The NSE Nifty 50, after closing on a high note on Friday, faces immediate resistance at around 25,000 levels, according to analysts. On the downside, 24,600-24,450 levels serve as key support zone, they added.

A successful breakout above 25,000 could push Nifty 50 up to 25,150-25,500, according to Amol Athawale, vice president for technical research at Kotak Securities.

"On the other side, below 24,450, the sentiment could change. Below the same, market could slip till 24,380. Further down side may also continue which could drag the index up to 24,165," Athawale noted.

Bajaj Broking Research expects the frontline index to consolidate in the range of 24,400-25,200 levels. The dips should be used as buying opportunity as the index is expected to hold above the support area of 24,400-24,500 and head higher towards 25,200 levels in the coming week, according to the brokerage.

Technically, Nifty held the support of the 21-Day Exponential Moving Average or 21-DEMA and formed a bullish candle on the daily chart, indicating strength. However, the index is still placed below the psychological resistance level of 25,000, according to Hrishikesh Yedve, AVP technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd.

"A firm breakout above 25,000 could drive the Nifty towards 25,200–25,250 levels in the short term. On the downside, 21-DEMA support is placed near 24,480. As long as the index holds above this level, the probability of an upside breakout remains high," Yedve said.

The Bank Nifty, another key index, faces resistance near 55,700 levels, whereas the 21-DEMA support is placed near 54,630, he added.

FII/DII Activity

Foreign portfolio investors turned net buyers of Indian equities on Friday after a day of selling, while domestic institutional investors stayed net buyers for the fourth straight day.

FPIs mopped up stocks worth Rs 1,794.59 crore and domestic institutional investors net bought equities worth Rs 299.78 crore, according to the provisional data from the National Stock Exchange.

F&O Action

Nifty May futures up by 0.96% to 24,890 at a premium of 37 points.

Nifty May futures open interest down by 0.24%.

Nifty Options May 29 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,000.

Market Recap

The benchmark equity indices closed higher on Friday after a day's respite, amid volatility in domestic markets.

The NSE Nifty 50 closed 243.45 points, or 0.99% higher at 24,853 and the BSE Sensex ended 769 points, or 0.95% up at 81,721. During the day, the Nifty 50 gained 1.22% to 24,909, while the Sensex gained 1.18% to 81,905.

Major Stocks In News

Reliance Infrastructure: The company has entered in an agreement with Cosmea Business Acquisitions Pvt. (size Rs 1,673 crore) towards settlement of obligations towards corporate guarantee issued by the company.

LT Foods: The company's arm acquires remaining 49% stake of Golden Star Trading for $15 million in California.

Glenmark Pharmaceuticals: The company incorporates wholly-owned arm Glenmark Consumer Care for pharmaceuticals and consumer care industry.

One 97 Communications: The Supreme Court stays GST demand Of Rs 5,712 crore on unit First Games.

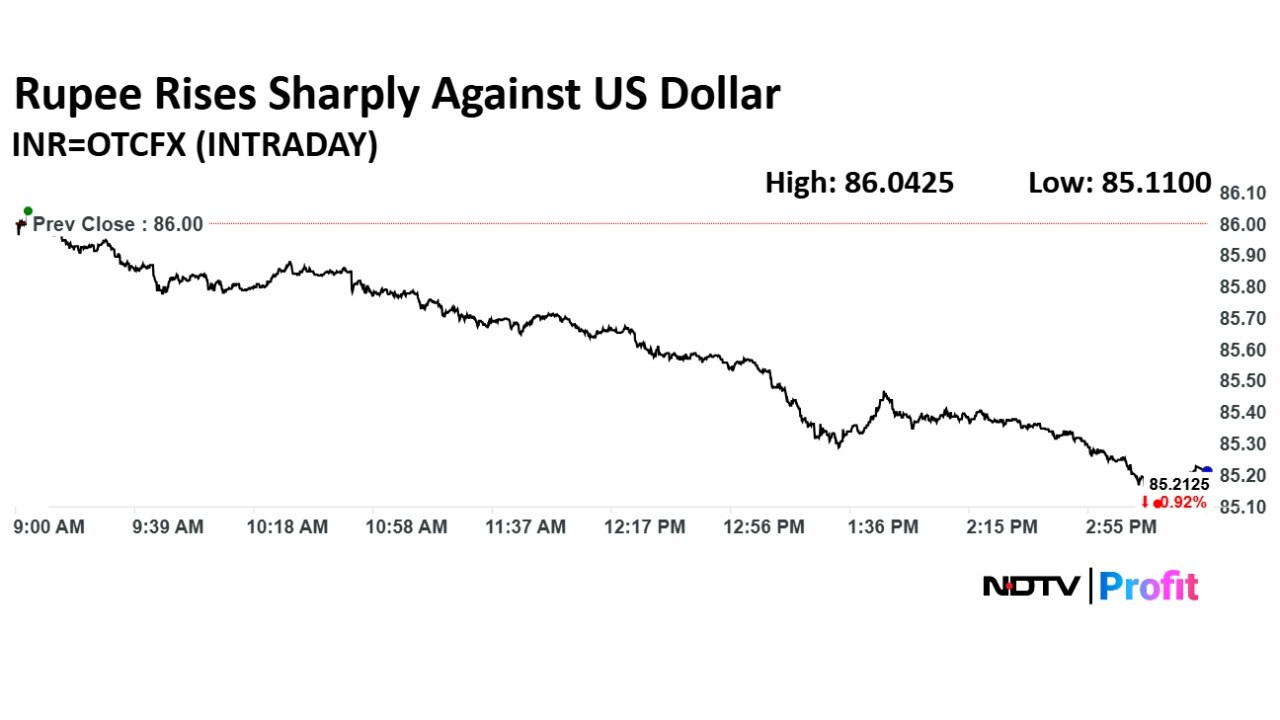

Currency Recap

The Indian rupee strengthened by 79 paise to close at 85.22 against the US dollar on Friday, recovering from its previous close of 86.01 on Thursday. This significant appreciation comes amid various global and domestic economic factors influencing the currency markets.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.