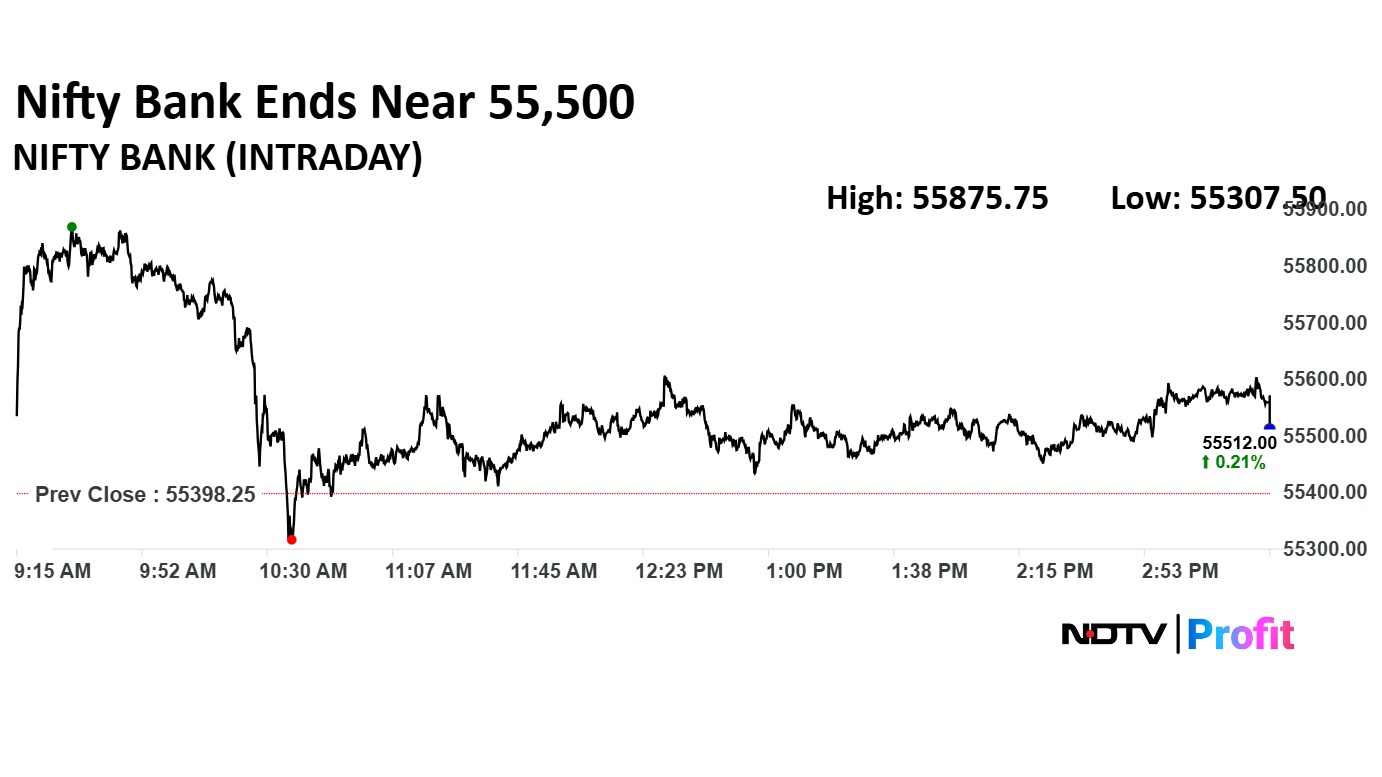

The Bank Nifty index formed a red candle with both-side shadow on the daily chart, which indicates indecision, according to Yedve.

On the upside, the index sees resistance near 56,000–56,100 levels. On the downside, the 21-double exponential moving average support is seen near 54,776. "As long as the index remains above this level, it could attempt a relief rally," Yedve said.

Market Recap

The benchmark equity indices closed lower on Tuesday, reversing its two-day gains amid volatility in domestic markets.

The NSE Nifty 50 closed 174.95 points or 0.70% lower at 24,826.20 and the BSE Sensex ended 624.82 points or 0.76% down at 81,551.63. During the day, the Nifty fell 1.19% to 24,704.10, while the Sensex dropped 1.28% to 81,121.70

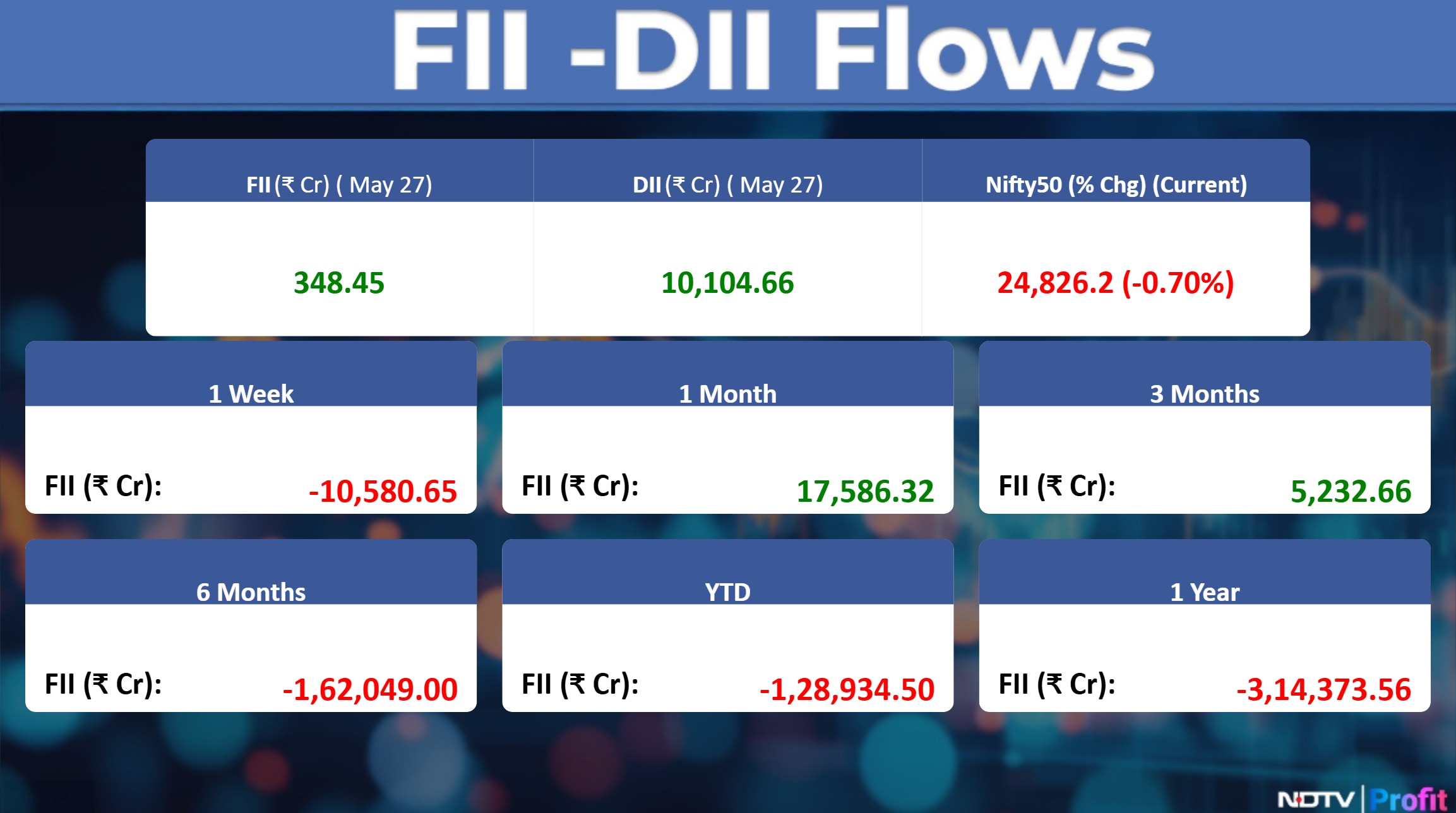

FII/DII Activity

Foreign portfolio investors mopped up stocks worth Rs 348.45 crore, according to the provisional data from the National Stock Exchange.

Domestic institutional investors stayed net buyers for the sixth straight day as they bought equities worth Rs 10,104.66 crore, the data showed.

The FPIs had bought shares worth Rs 136 crore on Monday.

F&O Cues

Nifty May Futures down by 0.7% to 24,860 at a premium of 34 points.

Nifty May Futures open interest down by 18.4%.

Nifty Options May 29 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,000.

Securities in ban period: RBL Bank.

Major Stocks In The News

ITC: British American Tobacco will sell about 2.3% stake of the company to institutional investors via block trade on May 28 at Rs 400 apiece, which is at 8% discount to current market price. The expected size of the deal is Rs 11,600 crore.

Tata Steel: The company filed a new written petition in Delhi High court over coal mine to seeks relief including compensation of Rs 757 crore along with applicable interest.

Vedanta: The firm's committee will mull issuance of non-convertible debentures on private placement basis on May 30.

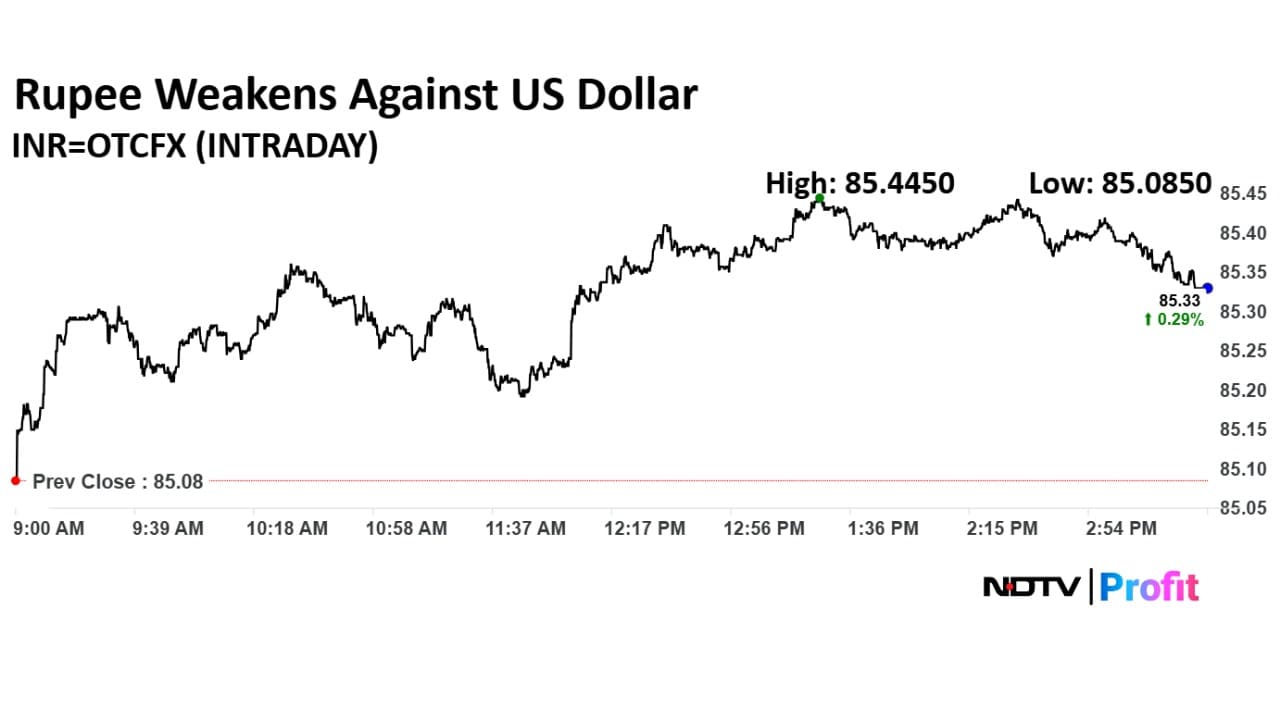

Currency Recap

The Indian rupee weakened by 25 paise to close at 85.34 against the US dollar on Tuesday, in comparison to its previous close of 85.09 on Monday. This significant depreciation comes amid various global and domestic economic factors influencing the currency markets.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.