- Resistance for NSE Nifty 50 is near 25,000-25,200, with 25,000 as key resistance level

- Support for Nifty is at 24,400-24,337, breach may lead to decline towards 24,000

- Bank Nifty support lies at 53,500-53,300; breakdown may push it to 52,500-52,000 zone

The resistance for NSE Nifty 50 is seen at around 25,000-25,200 levels, analysts said, in the aftermath of the benchmark equity index performing in a mixed manner following the government's biggest reform of goods and services tax.

"On the higher side, the 50-day simple moving average of 25,000 would act as a crucial resistance zone for traders," said Amol Athawale, vice president - technical research, Kotak Securities.

A move above 25,000 levels will open further upside towards the "key resistance area of 25200-25,250 levels", Bajaj Broking Research said in a note. "Immediate support is placed at 24,400-24,337 levels being the confluence of the recent lows and the key retracement area."

According to the brokerage, a breach below the same will signal acceleration of decline towards the key support area of 24,000 in the coming weeks, being the confluence of 52-week extended moving average and the previous major breakout area.

On the daily chart, the trend for Nifty 50 looks sideways to slightly positive, said Rupak De, senior technical analyst at LKP Securities. "However, momentum may pick up once Nifty moves decisively above 24,750. In that case, it might move towards 25,150 to 25,250 in the short term, while on the lower end, we have support at 24,500."

Kotak Securities' Amol Athawale also believes that 24,500 remains a crucial support zone. "If the index falls below this level, it is likely to retest 24,350. Further downside may continue, potentially dragging the index to the 200-day SMA or 24,100," he said.

The Bank Nifty, another keenly tracked index, faces immediate support at 53,500–53,300, which coincides with the 200-day extended moving average and the swing low of May 2025, Bajaj Broking said.

"A breakdown below this support cluster could trigger a further leg of downside towards the 52,500–52,000 zone, which is seen as the next major demand area," it added.

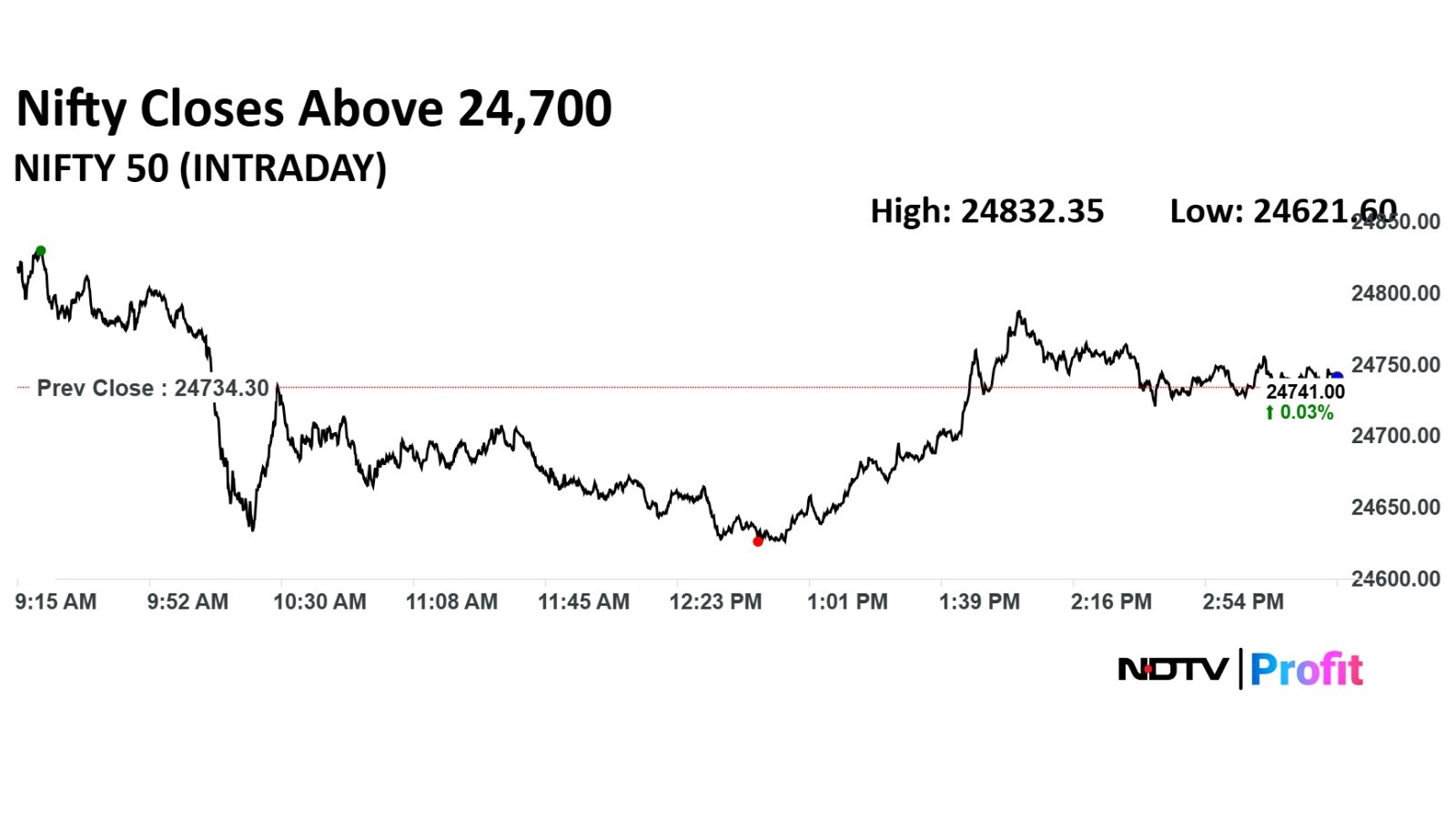

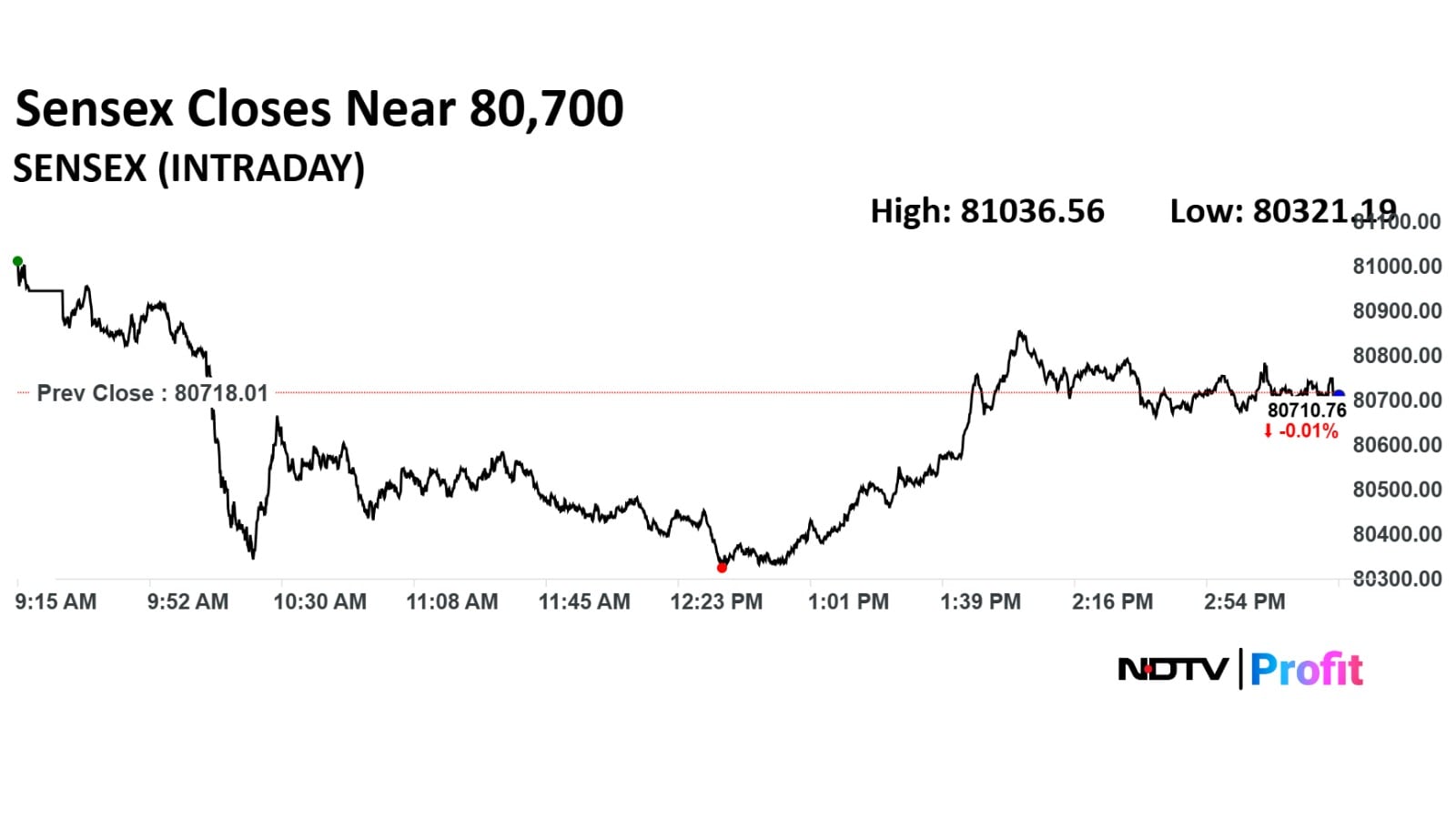

Market Recap

The benchmark equity indices ended flat on Friday after a see-saw trade as the markets had a mixed reaction to the overhaul in the goods and services tax.

The NSE Nifty 50 settled 6.7 points or 0.03% higher at 24,741 and the BSE Sensex closed 7.25 points or 0.01% lower at 80,710.76 on Friday. The Nifty fell much as 0.46% during the day, while the Sensex dropped 0.49%

Currency Update

The Indian rupee tumbled to a new record low on Friday, falling 21 paise to trade at 88.36 against the US dollar, weighed down by persistent foreign fund outflows and global trade tensions.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.